- Subscriber growth reports: If Netflix gains more subscribers than expected (like the 7.7 million new users in Q4 2022), its price often jumps significantly.

- Earnings reports: Strong revenue and profits can drive price upward — Netflix’s 8% stock increase after beating earnings expectations in January 2023 demonstrates this impact.

- Content releases: Major hit shows like “Stranger Things” or “Squid Game” can boost subscriber numbers and investor confidence.

- Market competition: News about competitors like Disney+ or Amazon Prime can impact investor sentiment on Pocket Option trading charts.

- Global events: Economic shifts, regulations, or content production delays can also play a role in price volatility.

Netflix -- what it is and how to trade it on Pocket Option

Curious about trading Netflix stock but not sure where to start? This article gives you a clear and simple overview of what Netflix is, how its price moves, and how to trade it step by step on Pocket Option -- even if you're brand new to trading.

What is Netflix?

Netflix is one of the most popular entertainment companies in the world, founded in 1997 and now boasting over 220 million subscribers globally. Known for streaming movies, TV shows, and original content, it’s also a publicly traded company listed on the NASDAQ exchange with a market capitalization exceeding $250 billion. When you trade Netflix as a digital asset on Pocket Option, you’re speculating on its stock price movement — whether it will rise or fall — rather than buying shares directly. This makes learning how to buy Netflix much more accessible for everyday traders.

How does the price quote work?

A quote like Netflix = 565.30 on the Pocket Option platform means that one share of Netflix is currently valued at 565.30 USD.

In this case, the quote is in USD, which makes it the base currency. You’re essentially seeing how much one Netflix stock is worth in dollars on Pocket Option’s real-time trading interface.

Simple example: Imagine you’re shopping for a gadget online and its price is $565.30 — it’s the same idea here, but applied to the value of one Netflix stock that you can trade on Pocket Option.

What affects Netflix’s price movement?

For example, during the pandemic, Netflix usage surged with a 16 million subscriber increase in Q1 2020, which positively impacted its stock price by over 30% — creating ideal conditions for those who knew how to invest in Netflix through platforms like Pocket Option.

How to read the Netflix price movement

When the Netflix stock price increases — say from 565.30 to 578.10 on Pocket Option’s trading charts — this suggests growing investor confidence or strong company performance. It means the value of the stock is rising relative to the USD, creating potential opportunities for “buy” positions.

If the price goes down, it could mean market concerns, weaker earnings, or general sell-off trends in tech stocks — perfect for “sell” positions on Pocket Option.

Another example: If Netflix was 600 yesterday and now it’s 580 on Pocket Option, the price has dropped, possibly due to a negative quarterly report, creating a potential trading opportunity for those who know how to trade Netflix effectively.

Tutorial: Trading Netflix step-by-step on Pocket Option

Want to try a trade on Netflix? Here’s a quick way to do it using Quick Trading on Pocket Option:

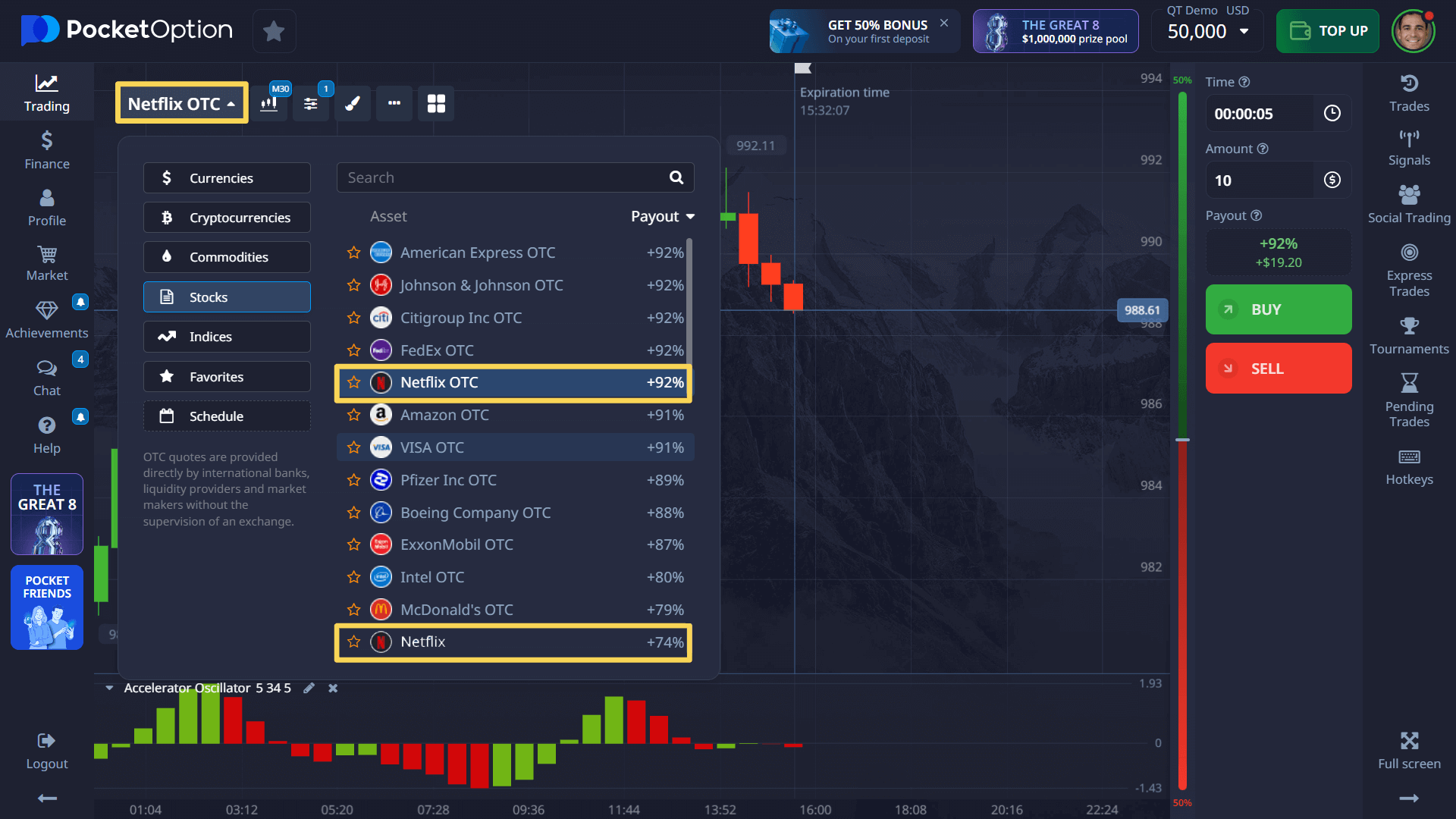

- Find the asset: Log in to Pocket Option and search for “Netflix” or “Netflix OTC” (available with short durations from 5 seconds for OTC).

