- Industry partnerships and contract awards

- Technological milestone achievements

- Competitive landscape developments

- Regulatory changes affecting commercial space operations

- General market sentiment toward space technology investments

LUNR Stock Forecast Comprehensive Investment

The LUNR stock forecast has become a topic of significant interest among investors looking to diversify their portfolios with space technology assets. As the commercial space industry continues to expand, understanding the potential trajectory of companies like LUNR could provide valuable opportunities for growth-oriented investors.

Article navigation

- Current Market Position of LUNR

- Key Factors Influencing LUNR Stock Price Prediction

- LUNR Stock Forecast 2025: Expert Projections

- Don’t Wait Until 2025 — Explore Real-Time Trading Opportunities Now

- Technical Analysis Perspectives

- Comparative Industry Analysis

- Investment Strategies Based on LUNR Stock Forecast

- Conclusion

The space technology sector has seen remarkable growth in recent years, with private companies increasingly entering what was once exclusively government territory. LUNR, as an emerging player in this field, represents both opportunities and challenges for investors. A thorough LUNR stock prediction requires examining multiple factors including financial performance, industry trends, competition, and technological developments.

Current Market Position of LUNR

Before diving into the LUNR stock forecast, it’s essential to understand the company’s current market position. LUNR has established itself in the commercial space industry with its innovative approach to satellite technology and space logistics. The company has been working on developing cost-effective solutions for satellite deployment and maintenance, which could potentially disrupt traditional space operations.

| Financial Metric | Previous Year | Current Year | Year-over-Year Change |

|---|---|---|---|

| Revenue | $23.4M | $37.2M | +58.9% |

| Operating Margin | -42.3% | -28.1% | +14.2% |

| R&D Expenditure | $18.7M | $22.3M | +19.3% |

| Cash Reserves | $64.5M | $52.1M | -19.2% |

Recent financial data shows improving operational efficiency despite continued negative margins. This trajectory suggests that while LUNR is still in its growth phase, it’s making measurable progress toward profitability.

Key Factors Influencing LUNR Stock Price Prediction

Several critical factors will likely influence the LUNR stock price prediction over the coming years. Understanding these drivers can help investors make more informed decisions about potential entry and exit points.

NASA Contracts In December 2024, Intuitive Machines secured new NASA contracts worth up to $4.82 billion, focused on lunar communications and navigation services. These deals solidify LUNR’s position in long-term lunar infrastructure. (Source: MarketWatch)

Political Influence In early 2025, presidential candidate Donald Trump voiced strong support for renewed U.S. space exploration. This led to a surge in investor interest in space-related stocks, including LUNR. (Source: MarketWatch)

Financial Outlook Q4 2024 revenue grew by 80% YoY, hitting $54.7 million. The company projects total 2025 revenue between $250 million and $300 million, with positive adjusted EBITDA expected by the end of 2025 or early 2026. (Source: Investopedia)

Key factors:

