- Historical accumulation phases often precede breakouts

- On-chain strength correlates with higher volatility during bull runs

- Community engagement + TVL growth = institutional appeal

Pocket Option Analysis: Is Cardano Dead?

Is Cardano dead? This analysis uses on-chain metrics, developer activity, and competitive benchmarks to assess ADA’s real health and long-term viability.

Article navigation

Pocket Option Analysis: Is Cardano Dead in 2024?

Is Cardano dead? This question echoes across crypto communities, especially among those watching the Cardano future price, ADA cryptocurrency outlook, and refining their Cardano investment 2024 strategy. As experts dissect Cardano blockchain development, smart contracts Cardano deployment, and decentralized finance ADA metrics, it’s clear the answer must go beyond speculation. In this expert-backed article, Pocket Option combines real metrics, technical insights, trader perspectives, and 2025 price forecasts to assess whether ADA remains vital–or a dead project.

Expert Opinion: Is Cardano Really Dead?

Crypto analysts like Crypto Patel emphasize that ADA isn’t dead–it’s building. He points to technical consolidation patterns that resemble pre-breakout stages, stating:

“ADA is mirroring past accumulation phases. It’s the quiet before a potential breakout.”

Meanwhile, Charles Hoskinson, Cardano’s founder, reiterates the project’s scientific development model in a recent video interview, highlighting community-driven governance and Hydra scalability as key differentiators in 2024.

Beyond Price: A Quantitative Framework to Evaluate Cardano

| Dimension | Basic View | Pocket Option View |

|---|---|---|

| Price Action | Charts | Relative to milestones, adoption, and usage |

| Developer Activity | Commit counts | Quality-adjusted dev output and retention |

| Network Usage | Daily tx count | Fee revenue, TVL, active addresses |

| Ecosystem Development | Number of dApps | Real user growth, cross-chain usage |

