- Tourism and agriculture affect Morocco’s seasonal income.

- Interest rate decisions in Morocco and the US influence capital flows.

- Trade balance impacts MAD via phosphate and fuel prices.

- Remittances from abroad can strengthen MAD.

- Global risk appetite can shift investors into or out of emerging market currencies.

MAD/USD - everything you need to know before placing your first trade

MAD/USD is a straightforward currency pair that anyone can start analyzing with just a bit of practice. It reflects the exchange relationship between the Moroccan Dirham and the US Dollar. As Morocco's economy expands and the USD remains a global benchmark, this pair draws interest for its stability and regional ties. In this article, we'll explain how to trade MAD/USD, what drives its value, and how to begin trading on Pocket Option.

Article navigation

- What is MAD/USD?

- How does the currency quote work?

- What influences MAD/USD?

- Historical trend of MAD/USD

- How to read the MAD/USD rate

- What is the sentiment of MAD/USD stock?

- How much is $100 US in Morocco?

- How much is $100 US in dirhams?

- Is 1000 Moroccan dirhams a lot?

- Is the dollar strong in Morocco?

- Why trade MAD/USD on Pocket Option?

- Quick Trading Example on MAD/USD

- Try Without Risk – $50,000 Demo Account

What is MAD/USD?

MAD/USD shows how many US Dollars are needed to buy one Moroccan Dirham. This Forex pair helps traders track regional trends, currency performance, and cross-border trade.

MAD/USD is frequently used to monitor Morocco’s balance of trade, import costs, and investor confidence.

How does the currency quote work?

For example:

MAD/USD = 0.099 means 1 MAD is equal to 0.099 USD.

This means MAD is weaker–many Dirhams are needed to equal one Dollar.

Example:

If you exchange 100 MAD at this rate, you’ll get $9.90.

The closer this value gets to 1, the stronger the MAD is compared to the USD.

What influences MAD/USD?

Several macroeconomic factors affect MAD/USD:

These macro indicators help traders build a reliable MAD/USD forecast.

Historical trend of MAD/USD

Between 2020 and 2025, MAD/USD fluctuated between 0.093 and 0.105. During 2022, the Dirham appreciated slightly due to record agricultural exports and a rebound in tourism.

However, in late 2023, the USD surged globally, pushing MAD/USD down to 0.095. As of mid-2025, the rate has stabilized around 0.099, reflecting balanced macro conditions.

Data Source: World Bank, Bank Al-Maghrib

How to read the MAD/USD rate

If MAD/USD moves from 0.099 to 0.104, the Dirham is getting stronger–it takes more Dollars to buy one MAD.

If it falls to 0.095, MAD is losing value and the USD is strengthening.

Movements like these can show whether market sentiment is favoring the Moroccan or US economy.

What is the sentiment of MAD/USD stock?

Market sentiment around MAD/USD depends on economic news, central bank policies, and risk appetite. Recently, as of mid-2025, the MAD has shown resilience due to a steady flow of remittances and strong agricultural exports. However, high US interest rates continue to pressure emerging market currencies, including MAD.

Tip for traders: Follow the Federal Reserve and Bank Al-Maghrib announcements closely. Hawkish US policy can push MAD/USD down, while dovish stances can offer recovery potential for MAD.

How much is $100 US in Morocco?

To convert $100 into Moroccan Dirhams (MAD), use the current exchange rate. At MAD/USD = 0.099, divide 100 by 0.099:

$100 / 0.099 = approx. 1,010 MAD

This means with $100, you can get around 1,010 Moroccan Dirhams, although actual rates may vary slightly based on fees and market conditions.

How much is $100 US in dirhams?

As with the previous calculation, if 1 MAD = 0.099 USD, then:

$100 = ~1,010 MAD

This estimate provides a practical idea of how much spending power $100 offers in Morocco, enough for meals, transport, or even hotel stays in mid-range cities.

Is 1000 Moroccan dirhams a lot?

It depends on the context. In Moroccan terms:

- 1000 MAD is around $98.50 at the rate of 0.099.

- It’s enough to cover a week’s groceries for a small household.

- You can get 2-3 nights at a local hotel, or multiple restaurant meals.

While not luxurious, it represents a decent short-term budget for local living or travel expenses.

Is the dollar strong in Morocco?

Currently, the USD is strong relative to the MAD, especially after several US rate hikes. The strength of the dollar makes American goods and travel more expensive for Moroccans but gives US traders more purchasing power within Morocco.

For investors and traders, this means bearish pressure on MAD/USD can signal opportunities to short the Dirham or hedge regional exposure.

Why trade MAD/USD on Pocket Option?