| Growth Driver | Impact Level | Timeline | Probability |

|---|---|---|---|

| Government Contracts | High | 12-24 months | Medium |

| Commercial Partnerships | Medium | 6-18 months | High |

| Technology Patents | High | 18-36 months | Medium |

| Market Expansion | Medium | 12-24 months | Medium |

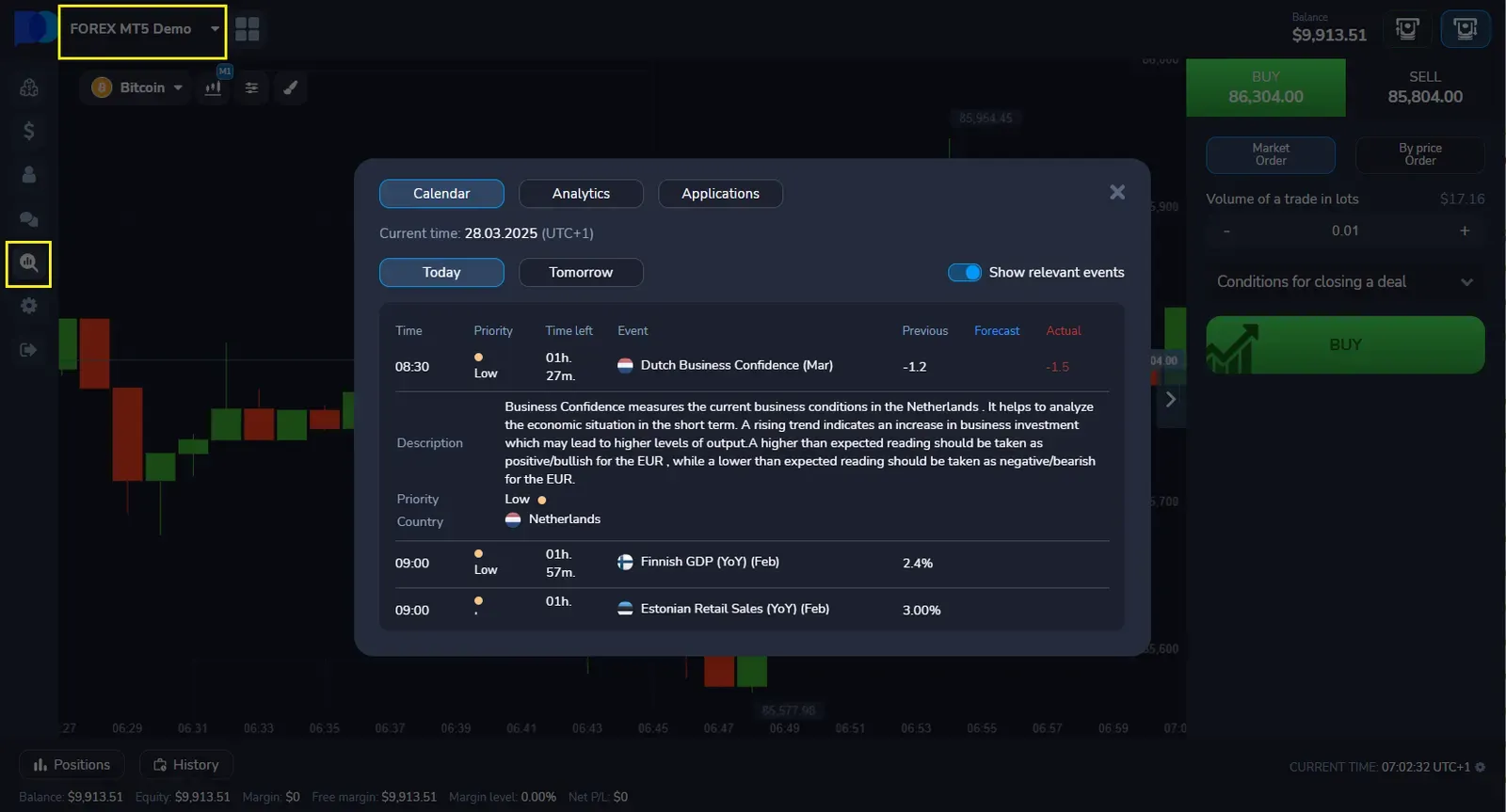

*Use the economic calendar and news on Pocket Option to make more informed trading decisions

LUNR Stock Forecast 2025: Expert Projections

Looking specifically at the LUNR stock forecast 2025, analysts have provided varying projections based on different growth scenarios. These estimates take into account expected industry developments, company-specific milestones, and broader economic factors.

Wall Street Forecasts

Analysts on Wall Street expect Intuitive Machines (NASDAQ: LUNR) to reach a target price of $15.60 by March 2026 — a potential upside of over 127% from the current price. Estimates range from $12.00 (low) to $21.00 (high).

(Source: WallStreetZen)

According to MarketBeat, the consensus from 7 analysts puts the average target price at $16.00, with a high forecast of $21.00 and a low of $12.00.

(Source: MarketBeat)

| Scenario | Price Target Range | Key Assumptions |

|---|---|---|

| Conservative | $12.50 – $18.75 | Modest growth in contracts, continued R&D spending |

| Base Case | $19.25 – $27.50 | Expected contract wins, improving margins |

| Optimistic | $28.00 – $42.00 | Major breakthrough, significant new partnerships |

| Breakthrough | $43.00 – $65.00 | Disruptive innovation, industry leadership |

The wide range in these projections reflects the inherent uncertainty in emerging technology sectors. For most analysts, the base case represents the most likely outcome, though individual investors should consider their own risk tolerance when evaluating these forecasts.

