- CAD is the base currency

- CHF is the quote currency

CADCHF -- What It Means and How to Trade This Currency Pair from Scratch

New to CADCHF? Don't worry -- we're here to make things simple. This guide will explain what CADCHF means, how the quote works, what drives its price, and how you can trade CADCHF today using Pocket Option. Whether you're curious about short-term trading or just testing the waters, we've got you covered. In this article, you'll also learn how to buy CADCHF, how to invest in CADCHF, and gain a deeper understanding of CADCHF analysis to help you make informed decisions when trading.

What is CADCHF?

CADCHF is the exchange rate between the Canadian Dollar (CAD) and the Swiss Franc (CHF). It shows how many Swiss Francs you need to get 1 Canadian Dollar.

This currency pair links two stable economies: Canada’s resource-rich market and Switzerland’s finance-oriented one. Trading CADCHF allows you to follow trends influenced by oil, banking, and interest rate policy.

If you’re wondering about the cadchf meaning, it’s simply a way to measure how the two currencies relate to one another — and to trade on their movements.

How CADCHF Quotes Work

Let’s say you see CADCHF = 0.6600. This means 1 Canadian Dollar equals 0.66 Swiss Francs.

If the number goes up, the Canadian Dollar is getting stronger compared to the Franc.

Example:

If the quote moves from 0.6500 to 0.6700, you’ll get more CHF for each CAD. This matters if you’re trading or exchanging currencies — and gives traders insight into currency strength.

What Affects the CADCHF Rate?

To make sense of cadchf analysis, it helps to look at what moves the rate:

- Oil Prices — Canada is a major oil exporter, so CAD is tied to global oil trends. When oil prices rise, the Canadian Dollar often strengthens due to Canada’s strong reliance on oil exports.

- Interest Rates — Decisions by the Bank of Canada and Swiss National Bank shape currency flows. An interest rate hike by either country tends to attract investors and increase demand for the currency.

- Economic Outlook — GDP, employment data, and inflation matter. Strong economic performance in Canada or Switzerland can drive the CADCHF rate higher.

- Risk Sentiment — CHF often acts as a safe-haven currency, rising during market uncertainty. When markets are volatile, traders might flock to the Swiss Franc, weakening the Canadian Dollar.

Each of these elements plays into daily and long-term CADCHF movements.

How to Interpret Changes in the CADCHF Rate

Let’s break it down.

If the rate climbs from 0.6550 to 0.6700, the Canadian Dollar is strengthening.

If it falls from 0.6700 to 0.6480, the Swiss Franc is gaining ground.

Changes in price reflect which economy is performing more strongly or attracting more investment at the moment.

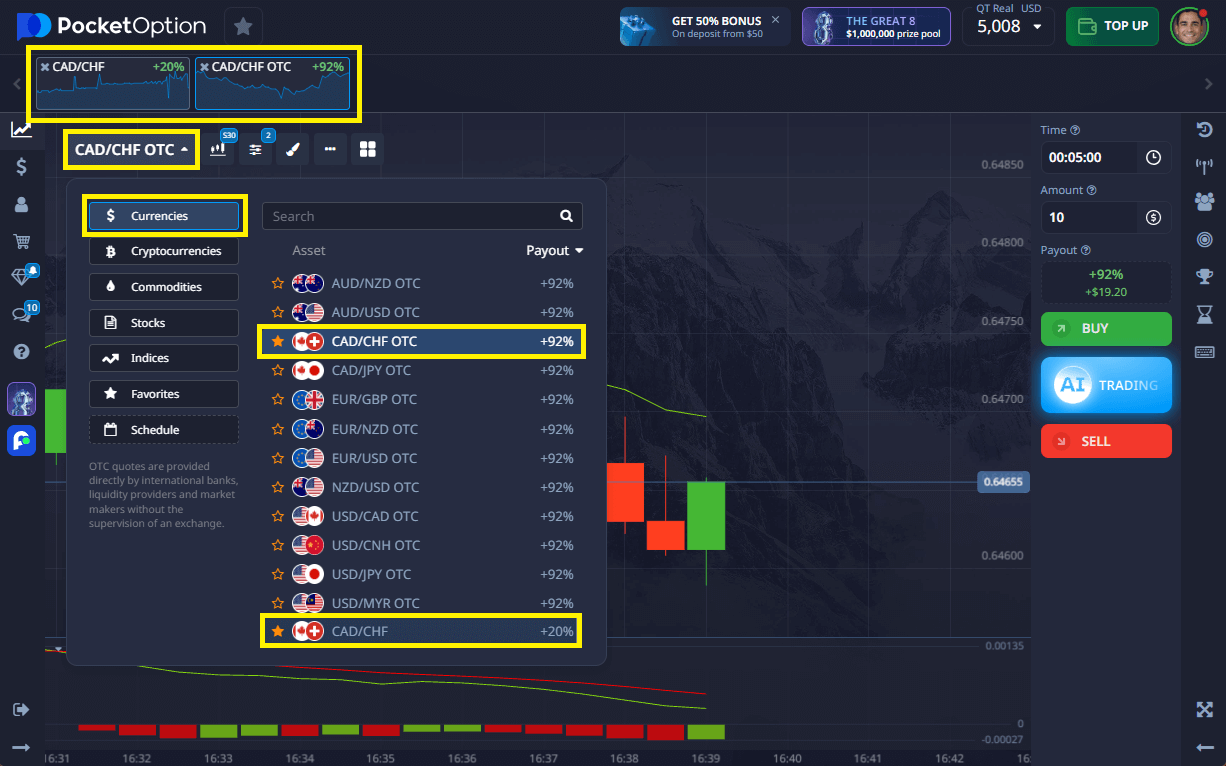

Step-by-Step Quick Trading: How to Trade CADCHF on Pocket Option

- Search for the asset:

Find CADCHF or CADCHF OTC in the platform’s asset list. - Open the chart and study it:

Use indicators or trend data if needed to understand market sentiment. - Choose your amount:

Start from as little as $1, giving you flexibility to trade with minimal risk. - Set your trade time:

From 5 seconds or more (5 seconds available only for OTC assets). - Make your prediction:

- If you think the rate will rise, press BUY.

- If you expect it to drop, press SELL.

- Review return rate:

Up to 92% on a correct forecast (shown clearly before the trade).

Try It Free: Practice CADCHF on a $50,000 Demo Account

Not sure if you’re ready to trade CADCHF for real? No pressure.

Start with a $50,000 demo account that unlocks instantly after registration. Practice with real-time market data, test tools, and build confidence before using actual funds.

When you’re ready to go live, you can trade from just $5 (deposit may vary depending on payment methods) and unlock full features like:

- Copy trading

- Trade cashback

- Trading tournaments

- Full asset access

FAQ

How to trade CADCHF if I'm new to forex?

Open the asset on Pocket Option, select trade time and amount, then forecast the direction -- up or down.

How to buy CADCHF for the first time?

Register and place a forecast-based trade on CADCHF with as little as $1.

How to invest in CADCHF for the long term?

Monitor economic indicators and trade with longer durations using your market outlook. Keep an eye on factors like oil prices and interest rates for better long-term predictions.

What does CADCHF mean in trading?

It shows the exchange rate between the Canadian Dollar and Swiss Franc -- and is used to speculate on their strength.

Where can I find reliable CADCHF analysis?

Pocket Option offers charts and sentiment tools to help with your analysis directly on the trading platform.