- China’s monetary policy and central bank actions

- Oil prices and their effect on UAE exports

- China–UAE trade agreements and cross-border investments

- US Dollar strength (due to AED’s USD peg)

AEDCNY: Understanding the UAE Dirham and Chinese Yuan Pair in Global Trade

The AED/CNY pair shows the exchange rate between the UAE Dirham (AED) and the Chinese Yuan (CNY). It's shaped by trade flows, oil pricing, and regional economic stability. While not as volatile as major pairs, AED/CNY is gaining attention among traders exploring Middle Eastern and Asian market links. Here's how to trade AEDCNY, what influences it, and how to get started safely.

Understanding how to trade AEDCNY requires knowledge of Gulf–Asia trade dynamics and how oil-linked currencies like the Dirham interact with managed currencies like the Yuan. If you’re just starting, this pair offers a structured entry point for stable trading.

What Is AED/CNY?

AED/CNY reflects how many Chinese Yuan are needed to buy one UAE Dirham. The Dirham is pegged to the US Dollar, which stabilizes its behavior, while the Yuan follows a managed float system controlled by the People’s Bank of China.

This pair is useful for traders watching Gulf–Asia trade relations, energy-linked currencies, and diversified forex setups.

How Currency Quotation Works

If AED/CNY = 1.95, this means 1 AED equals 1.95 Chinese Yuan. The AED is the base currency here.

Example: Converting 100 AED would give you approximately 195 CNY. Small shifts in this number often reflect changes in the Yuan’s valuation, since AED remains relatively fixed.

Factors Influencing AED/CNY Movement

If oil prices rise and China increases demand, AED/CNY might move higher. This is important for those learning how to invest in AEDCNY with long-term macro exposure.

How to Interpret AED/CNY Price Changes

If AED/CNY climbs from 1.94 to 1.97, it means AED is gaining value or the Yuan is weakening.

A drop to 1.91 might suggest stronger demand for Chinese exports or Dollar weakness.

Example: If Chinese inflation falls and PBOC cuts rates, AED/CNY may rise due to a weakening Yuan.

