- European Central Bank interest rate decisions

- Russian Central Bank policies and capital flow regulations

- Oil and gas price fluctuations

- Sanctions, trade disruptions, and political risks

EURRUB: What Moves the Euro-Russian Ruble Pair and How to Trade It Effectively

The EUR/RUB currency pair reflects the exchange rate between the Euro and the Russian Ruble. It's a politically sensitive and economically reactive pair, often influenced by sanctions, oil prices, and central bank decisions. For traders, EUR/RUB presents opportunities through strong directional movements -- especially during geopolitical shifts.

For those exploring EURRUB forex potential, this pair stands out due to its unique combination of commodity influence and policy-driven volatility.

What Is EUR/RUB?

EUR/RUB shows how many Russian Rubles are required to buy one Euro. It’s not a major pair in the global market, but its behavior is often more volatile due to Russia’s resource-dependent economy and the Euro’s global reserve role.

The EURRUB forex environment is shaped by contrasting monetary systems: a floating Eurozone economy and a semi-managed Ruble affected by capital controls.

How Currency Quotation Works

If EUR/RUB = 103.70, it means one Euro equals 103.70 Russian Rubles. The Euro is significantly stronger in this quote.

Example: Exchanging €100 gives you 10,370 RUB. Traders often watch how quickly this rate changes after policy statements or commodity price shifts.

Factors Influencing EUR/RUB Movement

For example, a sudden drop in oil prices might weaken RUB, sending the EUR/RUB rate higher. On the other hand, strong intervention by the Bank of Russia could stabilize or strengthen the Ruble.

How to Interpret EUR/RUB Price Changes

If the EUR/RUB rate moves from 102.50 to 106.00, the Euro is gaining strength or the Ruble is weakening.

A drop to 100.80 suggests the Ruble is strengthening.

Example: A sudden increase from 101.20 to 105.40 may signal market reaction to new sanctions or oil supply disruptions.

