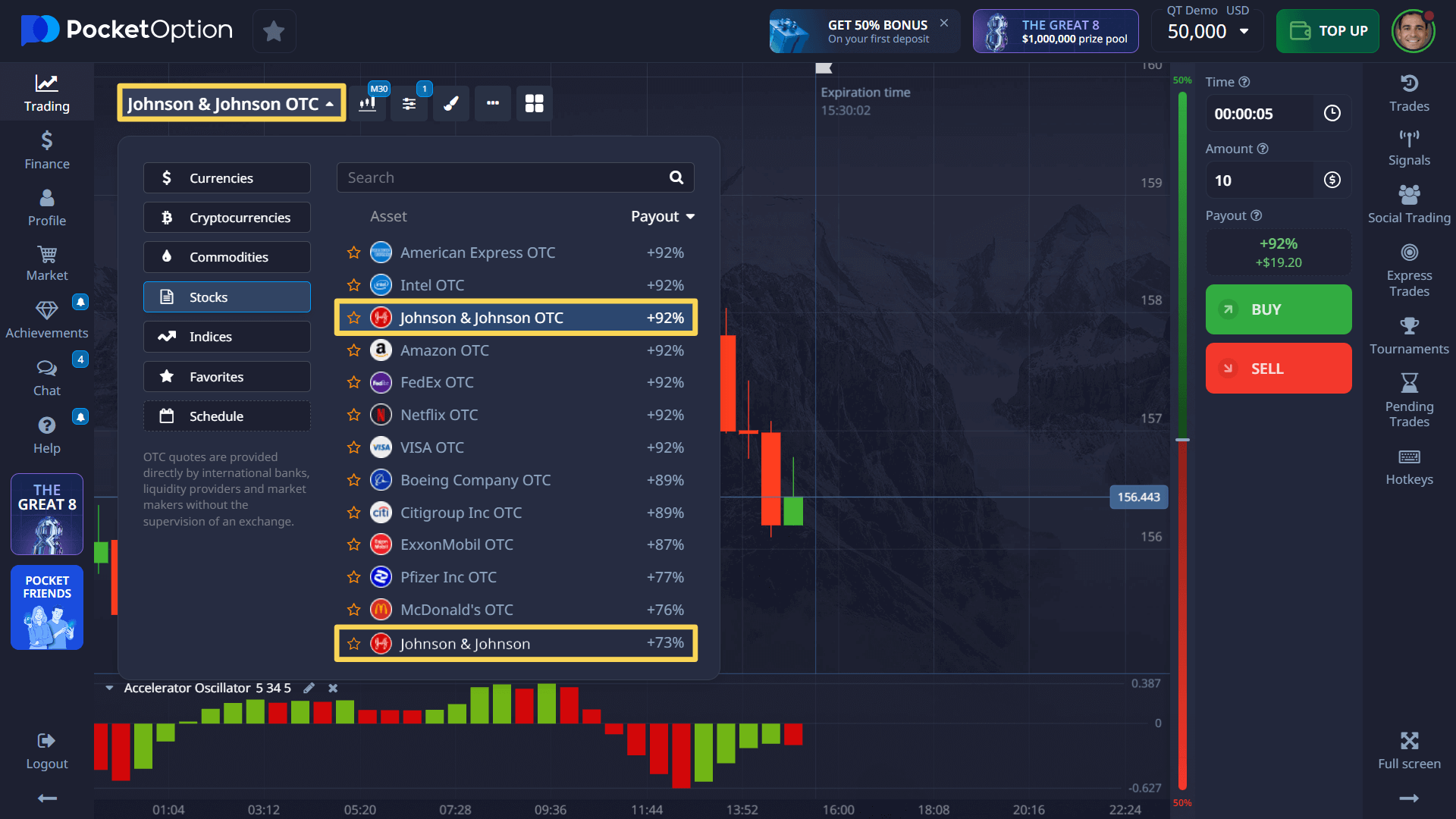

- Log in to your Pocket Option account and type “Johnson & Johnson” in the asset search bar. You’ll find both standard and OTC (Over-The-Counter) options.

