- Interest rate policy from the RBA and RBNZ

- Commodity prices (especially iron ore and dairy)

- Employment, inflation, and GDP data from both economies

- China’s economic performance — both AUD and NZD are sensitive to Chinese demand

AUDNZD: Understand the Australian Dollar vs. New Zealand Dollar and How to Trade It

The AUD/NZD currency pair reflects the relationship between two closely linked economies -- Australia and New Zealand. Both are commodity-driven and geographically connected, yet central bank policies and trade cycles often diverge. For traders, this pair offers low spreads, medium volatility, and frequent technical setups. Here's how to trade AUDNZD effectively in this environment.

Because the currencies are relatively correlated, trends can be clean — making it easier for traders to identify a clear AUDNZD signal and develop strong strategies around it. Whether you’re learning how to buy AUDNZD or how to invest in AUDNZD over the long term, a structured approach is key.

What Is AUD/NZD?

AUD/NZD represents how many New Zealand Dollars are needed to purchase one Australian Dollar. Since both countries rely heavily on exports — especially dairy and minerals — this pair tends to follow economic releases, central bank announcements, and risk sentiment in the Asia-Pacific region.

How Currency Quotation Works

If AUD/NZD = 1.0800, this means one Australian Dollar equals 1.08 New Zealand Dollars. AUD is the base currency.

Example: Exchanging 100 AUD would give you 108 NZD. If the rate rises to 1.0900, the Australian Dollar is strengthening.

Factors Influencing AUD/NZD Movement

You’ll often see clear setups during policy divergence — making it a solid pair for technical strategies or signal-based entries.

How to Interpret AUD/NZD Price Changes

A rise from 1.0720 to 1.0850 means AUD is gaining or NZD is weakening.

A drop to 1.0650 signals New Zealand Dollar strength or a correction in the AUD.

Example: An upbeat jobs report in Australia while New Zealand signals rate cuts may lead to a bullish AUDNZD signal and a breakout upward.

