- Messenger

- Threads

- Meta AI

- Meta Quest VR and Reality Labs

Meta Stock Price Prediction

Meta Platforms Inc. (NASDAQ: META), formerly Facebook Inc., is among the most closely monitored stocks in the tech sector. In this analysis, we provide a comprehensive and unbiased evaluation of its historical performance, expert predictions, and the multiple factors influencing its share price. The goal is to assist potential traders or investors in making informed decisions based on transparent data and projections.

Company Overview

Background of Meta Platforms

Meta Platforms Inc. was founded in 2004 and rebranded from Facebook to Meta in 2021. The transition reflects a strategic shift toward metaverse development, augmented and virtual reality, and advanced AI services.

Key Operations

Its primary revenue still derives from digital advertising, with significant investment allocated to long-term technologies such as the metaverse.

5-Year Stock Performance Review

The table below shows the year-end stock price and notable events that influenced the META stock over the past five years:

| Year | Year-End Price (USD) | Annual Change (%) | Key Event |

|---|---|---|---|

| 2020 | 273.16 | +33.09% | Surge in social media use during pandemic |

| 2021 | 336.35 | +23.14% | Announcement of Meta rebrand |

| 2022 | 120.34 | −64.23% | Decline due to heavy Reality Labs losses |

| 2023 | 353.78 | +194% | Recovery post cost-cutting and ad rebound |

| 2024 | 489.63 | +38.38% | AI integration and record ad revenue |

Extended 5-Year Price History (2020–2025)

Over the past five years, Meta Platforms stock (ticker: META) has exhibited significant volatility, with both sharp rallies and deep corrections. At the beginning of 2020, the price was considerably lower than current levels. The stock peaked at approximately $740.91 in February 2025, before undergoing a correction and trading between $520 and $580 in April 2025.

Historical Price Chart (2020–2025)

- 2020: Started from low levels, around $150–$200

- 2021–2022: Saw steady growth, with price reaching $300–$350

- 2023: Continued rising above $500

- 2024–Early 2025: Peaked near $740, followed by a correction to the $520–$580 range

2-Year Forecast (2025–2027)

Notable Forecasts for META (2025–2027)

| Year | Minimum Price (USD) | Maximum Price (USD) | Notes |

|---|---|---|---|

| 2025 | 1,927.80 | 5,028.33 | Experimental model for crypto META |

| 2025 | 505.00 | 900.00 | TradingView forecast for Meta Platforms stock |

| 2026 | 741.03 | 2,432.76 | Likely applies to the cryptocurrency Meta (MTA) |

| 2027 | 914.07 | 1,936.24 | Forecast refers to crypto, not company equity |

It is important to distinguish these Meta stock price forecast: the extremely high values (above $1,000) apply to the cryptocurrency Meta (MTA), not the publicly traded Meta Platforms Inc. stock. For the actual shares, most expert estimates suggest a target range between $500 and $900, implying a potential upside of approximately 40% over the next two years. The latest meta stock projection shows a possible upward trend through 2026 based on current AI-driven revenue growth

Summary of Historical and Projected Prices

- META stock has climbed from $150 in 2020 to a peak near $740 in early 2025

- As of April 2025, the price fluctuates around $520–$580

- The consensus forecast for the next two years sees potential growth toward $900, with periodic corrections expected

- Forecasts projecting values above $1,000 pertain to the Meta (MTA) crypto token, not the company’s equity

Recent Developments and News

- AI integration: Meta AI launched in WhatsApp, Facebook, and Instagram in 2024. Usage exceeded expectations and enhanced user engagement metrics.

- Advertising Revenue: Q4 2024 earnings reported $40.1 billion in ad revenue, up 23% YoY.

- Reality Labs Loss: Despite continued investment, the division reported another annual loss of $16 billion.

- Layoffs & Efficiency Drive: 21,000+ employees were cut between 2022–2023, significantly improving margins.

- Stock Buybacks: $50 billion buyback authorized in early 2025, pushing investor confidence.

Expert Meta Stock Predictions and Analyst Ratings

Consensus Forecast from Analysts

Meta Stock Prediction compiled from Goldman Sachs, Morgan Stanley, JPMorgan, UBS, Morningstar, and others.

| Year | Average Target (USD) | Bullish View (USD) | Bearish View (USD) |

|---|---|---|---|

| 2025 | 610 | 710 | 520 |

| 2026 | 680 | 790 | 580 |

| 2030 | 950 | 1,200 | 720 |

Major drivers cited include improved ad targeting through AI, cost reductions, and dominance in social platforms. Long-term risks focus on continued spending on Reality Labs and potential antitrust action.