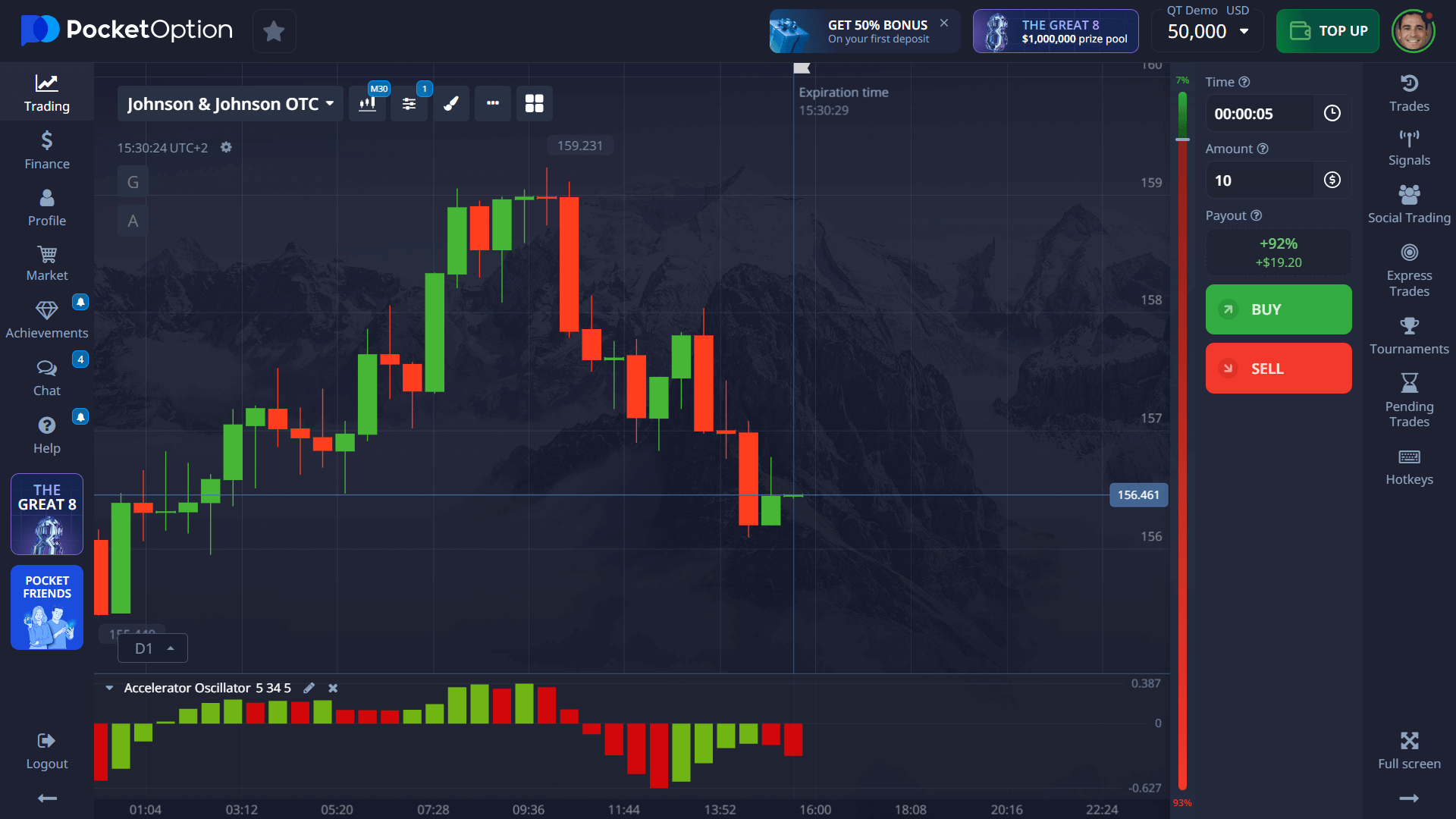

- Analyze JNJ’s chart patterns using Pocket Option’s 20+ technical indicators. Volume indicators often signal institutional interest levels.

