- Financial performance: Quarterly earnings reports (typically released in January, April, July, and October) can cause significant price swings. For example, when Microsoft reported a 33% growth in Azure cloud revenue in Q1 2024, its stock jumped 5% in a single day.

- Product launches and innovations: Major announcements about Windows updates, Surface hardware, or AI advancements can drive investor sentiment. Microsoft’s AI integration announcements in 2023 contributed to a 15% price increase over just two weeks.

- Competitive landscape: Moves by competitors like Amazon (AWS), Google (Cloud), or Apple can impact Microsoft’s market position and stock value. When a competitor faces setbacks, Microsoft often sees upward price movement.

- Macroeconomic factors: Interest rates, inflation data, and broader market sentiment affect tech stocks like Microsoft. During the 2023 banking crisis, Microsoft initially fell 7% before recovering as investors sought stable tech companies.

- Regulatory developments: Antitrust investigations or new tech regulations can create uncertainty. The 2023 FTC scrutiny of Microsoft’s acquisition activities temporarily suppressed stock growth by approximately 3-4%.

How to Trade Microsoft: Understanding the Stock and How to Start Trading on Pocket Option Today

Curious about how to invest in Microsoft? In this article, we'll break down what Microsoft stock is, how it moves, and how to make your first trade on Pocket Option -- even if you're brand new to trading.

What is Microsoft?

Microsoft Corporation (NASDAQ: MSFT) is one of the world’s most valuable tech companies, founded in 1975 by Bill Gates and Paul Allen. With a market capitalization exceeding $3 trillion in 2024, Microsoft has transformed from a software company into a diversified technology leader in operating systems, cloud computing, enterprise solutions, and hardware.

When trading Microsoft on Pocket Option, you’re speculating on the movement of Microsoft’s share price rather than owning the actual shares. This allows you to benefit from both rising prices (by going long) and falling prices (by going short), depending on your market analysis and strategy.

Microsoft stock is particularly popular among traders on Pocket Option due to its liquidity, well-documented price patterns, and the company’s consistent presence in financial news – making it easier to follow fundamental developments that might impact its value.

How does the price quote work? (Simple Breakdown)

When you see a Microsoft stock quote on Pocket Option, it might display something like:

Microsoft = $412.25

This means one share of Microsoft is currently valued at $412.25 in USD. The USD represents the quote currency – the currency used to value the stock.

To understand this concept better, imagine you’re at a market: if an apple costs $1.50, you need to pay $1.50 to get one apple. Similarly, you would need $412.25 to purchase one share of Microsoft stock in a traditional investment. On Pocket Option, you’re not buying the actual stock but trading based on its price movements, which gives you more flexibility with smaller capital.

What affects Microsoft’s price movement?

Microsoft’s stock price is influenced by multiple factors that traders on Pocket Option should monitor:

Understanding these factors helps Pocket Option traders anticipate potential price movements and make more informed decisions when trading Microsoft.

How to read Microsoft’s price trend

Analyzing Microsoft’s price trends on Pocket Option requires understanding both short and long-term patterns:

For example, if Microsoft opened at $390.00, moved to $405.00, and then settled at $402.75 over a trading session, this indicates strong initial buying pressure followed by some profit-taking but overall positive sentiment.

Historical context matters too. Microsoft has shown remarkable resilience during market downturns – during the 2022 tech selloff, it declined only 28% compared to the Nasdaq’s 33% drop, demonstrating its status as a defensive tech stock on Pocket Option.

Key price patterns to watch when trading Microsoft include:

- Support levels near major moving averages (50-day, 200-day)

- Resistance at previous all-time highs

- Volume spikes during earnings announcements

- Correlation with broader tech indices like Nasdaq

Pocket Option’s technical analysis tools help you identify these patterns efficiently, giving you an edge when deciding how to trade Microsoft.

