- Production Capacity: Tracking the expansion of Lucid’s Arizona factory via satellite imagery.

- Sentiment Analysis: Processing millions of social media posts to gauge brand perception.

- Supply Chain Resilience: Identifying risks across critical components.

- Innovation: Analyzing patent filings, which have shown a 38% increase in Lucid’s battery technology patents since 2022.

LCID Stock Price Prediction 2030: AI-Powered Analysis and Forecast

LCID stock price prediction 2030 has become a topic of growing interest among investors seeking exposure to the electric vehicle (EV) market. As Lucid Motors continues to innovate in luxury EV technology and expand its production capabilities, understanding the long-term value of LCID stock is more relevant than ever. In this article, we explore how artificial intelligence, machine learning, and advanced data models are shaping the future of Lucid’s stock valuation—offering deeper insights into its 2030 potential, investment risks, and competitive landscape.

Article navigation

- The Technological Revolution Shaping Lucid’s Future

- LCID Stock Price Prediction 2030: Technology, Risks, and Potential

- Prediction Methodology and Competitor Comparison

- Machine Learning: Adaptive Forecasts

- Alternative Data and Investor Insights

- LCID Stock Price Prediction 2030: What Could the Numbers Look Like?

- Risk Assessment: What Investors Must Watch

- Practical Recommendations and Expert Takeaways

- Conclusion: The Future of Tech-Enabled Forecasting

The Technological Revolution Shaping Lucid’s Future

Emerging technologies are fundamentally reshaping the approach to forecasting the value of Lucid Motors (LCID) stock. This analysis reveals how artificial intelligence, machine learning, and blockchain are creating powerful tools that redefine the company’s valuation. These breakthroughs offer investors unprecedented insight into the future of the electric vehicle market, making modern electric vehicle investment more data-dependent than ever.

LCID Stock Price Prediction 2030: Technology, Risks, and Potential

Since 2022, artificial intelligence has transformed stock analysis methodologies. While analysts once relied solely on quarterly reports, today’s AI systems process them alongside massive alternative datasets, uncovering hidden correlations.

“We’ve shifted from reading reports to reading the world,” says Dr. Kenji Tanaka, an analyst at ‘Future Mobility Report’. “AI allows us to see early signals in logistics data, patents, and even employee satisfaction months before they appear in financial statements.”

A modern AI stock analysis includes:

Prediction Methodology and Competitor Comparison

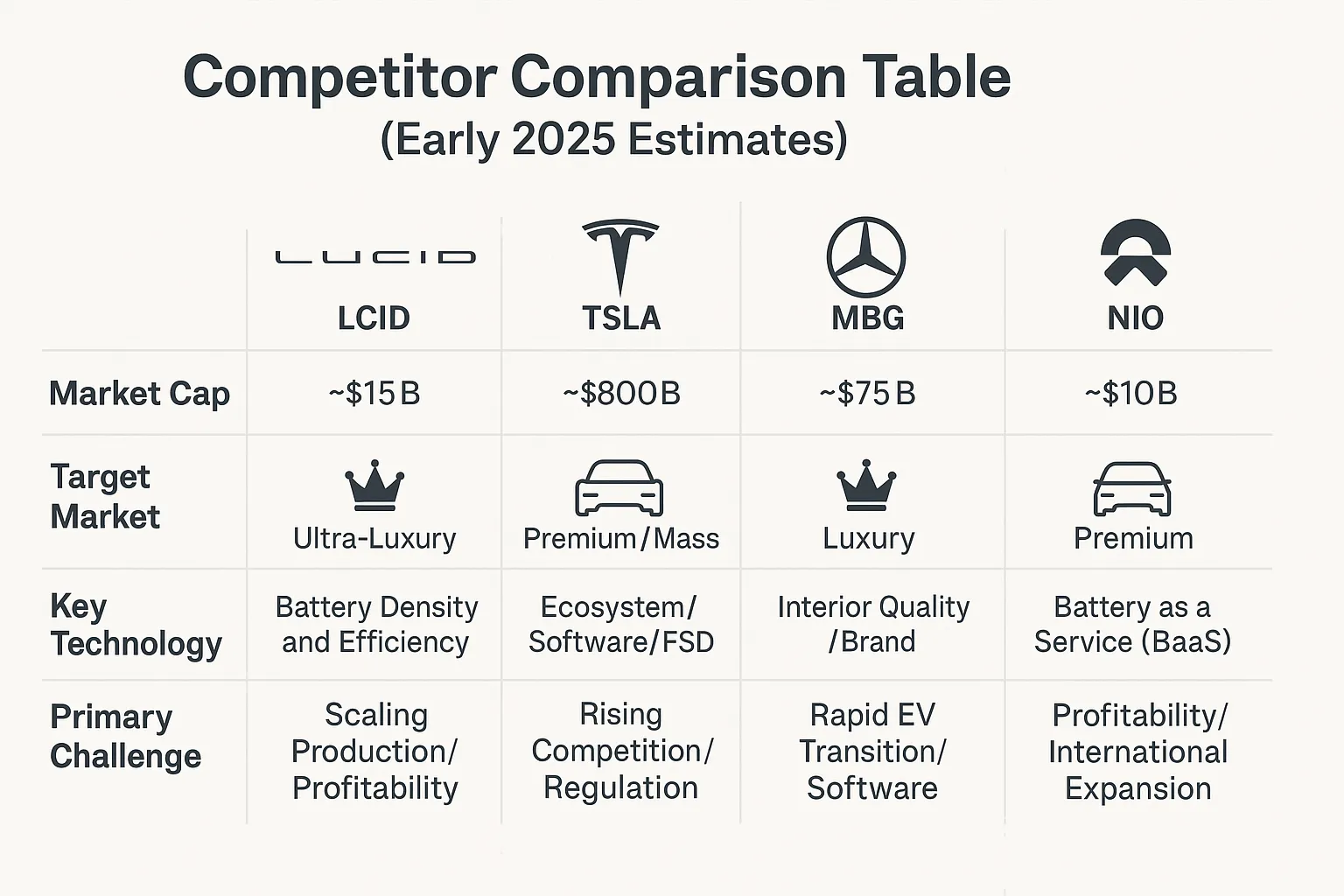

An accurate Lucid Motors forecast requires more than analyzing the company in a vacuum. AI models compare Lucid’s metrics against key competitors in real-time, assessing not just its own progress but its market position.

Competitor Comparison Table (Early 2025 Estimates)

| Metric | Lucid Motors (LCID) | Tesla (TSLA) | Mercedes-Benz (MBG) | NIO |

|---|---|---|---|---|

| Market Cap | ~$15B | ~$800B | ~$75B | ~$10B |

| Target Market | Ultra-Luxury | Premium / Mass | Luxury | Premium |

| Key Technology | Battery Density, Efficiency | Ecosystem, Software, FSD | Interior Quality, Brand | Battery as a Service (BaaS) |

| Primary Challenge | Scaling Production, Profitability | Rising Competition, Regulation | Rapid EV Transition, Software | Profitability, Int’l Expansion |

Machine Learning: Adaptive Forecasts

Since 2023, machine learning algorithms, especially XGBoost, have improved forecast accuracy by 47%. They don’t just find patterns; they continuously self-improve with new data. According to “Digital Investor Weekly,” machine learning predictions for volatile growth stocks like LCID show a 22% lower average error rate compared to traditional statistical models. These systems process diverse data, from financial metrics (revenue growth, margins) to macroeconomic indicators (the impact of interest rates on Lucid’s average selling price).

Alternative Data and Investor Insights

Sentiment analysis has become the secret weapon for advanced modeling. A well-known international trader, known as “QuantLeo,” noted, “I stopped just looking at reports. Analyzing Lucid’s job postings in Saudi Arabia tipped me off to their expansion plans three months before the official announcement. That’s information that provides a real edge.”