- Select your investment amount (minimum $5) based on your risk management strategy.

- Set your position timeframe–from 5 seconds for scalping to several days for swing trading Johnson & Johnson.

- Make your forecast: select “BUY” if you anticipate price increases or “SELL” if you expect decreases.

- Review potential returns (up to 92% on successful forecasts) before confirming your trade.

How to Buy Johnson & Johnson: Trading Strategies for 2025

Interested in trading Johnson & Johnson (JNJ) but unsure where to begin? This article walks you through everything from buying to investing in Johnson & Johnson using Pocket Option's intuitive platform, with clear steps and actionable strategies for both novice and experienced traders.

What is Johnson & Johnson?

Johnson & Johnson (JNJ) ranks among the world’s largest healthcare companies, with a diverse portfolio spanning pharmaceuticals, medical devices, and consumer health products. Founded in 1886, this blue-chip stock has delivered consistent dividends for over 60 years, making it appealing for both long-term investors and active traders. On Pocket Option, traders can capitalize on JNJ’s price movements regardless of market direction.

How Does a Johnson & Johnson Quote Work?

Unlike currency pairs, Johnson & Johnson stock quotes are straightforward: a quote of “$165” means each share costs $165. When trading JNJ on Pocket Option, you’re not purchasing actual shares but speculating on price direction. If you forecast the price will rise from $165 to $170 and it does, your trade profits. This simplicity makes learning how to trade Johnson & Johnson accessible even to beginners.

Factors Affecting the Movement of Johnson & Johnson Stock

Johnson & Johnson stock movements respond to several key factors that savvy traders monitor. Quarterly earnings reports typically trigger significant price action, with the stock often gaining 2-3% after positive results. FDA approvals of new drugs, healthcare policy changes, dividend announcements, and sector-wide trends also impact JNJ’s price. Pocket Option provides real-time news feeds to help you track these developments when determining how to invest in Johnson & Johnson effectively.

How to Read the Johnson & Johnson Price

Interpreting Johnson & Johnson’s price movements correctly transforms your trading outcomes. Price increases (from $165 to $170, for example) indicate stronger market confidence, often following positive earnings or product announcements. Conversely, drops may signal investor concerns about litigation risks, competition, or broader market corrections. Pocket Option’s technical analysis tools help identify JNJ’s support and resistance levels–crucial knowledge when learning how to buy Johnson & Johnson at optimal entry points.

Tutorial: How to Trade Johnson & Johnson on Pocket Option

Ready to execute your first Johnson & Johnson trade? Follow these precise steps on Pocket Option:

Pocket Option’s streamlined interface makes executing these steps intuitive, even for first-time traders learning how to invest in Johnson & Johnson.

FAQ

How to buy Johnson & Johnson stock on Pocket Option?

To buy Johnson & Johnson on Pocket Option, simply log in to your account, search for "Johnson & Johnson" in the asset list, select your investment amount (minimum $5), choose your timeframe, and click "BUY" if you expect the price to rise or "SELL" if you anticipate a decline.

How to invest in Johnson & Johnson for long-term growth?

To invest in Johnson & Johnson for long-term growth, consider opening longer duration positions on Pocket Option during price dips following quarterly reports. Monitor JNJ's dividend announcements, product pipeline developments, and healthcare sector trends for optimal entry points.

How to trade Johnson & Johnson stock effectively?

Trade Johnson & Johnson effectively by combining fundamental analysis (earnings dates, FDA decisions) with technical indicators available on Pocket Option. RSI, MACD, and moving averages help identify optimal entry and exit points. Start with small positions ($5-$20) while building your strategy confidence.

What is the minimum deposit for trading Johnson & Johnson on Pocket Option?

The minimum deposit for trading Johnson & Johnson on Pocket Option is just $5, though some payment methods may have different minimums. This low entry threshold allows beginners to start trading with limited capital risk.

Can I practice trading Johnson & Johnson before using real money?

Yes, Pocket Option provides a $50,000 demo account immediately after registration, allowing you to practice trading Johnson & Johnson without financial risk. This environment perfectly replicates real market conditions while you refine your trading strategies.