- ECB interest rate decisions

- Turkish central bank policy and inflation rates

- Political developments in Turkey

- Eurozone trade and investor sentiment

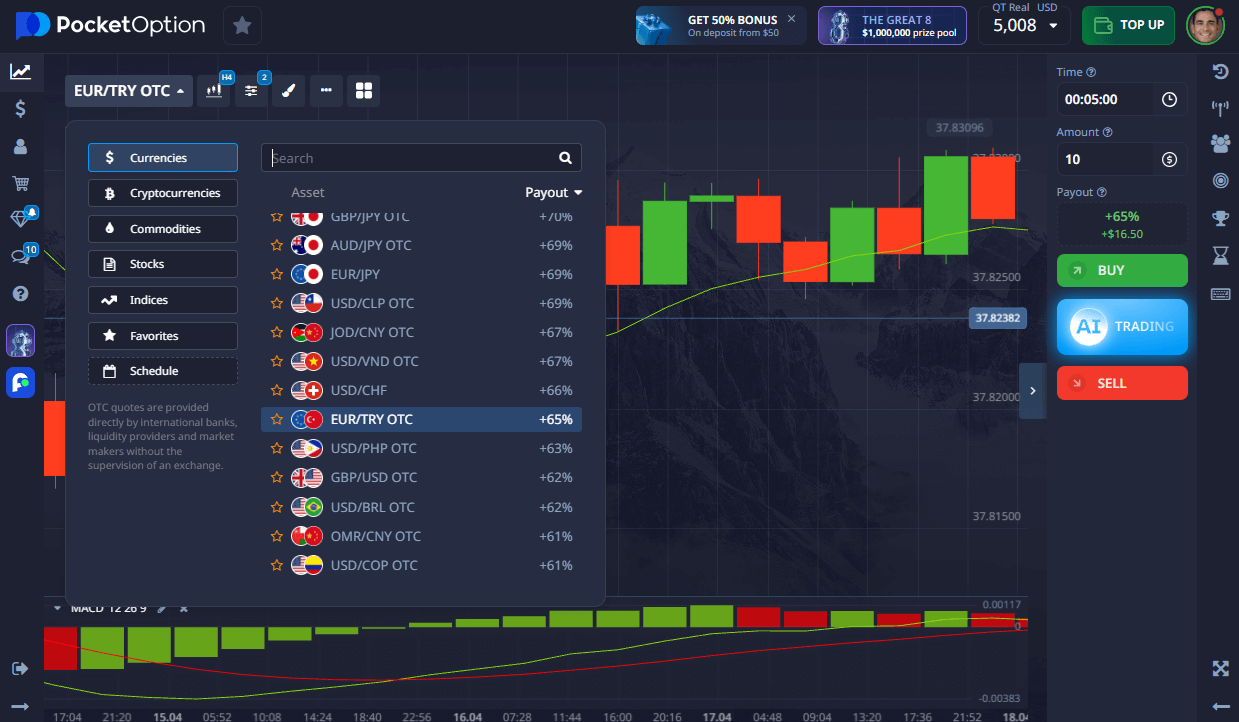

EURTRY: How This Euro and Turkish Lira Pair Moves and How to Trade It Effectively

The EUR/TRY pair tracks the exchange rate between the Euro and the Turkish Lira. Known for its volatility and strong directional trends, it offers opportunities for traders looking to capture momentum moves. With the Euro reflecting stability and the Lira often under pressure, EUR/TRY can behave aggressively in times of economic uncertainty.

What Is EUR/TRY?

EUR/TRY represents how many Turkish Lira are needed to purchase one Euro. The Euro is one of the most stable global currencies, while the Turkish Lira is subject to inflation, monetary interventions, and geopolitical events.

This contrast makes EUR/TRY attractive for traders who seek directional trades and are comfortable with higher volatility.

How Currency Quotation Works

If EUR/TRY = 34.50, that means one Euro equals 34.50 Turkish Lira. The Euro is the base currency, and it’s clearly stronger in this pair.

Example: Exchanging €100 gives you 3,450 TRY. Even small fluctuations in this quote can mean significant movement due to the Lira’s instability.

Factors Influencing EUR/TRY Movement

For instance, unexpected changes in Turkish monetary policy can send EUR/TRY sharply upward. Conversely, strong growth data from Turkey may support the Lira.

How to Interpret EUR/TRY Price Changes

If EUR/TRY rises from 34.00 to 35.20, the Euro is gaining strength.

If it falls to 33.80, the Lira is strengthening.

Example: A rise from 34.10 to 35.00 may indicate capital flight from Turkey or inflation fears, leading to increased demand for the Euro.

Step-by-Step Quick Trading Example on EUR/TRY

- Open Pocket Option and find EUR/TRY OTC in the asset list.

- Analyze the chart — apply moving averages, MACD, or sentiment indicators.

- Set your trade size — starting from just $1.

- Choose your expiration — from 5 seconds and up (5 seconds only for OTC assets).

- Forecast the direction:

- Click BUY if you believe the rate will rise.

- Click SELL if you expect a drop.

The platform shows your potential payout upfront — up to 92% if your forecast is correct.

➡️ Registration takes seconds. Start with a $5 minimum deposit (deposit may vary depending on payment methods) or explore the platform risk-free with the demo account.

Try Risk-Free — $50,000 Demo Account

Want to explore how to trade EURTRY without risking real money? Pocket Option offers a $50,000 demo account so you can test strategies, analyze charts, and gain hands-on experience.

This is your space to learn how to invest in EURTRY or try advanced setups in real market conditions — with no deposit required.

Later, switch to a live account from $5 to unlock:

- Copy-trading

- Cashback

- Tournaments

- Access to all trading tools

Conclusion

EUR/TRY is a highly reactive pair shaped by inflation risk, monetary shifts, and geopolitical headlines. For traders looking for volatility and momentum, it provides a rich space to develop strategic setups. Whether you’re learning how to trade EURTRY or looking to invest in EURTRY more confidently, the demo account offers a practical way to start without exposure.

FAQ

How to trade EURTRY on Pocket Option?

Select the pair, use indicators or sentiment tools, and place your forecast -- from $1 with flexible expiration.

How to buy EURTRY efficiently?

Choose the direction based on market movement and use chart signals to support your entry.

How to invest in EURTRY for long-term results?

Watch interest rate policy, inflation data, and apply fundamental and technical analysis to time your trades.

What makes EURTRY volatile?

Inflation and policy changes in Turkey, as well as shifts in Eurozone stability, create large swings.

Is EURTRY good for short-term trading?

Yes, because of its volatility, EUR/TRY can produce significant intraday movement ideal for short-term setups.