- London Session (08:00-16:00 GMT): High liquidity and volatility

- New York Session (13:00-21:00 GMT): Overlap with London, ideal for trading GBPUSD

GBPUSD: How it Works and How to Start Trading GBP/USD

The GBPUSD pair is one of the most traded and analyzed currency pairs in the forex market. Whether you're a novice or experienced trader, mastering how to trade GBPUSD can significantly enhance your market performance. This guide covers vital economic drivers, trading strategies, platform selection, and real trading examples using Pocket Option.

Understanding the GBPUSD Currency Pair

The GBPUSD currency pair represents the British Pound (GBP) versus the US Dollar (USD). A quote of GBP/USD = 1.2550 means one British Pound equals 1.2550 US Dollars.

Example: If you exchange £100, you receive $125.50. This exchange rate helps traders calculate relative value and potential returns in forex.

What is GBPUSD in Forex?

How to trade gbpusd in forex? It is categorized as a major currency pair due to the trading volume and liquidity provided by the UK and US economies. Traders monitor this pair to gauge market sentiment, economic trends, and risk appetite.

GBPUSD Today Buy or Sell?

Use platforms like GBPUSD — TradingView to monitor live charts and market sentiment. Analyze current technical patterns, data releases, and economic indicators to determine if it’s a good time to buy or sell.

Key Factors Influencing GBP/USD Movement

| Factor | Impact on GBP/USD |

|---|---|

| Bank of England interest rate policy | Direct influence on GBP strength |

| U.S. Federal Reserve decisions | USD impact, often moves GBPUSD inversely |

| Brexit-related developments | High volatility on GBP side |

| UK/US inflation, GDP & economic data | Macro backdrop that guides price movements |

| Central Bank statements | Change in market conditions and sentiment |

Example: If the Fed raises interest rates, the USD may strengthen, pushing GBP/USD lower. Conversely, a hawkish stance from the Bank of England may cause GBP/USD to rise.

How to Interpret GBP/USD Price Changes

When GBP/USD moves from 1.2500 to 1.2700, it signals Pound appreciation. A drop to 1.2300 indicates a stronger Dollar.

Example: A move from 1.2550 to 1.2650 may reflect strong UK employment data or rising bond yields. Each pip movement can represent a significant gain or loss depending on position size.

What Is the Best Time to Trade GBPUSD?

Pro Tip: Monitor key support and resistance levels during economic data releases and major trading sessions.

Trading Strategies for GBPUSD

Combining Technical and Fundamental Analysis

| Analysis Type | Tools & Insights |

|---|---|

| Fundamental | BOE/Fed rates, GDP, CPI, employment reports |

| Technical | RSI, Bollinger Bands, Moving Averages |

Popular Indicators:

