- European Central Bank (ECB) policy and inflation data

- Swiss National Bank (SNB) interest rate policy and currency interventions

- Risk appetite in European financial markets

- Cross-border trade and export competitiveness

EURCHF: Key Principles, Spread Behavior, and How to Trade the Euro/Swiss Franc Pair

The EUR/CHF currency pair compares the Euro to the Swiss Franc -- two stable European currencies. Known for tight ranges and low volatility, it appeals to traders who value precision, low spreads, and conservative setups. In this article, we explore how to trade EURCHF, how to interpret its spread, and how to start safely.

The EURCHF spread is among the lowest in the forex market, making it attractive for institutional trading, scalping, and interest rate speculation. Understanding how to trade EURCHF efficiently means learning how low-cost execution works across different conditions.

What Is EUR/CHF?

EUR/CHF reflects the number of Swiss Francs needed to buy one Euro. Both currencies are strong, with Switzerland known for its financial discipline and the Eurozone for its political and economic scale.

How Currency Quotation Works

If EUR/CHF = 0.9685, this means 1 Euro equals 0.9685 Swiss Francs.

Example: You exchange €100 and receive 96.85 CHF. A rate change from 0.9685 to 0.9750 signals Euro strength or CHF weakness.

Factors Influencing EUR/CHF Movement

The SNB is known for managing excessive Swiss Franc strength, while the ECB focuses on inflation and growth support. This makes EURCHF spread behavior both subtle and technical.

How to Interpret EUR/CHF Price Changes

If EUR/CHF rises from 0.9650 to 0.9720, the Euro is gaining value.

A drop to 0.9600 indicates Swiss Franc strength.

Example: After a dovish ECB update and hawkish SNB commentary, EUR/CHF may fall sharply — signaling risk-off behavior or safe-haven flows.

Step-by-Step Quick Trading Example on EUR/CHF

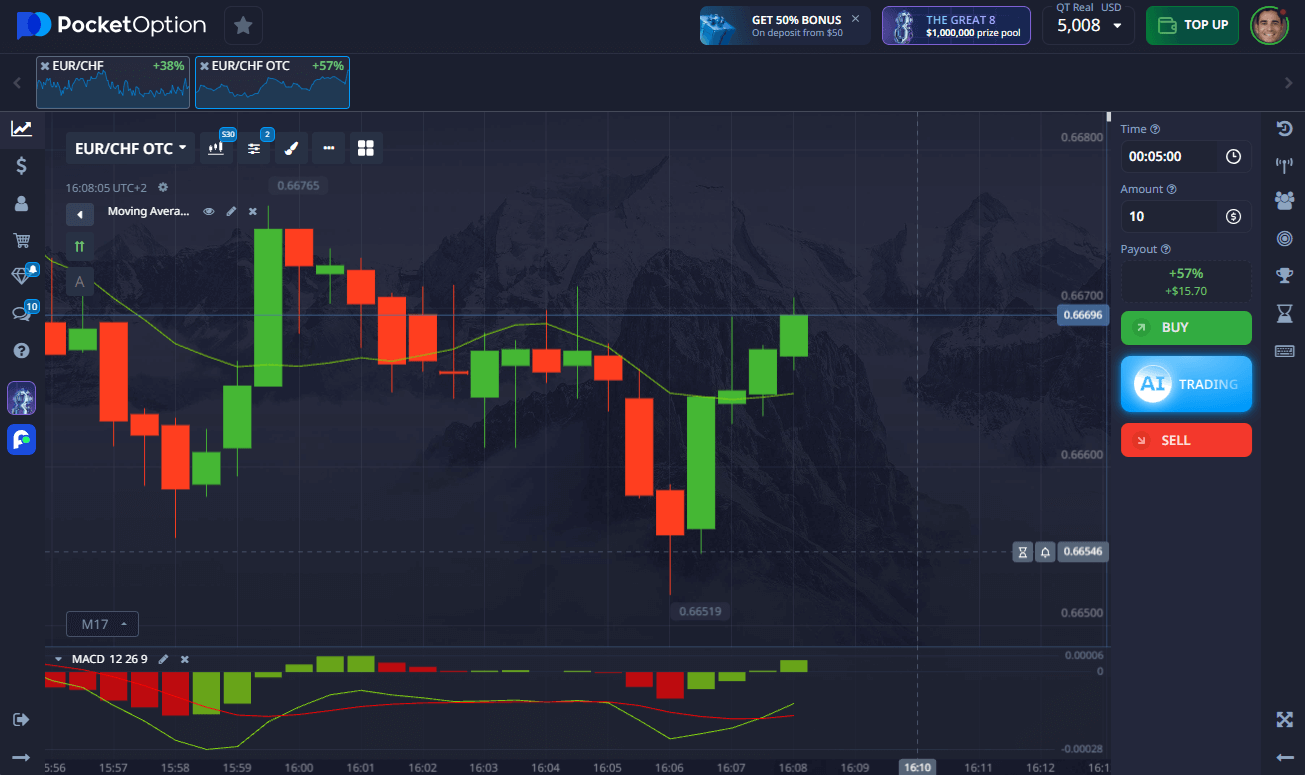

- Open Pocket Option and locate EUR/CHF or EUR/CHF OTC in the asset list.

- Analyze the chart — apply support/resistance levels or moving averages.

- Set your trade amount — starting from just $1.

- Select expiration time — from 5 seconds and up (5 seconds for OTC assets).

- Make your forecast:

- Click BUY if you expect EUR/CHF to rise.

- Click SELL if you think it will fall.

- Platform displays potential returns — up to 92% for correct forecasts.

➡️ It’s easy to start — register in seconds and begin trading with a $5 minimum deposit (deposit may vary depending on payment methods), or try demo mode.

Try Risk-Free — $50,000 Demo Account

Not sure how to trade EURCHF yet? Use a $50,000 demo account on Pocket Option to practice different setups and understand how the EURCHF spread affects execution.

Learn how to buy EURCHF in short bursts, how to invest in EURCHF with a long-term approach, and track spread dynamics without financial risk.

When you’re ready, switch to a real account from $5 and unlock:

- Copy-trading

- Cashback

- Strategy competitions

- Full access to market indicators

Conclusion

With its low volatility and tight spreads, EUR/CHF is ideal for traders who value controlled setups. By understanding how to trade EURCHF with proper risk tools and spread awareness, you can take advantage of this stable currency pair in both quiet and active market conditions. Start with the demo — and move to live when you’re ready.

FAQ

How to trade EURCHF efficiently?

Use breakout or pullback setups, monitor economic updates, and take advantage of the tight spread.

How to buy EURCHF on Pocket Option?

Select the pair, analyze its recent trend, and place a forecast trade based on expected movement.

How to invest in EURCHF longer-term?

Focus on interest rate differentials, SNB actions, and macro developments in the Eurozone.

What is the typical EURCHF spread?

EURCHF typically has a low spread, often under 1 pip, making it cost-effective for frequent trading.

Is EURCHF good for conservative strategies?

Yes -- its low volatility and tight spread favor traders who prefer stable, controlled setups.