- Global oil prices and Bahrain’s energy exports

- Monetary policy from the People’s Bank of China

- Trade relations between the Gulf region and Asia

- USD movements, since BHD is partially pegged to the Dollar

BHDCNY: What Moves the BHD/CNY Pair and How to Start Trading It

The BHD/CNY currency pair compares the Bahraini Dinar (BHD) with the Chinese Yuan (CNY). While not among the most commonly traded pairs, it offers interesting insights into the economic relationship between the Gulf and East Asia. For traders, understanding how to trade BHDCNY begins with learning its price behavior, quotation, and monetary context.

Traders monitoring oil-driven economies often look to BHDCNY for non-standard but meaningful setups. If you’re curious about how to trade BHDCNY or looking for alternative regional exposure, this pair can diversify your trading toolkit.

What Is BHD/CNY?

BHD/CNY expresses the value of one Bahraini Dinar in Chinese Yuan. The Dinar is a high-value, oil-linked currency used in Bahrain, while the Chinese Yuan is a managed floating currency tied to global trade and domestic policy targets in China.

Traders often explore this pair for diversification or as part of broader Gulf–Asia trading strategies.

How Currency Quotation Works

If BHD/CNY = 19.12, it means one Bahraini Dinar equals 19.12 Chinese Yuan. In this quote, the BHD is the base currency.

Example: If you convert 10 BHD, you receive approximately 191.20 CNY. Even small fluctuations in this rate may reflect oil price changes or Chinese economic policy shifts.

Factors Influencing BHD/CNY Movement

These elements help shape whether it’s a good time to invest in BHDCNY, particularly if you monitor news in the energy and industrial sectors.

How to Interpret BHD/CNY Price Changes

If BHD/CNY rises from 18.90 to 19.30, the Bahraini Dinar is strengthening or the Yuan is weakening.

If it drops to 18.70, this may indicate a stronger CNY or a shift in oil-linked capital flows.

Example: A rise in oil prices may push BHD/CNY upward due to improved fiscal conditions in Bahrain.