Step-by-Step Quick Trading Example on EUR/RUB

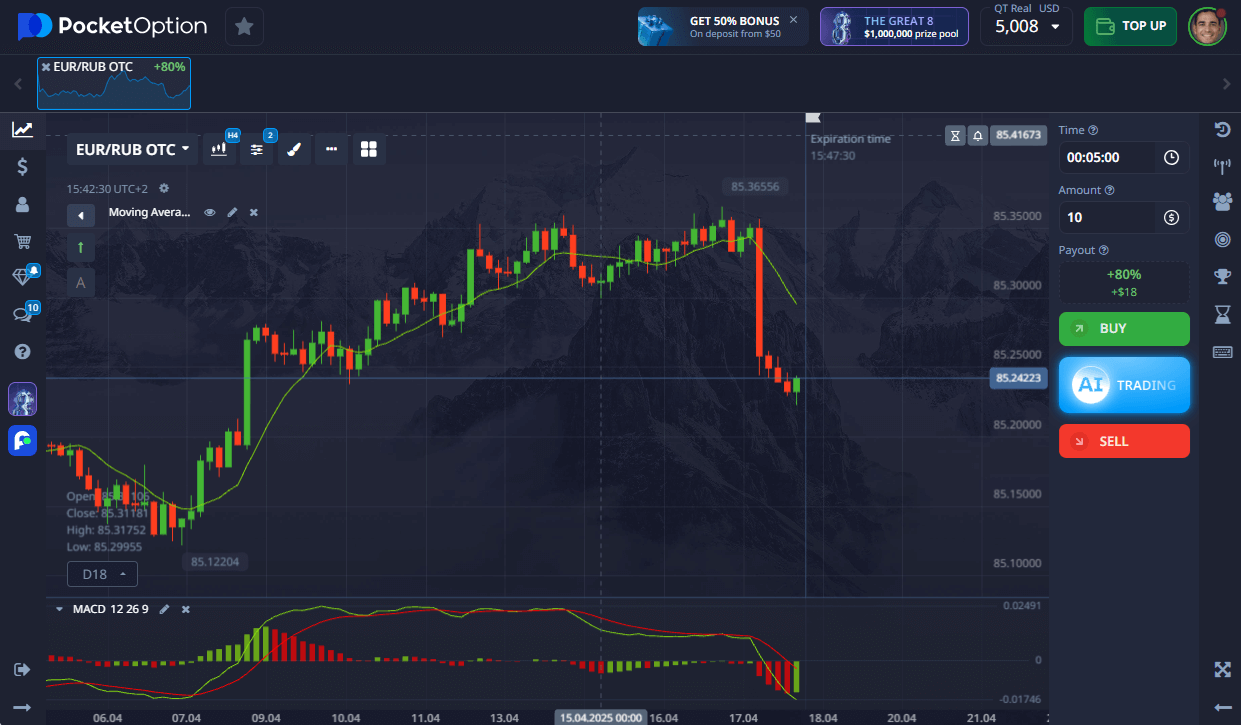

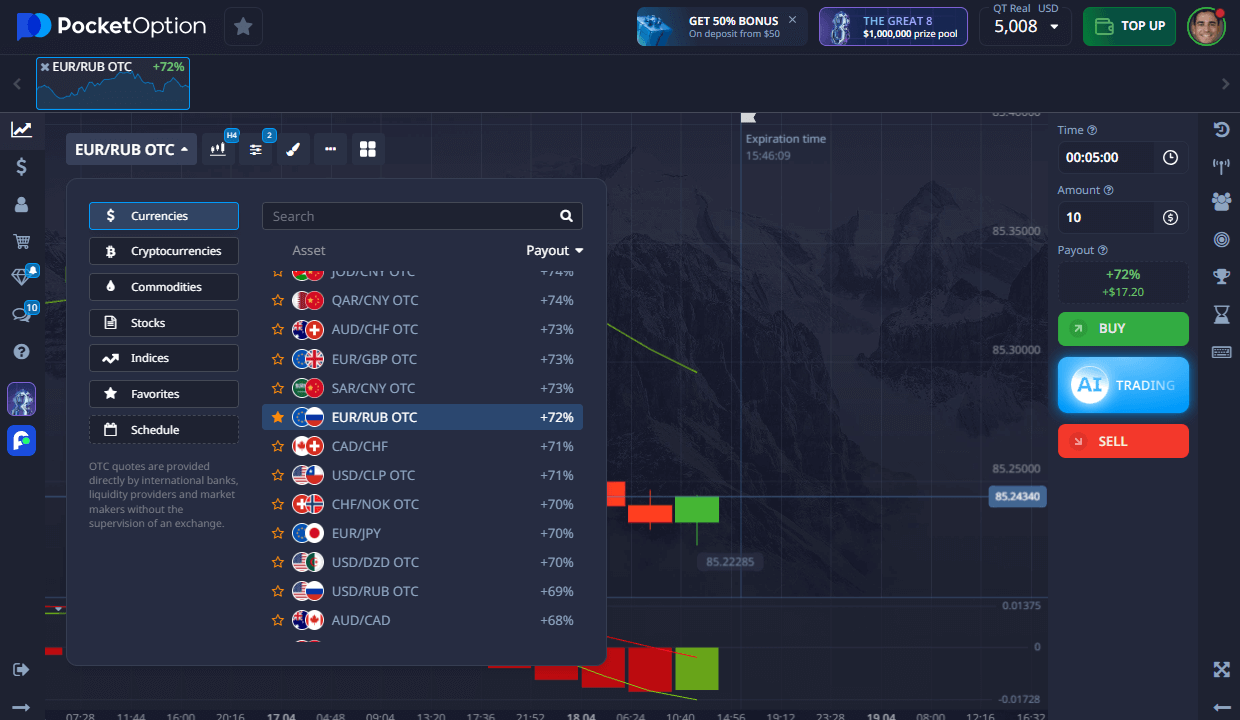

- Open Pocket Option and find EUR/RUB OTC in the platform’s asset list.

- Review the chart using volatility tools and trend indicators.

- Select your trade amount — starting from $1.

- Choose the expiration — from 5 seconds and more (5 seconds available only for OTC).

- Forecast price movement:

- Click BUY if you believe the rate will rise.

- Click SELL if you expect it to fall.

The system shows potential returns up to 92%, visible before execution.

➡️ Registration takes only a few seconds. Start trading with a $5 minimum deposit (deposit may vary depending on payment methods), or use a demo account to try strategies without risk.

Try Risk-Free — $50,000 Demo Account

Not sure how to start trading the EURRUB forex pair? Use Pocket Option’s free demo account and receive $50,000 virtual funds to explore the platform, test strategies, and study the EURRUB rate in action.

This is the safest way to get familiar with volatility, indicators, and real-time analysis — no deposit required.

Once you’re ready, switch to a live account starting from $5 and access:

- Copy-trading

- Cashback

- Tournaments

- Full-featured charts and indicators

Conclusion

EUR/RUB offers a unique opportunity to engage with a politically charged and commodity-driven currency environment. Learning how to trade EURRUB requires understanding both European and Russian monetary policy, energy prices, and real-time market sentiment. The demo account is your entry point for exploring EURRUB volatility and practicing safely before moving to live trades.

FAQ

What is the EURRUB rate today?

The EURRUB rate changes frequently based on economic news, sanctions, and central bank actions -- check live charts on the platform.

How to trade EURRUB as a beginner?

Use the demo account to practice and start with small trades while following news and charts.

Why is the EURRUB forex pair volatile?

It reacts to oil prices, political risks, and central bank interventions on both sides.

How to invest in EURRUB for longer-term results?

Focus on interest rate trends, inflation data, and major policy shifts from the ECB or Bank of Russia.

Can I buy EURRUB short term on Pocket Option?

Yes -- you can enter forecast trades starting from 5 seconds using the Quick Trading interface.

How to buy EURRUB efficiently?

Choose the forecast direction based on news and chart data, then use Pocket Option's interface to buy EURRUB in just a few clicks.