Don’t Wait Until 2025 — Explore Real-Time Trading Opportunities Now

While long-term projections such as the LUNR stock forecast for 2025 rely on strategic planning and patience, modern investors increasingly turn to flexible tools that allow them to act on market signals instantly. One such platform is Pocket Option — a global trading interface available since 2017, offering immediate access to financial markets without complex installation or delays.

📌 Just forecast whether the price will rise or fall — and if you’re right, you can earn up to 92% profit in minutes.

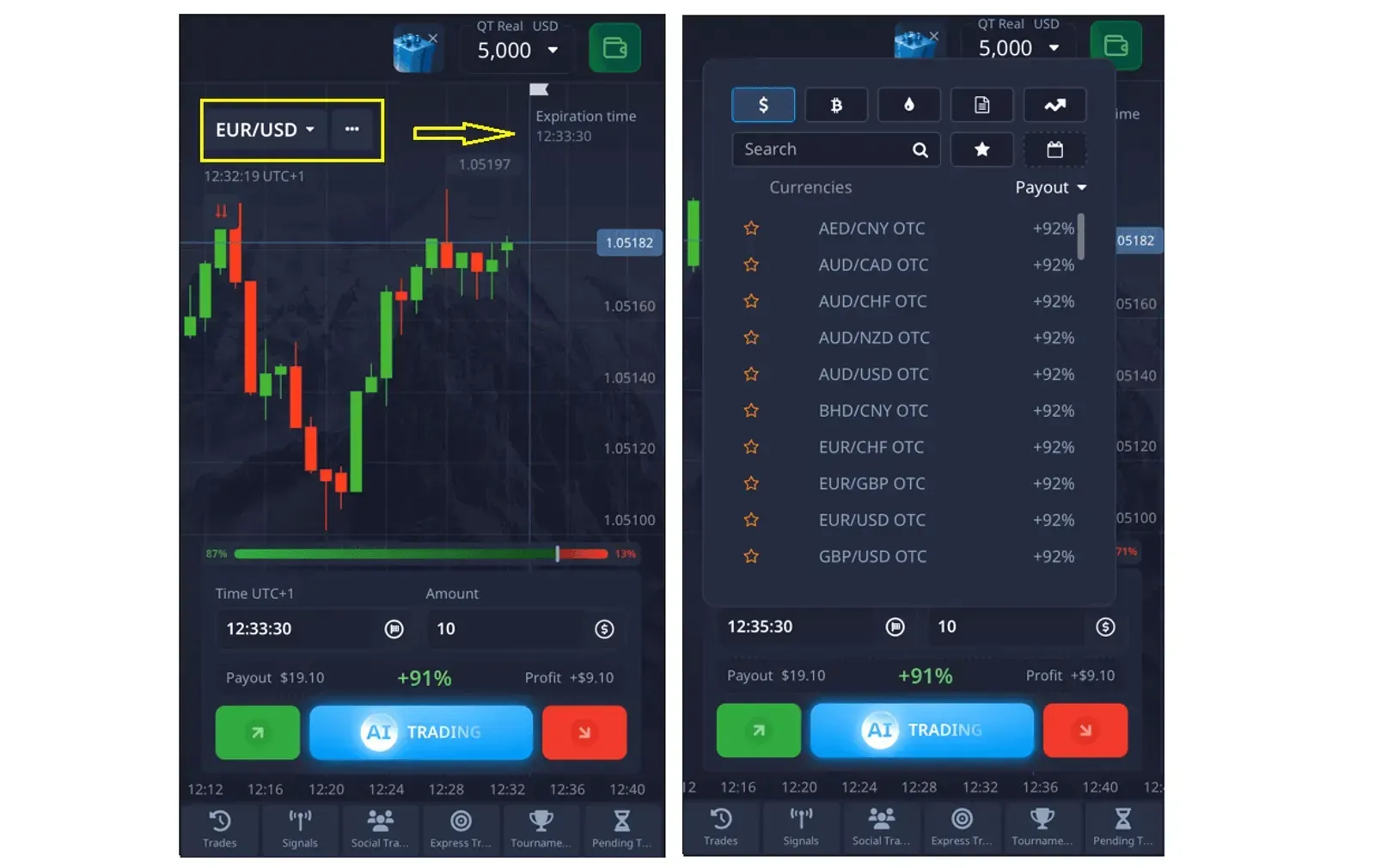

📌With Pocket Option, users can analyze short-term price trends and respond in real time, trading over 100 assets, including stocks, cryptocurrencies, and forex pairs.