Key Factors Influencing Meta Stock

Positive Signals

- Strong free cash flow

- Leadership in global social media markets

- Expanding AI applications in advertising and content delivery

Risks and Headwinds

- Regulatory scrutiny in the US and EU

- Unclear monetization path for VR/metaverse initiatives

- Competition from TikTok, Apple Vision Pro, and AI-native platforms

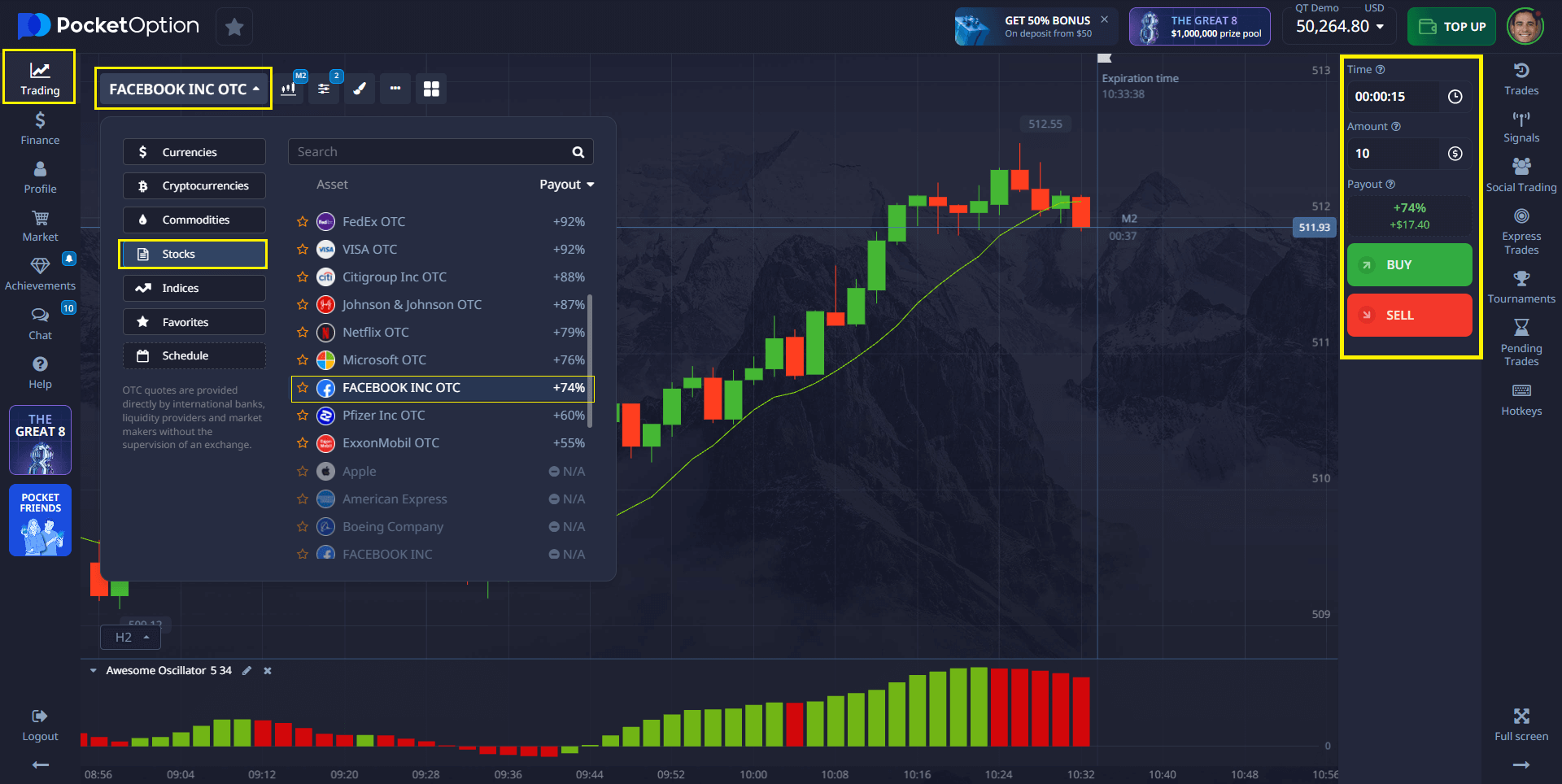

Trading Stocks on Pocket Option

100+ stocks is available for short-term prediction on the Pocket Option platform, including during weekends via OTC (Over-the-Counter) trading. Traders can access over 100+ assets across various markets — including stocks, currencies, commodities, and cryptocurrencies. The platform regularly adds new instruments to its trading catalog.

🔥 For those who prefer to test strategies before committing real funds, Pocket Option offers a free demo account with a virtual balance of $50,000. This account allows you to explore the full functionality of the platform, including access to charts, indicators, and market tools — all without any financial risk.