Step-by-Step Quick Trading Example on AED/CNY

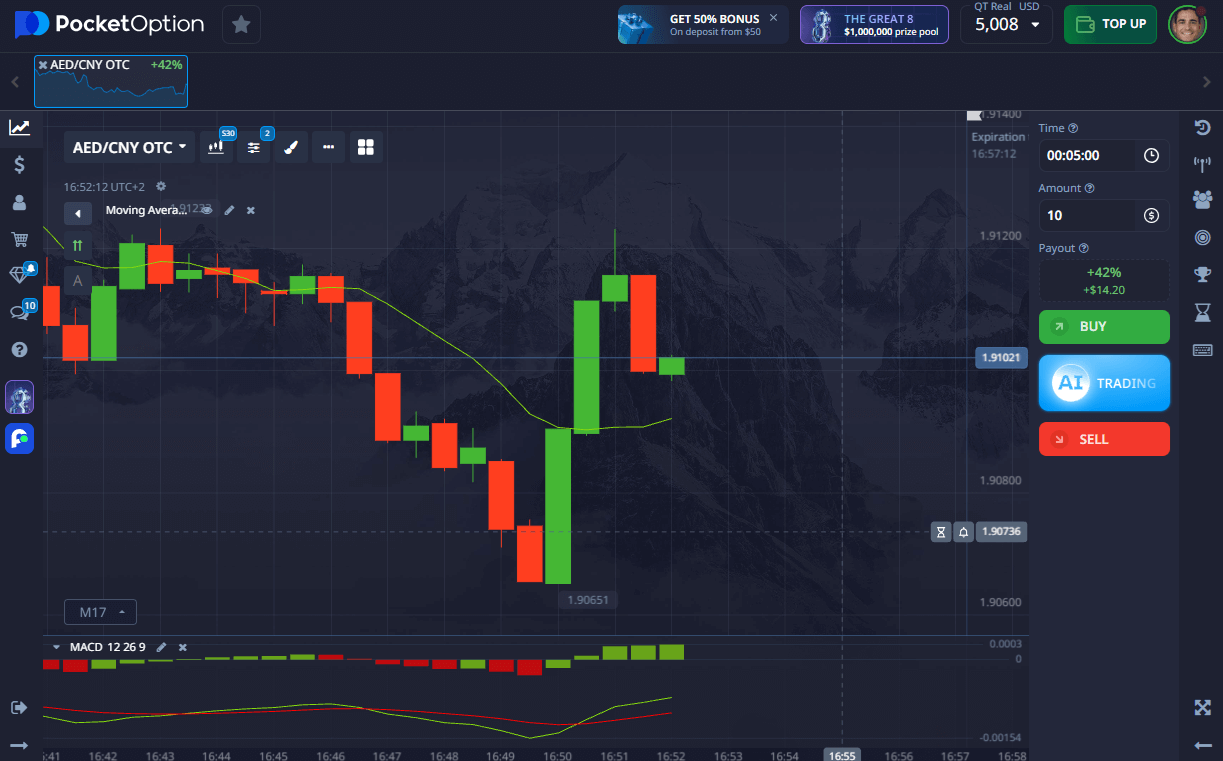

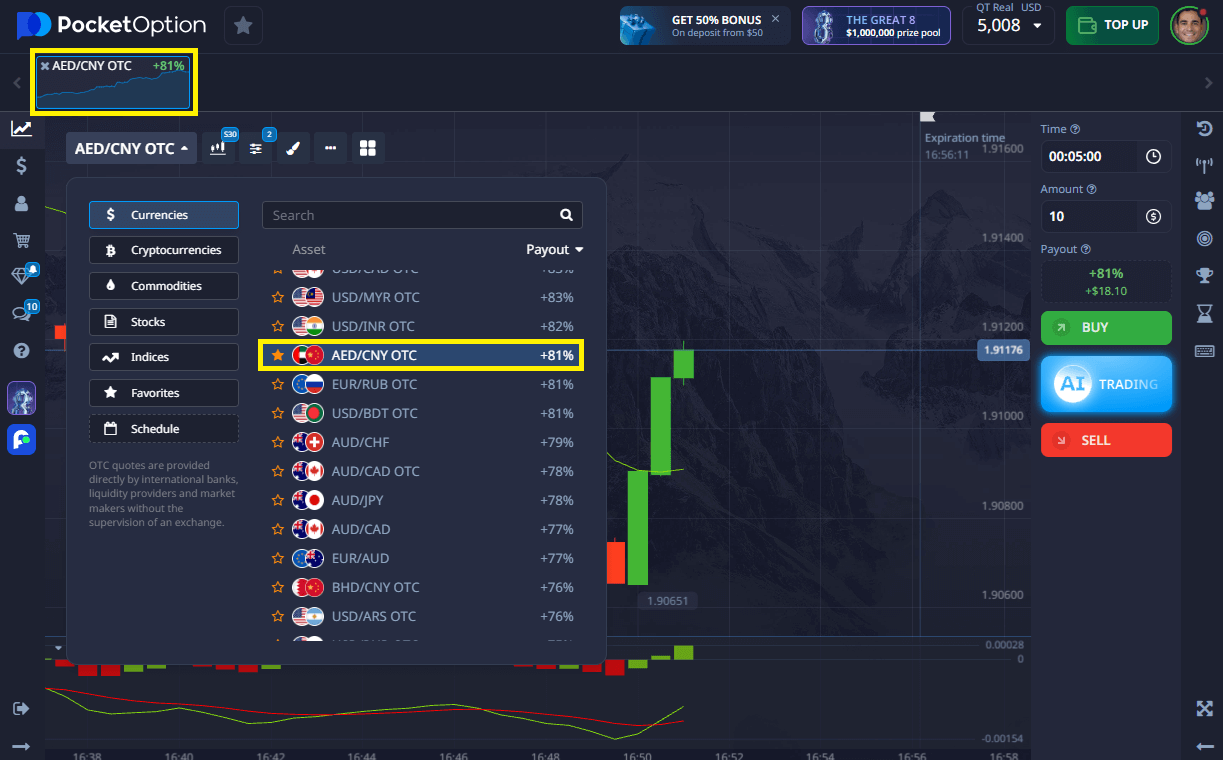

- Open Pocket Option and find AED/CNY OTC in the platform’s asset list.

- Check the chart using indicators like RSI or Moving Average.

- Select your trade size — from just $1.

- Choose a trade time — from 5 seconds and up (for OTC assets).

- Make your forecast:

- Click BUY if you expect the rate to rise.

- Click SELL if you expect a drop.

- Expected return is visible in advance — up to 92% if your forecast is correct.

➡️ Register quickly and trade live with a $5 minimum deposit (deposit may vary depending on payment methods), or use the demo to start risk-free.

Try Risk-Free — $50,000 Demo Account

Want to test trading before investing real money? Open your free $50,000 demo account on Pocket Option to practice how to trade AEDCNY with full market tools.

Use the opportunity to understand pricing behavior, test strategies, and refine your decision-making — especially if you’re learning how to buy AEDCNY or exploring longer-term positions.

After demo training, you can switch to a real account from just $5 and unlock:

- Copy-trading

- Cashback

- Weekly trading contests

- Advanced charting tools

Conclusion

If you want to trade regional currency setups with macro stability, AED/CNY is a good candidate. Understanding how to trade AEDCNY and how to invest in AEDCNY effectively gives you access to a stable pair that reflects global trade energy dynamics. Start with the demo and upgrade to live trades once you’re ready.

FAQ

How to trade AEDCNY for beginners?

Use the demo account, watch how the pair responds to oil and USD trends, and trade in small amounts first.

How to buy AEDCNY?

Select the pair, analyze the direction, and place a short-term forecast trade based on your outlook.

How to invest in AEDCNY long term?

Focus on China--Gulf trade relations, Yuan valuation policies, and oil-linked capital flows.

Is AEDCNY stable compared to major pairs?

Yes -- AED is pegged to the Dollar, and CNY is managed by China's central bank, making the pair less volatile.

What's a good time to trade AEDCNY?

During overlapping Gulf--Asia market hours or when economic news is released from either region.

Comments 1