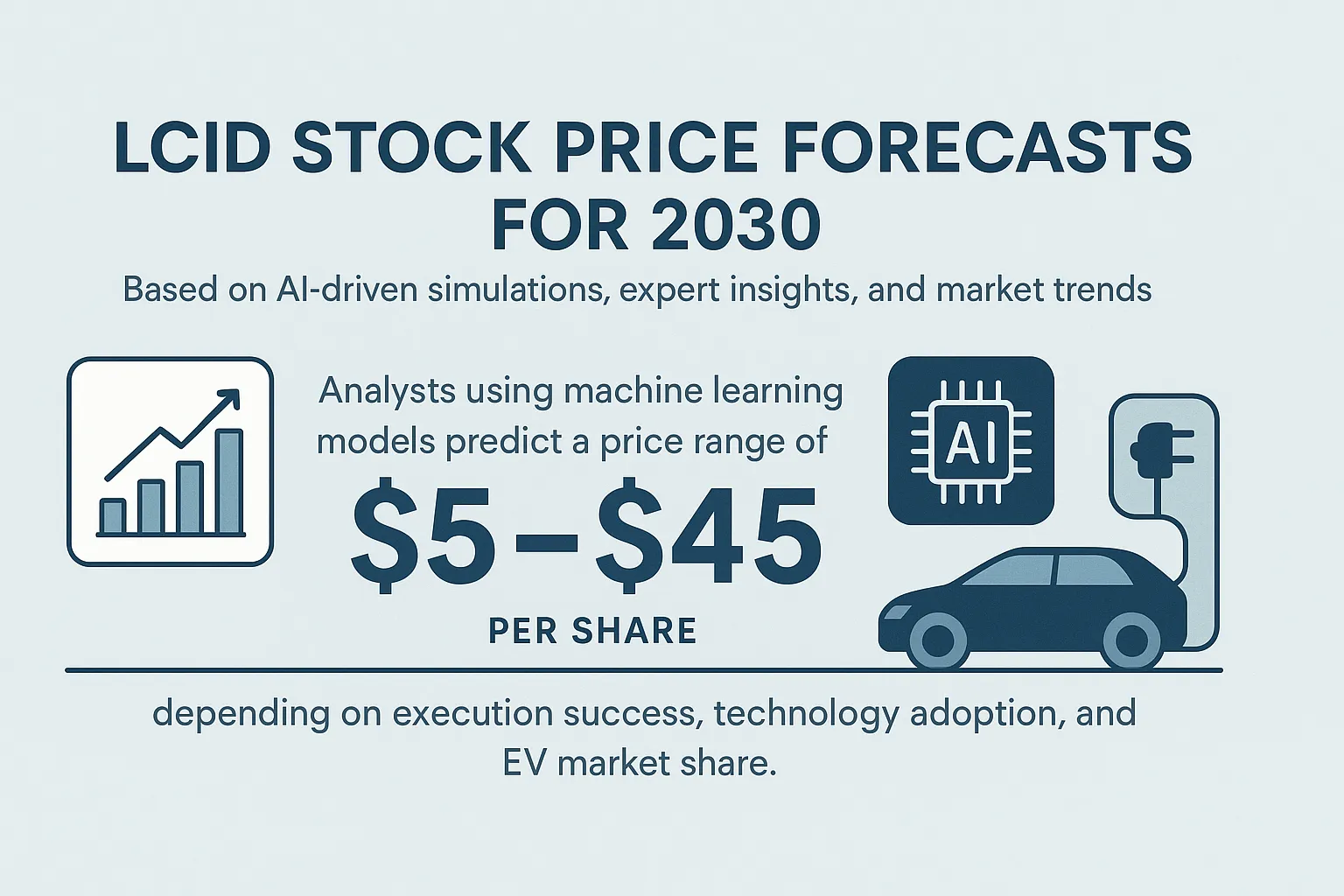

LCID Stock Price Prediction 2030: What Could the Numbers Look Like?

Based on AI-driven simulations, expert insights, and market trends, LCID stock price forecasts for 2030 vary across different scenarios. Analysts using machine learning models suggest a price range between $5 and $45 per share, depending on execution success, technology adoption, and EV market share. Here’s a closer look:

Quantitative Modeling and the LCID Target Price 2030

For long-term forecasts, such as the LCID target price for 2030, Monte Carlo simulations are crucial. Advanced platforms run tens of thousands of simulations, factoring in variables like production ramp-up, market share, and margin evolution. This creates a probability distribution of potential outcomes for the LCID stock price, not a single misleading target.

LCID 2030 Prediction: Monte Carlo Scenarios

| Scenario | Key Assumptions | Probability | Estimated 2030 Stock Price |

|---|---|---|---|

| Breakthrough Success | Solid-state battery by 2027; production > 500k units/year. | 20% | $35 — $45 |

| Steady Growth | Current trajectory; profitability by 2028; production ~350k units. | 45% | $18 — $25 |

| Challenged Execution | Scaling issues; competitive pressure; need for additional capital. | 35% | $5 — $12 |

Risk Assessment: What Investors Must Watch

Like any electric vehicle investment, LCID comes with significant risks. A comprehensive analysis must include:

- Market Risks: An economic slowdown could reduce demand for luxury vehicles. Aggressive pricing from competitors (especially Tesla) could squeeze margins.