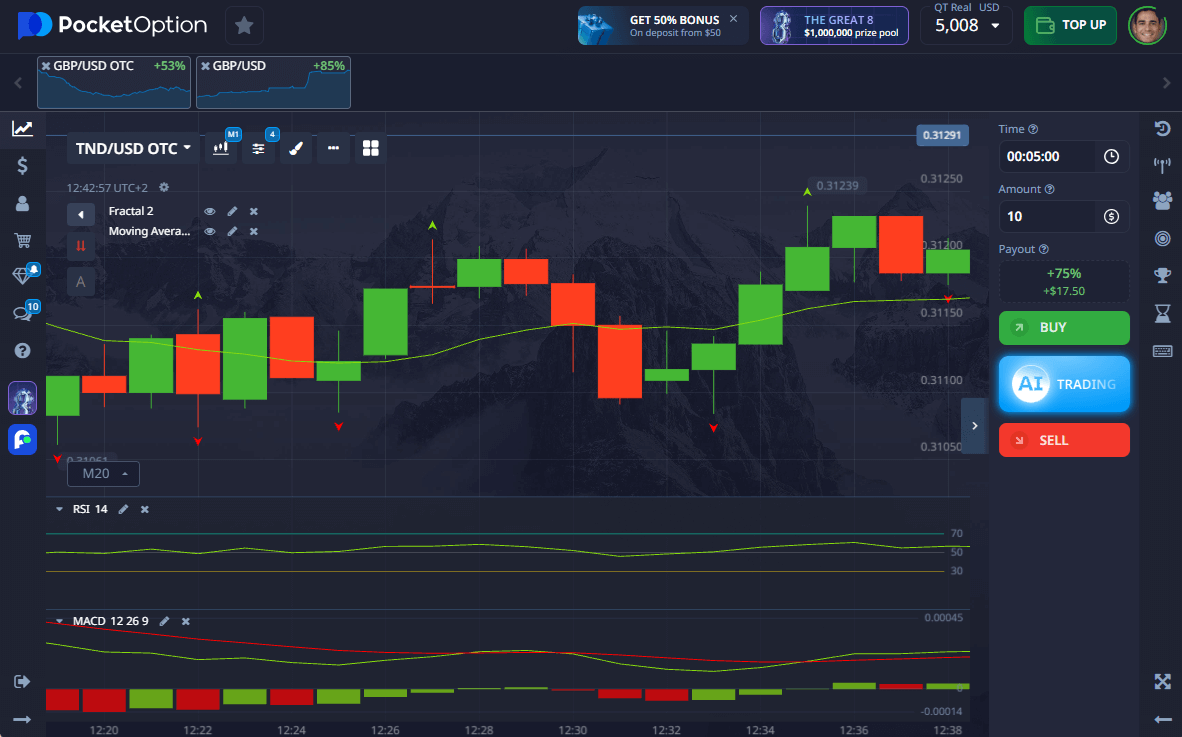

- Moving Averages for trend direction

- RSI for overbought/oversold zones

- Bollinger Bands for volatility and breakout spotting

- MACD for momentum analysis

Chart Patterns and Breakouts

Recognize patterns like:

- Head & Shoulders

- Double Tops/Bottoms

- Triangles

These patterns help anticipate reversals and breakouts. Combined with CFDs, traders can profit in both rising and falling markets.

Breakout Strategy: Set pending orders above resistance or below support levels, using stop-loss orders to manage risk.