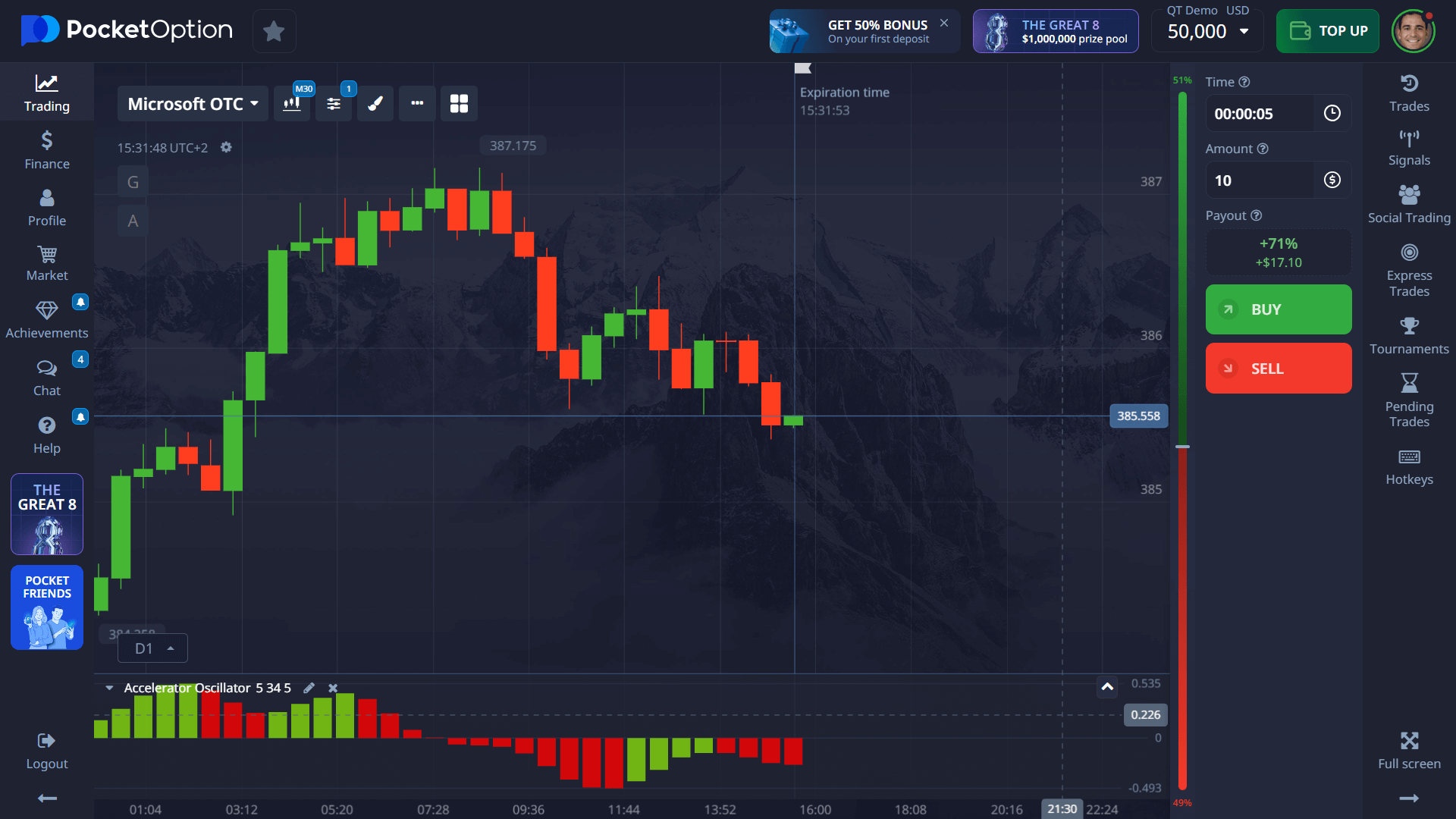

Tutorial: How to make a Microsoft Quick Trade on Pocket Option

Follow these detailed steps to execute your first Microsoft trade on Pocket Option:

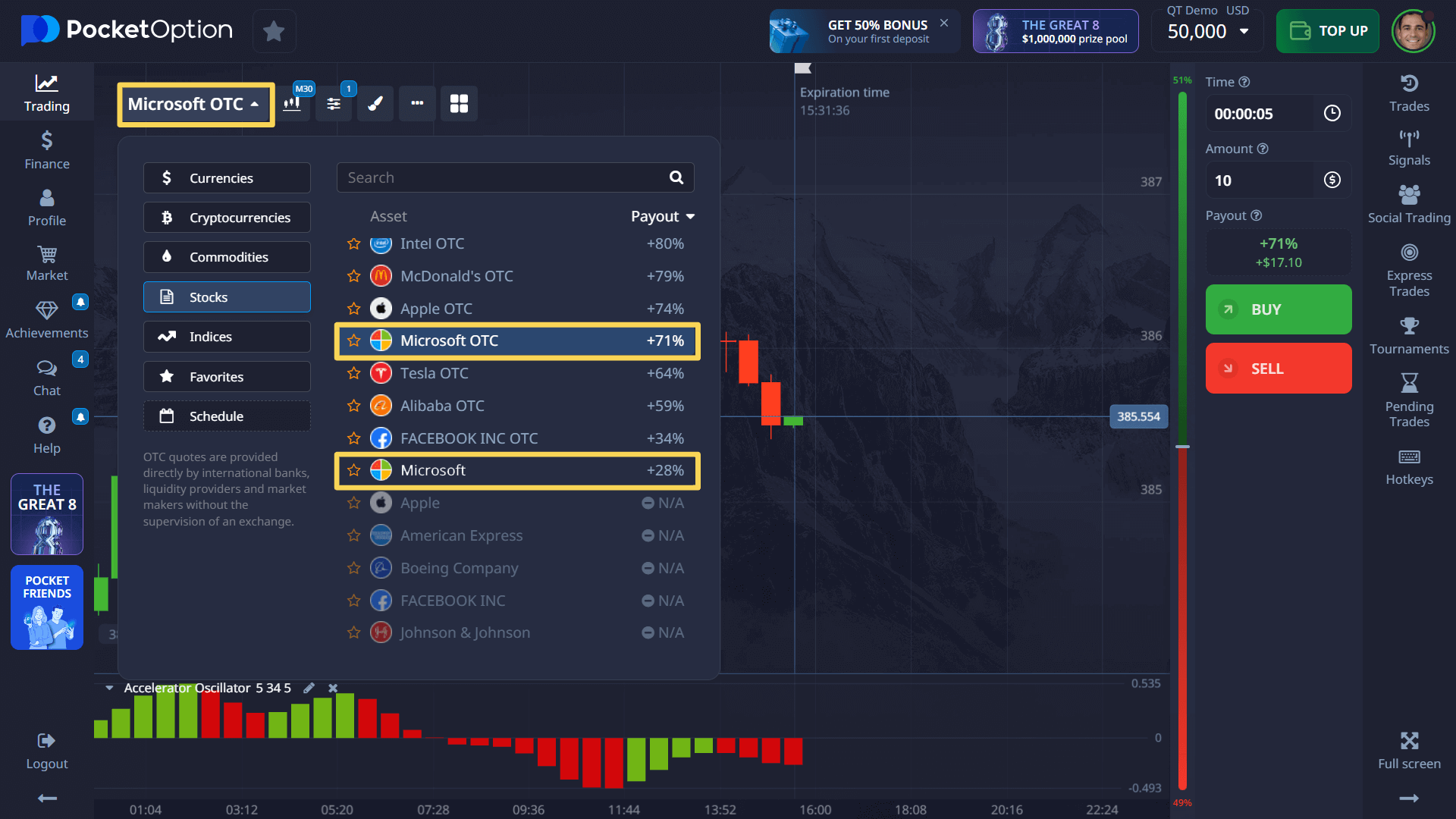

- Locate Microsoft: After logging into your Pocket Option account, search for “Microsoft” or “MSFT” in the asset selection panel. You’ll find both regular market hours trading and Microsoft OTC (available 24/5).