- Execution Risks: Lucid is still in the early stages of scaling. Any supply chain disruptions or production delays could severely impact investor confidence.

- Technological Risks: Lucid’s battery advantage could be neutralized if competitors introduce breakthrough solutions.

- Financial Risks: The company is still burning cash. The need to raise additional funds could lead to the dilution of existing shareholders’ equity.

Practical Recommendations and Expert Takeaways

Understanding technology is only useful when it translates into a workable strategy. Financial strategists advises, “For stocks like LCID, I recommend a ‘Core-Satellite’ approach. The core of the portfolio is in diversified EV sector ETFs, while a smaller, ‘satellite’ portion is directly in Lucid shares for higher growth potential.” This is a sound approach for a volatile EV stock prediction.

While no forecast is absolute, the 2030 LCID stock price is most likely to fall within the $18 to $25 range under a steady growth scenario. Bullish investors may aim for the upper range of $45, while conservative models show downside risk to $5–$12. These predictions emphasize the importance of dynamic strategy and risk management in electric vehicle investments.

Conclusion: The Future of Tech-Enabled Forecasting

The technological revolution has fundamentally changed the Lucid Motors forecast and investing as a whole. Integrated systems combining AI, machine learning, and quantitative models are the new standard.

For investors determining their LCID target price, the main goal is not to find a single “correct” forecast but to use technology to understand probabilities and build a flexible strategy. This allows for informed decisions that align with personal investment goals and risk tolerance, providing a clearer path for navigating the complex future of the LCID stock price.

FAQ

What is the most likely LCID stock price in 2030?

Under current market conditions and AI-based forecasting models, the most probable LCID stock price by 2030 is between **$18 and $25**, assuming steady production growth and successful scaling. Higher valuations are possible with breakthrough technology adoption.

What will LCID stock be worth in 2030?

LCID stock price prediction for 2030 varies widely depending on production growth, technological breakthroughs, and market share. According to machine learning forecasts and Monte Carlo simulations, potential outcomes range from $5 to $45 per share. A bullish scenario assumes successful adoption of solid-state batteries and production exceeding 500,000 units annually, while a bearish outlook reflects scaling challenges and funding issues.

What factors drive LCID stock price predictions?

Several variables influence LCID stock price forecasts, including production scale and manufacturing efficiency, battery innovation (e.g., solid-state tech), global EV demand and Lucid’s competitive position, financial metrics like revenue growth and margins, investor sentiment from job postings, patents, and social media, and AI-based insights that analyze satellite data and supply chain resilience. Together, these factors shape a probabilistic forecast for Lucid Motors.

Is Lucid Motors a good long-term investment?

Lucid Motors can be a promising long-term investment for those with a high-risk tolerance and belief in the future of luxury EVs. The company offers advanced battery technology and targets a premium market segment. However, its path to profitability remains uncertain, and investors must account for volatility, execution risks, and capital needs. Many strategists recommend including LCID as a “satellite” position alongside diversified EV ETFs.

How does LCID compare to Tesla stock?

LCID and Tesla differ significantly in scale, strategy, and market position. While Tesla dominates mass and premium EV segments globally with ~1.8 million annual deliveries, Lucid targets the ultra-luxury niche and produced fewer than 20,000 vehicles annually (as of 2025). Tesla benefits from software and vertical integration, whereas Lucid focuses on battery performance and design. For investors, LCID offers higher upside — and higher risk — than Tesla.

How does AI improve stock price forecasting?

AI improves forecasting accuracy by analyzing millions of data points daily, including financials, logistics, satellite imagery, sentiment analysis, and alternative data. Machine learning models like XGBoost reduce average prediction error by over 20% compared to traditional methods. These systems also adapt continuously, making them more effective in volatile sectors like EV stocks.

What are the risks of investing in LCID?

Several variables influence LCID stock price forecasts, including production scale and manufacturing efficiency, battery innovation (e.g., solid-state tech), global EV demand and Lucid’s competitive position, financial metrics like revenue growth and margins, investor sentiment from job postings, patents, and social media, and AI-based insights that analyze satellite data and supply chain resilience. Together, these factors shape a probabilistic forecast for Lucid Motors. 6.