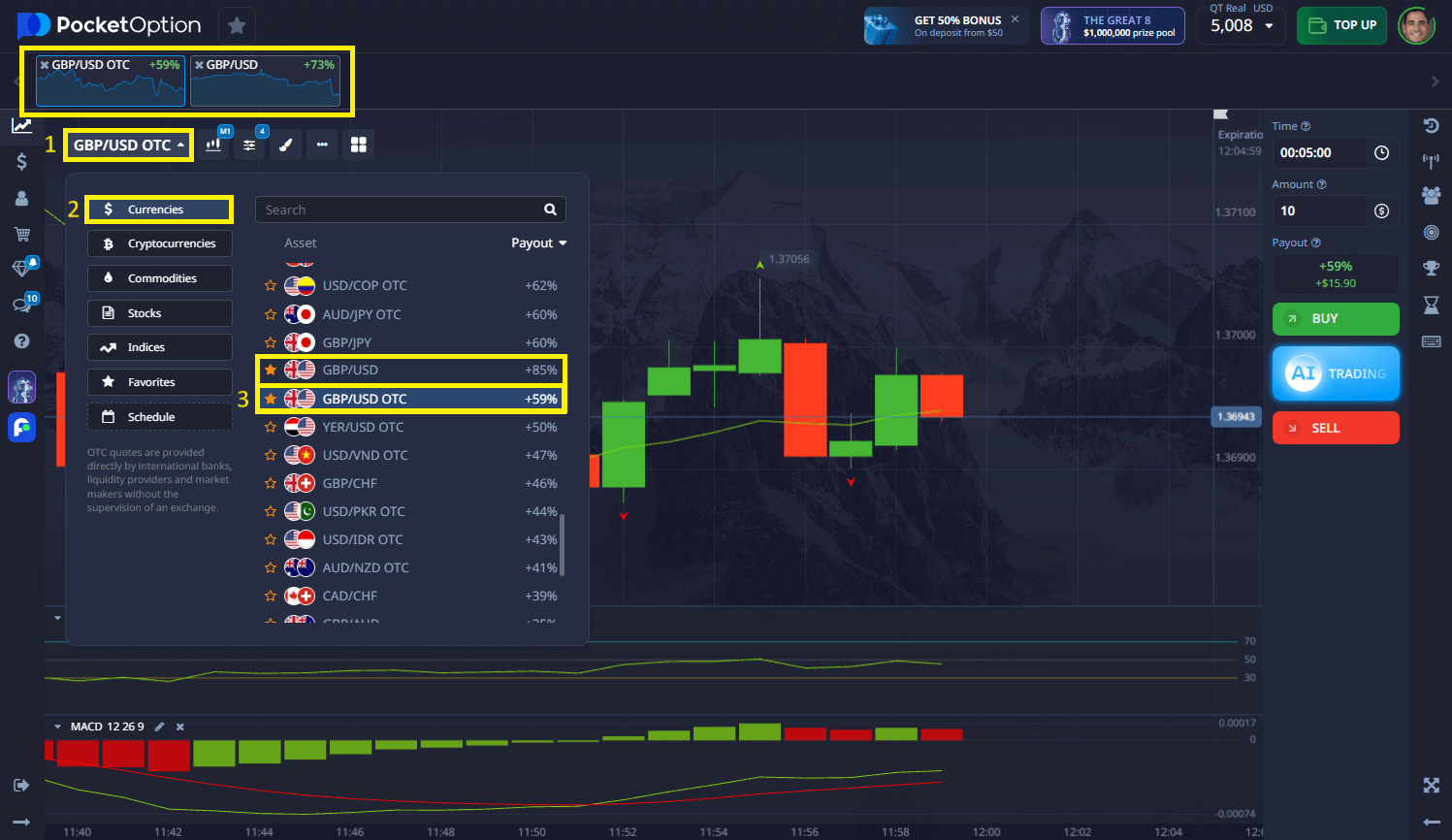

Example Quick Trading Strategy on Pocket Option

Step-by-Step GBP/USD Trade

- Open Pocket Option and select GBP/USD or GBP/USD OTC.

- Analyze GBPUSD live charts using technical analysis.

- Choose trade amount from $1 minimum.

- Pick expiration time (e.g., 30s, 1m, etc.).

- Predict direction:

- Click BUY if expecting price rise

- Click SELL if expecting price drop

- Payouts up to 92% are shown before trade.

Using CFDs to Trade GBP/USD

Contracts for Difference (CFDs) allow speculation without owning the currency. They offer leverage and flexibility to profit in both rising and falling markets. Risk management is crucial due to magnified losses.

| Benefit | Description |

|---|---|

| Flexibility | Long or short trades on GBPUSD |

| Leverage | Greater exposure with smaller capital |

| Real-time charts | React quickly to price swings |

Risk Management: Smart Practices

- Stop-Loss Orders: Limit downside

- Take-Profit Orders: Secure gains

- 1-2% Rule: Don’t risk more than 2% of capital per trade

- Economic Calendar: Avoid trading during high-impact news without a plan

Common Mistakes:

- Ignoring economic indicators and interest rate decisions

- Overleveraging

- Emotional trading

- No strategy testing or defined trading strategy

Choosing a Platform: Why Pocket Option

Why Pocket Option for GBP/USD?

- Offers GBPUSD and GBP/USD OTC with high liquidity

- Minimum deposit from $5

- Copy trading, signal bots, cashback, and trading tournaments

- Advanced charting (candlesticks, indicators)

- Real-time data feeds

- Multi-device access (Windows, Mac, Android, iOS)

Trader Reviews:

- “Pocket Option’s interface is intuitive. I started trading GBPUSD with $10 and quickly scaled up.” — David M.

- “The signal bot really helps with short-term trading decisions. Great for volatile pairs like GBP/USD.” — Sophie R.

- “I enjoy trading with CFDs on Pocket Option. Easy access to leverage and tight spreads.” — Carlos N.

Learning Resources

Explore:

- Pocket Option blog and academy

- Webinars and YouTube channels

- Expert analysis from Bloomberg, Reuters, and FXStreet

- Books: “Currency Trading for Dummies”, “Trading in the Zone”

Download our free How to Trade GBPUSD PDF guide for offline reference and strategy tips

Expert Insight:

“GBP/USD is sensitive to central bank rhetoric, especially from the Fed and BoE. Traders should watch statements closely.” — Paul Donovan, UBS

Summary: Start Trading GBP/USD with Confidence

How to trade GBPUSD successfully requires a blend of market knowledge, technical skills, and risk discipline. Whether you’re day trading or swing trading, Pocket Option provides a dynamic platform to execute your strategies with ease.

Start with a demo account or deposit as low as $5 to trade GBPUSD live. Stay updated with macroeconomic events, backtest your strategies, and refine your execution.

FAQ

Can you trade GBPUSD?

Yes, GBPUSD is one of the most traded currency pairs, offering high liquidity and volatility ideal for both beginners and experienced traders.

Which indicator is best for GBP/USD?

Moving Averages and RSI are highly effective, but combining with Bollinger Bands and MACD can offer additional confirmation.

Is GBPUSD good for beginners?

Yes, due to its high liquidity and clear reaction to economic data, it provides excellent learning opportunities.

What time should I trade GBP USD?

The best trading session is during the London and New York overlap (13:00–16:00 GMT) due to maximum liquidity.

How to trade GBPUSD on Pocket Option?

Choose the asset, analyze trends, and place trades starting from $1 in a few clicks.

How to buy GBPUSD?

Select the GBP/USD pair, make your forecast, and click buy or sell based on market direction.

How to invest in GBPUSD?

Monitor economic indicators and use both trend-following and reversal strategies depending on your analysis.

Is GBPUSD suitable for beginners?

Yes, the pair is liquid, widely covered in financial news, and supported with tools on Pocket Option.

What makes GBPUSD move?

Interest rate decisions, economic releases, and geopolitical developments between the UK and the U.S.