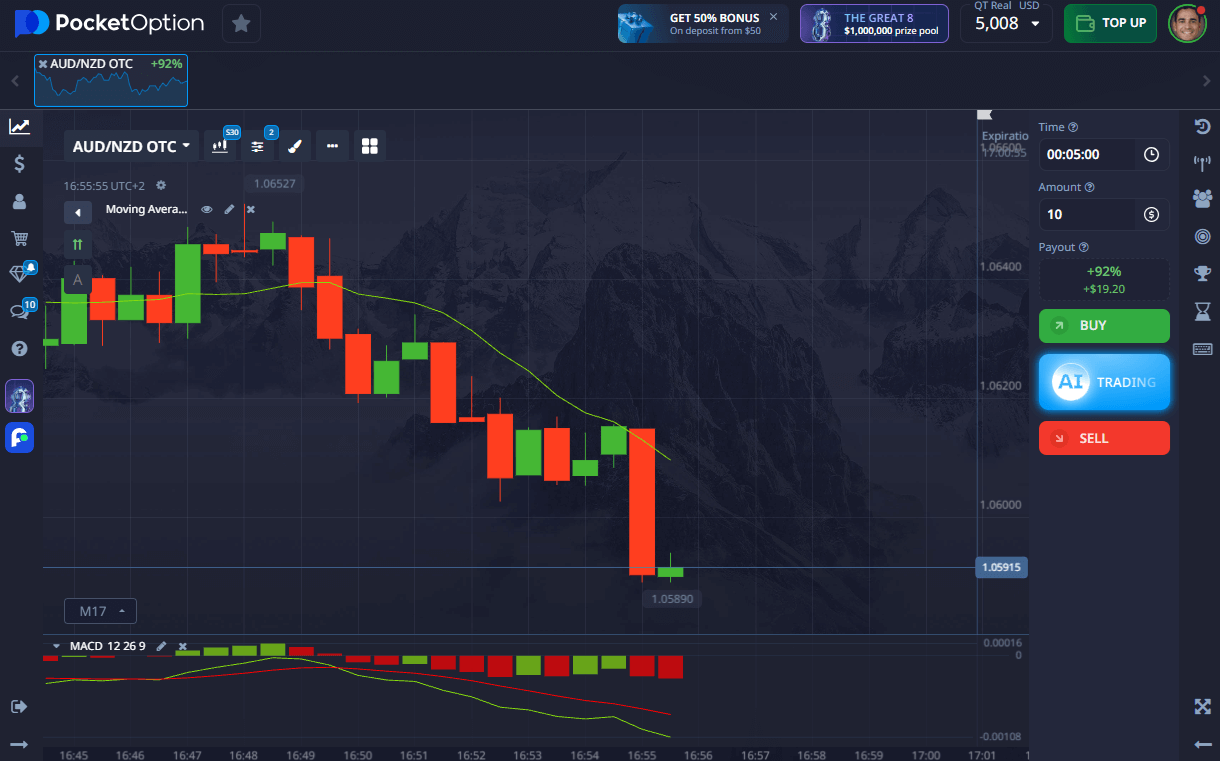

Step-by-Step Quick Trading Example on AUD/NZD

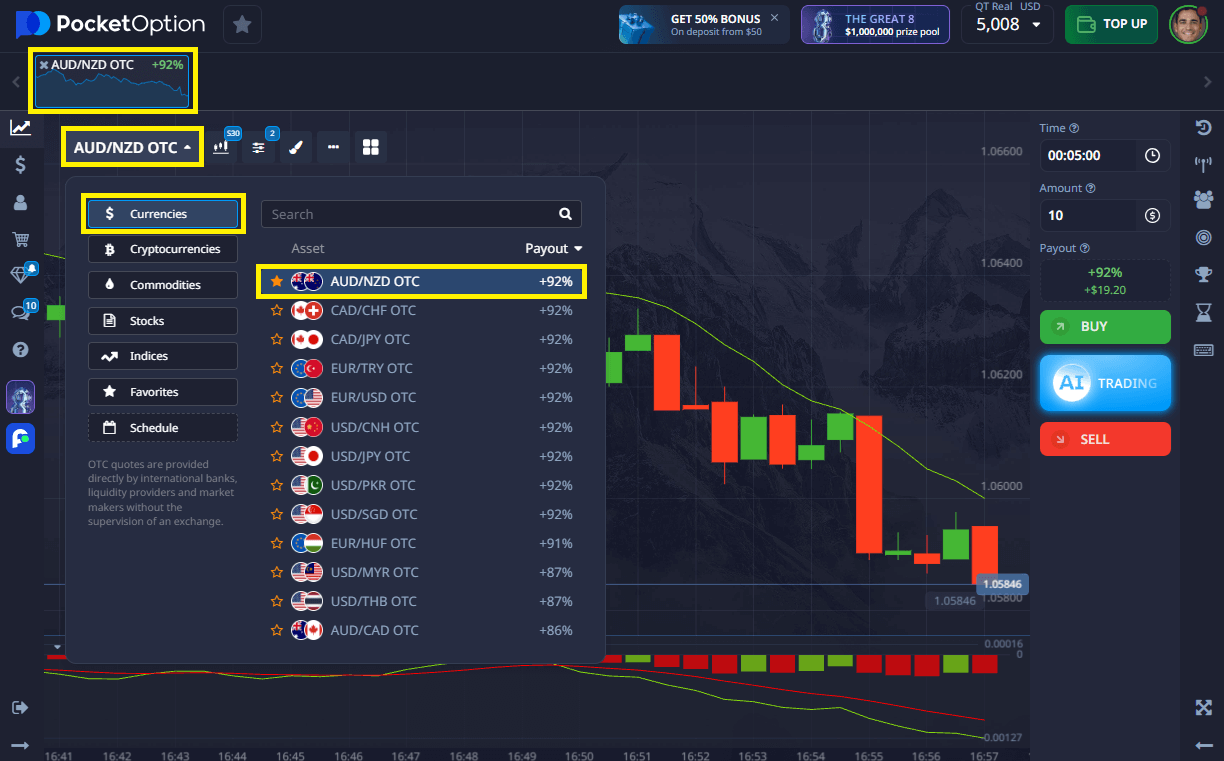

- Open the Pocket Option platform and find AUD/NZD OTC in the asset list.

- Analyze the chart using trendlines, oscillators, or the latest AUDNZD signal.

- Choose your trade amount — starting from just $1.

- Set trade time — from 5 seconds and up (for OTC assets).

- Predict the movement:

- Click BUY if you expect the rate to go up.

- Click SELL if you expect it to fall.

- Your expected return (up to 92%) is shown before placing the trade.

➡️ Getting started takes only seconds — register and begin trading from a $5 minimum deposit (deposit may vary depending on payment methods), or practice first on a demo account.

Try Risk-Free — $50,000 Demo Account

Want to explore how to trade AUDNZD without financial risk? Pocket Option offers a $50,000 demo account to simulate real trades using live price data.

Practice technical entries, read charts, test AUDNZD signal tools, and understand key economic influences — all without deposit.

When ready, you can open a real account from just $5 and access:

- Copy-trading

- Cashback rewards

- Weekly contests

- Full range of market tools

Conclusion

If you want a technically responsive and economically transparent pair, AUD/NZD delivers. Learning how to trade AUDNZD or how to invest in AUDNZD is easier when you begin with a demo account and build your understanding around real-time data and clean signals.

FAQ

How to trade AUDNZD successfully?

Use technical signals, news releases, and central bank expectations to time short-term entries.

How to buy AUDNZD on Pocket Option?

Select the pair, analyze price direction, and open a forecast trade starting from $1.

How to invest in AUDNZD for the long term?

Follow rate cycles, commodity data, and major macroeconomic divergences between Australia and New Zealand.

What is an AUDNZD signal?

It's a trade idea or technical alert suggesting a potential move in the pair, based on trend or breakout conditions.

Is AUDNZD better for beginners or experienced traders?

Both -- it offers clean technical patterns with moderate volatility, ideal for strategy testing.