- ECB interest rate decisions and inflation data

- Reserve Bank of New Zealand (RBNZ) policy updates

- Dairy and commodity export prices (important for NZD)

- Global risk sentiment and carry trade flows

EURNZD: Forex Behavior, Analysis Tools, and How to Trade the Euro vs. New Zealand Dollar

The EUR/NZD pair reflects the exchange rate between the Euro and the New Zealand Dollar -- two currencies with different monetary cycles. While the Euro often moves with ECB policy, NZD reacts strongly to commodity prices and RBNZ decisions. For traders, this pair offers sharp movements and a wide interest rate differential, making it ideal for active strategies.

The EURNZD forex market is dynamic, influenced by fundamental and technical forces. Learning how to trade EURNZD begins with understanding both currencies’ behavior under global economic pressure.

What Is EUR/NZD?

EUR/NZD shows how many New Zealand Dollars are needed to buy one Euro. The pair is sensitive to macroeconomic trends in the Eurozone and New Zealand’s agricultural export market.

The EURNZD forex environment often sees strong swings during central bank events, inflation data, and global commodity price changes.

How Currency Quotation Works

If EUR/NZD = 1.8000, this means one Euro is worth 1.80 New Zealand Dollars. The Euro is the base currency and is stronger in this example.

Example: Exchanging €100 gives you NZ$180. A rate change from 1.8000 to 1.8200 means the Euro is strengthening or the Kiwi Dollar is weakening.

Factors Influencing EUR/NZD Movement

For example, rising milk prices may boost NZD, weakening EUR/NZD. Alternatively, hawkish comments from the ECB may push the Euro higher.

How to Interpret EUR/NZD Price Changes

When EUR/NZD climbs from 1.7850 to 1.8100, it means the Euro is strengthening.

If it drops to 1.7700, the New Zealand Dollar is gaining.

Example: A sharp increase might follow weak GDP results from New Zealand or strong Eurozone PMI data.

