- Reserve Bank of Australia (RBA) rate changes

- Bank of Japan policy and inflation control measures

- Risk sentiment in global markets

- China’s economic data (affects AUD indirectly)

AUDJPY: What Moves the Australian Dollar and Japanese Yen Pair and How to Trade It

The AUD/JPY currency pair connects the Australian Dollar with the Japanese Yen -- two currencies that reflect different parts of the global economy. While the AUD is tied to commodity exports and risk sentiment, the JPY is often a safe-haven asset. For traders, this pair offers a mix of volatility and macro sensitivity. Here's how to trade AUDJPY in today's market.

This setup attracts both fundamental and technical traders — especially those using AUDJPY trading signals based on risk sentiment, interest rates, and economic divergence. Whether you’re exploring how to buy AUDJPY or looking to invest in AUDJPY more strategically, understanding its behavior is key.

What Is AUD/JPY?

AUD/JPY shows how many Japanese Yen are needed to buy one Australian Dollar. The AUD is strongly linked to commodity cycles, especially iron ore, while the JPY responds to global risk flows and Bank of Japan policy.

How Currency Quotation Works

If AUD/JPY = 98.50, it means 1 Australian Dollar equals 98.50 Japanese Yen. Here, the AUD is the base currency.

Example: Converting 100 AUD would give you 9,850 JPY. If the rate rises to 99.30, it suggests AUD is strengthening or JPY is weakening.

Factors Influencing AUD/JPY Movement

Shifts in investor sentiment or carry trade dynamics are often reflected in the AUDJPY sentiment trend and short-term price spikes.

How to Interpret AUD/JPY Price Changes

If AUD/JPY climbs from 97.80 to 99.20, the Australian Dollar is strengthening.

If it drops to 96.70, the Japanese Yen is likely gaining on risk-off behavior.

Example: A shift from 98.20 to 99.00 may follow strong employment data in Australia and falling bond yields in Japan — a classic bullish AUDJPY trading pattern.

