- Options trading becomes less accessible at high nominal prices.

- Retail sentiment still favors stocks with lower prices per share.

Microsoft Stock Split Analysis: Will MSFT Split in 2025-2026?

MSFT stock split prediction: Could another split be coming? With Microsoft’s price at record highs, this analysis covers key signals, market trends, and expert expectations for 2025.

Article navigation

- Stay Ahead with MSFT

- MSFT Stock Split Prediction: Will Microsoft Split Its Stock in 2025?

- Stock Split History: Patterns and Context

- Market Psychology and Strategic Timing

- Competitive Landscape: Peer Split Behavior

- Expert Forecasts: Will MSFT Stock Split in 2025?

- The Dow Jones Effect on Microsoft Split Considerations

- Strategic Triggers for the Next Microsoft Split

- Strategic Investment Approaches Around a Potential Split

- Trading MSFT Stock on Pocket Option

- Final Thoughts

MSFT Stock Split Prediction: Will Microsoft Split Its Stock in 2025?

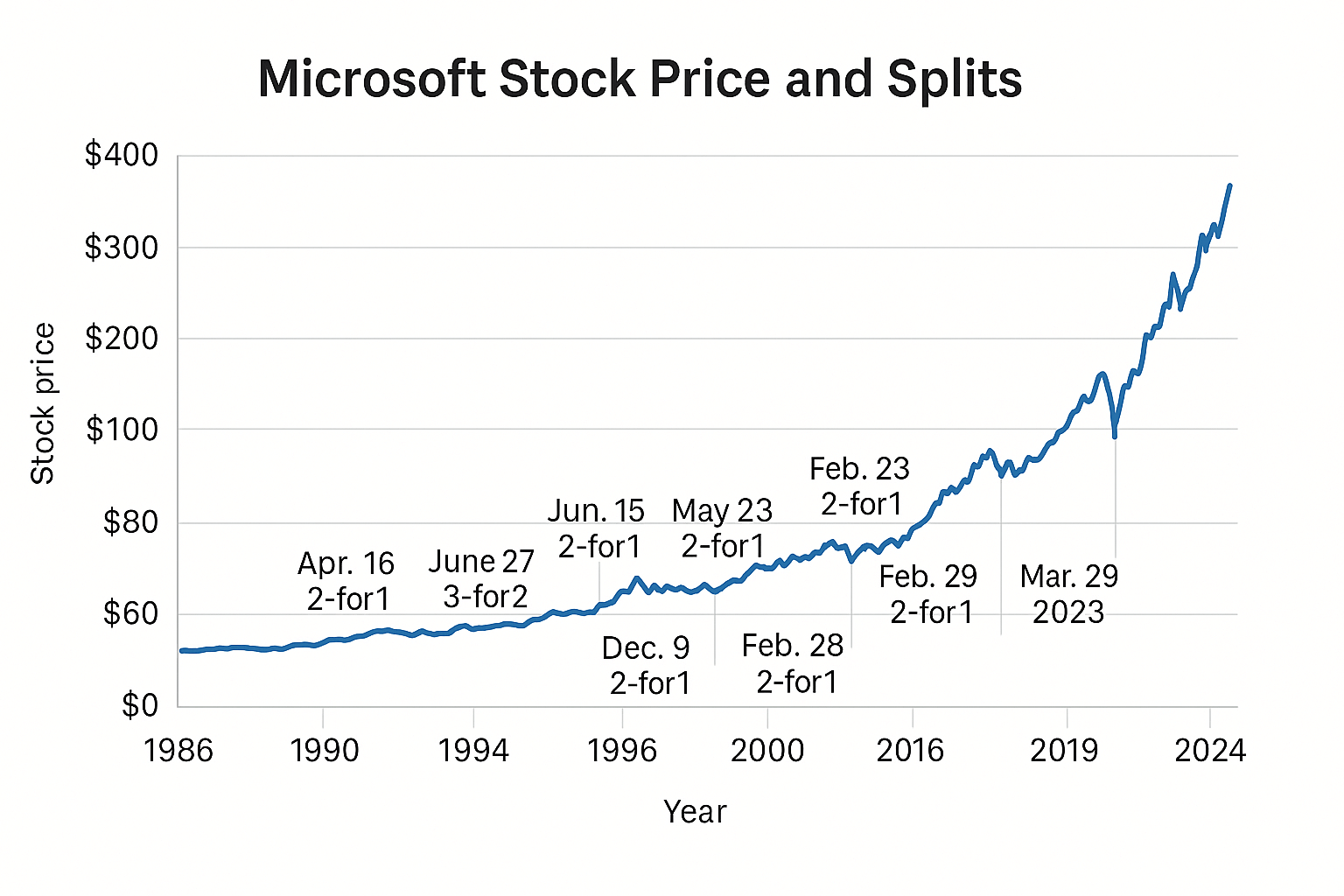

Since going public in 1986, Microsoft has developed a consistent pattern with stock splits that holds valuable historical context. The company has executed nine stock splits in total. The most recent Microsoft stock split occurred in 2003, a 2-for-1 split when the stock traded around $48.

