- Inflation: Rising inflation typically drives investors to Gold as a value preservation tool

- Interest Rates: Higher rates often pressure Gold prices downward as interest-bearing assets become more attractive

- Dollar Strength: Since Gold is priced in USD, a stronger dollar generally makes Gold more expensive for foreign buyers

- Geopolitical Crises: International tensions usually increase Gold demand as a safe-haven asset

- Central Bank Policies: Major reserve accumulation by central banks can significantly impact global Gold prices

How to Buy and Trade Gold: Essential Trading Strategies and Investment Tips

Gold has fascinated humanity for over 5,000 years and remains one of the most sought-after assets globally. In 2023, global gold demand reached a record high of 4,899 tonnes. This article explains how to buy Gold, how to invest in Gold effectively, and how to trade Gold in today's dynamic market.

What is Gold as a Trading Asset?

Gold is a precious metal that serves as a store of value, inflation hedge, and investment vehicle. When learning how to buy Gold, investors should understand they can access this market through physical gold (coins and bars), gold stocks, futures contracts, and exchange-traded funds (ETFs) that track gold prices. Each method offers different advantages in terms of liquidity, storage requirements, and market exposure.

How Does the Gold Price Work?

Gold prices fluctuate based on supply and demand dynamics, geopolitical tensions, inflation rates, and broader economic indicators. Prices are typically quoted per troy ounce in US dollars. For example, when Gold is quoted at “$1,800,” it indicates one troy ounce costs $1,800 in the current market.

Understanding how to trade Gold requires recognizing that rising prices signal strengthening gold value, while declining prices indicate weakening. Unlike currencies or stocks, gold’s intrinsic value often increases during economic uncertainty, making it a unique trading asset.

Factors Influencing Gold Price Movement

How to Read Gold Price Charts Effectively

When analyzing how to invest in Gold through trading charts, remember that increasing prices typically indicate the base currency (usually USD) is weakening against Gold. For instance, if Gold rises from $1,800 to $1,850, this suggests Gold has gained value relative to the dollar.

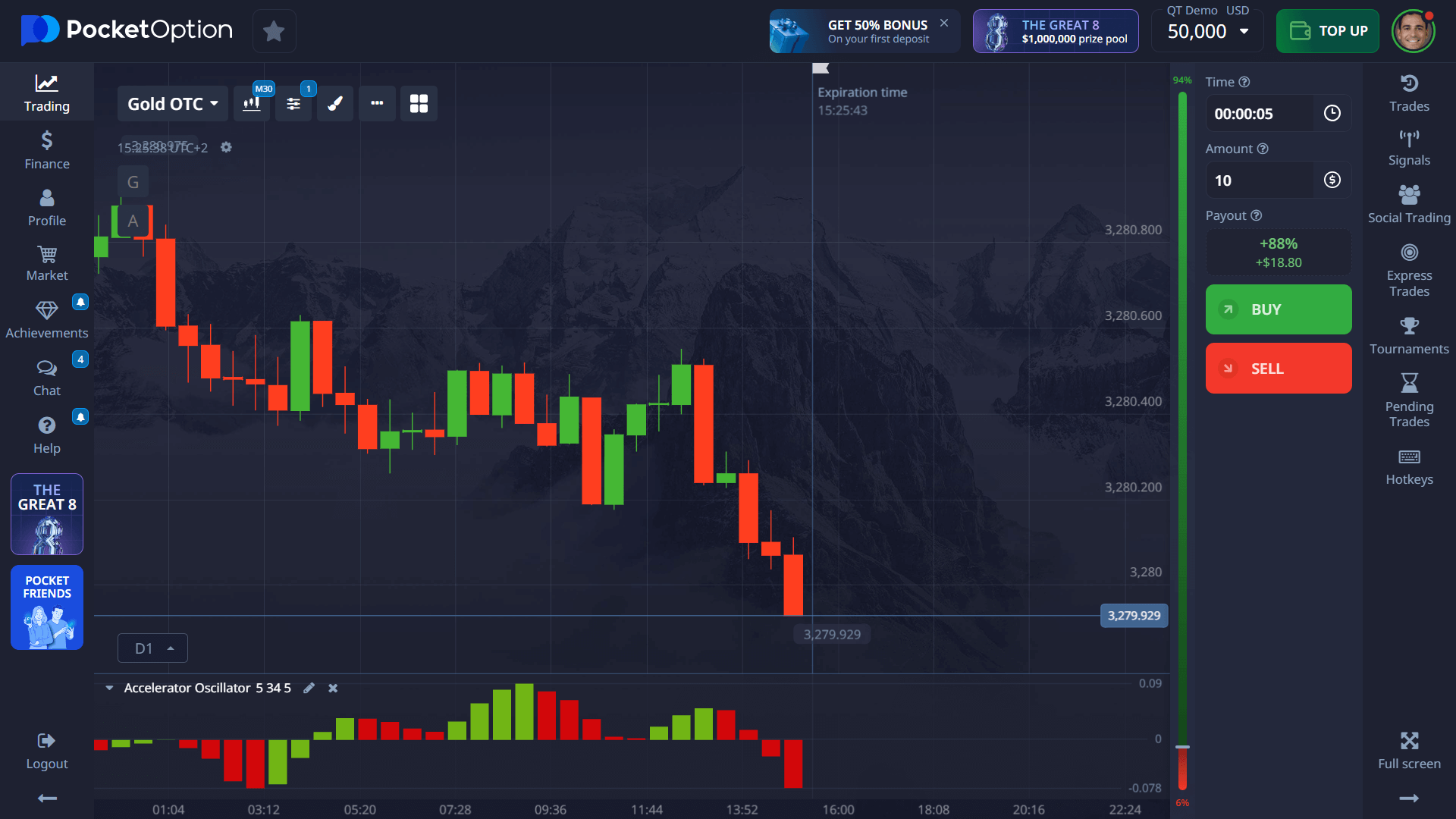

Successful gold traders monitor various timeframes–from 1-minute charts for short-term trades to weekly charts for identifying longer-term trends. Technical indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands can help pinpoint potential entry and exit points.