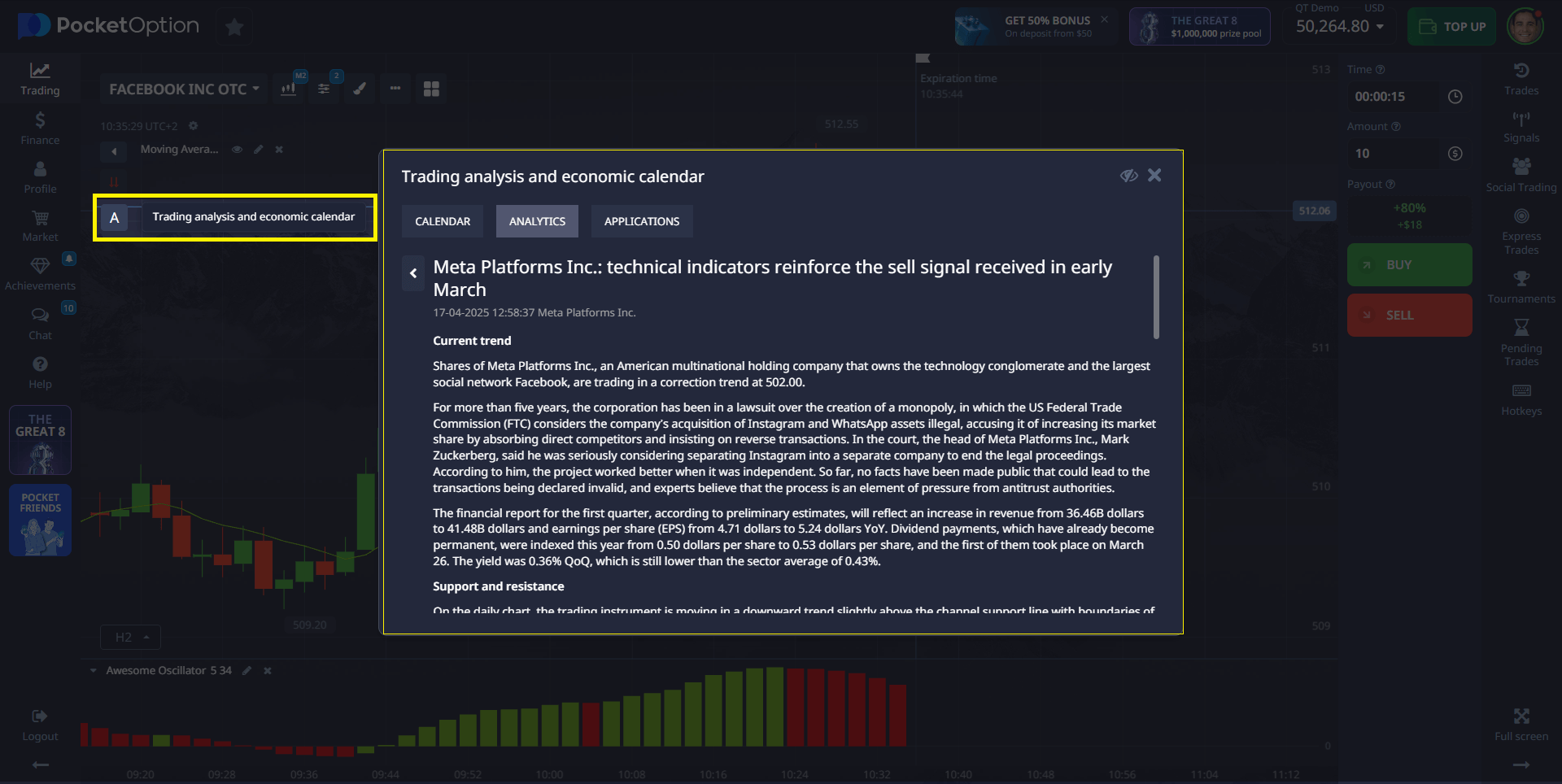

Example: Opening a Trade on Facebook OTC

Select the Asset: From the asset list, choose “Facebook OTC” (available outside standard trading hours).

Analyze the Chart: Use technical tools or the built-in Trader’s Sentiment indicator to assess potential direction.

Set Trade Parameters: Choose an amount starting from $1. Set the trade duration — for OTC assets, it can be as short as 5 seconds.

Make Your Forecast: If you believe the price will go up, click BUY. If you expect the price to go down, click SELL.

If your prediction is correct, you earn a return of up to 92%. The potential profit rate is displayed before the trade is confirmed.

Real Account Features

- Copy Trading: Automatically follow top traders

- Cashback: Receive a percentage back from your trading volume

- Advanced Tools: Access to tournaments, promotions, and trading statistics

Pocket Option combines flexibility with a wide range of assets and tools, making it suitable for both new and experienced traders.

Conclusion

Meta Platforms remains a dynamic and evolving tech company, with growing emphasis on AI, immersive experiences, and ad innovation. While past performance shows resilience, the future path depends heavily on long-term bets paying off and regulatory stability. Analysts remain divided on the meta platforms stock prediction, citing both strong ad performance and ongoing metaverse losses. Traders should evaluate both macroeconomic factors and internal strategic shifts when considering exposure to META stock.

FAQ

What is Meta’s stock symbol?

The ticker for Meta Platforms Inc. is META on the NASDAQ exchange.

What are the key risks for Meta stock?

Primary risks include high spending on unproven technologies and regulatory pressure.

Will Meta’s AI investments increase stock value?

Most analysts believe AI monetization will contribute positively, but timeline remains uncertain.

Can I trade META stock on Pocket Option?

Yes, you can trade META and 100+ other assets directly with real-time forecasting tools.

How did META stock perform in 2024?

It gained over 38%, driven by strong ad revenue and investor-friendly initiatives.