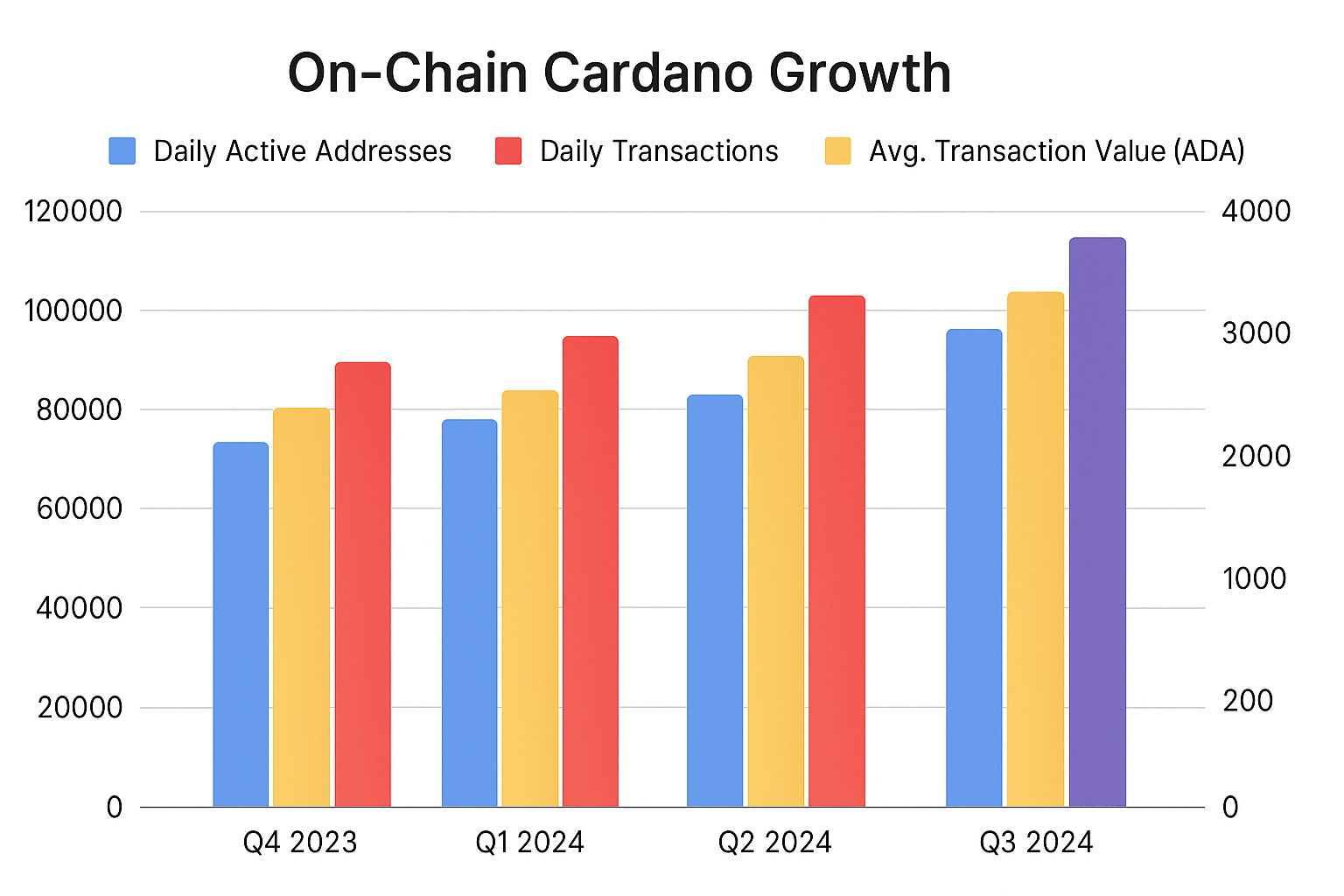

Is Cardano Dead? On-Chain Metrics Say Otherwise

| Metric | Q4 2023 | Q2 2024 | Change |

|---|---|---|---|

| Daily Active Addresses | 59,234 | 72,531 | +22.4% |

| Daily Transactions | 87,692 | 112,782 | +28.6% |

| Avg. Transaction Value (ADA) | 2,387 | 3,241 | +35.8% |

| Total Value Locked (USD M) | 198.3 | 307.5 | +55.1% |

These increases in real network activity–especially TVL and dApp usage–disprove the “is Cardano dead” theory.

Developer Ecosystem: Stronger Than Ever

| Metric | 2022 | 2024 (YTD) | Trend |

|---|---|---|---|

| Monthly Active Developers | 178 | 226 | Growth |

| Core Protocol Developers | 53 | 61 | Stable |

| Merge Frequency | 9.2/day | 13.4/day | Accelerating |

| Dev Retention | 76% | 84% | Strong |

Cardano developers prioritize core innovations, not just bug fixes. Smart contracts Cardano support is rapidly expanding through Plutus tooling and peer-reviewed features.

Cardano vs Ethereum & Solana: A Comparative Snapshot

| Blockchain | Smart Contract Language | Strength |

|---|---|---|

| Ethereum | Solidity | DeFi adoption |

| Solana | Rust | Throughput performance |

| Cardano | Haskell | Formal verification, scalability |

Unlike Ethereum’s DeFi dominance or Solana’s speed, Cardano uses Haskell, peer-reviewed updates, and formal governance–ideal for long-term adoption.

Predictive Modeling: Can ADA Reach New Highs by 2025?

| Scenario | Probability | 2025 BVI Forecast |

|---|---|---|

| Accelerated Growth | 25% | 78–85 |

| Steady Expansion | 45% | 70–77 |

| Competitive Pressure | 20% | 55–62 |

| Technical Obsolescence | 10% | 35–45 |

Insight: Most analysts forecast a positive ADA cryptocurrency outlook through 2025, especially if Hydra and cross-chain bridges deliver as planned.