Pocket Option offers a dynamic and intuitive interface for MAD/USD trading, making it a prime choice for both beginners and experienced traders. Here’s why:

- Fast execution: Trade within seconds using Quick Trading or Digital Options.

- Multiple assets: Combine MAD/USD with other best Forex pairs Pocket Option supports.

- Demo access: Explore Pocket Option demo MAD/USD to test strategies.

- Low entry: Start live trading with just $5.

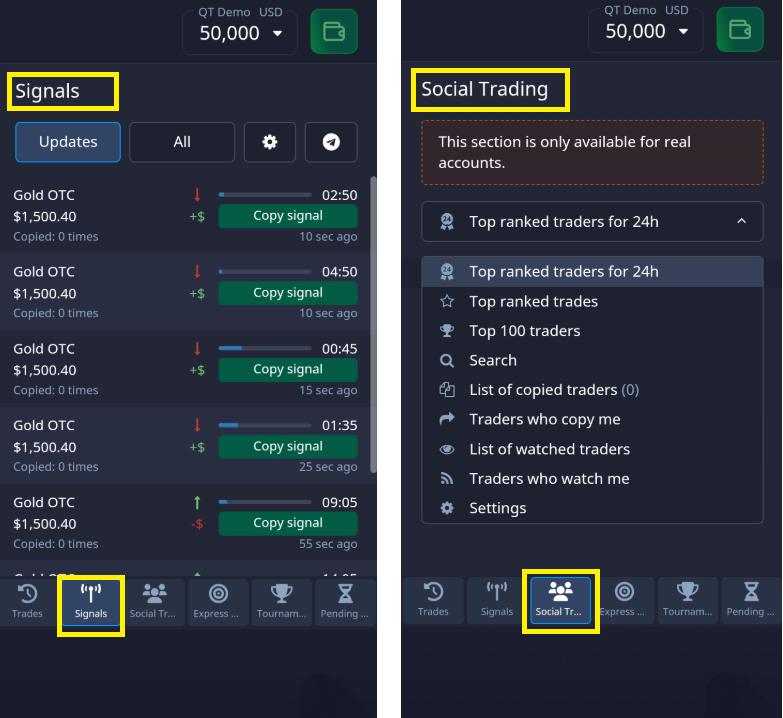

- Education and tools: Charts, signals, copy trading and full support in one platform.

If you want to trade Moroccan dirham on Pocket Option, the platform offers flexibility and speed unmatched in its segment.

Quick Trading Example on MAD/USD

Follow these steps to trade MAD/USD using Pocket Option’s Quick Trading feature:

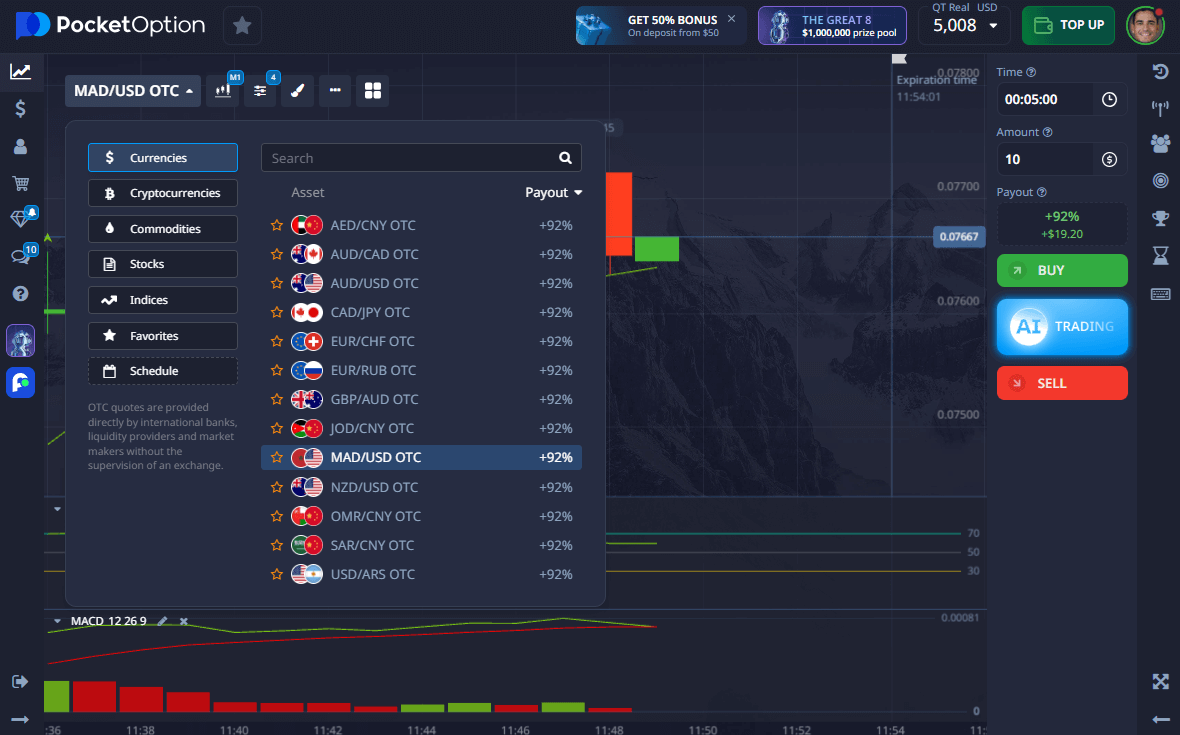

- Find the asset: MAD/USD or MAD/USD OTC

- Analyze the chart: Use indicators or watch sentiment

- Enter your amount: from $1

- Set time: from 5 seconds (for OTC assets, the minimum is 5 sec)

- Forecast the direction:

— Think price will rise? Click BUY

— Expect a drop? Click SELL

Outcome: If your forecast matches the price direction, you may receive up to 92% return (rate shown before trade).

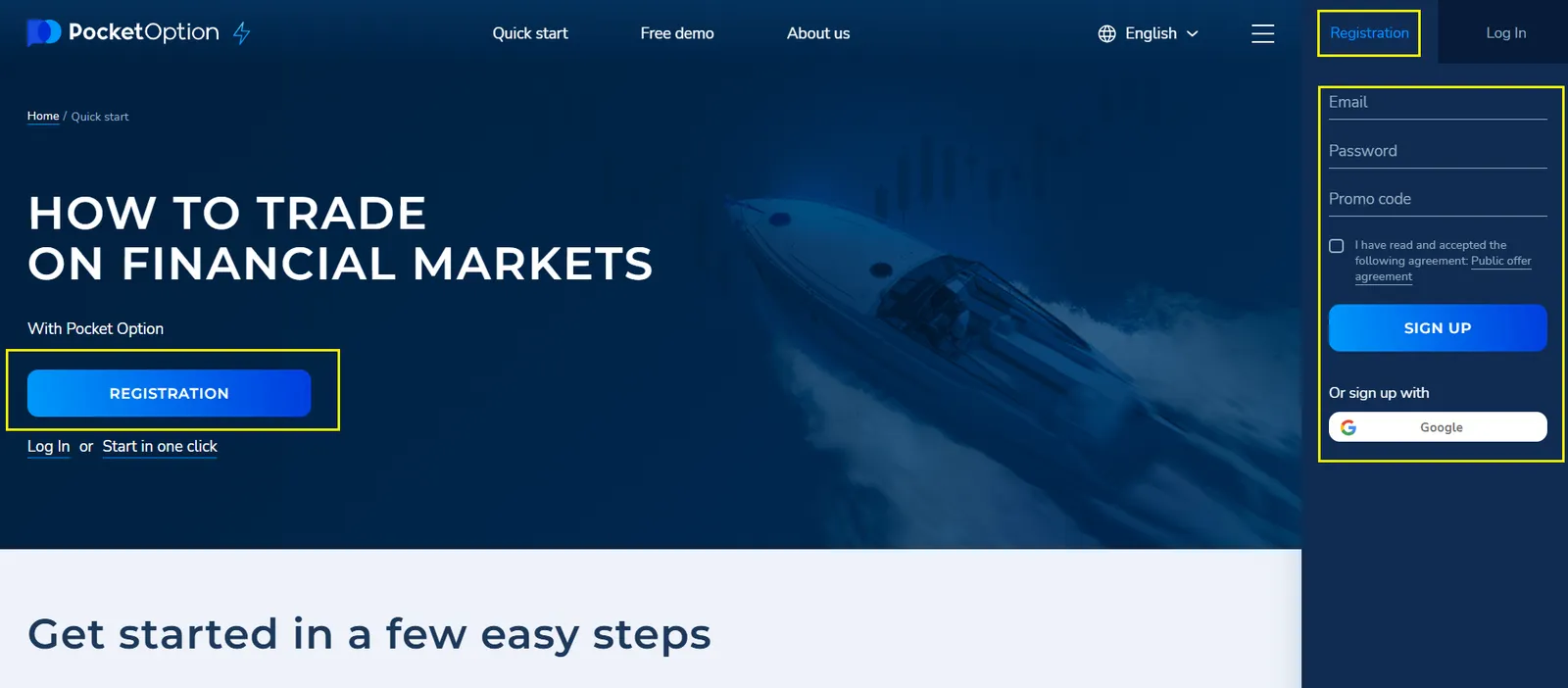

📌 Getting started is simple

Register and explore the platform. You can deposit from just $5 (deposit may vary depending on payment methods) or try a free demo account to learn without pressure.