Step-by-Step Quick Trading Example on EUR/NZD

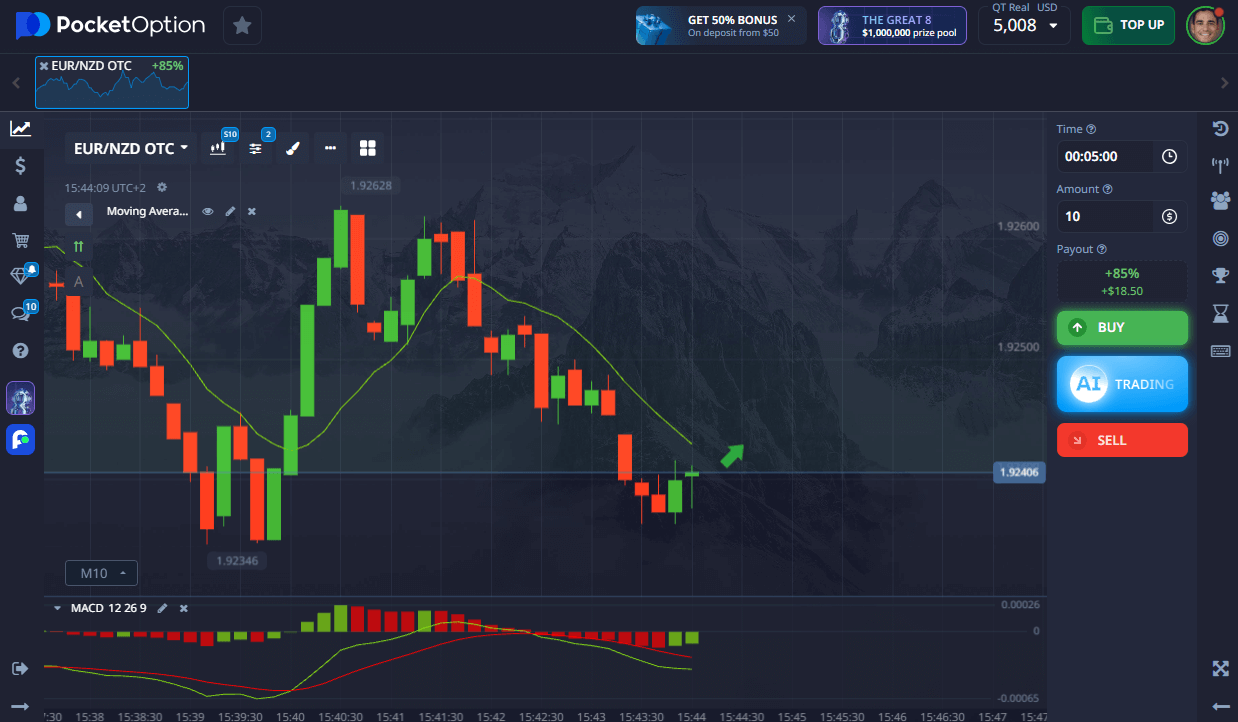

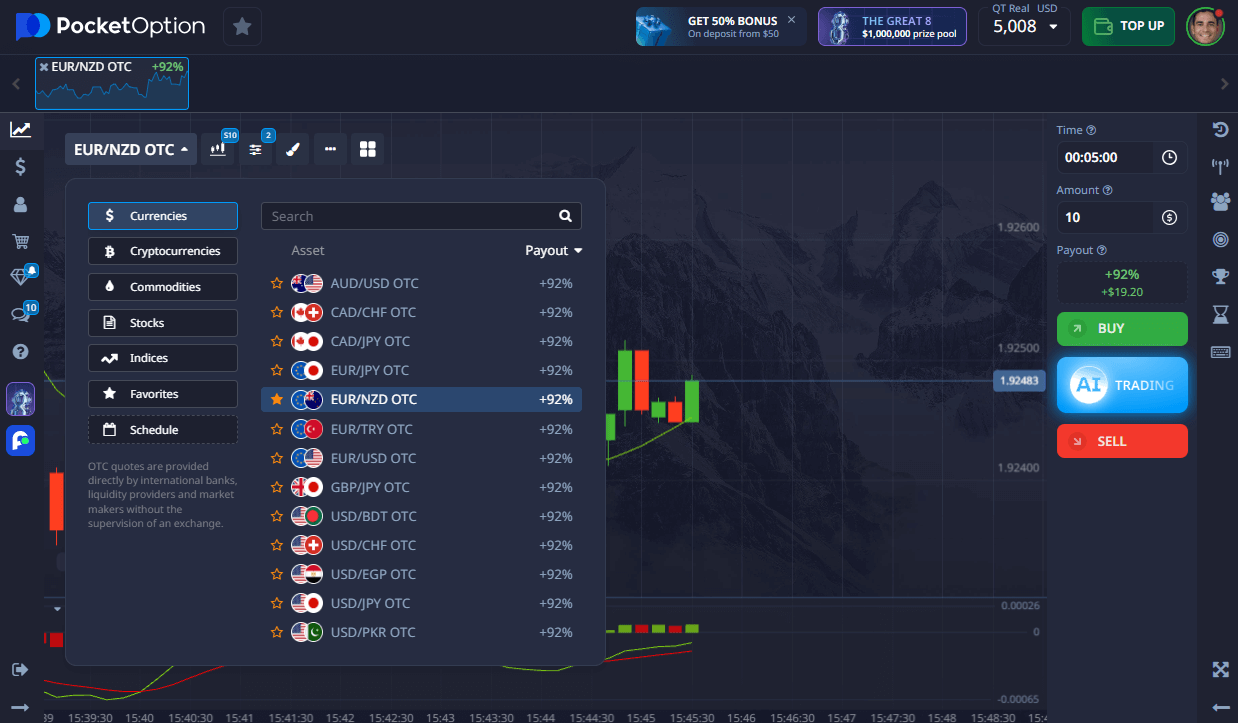

- Log into Pocket Option and find EUR/NZD OTC in the asset list.

- Analyze the chart — use momentum indicators, sentiment tools, or volume overlays.

- Set your investment amount — from $1 and up.

- Choose trade time — starting from 5 seconds (available for OTC assets).

- Make a forecast:

- Click BUY if you expect the rate to rise.

- Click SELL if you think it will fall.

Expected return is shown before trade — up to 92% for a correct forecast.

➡️ You can open an account in seconds. Trade EURNZD live with a $5 minimum deposit (deposit may vary depending on payment methods), or explore without risk using the demo.

Try Risk-Free — $50,000 Demo Account

Want to see how to trade EURNZD without risking money? Pocket Option offers a $50,000 demo account, letting you test strategies, analyze charts, and explore EURNZD sentiment with zero cost.

You’ll be able to follow EURNZD technical analysis today, test indicators, and review setups before moving to a live account.

Once ready, switch from demo to real trading from just $5 and access:

- Copy-trading

- Cashback

- Competitions and tournaments

- Full technical toolkit

Conclusion

EURNZD offers both macroeconomic depth and short-term technical opportunity. If you’re looking to trade EURNZD confidently, start with a free demo to get familiar with the behavior of the pair under real market pressure. From exploring indicators to spotting sentiment changes, learning how to buy EURNZD or how to invest in EURNZD starts with practice — and Pocket Option gives you the tools to begin without risk.

FAQ

How to trade EURNZD effectively?

Use indicators, follow economic news, and practice your timing with small trades or demo sessions.

How to buy EURNZD?

Select EUR/NZD on the platform, analyze market direction, and place a forecast-based trade.

How to invest in EURNZD long term?

Focus on monetary policy cycles and use trend-following strategies across timeframes.

What is EURNZD sentiment today?

Sentiment reflects market bias -- bullish or bearish -- based on technical levels and economic expectations.

Where to find EURNZD technical analysis today?

Pocket Option provides live charts, indicator sets, and news flow to support your analysis.