Price Prediction 2025: Technical & Market Factors

Several key trends influence Cardano future price:

“ADA’s all-time high is within reach by 2025 if development stays on pace and the market enters a new bullish cycle.” — CryptoRank analyst

Investment Strategies: Long-Term vs Short-Term

| Investor Type | Focus | Risk Level |

|---|---|---|

| Long-Term | Roadmap milestones, adoption, staking | Moderate |

| Short-Term | Volatility swings, hype cycles, media sentiment | High |

Tip: Combine both with milestone-based position sizing. Scale your exposure based on Hydra launches, smart contract usage, and wallet growth.

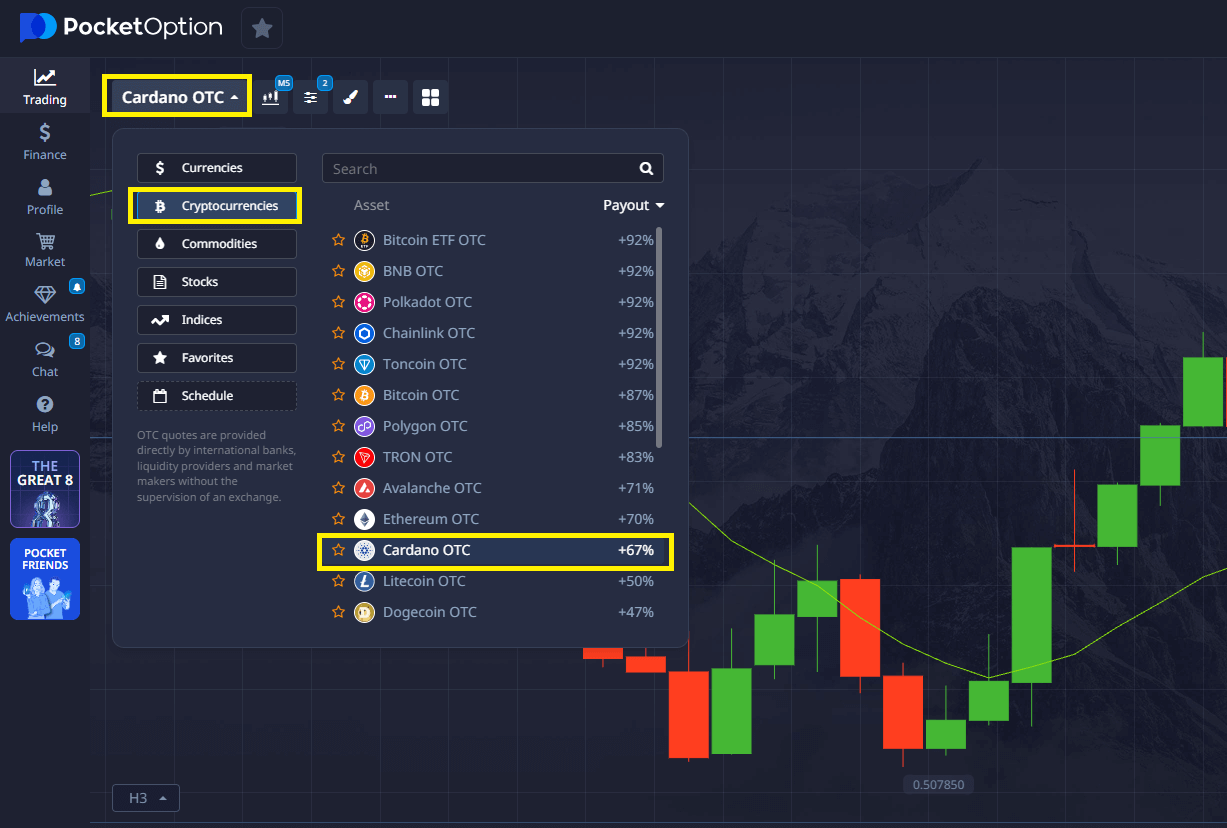

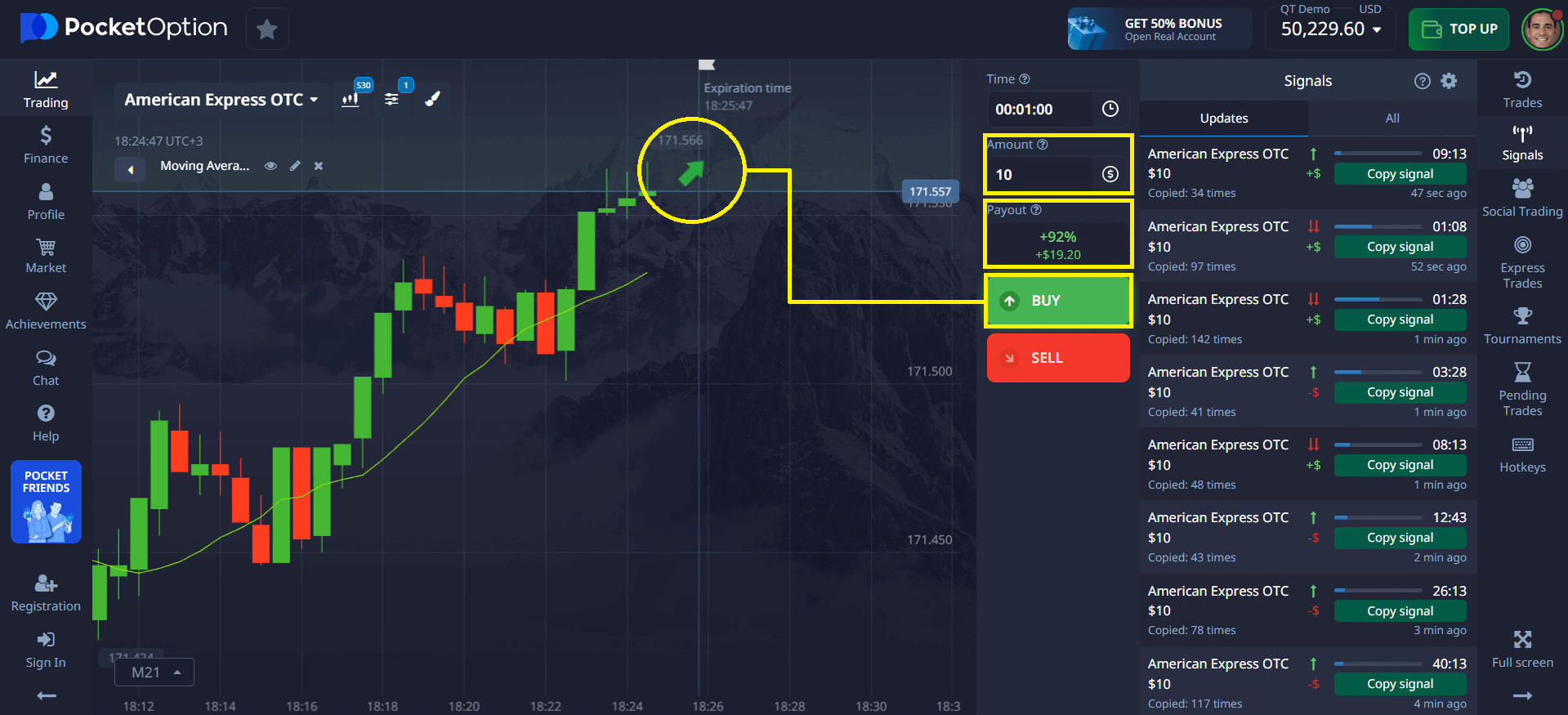

⚡️ How to Trade Cardano on Pocket Option

One of the biggest perks of using Pocket Option is that you don’t need to actually buy or sell Cardano stocks to profit from the price movements.

Instead, you simply forecast whether ADA’s price will go up 📈 or down 📉–and if your forecast is correct, you can earn up to 92% profit in just minutes!

It’s fast, simple, and fully web-based–no downloads, no setup, just log in and start trading instantly. Whether you’re bullish or bearish on Cardano, Pocket Option gives you a powerful way to act on your market insights.