Step-by-Step Quick Trading Example on AUD/JPY

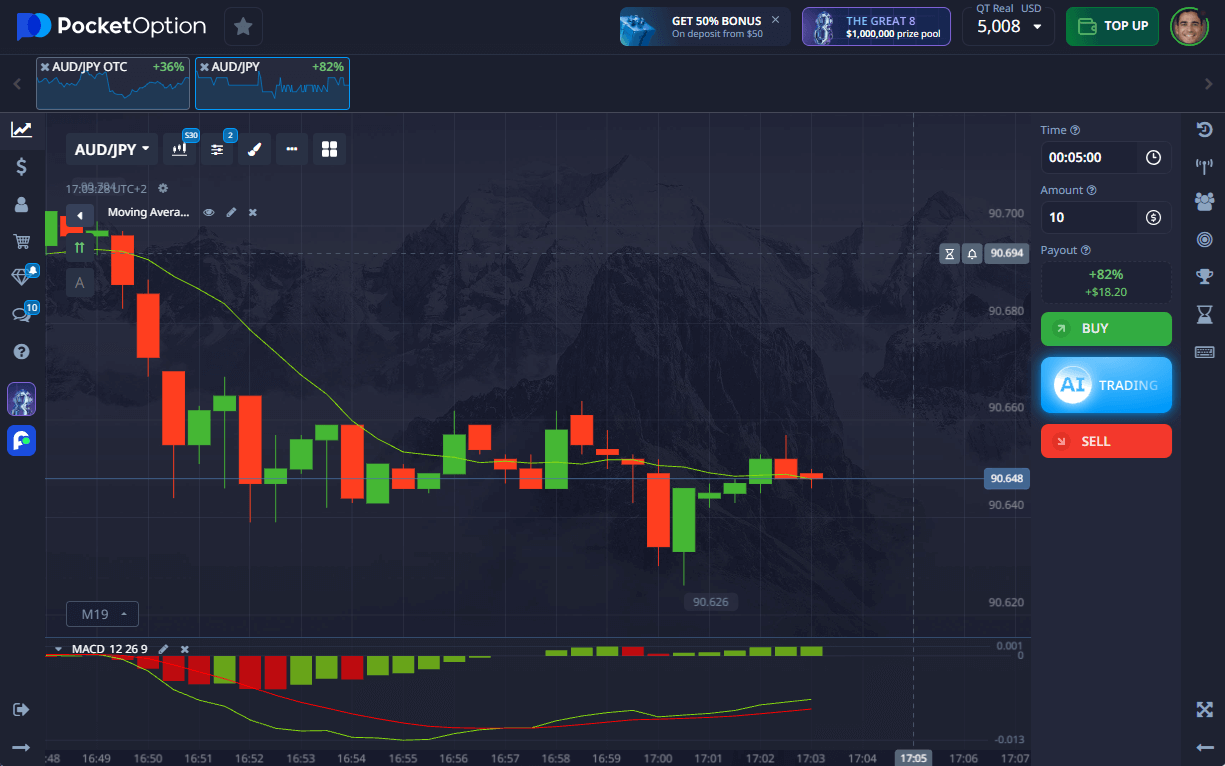

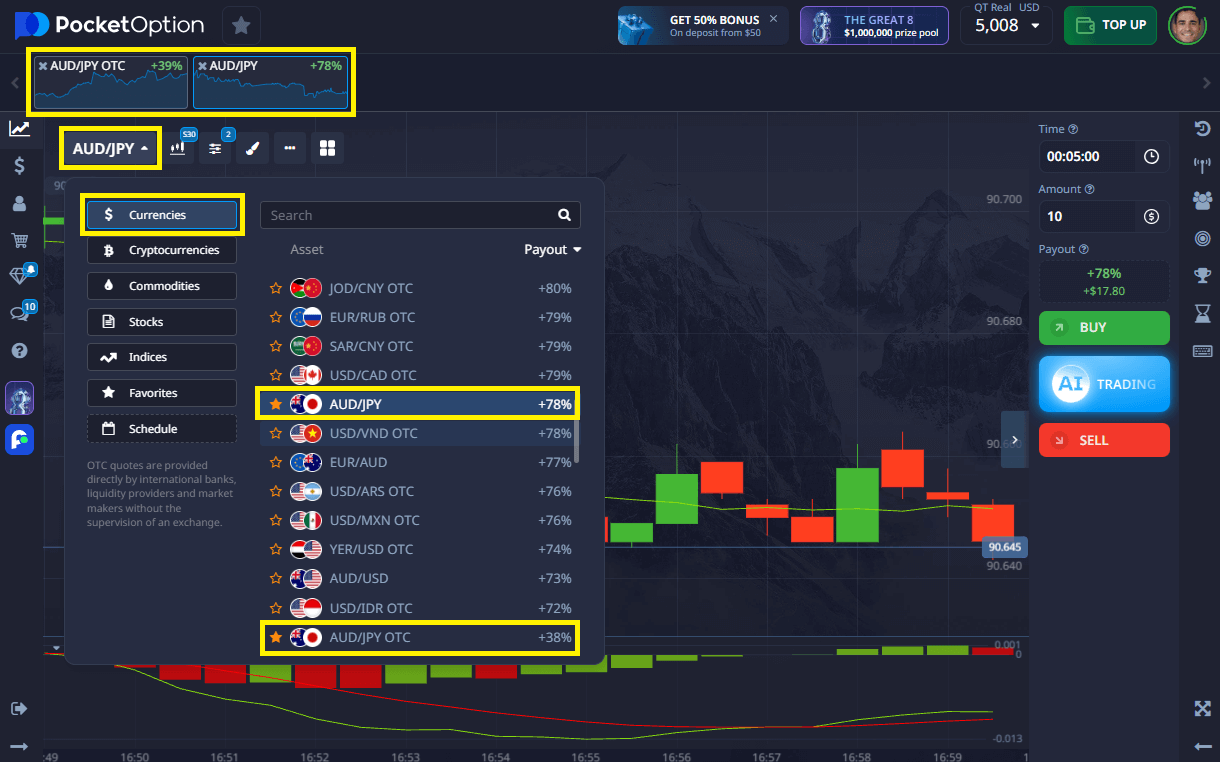

- Log in to Pocket Option and find AUD/JPY or AUD/JPY OTC in the asset list.

- Review the chart — use trend indicators, RSI, or follow a recent AUDJPY trading signal.

- Choose your trade size — from $1.

- Select expiration — from 5 seconds and more (5s available for OTC assets).

- Make your forecast:

- Press BUY if you expect the rate to rise.

- Press SELL if you expect it to fall.

- Return rate — up to 92%, displayed before execution.

Try Risk-Free — $50,000 Demo Account

Want to test how to buy AUDJPY without financial exposure? Use the free $50,000 demo account on Pocket Option to simulate trades, follow technical setups, and respond to AUDJPY sentiment changes.

This is the best way to learn how to invest in AUDJPY at your own pace and gain confidence before switching to real trades.

Once you’re ready, unlock full features with a real account from $5:

- Copy-trading

- Cashback programs

- Trading tournaments

- All charting and signal tools

Conclusion

Whether you’re following macro trends or short-term momentum, learning how to trade AUDJPY will help you navigate risk, rate cycles, and sentiment. With strong fundamentals, real-time signals, and demo access — you can confidently test strategies and decide how to invest in AUDJPY on your terms.

FAQ

How to trade AUDJPY safely?

Use technical indicators and sentiment analysis, start with small trades, and manage risk using demo practice.

How to buy AUDJPY on Pocket Option?

Select the pair, review the chart direction, and open a forecast trade based on short-term or swing analysis.

How to invest in AUDJPY long term?

Follow macro trends, central bank policies, and commodity price cycles relevant to both economies.

What is happening with AUDJPY stock today?

The pair is slightly bullish today amid rising Australian bond yields and a weaker Yen, but traders remain cautious.

What is the sentiment of AUDJPY stock?

Sentiment is moderately bullish, with traders expecting upward movement as global risk appetite returns.