- Analyze the chart: Utilize Pocket Option’s comprehensive charting tools to evaluate Microsoft’s current trend. Toggle between timeframes (1-minute for short trades, 15-minute or 1-hour for longer positions) and apply indicators like RSI (for overbought/oversold conditions) or MACD (for trend strength).

- Set your investment amount: Determine how much to invest based on your risk management strategy. Pocket Option allows trades starting from just $1, making it accessible for beginners. For Microsoft trading, consider limiting each position to 1-5% of your total trading capital.

- Select expiration time: Choose how long your trade will last. For Microsoft, consider matching your expiration to the timeframe of your analysis – shorter for technical breakouts, longer for trades based on fundamental analysis.

- Choose direction: Based on your analysis, decide whether to place a BUY (if you expect Microsoft’s price to rise) or SELL (if you anticipate a decline) position. Pocket Option shows your potential return percentage before you confirm the trade.

- Monitor and manage: After placing your trade, use Pocket Option’s monitoring tools to track its progress. The platform offers real-time updates and notifications about significant price movements.

Pocket Option provides additional features for Microsoft trading, including multipliers to increase potential returns, and partial closure options to secure profits while keeping positions open.

Try trading Without Risk on Demo Account

Before committing real capital to Microsoft trading, take advantage of Pocket Option’s comprehensive $50,000 practice environment:

This free demo account allows you to:

- Practice how to buy Microsoft stock in different market conditions

- Test various technical indicators to see which work best for Microsoft’s price patterns

- Experiment with different trade durations to find your optimal strategy

- Learn how to invest in Microsoft without risking actual funds

- Master Pocket Option’s platform features and trading interface

When you’re ready to transition to live trading, Pocket Option offers competitive advantages:

- Start with as little as $5 (amount may vary by payment method)

- Access to Social Trading to follow successful Microsoft traders

- Up to 10% cashback on trading volume

- Regular tournaments with prize pools exceeding $50,000

- Educational resources specifically tailored for trading tech stocks like Microsoft

FAQ

How to trade Microsoft on Pocket Option?

To trade Microsoft on Pocket Option, first create an account and log in. Search for Microsoft in the asset list, analyze the chart using Pocket Option's technical tools, select your investment amount (minimum $1), choose your trade duration, and click BUY if you predict the price will rise or SELL if you expect it to fall. Your potential return (up to 92%) will be displayed before confirmation.

How to buy Microsoft on Pocket Option?

To buy Microsoft on Pocket Option, select Microsoft from the asset list, analyze current market conditions using the platform's tools, set your desired investment amount, choose your preferred expiration time, and click the BUY button if you believe the price will increase. Alternatively, try practicing with the free $50,000 demo account first to perfect your strategy.

How to invest in Microsoft safely?

To invest in Microsoft safely, begin with Pocket Option's free demo account to practice without risk. Start with small trades when moving to real money (as low as $1 per trade), implement strict risk management (limit positions to 2-5% of your capital), use technical analysis tools available on Pocket Option, stay informed about Microsoft's news and earnings dates, and consider diversifying across multiple assets.

What's the minimum deposit to trade Microsoft?

The minimum deposit to trade Microsoft on Pocket Option starts from $5, though this amount may vary depending on your selected payment method. Once deposited, you can place trades on Microsoft for as little as $1 per position, allowing you to manage risk effectively even with a small account.

Is the Microsoft OTC asset available anytime?

Yes, Microsoft OTC (Over-The-Counter) on Pocket Option is available for trading 24/5, even when the regular US stock markets are closed. This allows you to react to after-hours news or trade during your preferred time zone. The regular Microsoft asset follows standard NASDAQ trading hours (9:30 AM to 4:00 PM Eastern Time, Monday to Friday).