- Qatar’s gas and oil exports — a key source of national revenue

- China’s import demand and trade balance

- Central bank rate decisions in both countries

- Energy price fluctuations and OPEC+ updates

- Bilateral economic agreements between the Gulf and Asia

QAR/CNY -- what it is and how to start trading this currency pair step by step

QAR/CNY is the currency pair that reflects the value of the Qatari Riyal (QAR) against the Chinese Yuan (CNY). It shows how many yuan are required to buy one riyal. This pair offers insight into the economic relationship between Qatar and China, especially in the fields of energy and trade. In this article, we break down how to buy QARCNY, how the pair behaves, and what factors affect its price.

What Is QAR/CNY and How It Reflects Market Dynamics

QAR/CNY represents the exchange rate between the Qatari Riyal and the Chinese Yuan. It shows how the value of Qatar’s currency relates to China’s — two economies with growing connections in energy, construction, and trade. While it may not be the most traded pair, it offers insights into oil-linked and manufacturing-driven economies.

How the QAR/CNY Quote Works

Let’s say the current rate is QAR/CNY = 1.95. This means 1 Qatari Riyal equals 1.95 Chinese Yuan.

In this case, the riyal is stronger, since it takes more yuan to match its value.

Example: if you exchange 100 QAR, you would receive 195 CNY.

This quote helps traders evaluate the strength of oil-backed currencies like the riyal compared to manufacturing-focused currencies like the yuan.

What Influences QAR/CNY Movement

To forecast QAR/CNY movements, traders track macroeconomic signals and price shifts in the energy market.

How to Read QAR/CNY Changes

If the exchange rate rises from 1.95 to 2.00, the Qatari Riyal is strengthening — more yuan are needed to buy one riyal.

When the rate drops to 1.89, that signals a stronger Chinese Yuan, since it now takes fewer yuan to match one riyal.

For instance:

- Before: QAR/CNY = 1.95

- After: QAR/CNY = 1.89 → the yuan has gained value relative to the riyal

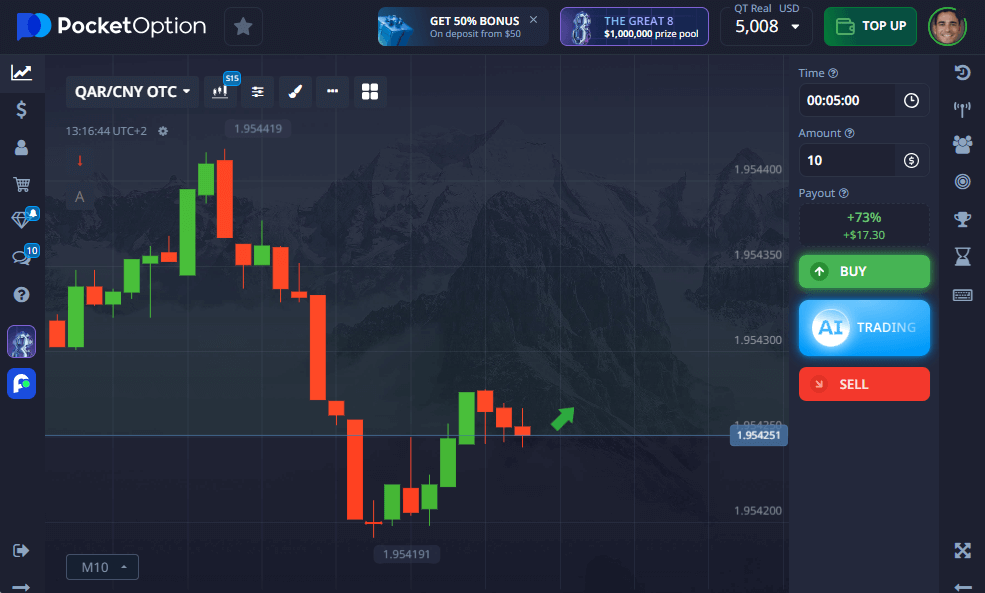

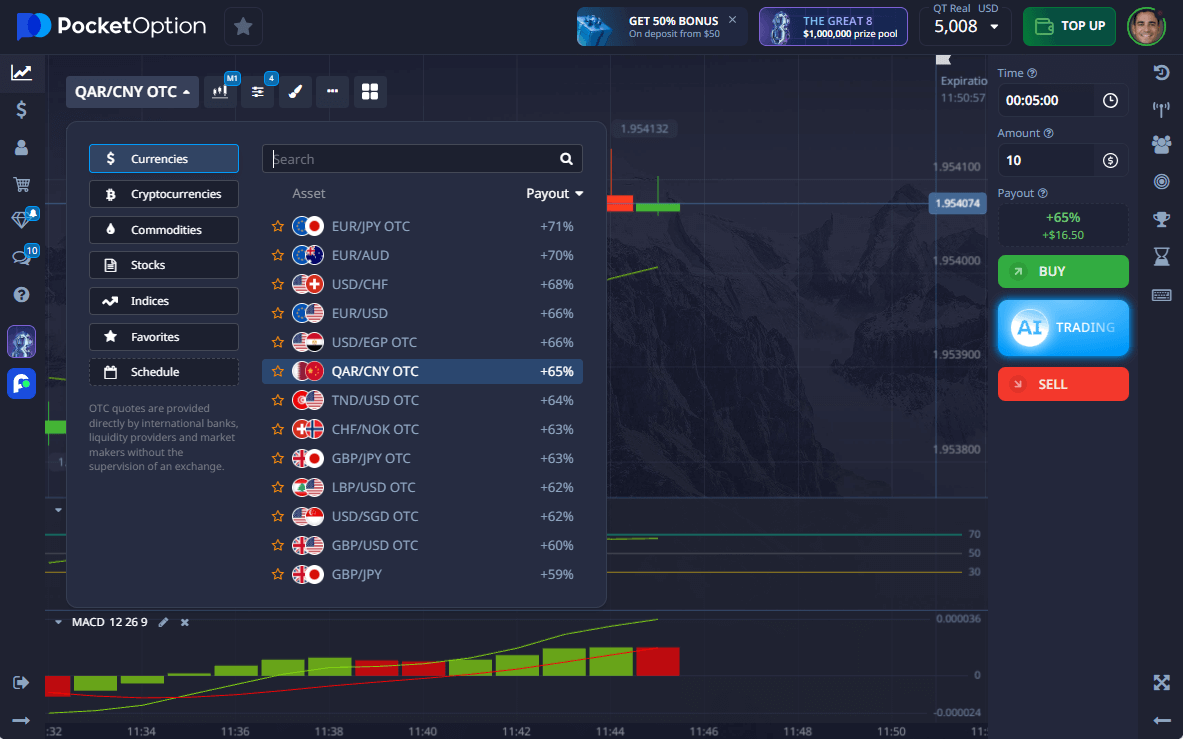

How to Trade QAR/CNY on Pocket Option

- Find the asset in the list: QAR/CNY or QAR/CNY OTC

- View the chart and apply indicators or sentiment analysis

- Select your trade amount — starting from $1

- Choose your duration — from 5 seconds and up (5-second trades are only available on OTC assets)

- Make your forecast:

- Click BUY if you expect the rate to go up

- Click SELL if you predict a decrease

- If your forecast is correct, the return can reach up to 92%. The exact rate is shown before you confirm.

Starting with QAR/CNY is simple — just register and you’re free to explore trading on a demo account or start real trades from $5 (deposit may vary depending on payment methods).

Try the $50,000 Demo Without Risk

Curious but not ready to go live? Start with a Pocket Option demo account — you’ll get $50,000 in virtual funds immediately after registration.

- Practice your strategy with no risk

- Test indicators and observe how QAR/CNY moves

- Use real charts in demo mode

Once you’re ready, switch to a live account from just $5 (deposit may vary depending on payment methods) to unlock:

- Copy Trading features

- Cashback on trades

- Trading tournaments

- Full platform access

FAQ

How to buy QARCNY?

Choose the QAR/CNY asset on Pocket Option, enter the amount, and decide the trade direction.

How to invest in QARCNY safely?

Start with a free $50,000 demo, then move to a real account from $5 (deposit may vary depending on payment methods).

How to trade QARCNY effectively?

Use sentiment analysis, economic news, and technical indicators to build your trading strategy.

What affects QAR/CNY price movement the most?

Energy exports, trade balances, and central bank policy changes are the biggest drivers.

Can I forecast QAR/CNY trends?

Yes, by combining charts and macro data, you can build a QAR/CNY forecast and adjust your trades accordingly.