Try Without Risk – $50,000 Demo Account

Not sure how to begin? Try trading MAD/USD with zero risk using the free demo account.

You’ll receive $50,000 in virtual funds after registration to:

- Explore strategies

- Practice trading

- Get familiar with Pocket Option tools

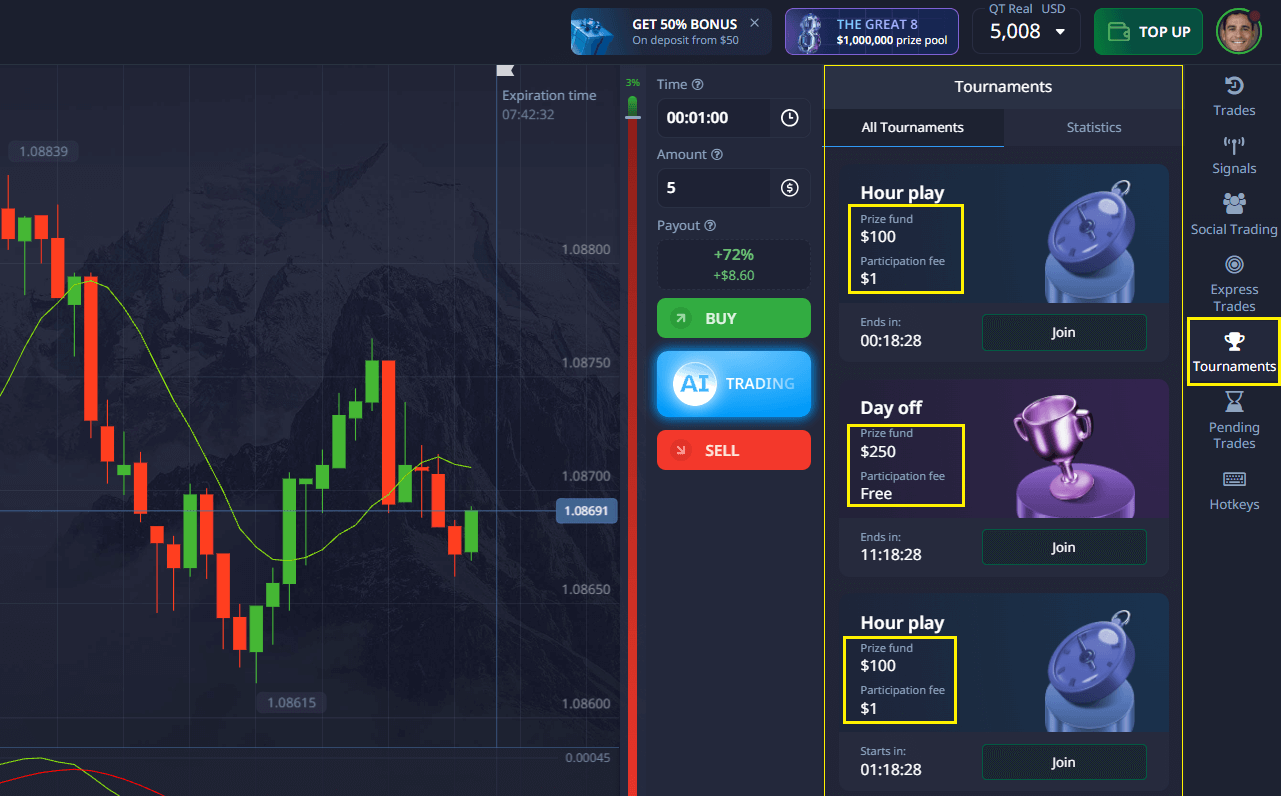

Later, you can switch to a live account with just $5 and unlock:

- Copy Trading

- Cashback

- Trading Tournaments

- Full analytics and indicators

Discuss this and other topics in our community!

FAQ

What is happening with MADUSD stock today?

You can view live MAD/USD market changes and build forecasts based on real-time data on Pocket Option.

How to trade MAD/USD effectively?

Open the MAD/USD chart, set your trade duration and amount, and forecast the movement.

How to buy MAD USD for trading?

Find MAD/USD in the asset list and initiate a position by selecting trade direction and time.

How to invest in MAD USD safely?

Try the demo account first, then move to a live account with just $5 to manage real trades.

What affects MAD/USD pricing?

Exchange rates depend on tourism, global risk appetite, US interest rate policy, and Moroccan export levels.