Stock Split History: Patterns and Context

| Split Date | Microsoft Split Ratio | Approx. Pre-Split Price | Market Conditions |

|---|---|---|---|

| Sep 21, 1987 | 2:1 | $114.50 | Pre-bull market rally |

| Apr 16, 1990 | 2:1 | $120.50 | Anticipating Windows 3.0 |

| Jun 27, 1991 | 3:2 | $105.25 | Growing software dominance |

| Jun 15, 1992 | 3:2 | $113.00 | Windows 3.1 peak |

| May 23, 1994 | 2:1 | $98.75 | Pre-Windows 95 positioning |

| Dec 9, 1996 | 2:1 | $157.25 | Internet Explorer expansion |

| Feb 23, 1998 | 2:1 | $178.13 | Tech boom height |

| Mar 29, 1999 | 2:1 | $178.56 | Dot-com bubble rise |

| Feb 18, 2003 | 2:1 | $48.30 | Post-dot-com recovery |

Microsoft historically split its stock when the share price hovered between $100 and $180. With MSFT stock now exceeding $300, the current valuation has prompted growing discussions around another MSFT stock split prediction.

Critical Factors Influencing MSFT Stock Split Timing. Share Price Accessibility in the Age of Fractional Trading.

Modern trading platforms, including Pocket Option, now support fractional shares, decreasing the necessity for splits to attract small investors. However:

Microsoft Corporate Strategy Under Satya Nadella

Since 2014, CEO Satya Nadella has emphasized:

- Long-term value via cloud infrastructure and AI

- Institutional investor appeal over retail accessibility

- Strategic acquisitions over cosmetic stock moves

This philosophical shift may explain the long gap since the last stock split.

Technical Indicators and Price Thresholds

Several technical indicators hint at a possible MSFT split in 2025:

| Indicator | Current Status | Split Signal Strength |

|---|---|---|

| $300 Level | Exceeded | Moderate |

| $400 Level | Approaching | Strong |

| P/E Ratio > 35 | Yes | Moderate |

| RSI > 75 | Occasionally | Weak |

| Options Concentration | High around round numbers | Moderate |

These technical indicators, when combined with historical behavior, form the backbone of many MSFT stock split prediction models.

Market Psychology and Strategic Timing

Despite algorithmic dominance, market psychology still plays a major role:

- Retail investors are drawn to lower-priced stocks

- Psychological triggers often influence split timing

Moreover, split announcements often coincide with earnings calls or notable market events to maximize impact.

Competitive Landscape: Peer Split Behavior

Microsoft’s no-split policy diverges from tech peers:

| Company | Split Date | Ratio | Pre-Split Price | Reason |

|---|---|---|---|---|

| Apple | Aug 2020 | 4:1 | ~$500 | Retail access and index balance |

| Alphabet | Jul 2022 | 20:1 | ~$2,750 | Employee stock distribution |

| NVIDIA | Jul 2021 | 4:1 | ~$760 | AI momentum and accessibility |

| Tesla | Aug 2020 | 5:1 | ~$2,300 | Index inclusion strategy |

This trend suggests a growing strategic use of stock splits–something Microsoft may revisit to remain competitively balanced.

Expert Forecasts: Will MSFT Stock Split in 2025?

According to a 2025 analyst survey:

-

60% expect a split in the next 18–24 months

-

25% believe Microsoft will maintain a no-split policy

-

15% remain neutral

Many investors are asking when will MSFT stock split, and while there is no official confirmation, analysts point to sustained high prices, AI-driven revenue growth, and competitive pressures as potential catalysts.

Key drivers behind these forecasts include:

- Sustained trading above key moving averages

- Pressure from Dow Jones Industrial Average for index balance

- Need to refresh employee stock incentives

- Accelerating AI revenue from Azure Cloud

The Dow Jones Effect on Microsoft Split Considerations

As a price-weighted index, the Dow Jones disproportionately favors high-priced stocks. A MSFT split would:

- Reduce Microsoft’s weight

- Improve balance across the index

- Mirror Apple’s 2020 strategy for similar reasons

Strategic Triggers for the Next Microsoft Split

| Catalyst | Likelihood | Timeline | Impact |

|---|---|---|---|

| Sustained trading above $400 | High | 6–12 months | Strong |

| Major AI product breakthroughs | Moderate | 12–24 months | Moderate |

| Peer tech splits (e.g. Amazon) | Moderate | Unpredictable | Moderate |

| Leadership change or restructure | Low | Unpredictable | Low |

| Expanded employee stock programs | Moderate | 12–18 months | Moderate |

Strategic Investment Approaches Around a Potential Split

Before Split:

- Accumulate on dips

- Use option strategies around psychological strike zones

- Watch earnings calls for split hints

After Split:

- Rebalance portfolio allocations

- Monitor post-split support levels

- Track new institutional buying patterns

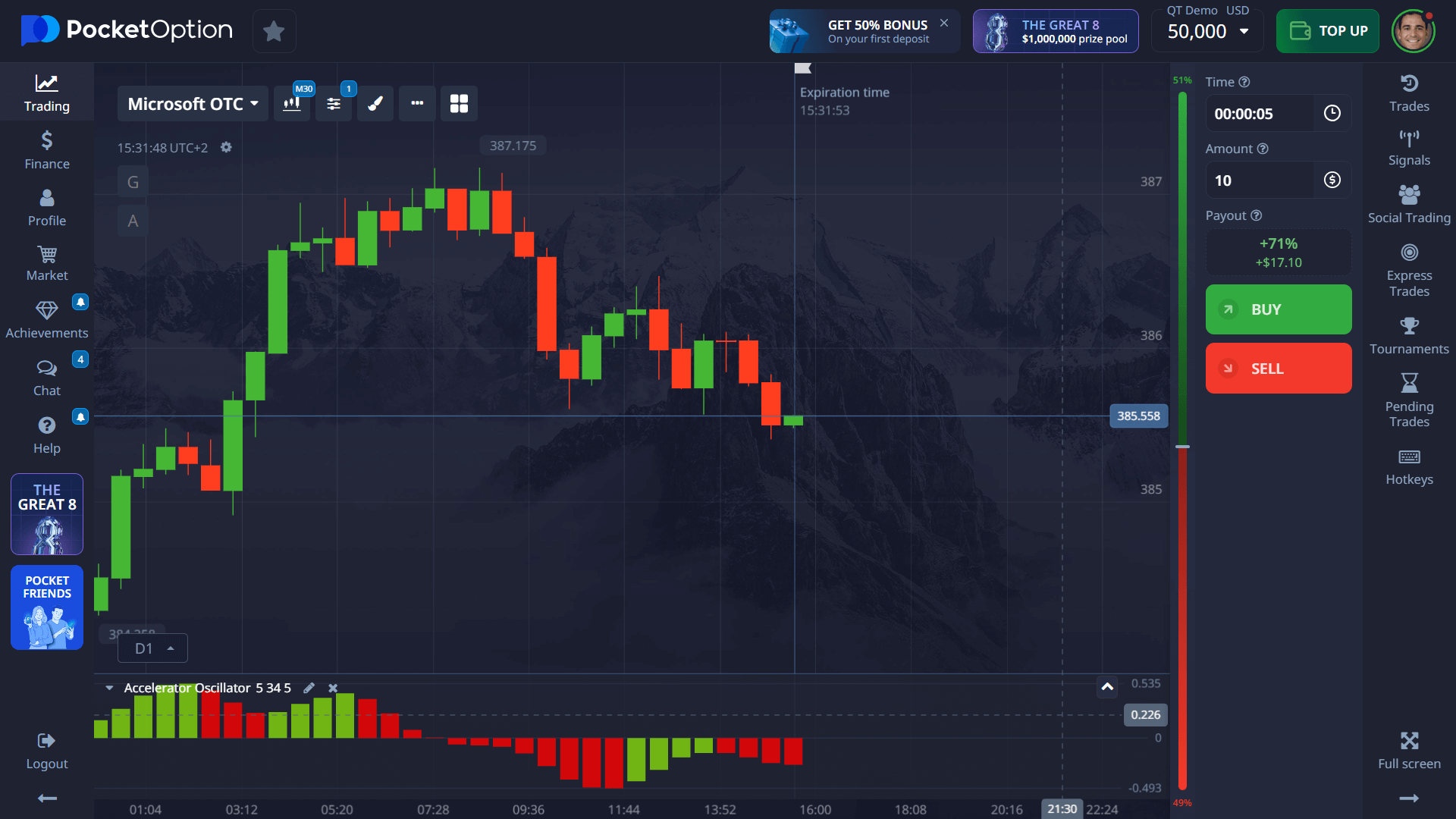

Trading MSFT Stock on Pocket Option

Pocket Option provides ideal tools to engage with MSFT:

- Fractional share access removes capital entry barriers

- Copy trading features align you with experienced strategies

- Trading signal bot help monitor volatility around key events like splits

As market psychology and technical indicators align, traders can use Pocket Option to prepare for or respond to any future Microsoft stock split announcements with agility.

Final Thoughts

With a rich stock split history, strong technical indicators, and rising attention from analysts, a 2025 Microsoft stock split appears increasingly likely. While not guaranteed, factors like Microsoft corporate strategy, market psychology, and competitive trends create a compelling narrative. Traders and investors using platforms like Pocket Option are well-positioned to capitalize on these developments–whether a split occurs or not. You can discuss this or other topics in our community!

FAQ

When was Microsoft's last stock split?

Microsoft last split its stock on February 18, 2003, with a 2-for-1 ratio when the price was around $48

What factors might trigger a Microsoft split in 2025?

Key triggers include sustained trading above $400, pressure from the Dow Jones index, AI growth, and strategic updates to employee incentive programs.

Would a Microsoft stock split increase my investment value?

No. A stock split does not change the total value of your investment—only the number of shares and share price.

What split ratio would Microsoft likely implement?

Historically, Microsoft has favored a 2-for-1 ratio, though a 3-for-1 or 4-for-1 split could also be possible based on peer trends

Can Microsoft stock reach $1000 before splitting?

While technically possible, most analysts believe Microsoft would likely act around the $400–$600 range to improve accessibility and maintain index balance.