- Inflation rates and central bank decisions in Lebanon

- U.S. Federal Reserve interest rate policy

- Political developments in Beirut

- Remittances and economic aid inflows

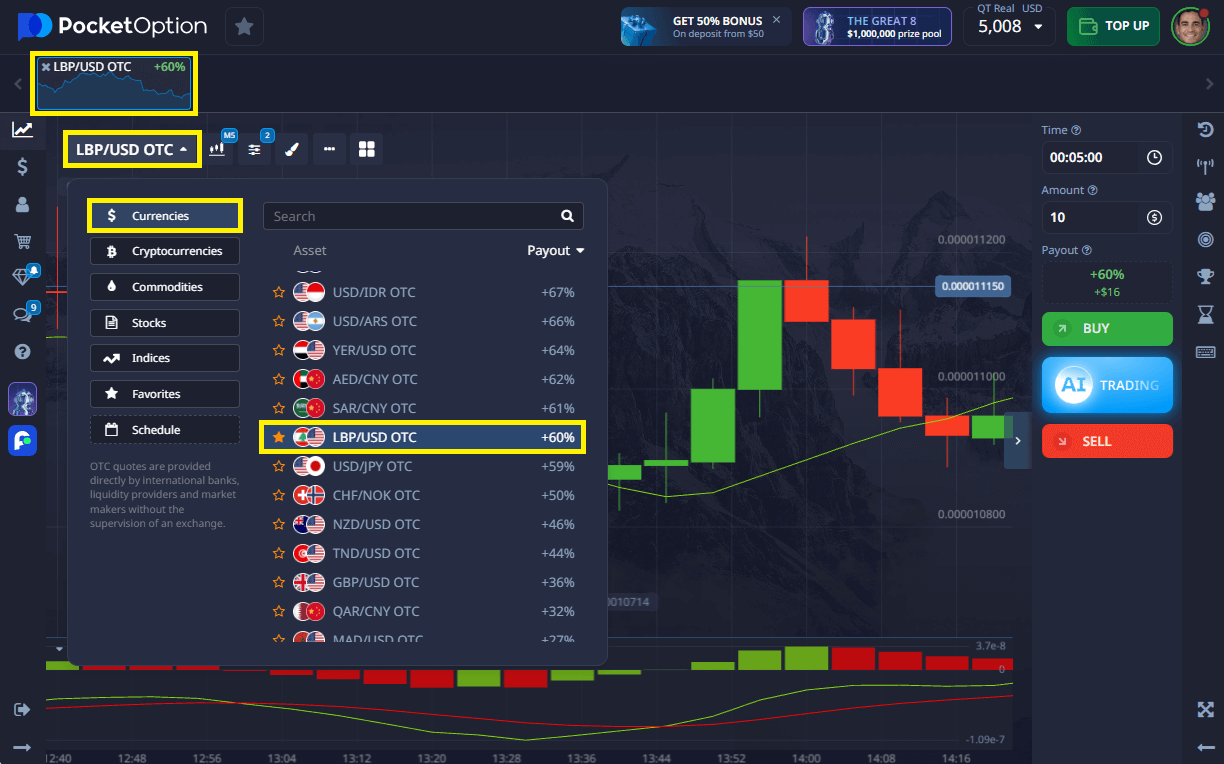

LBPUSD: What You Need to Know Before You Start Trading

The LBP/USD currency pair compares the Lebanese Pound (LBP) to the United States Dollar (USD). Due to Lebanon's ongoing economic crisis and the Dollar's global dominance, this pair displays highly asymmetric behavior -- offering insights and opportunities for short-term traders.

What Is LBP/USD?

LBP/USD expresses the value of one Lebanese Pound in US Dollars. Due to hyperinflation and limited foreign reserves in Lebanon, this rate has reached historic lows — making it a high-volatility asset for speculative trades.

The Central Bank of Lebanon has de-pegged the currency, and traders now use floating rates that vary significantly even within the same day.

How Currency Quotation Works

If LBP/USD = 0.00001114, it means 1 LBP is worth 0.00001114 USD. In this quote, the Lebanese Pound is the base currency, and it is significantly weaker than the US Dollar.

Example: Converting 1,000,000 LBP would yield approximately 11.14 USD. This illustrates the currency’s diminished purchasing power on global markets.

Factors Influencing LBP/USD Movement

If reform is stalled in Lebanon or foreign reserves drop, the LBP tends to weaken. On the other hand, a dovish shift in U.S. policy could momentarily support LBP/USD.

How to Interpret LBP/USD Price Changes

When LBP/USD rises from 0.00001114 to 0.00001200, the Lebanese Pound is strengthening relative to the Dollar.

When the rate falls to 0.00001050, the Pound is weakening.

Example: A drop from 0.00001110 to 0.00001080 may suggest negative news regarding Lebanon’s financial reserves or domestic policy.

Step-by-Step Quick Trading Example on LBP/USD

- Open the Pocket Option platform and find LBP/USD OTC in the asset list.

- Review the chart and apply technical indicators or sentiment tools.

- Choose your investment amount, starting from $1.

- Set the trade time — from 5 seconds and up (5 seconds available for OTC assets).

- Make your forecast:

- Click BUY if you expect the rate to rise.

- Click SELL if you expect the rate to fall.

- The system will display your potential return — up to 92% if the forecast is correct.

Try Risk-Free — $50,000 Demo Account

Want to test trading LBP/USD without investing real money? Pocket Option offers a fully equipped demo account with $50,000 virtual funds.

Use it to learn the platform, explore indicators, and build your confidence with zero financial pressure.

After registration, switch to a real account from just $5 and unlock:

- Copy-trading

- Cashback

- Trading tournaments

- Full feature access

Conclusion

LBP/USD is a currency pair with extreme volatility, influenced by Lebanon’s unstable economy and U.S. financial policy. It offers real-world insight into macroeconomic risks and the mechanics of short-term trading. Whether you’re practicing on demo or entering live markets, understanding how to trade LBPUSD helps you stay informed and adapt to fast-moving conditions.

FAQ

What is happening with LBPUSD stock today?

LBPUSD remains under pressure due to Lebanon's inflation and lack of effective monetary policy, keeping the rate near historic lows.

How to trade LBPUSD on Pocket Option?

Select the pair, use chart tools, and place trades starting from $1 -- available in both live and demo modes.

How to buy LBPUSD easily?

Log in to Pocket Option, find the asset, and execute a short-term forecast trade based on your analysis.

How to invest in LBPUSD effectively?

Use trend indicators, manage risk carefully, and consider news from both the U.S. and Lebanon.

Why does LBPUSD fluctuate so much?

The pair reflects Lebanon's unstable financial system and rapid LBP devaluation versus the relatively stable USD.