✔️ What Makes Pocket Option Stand Out:

- No lengthy commitments: You don’t need to wait months or years — identify price direction and potentially earn results in minutes.

- $50,000 demo account: Train with virtual funds before transitioning to live trading.

- Accessible trading: Start with a deposit from $5 and trade via browser or mobile app — no setup required.

✔️ Tools and Features Designed for Modern Traders:

- Interactive charting: Monitor indicators, select time intervals, and build strategies.

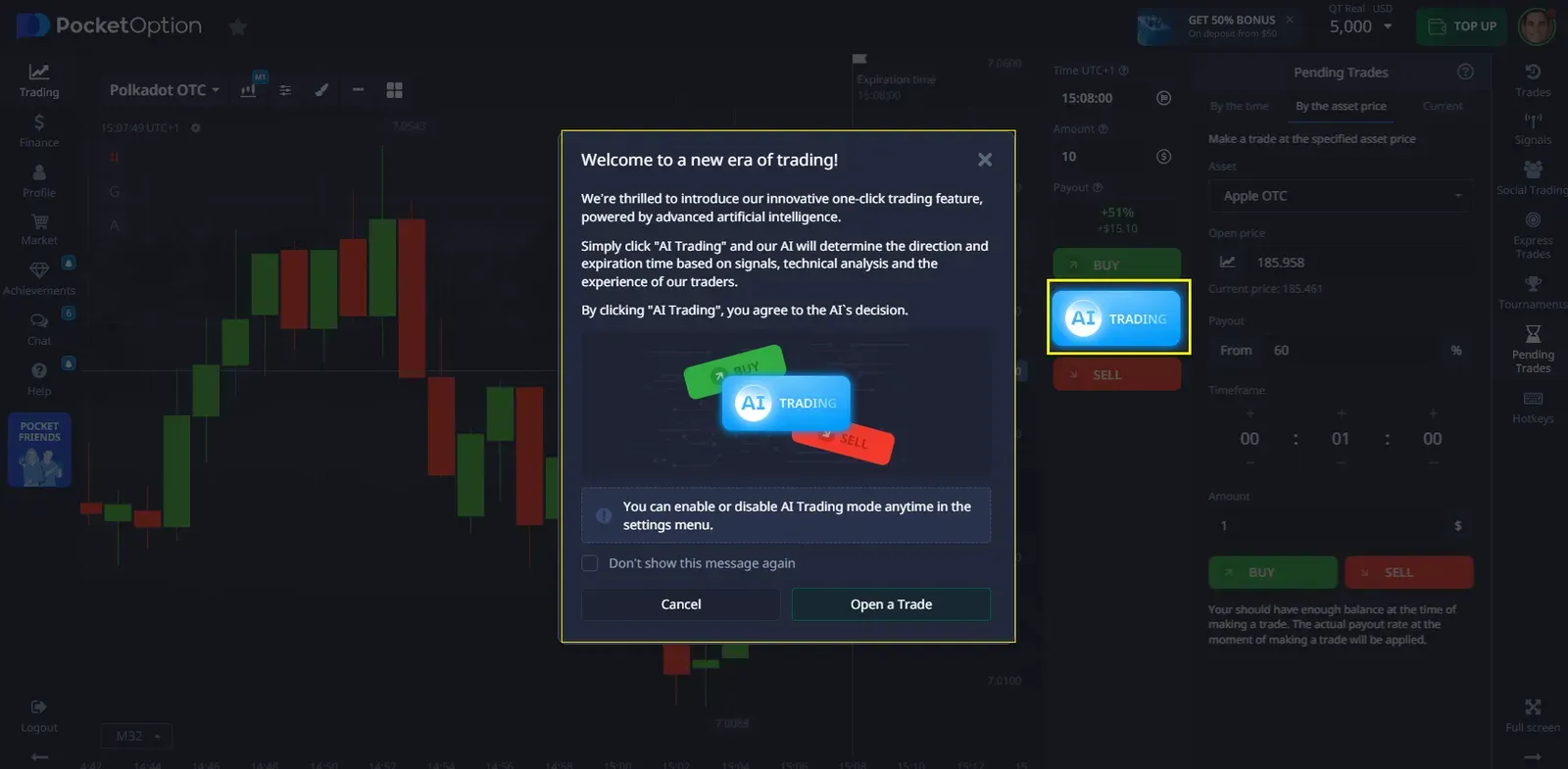

- Automated bots & AI support: Automate decisions based on data patterns.