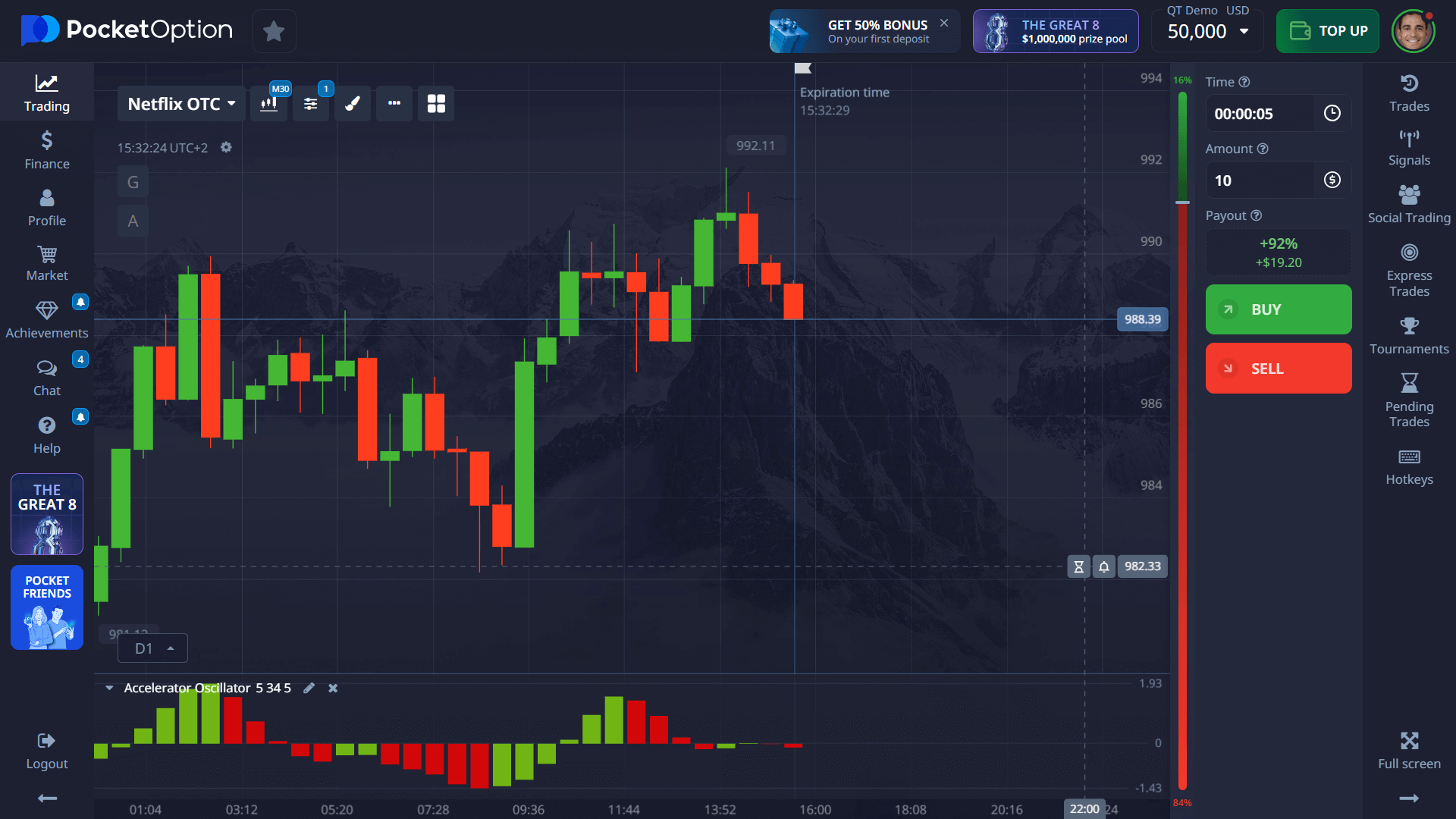

- Analyze the chart: You can view the live price and use Pocket Option’s built-in indicators or market sentiment tools.

- Choose your investment: Select a trade amount — starting from just $1 on Pocket Option.

- Set the time: Pick how long the trade will last. For OTC assets on Pocket Option, durations start from just 5 seconds.

- Make your forecast: If you think the price will go up, press BUY. If you believe it will go down, press SELL.

Pocket Option displays the potential return in advance — up to 92% if your forecast is correct.

It’s that simple — you can sign up in minutes and start trading with just $5 (deposit may vary depending on payment methods). Not ready yet? Try the demo first — no strings attached.

Try Risk-Free — $50,000 Demo Account

Worried about jumping straight into trading Netflix? Start with Pocket Option’s $50,000 demo account — it’s available immediately after registration.

You can practice how to trade Netflix, test different strategies, and explore the platform features — all without any financial commitment. The demo environment mirrors real market conditions perfectly, giving you authentic trading experience.

Once you’re ready, switch to a real account from just $5 (deposit may vary depending on payment methods). You’ll unlock:

- Copy Trading features to follow successful Netflix traders

- Cashback on trades up to 10%

- Access to Pocket Option trading tournaments with real prizes

- Full platform tools and technical indicators for Netflix price analysis

FAQ

How to trade Netflix on Pocket Option?

Sign up on Pocket Option, find Netflix in the asset list, analyze the price chart using built-in tools, and place a forecast-based trade using Quick Trading with as little as $1 per trade.

How to buy Netflix as a beginner?

You don't need to buy real shares -- on Pocket Option you can trade Netflix price movements starting from $1, making it accessible even for beginners with limited capital.

How to invest in Netflix without owning stock?

Pocket Option lets you speculate on Netflix's price movements without buying actual shares, ideal for low-capital investors who want exposure to this premium streaming stock.

What is the minimum deposit to start trading Netflix?

You can start from $5 on Pocket Option, but deposit minimums may vary depending on your chosen payment method. All major cards and e-wallets are accepted.

Can I practice trading Netflix without risk?

Yes, Pocket Option provides a $50,000 demo account immediately after registration to help you try out trading features and develop strategies completely risk-free.