Step-by-Step Quick Trading Example on BHD/CNY

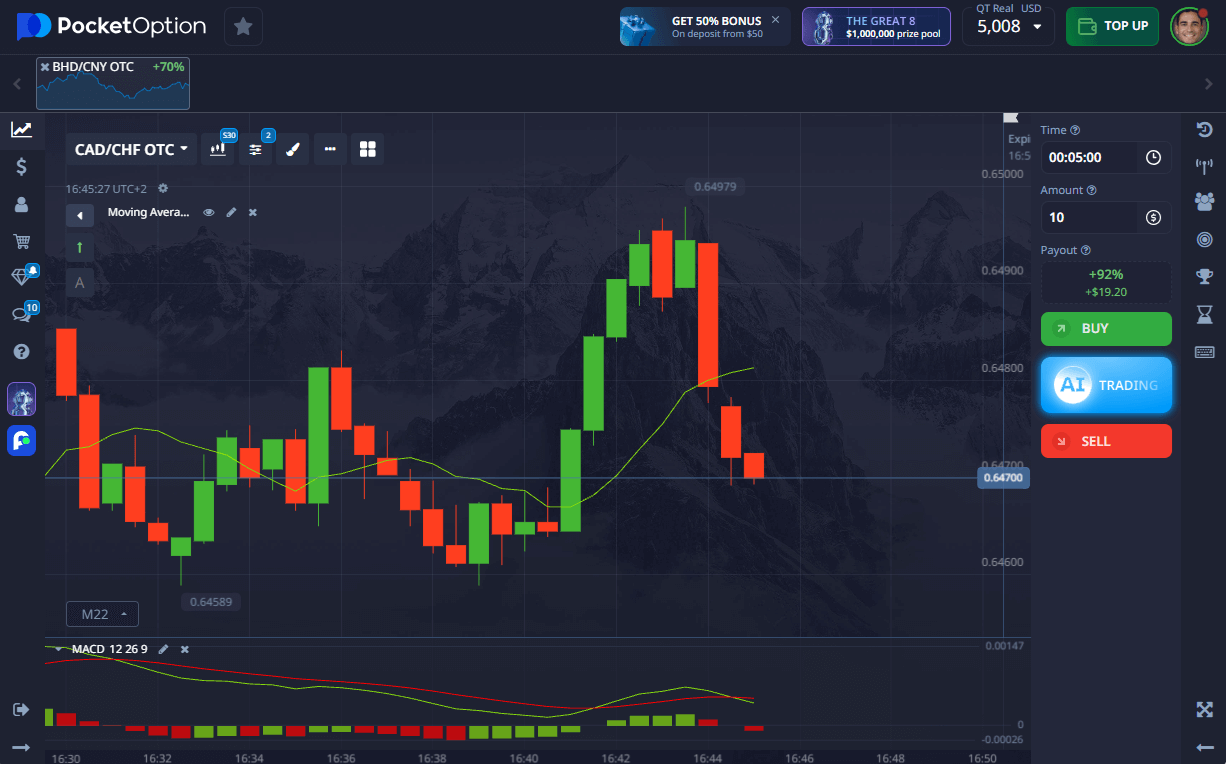

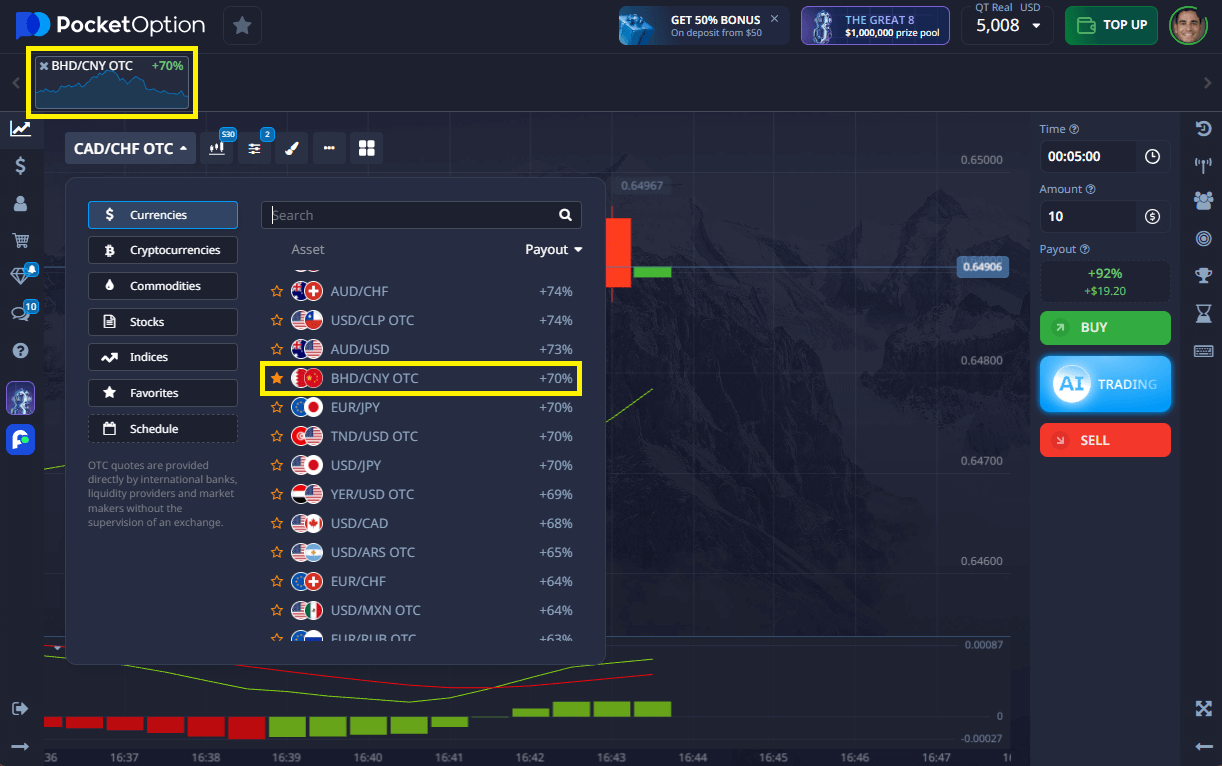

- Log into Pocket Option and find BHD/CNY or BHD/CNY OTC in the asset list.

- Review the chart using indicators or support/resistance zones.

- Set your trade amount — starting from just $1.

- Select expiration time — from 5 seconds and up (5 seconds available for OTC assets).

- Forecast direction:

- Press BUY if you expect the price to rise.

- Press SELL if you expect it to fall.

- Return rates up to 92% are displayed before trade confirmation.

➡️ Starting is easy — registration takes seconds. You can open a real account with just $5 (deposit may vary depending on payment methods) or use a demo to practice.

Try Risk-Free — $50,000 Demo Account

Want to explore how to trade BHDCNY without risking money? Use the Pocket Option $50,000 demo account to simulate real market conditions and test strategies.

This is a great way to learn how to buy BHDCNY, watch for signals, and assess risk before making live trades.

When you’re ready to switch, a real account from $5 unlocks full access to:

- Copy-trading

- Cashback

- Tournaments and leaderboards

- Advanced indicators

Conclusion

Although BHD/CNY isn’t a high-volume pair, it reflects real economic fundamentals. If you’re interested in how to invest in BHDCNY as a long-term macro play or how to trade BHDCNY with short setups, Pocket Option gives you the tools and demo access to build confidence — before risking capital.

FAQ

How to trade BHDCNY safely?

Use chart analysis, follow energy market updates, and practice on demo before placing live trades.

How to buy BHDCNY quickly?

Select the pair on Pocket Option, analyze direction, and enter a forecast-based position.

How to invest in BHDCNY long term?

Watch oil price trends, Chinese monetary shifts, and broader Gulf--Asia economic links.

Is BHDCNY suitable for new traders?

Yes, especially with practice using a demo account and small trade sizes from $1.

What makes BHDCNY move the most?

Oil price shifts, Chinese monetary interventions, and risk sentiment in emerging markets.