- Copy trading function: Learn by mirroring experienced traders’ moves.

- Tournaments & challenges: Compete with others and earn rewards while improving your skill.

✔️ Added Flexibility and Support:

- Regular promotions: Enhance your capital with trading bonuses.

- 50+ payment methods: Including cards, e-wallets, and digital currencies.

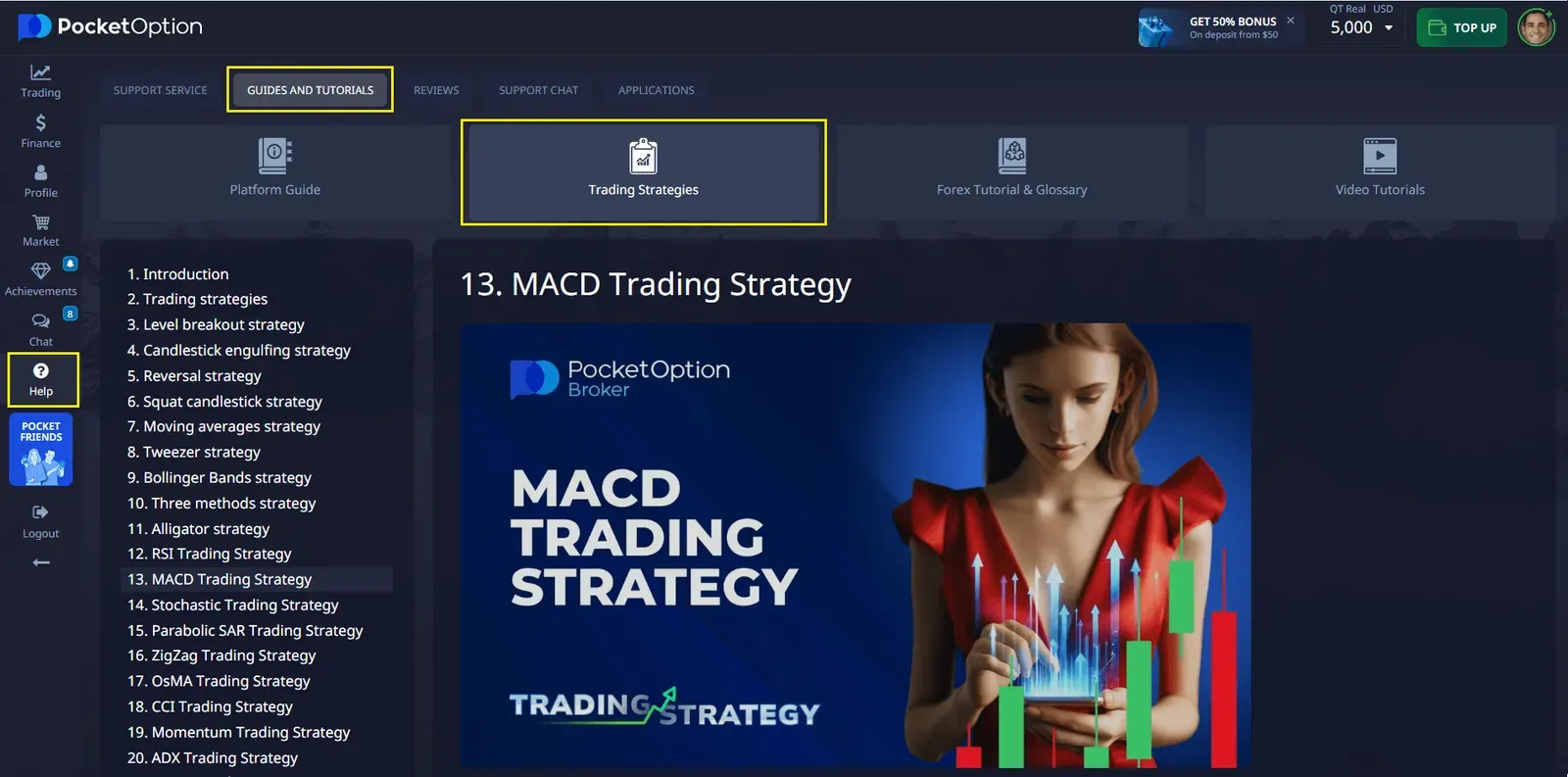

- Educational resources: Access video tutorials, trading strategies, and market outlooks for better decision-making.