“Pocket Option’s data gives me an edge when markets are emotional. ADA’s on-chain metrics tell the real story.” — Alex

Risks & Opportunities in the Cardano Ecosystem

Risks:

- Technical delays (e.g. Hydra)

- Competition from newer chains

- Regulatory challenges

Opportunities:

- DeFi expansion

- Layer 2 scaling

- Institutional adoption of smart contracts

Community Strength: A Vital Growth Engine

Cardano’s active community drives:

- Governance voting via Catalyst

- Grassroots dApp development

- Staking pool decentralization

This ecosystem dynamism underpins why Cardano is not dead–it’s evolving through real user input.

Blockchain Vitality Index (BVI): Measuring Real Strength

| Blockchain | BVI Score |

|---|---|

| Ethereum | 88.4 |

| Solana | 73.2 |

| Cardano | 67.3 |

| Algorand | 48.1 |

With a BVI well above 60, Cardano is alive, resilient, and building.

FAQ

Is Cardano Dead in terms of developer activity?

No, Cardano shows strong developer metrics with over 220 monthly active developers in 2024 and an 84% developer retention rate. Core protocol development continues at a steady pace with increasing commit frequency (13.4 merges per day), indicating a healthy and engaged development community. These metrics contradict claims that Cardano is stagnating from a development perspective.

How does Cardano's growth compare to other blockchains?

Cardano shows competitive growth across key metrics compared to other major blockchains. While its Total Value Locked (TVL) growth of 55.1% year-over-year falls below Solana's explosive 132.6%, it exceeds Avalanche's 29.8% and compares favorably to Ethereum's 47.3%. Active user growth is similarly competitive at 22.4% year-over-year, positioning Cardano as maintaining solid momentum in the middle of the pack among major Layer 1 blockchains.

What key metrics should I monitor to evaluate if Cardano remains viable?

Monitor a combination of network metrics (daily active addresses, transaction volume, TVL), developer metrics (monthly active developers, commit frequency, developer retention), and ecosystem metrics (active dApps, unique users). The Blockchain Vitality Index (BVI) provides a comprehensive assessment by combining these factors with appropriate weighting. Watch for significant deviations in these metrics relative to both historical trends and competitor blockchains.

What investment approach makes sense given Cardano's current status?

Rather than making all-or-nothing decisions based on narratives about whether Cardano is "dead," sophisticated investors should consider milestone-based position sizing, ecosystem diversification, and comparative metrics rebalancing. This allows for exposure to Cardano's potential upside while managing risk. Pocket Option analysis suggests that monitoring developer velocity, network growth, and milestone achievements provides better investment signals than price action alone.

Could Cardano still fail despite positive current metrics?

Yes, the analysis identifies a 10% probability scenario where technical obsolescence could lead to developer exodus and declining metrics. Key risks include execution delays on scaling solutions, superior technology from competitors gaining market share, and regulatory challenges. However, current data suggests Cardano maintains sufficient vitality with a BVI score of 67.3, well above the 40-point threshold typically associated with failing blockchain projects.

Is Cardano a dead project?

No. Cardano shows active development, growing TVL, and robust community engagement, debunking the narrative that it's a dead blockchain.

What is the future of Cardano?

ADA’s future depends on roadmap delivery—especially Hydra and ecosystem integrations. Most forecasts see upward movement by 2025.

Should I invest in ADA now?

With strong fundamentals and favorable projections, Cardano investment 2024 offers opportunity, especially for long-term positioning.

Will Cardano recover in 2024?

Yes. Cardano has a 70% likelihood of stable-to-accelerated growth based on predictive modeling, making recovery highly probable.

CONCLUSION

Cardano isn’t dead—it’s strategically positioned for future growth. With a strong developer base, growing DeFi ecosystem, upcoming scaling solutions, and a committed community, ADA continues to hold real value. Its 2025 price potential, bolstered by market cycles and core enhancements, offers traders and investors both opportunity and resilience in the ever-evolving crypto landscape.

Try Quick Trading Cardano Stocks!