📌Whether you’re commuting, working remotely, or following the latest LUNR news — the Pocket Option app lets you stay connected to the markets from anywhere.

Technical Analysis Perspectives

Beyond fundamental analysis, technical indicators provide additional insight for the LUNR stock price target. Traders on platforms like Pocket Option frequently utilize these metrics for short to medium-term position planning.

- Moving averages showing potential support and resistance levels

- Volume patterns indicating accumulation or distribution phases

- Relative strength comparisons to industry benchmarks

- Momentum indicators suggesting potential trend continuations or reversals

| Technical Indicator | Current Reading | Signal | Strength |

|---|---|---|---|

| 50-Day Moving Average | $14.23 | Bullish | Moderate |

| 200-Day Moving Average | $12.87 | Bullish | Strong |

| Relative Strength Index | 62 | Neutral | Weak |

| Volume Profile | Above Average | Bullish | Moderate |

Comparative Industry Analysis

To provide context for the LUNR stock forecast, comparing the company to industry peers helps establish reasonable expectations and valuation metrics. The commercial space sector includes companies at various stages of development and with different business models.

| Company | Market Cap | Revenue Growth | P/S Ratio | 5-Year CAGR Est. |

|---|---|---|---|---|

| LUNR | $620M | 58.9% | 16.7 | 42% |

| Competitor A | $2.7B | 43.2% | 12.3 | 38% |

| Competitor B | $1.4B | 27.5% | 9.8 | 31% |

| Competitor C | $860M | 62.1% | 19.2 | 45% |

While LUNR carries a premium valuation relative to some peers, its growth rate partially justifies this premium. Investors considering the LUNR stock price prediction should weigh whether this growth trajectory can be maintained as the company scales operations.

- Current valuation appears stretched but defensible given growth rates

- Early-stage space technology companies typically command higher multiples

- Relative performance against industry benchmarks has been favorable

- Institutional ownership has been increasing gradually

Investment Strategies Based on LUNR Stock Forecast

Given the available data and projections, investors may consider several strategies when approaching LUNR stock. These approaches vary based on risk tolerance and investment timeframe.

- Dollar-cost averaging to mitigate volatility risks

- Option strategies to establish defined risk parameters

- Position sizing appropriate to the speculative nature of the investment

- Including LUNR as part of a broader space technology basket

Platforms like Pocket Option provide tools for implementing various trading strategies, including options for managing downside risk while maintaining upside exposure. This flexibility can be particularly valuable when dealing with stocks that have wide forecast ranges.

Conclusion

The LUNR stock forecast presents a complex picture of potential growth tempered by industry-specific challenges. With revenue growth exceeding 50% annually and improving operational metrics, LUNR shows promising fundamentals despite not yet reaching profitability. Analyst price targets for 2025 range widely from $12.50 on the conservative end to potentially over $40 in breakthrough scenarios, reflecting both opportunity and uncertainty.

Investors should consider LUNR within the context of the broader commercial space industry, which continues to attract significant capital despite technological and regulatory hurdles. Technical indicators currently suggest moderately bullish sentiment, though volatility should be expected. For those interested in space technology investments, LUNR represents an interesting prospect that may warrant a measured position within a diversified portfolio.

FAQ

What factors most significantly impact the LUNR stock forecast?

Contract wins, technological breakthroughs, competitive developments, and regulatory changes in the commercial space industry are the most influential factors affecting LUNR's stock trajectory.

How does LUNR compare to other companies in the space technology sector?

LUNR trades at a slightly higher valuation multiple than industry averages but demonstrates stronger revenue growth than many peers, currently positioned as a smaller but rapidly growing player.

What is the LUNR stock price target according to analysts?

The consensus LUNR stock price target ranges from $19.25 to $27.50 in base-case scenarios for 2025, though estimates vary widely based on different growth assumptions.

Is LUNR stock suitable for conservative investors?

Due to its early-stage nature, negative earnings, and industry volatility, LUNR is generally more appropriate for growth-oriented investors with higher risk tolerance rather than conservative portfolios.

How can I analyze stock using Pocket Option platform?

Pocket Option provides technical analysis tools, Quick trading capabilities, and market data that can help traders evaluate entry points, implement risk management strategies, and track performance against sector benchmarks.