Step-by-Step Tutorial for Trading Gold on Pocket Option

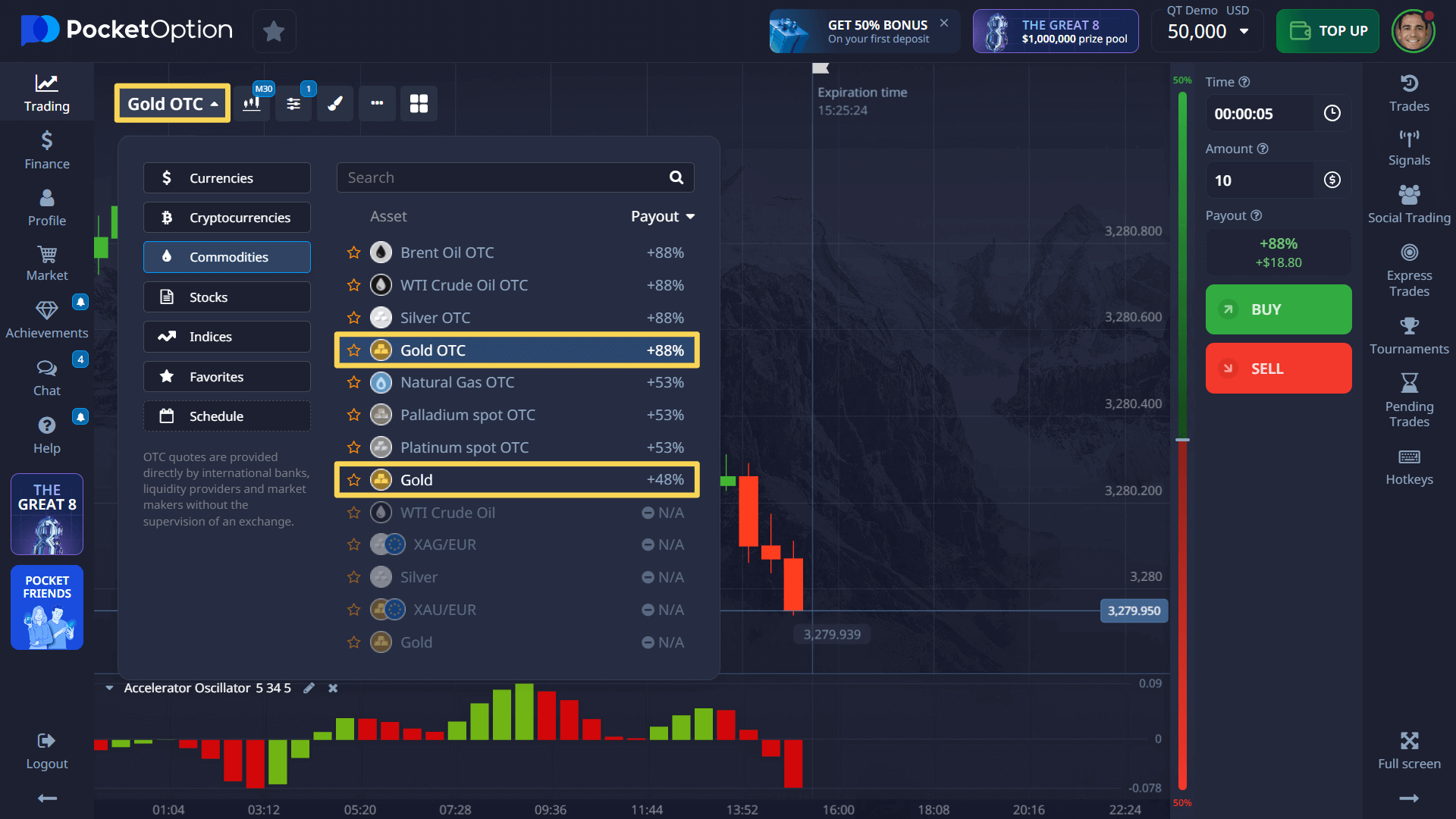

- Locate Gold in Assets: Select “Gold” from the available assets or “Gold OTC” for over-the-counter trading

- Analyze the Chart: Apply technical indicators and review market sentiment

- Select Investment Amount: Begin with as little as $1 to test your strategy with minimal risk

- Set Trade Duration: Choose timeframes as short as 5 seconds for OTC Gold assets

- Make a Market Forecast: Based on analysis, decide if Gold price will rise (BUY) or fall (SELL)

- Review Profit Potential: Verify the exact return percentage (up to 92%) before executing your trade

Try Trading Without Risk on Demo Account

For traders learning how to buy Gold, Pocket Option offers a risk-free environment with a $50,000 demo account upon registration. This practice account allows you to refine strategies, familiarize yourself with the platform features, and gain confidence in gold trading without financial exposure.

Once comfortable, transition to live trading requires just a $5 minimum deposit (amount may vary by payment method). This low entry barrier makes gold trading accessible to beginners while providing the educational foundation needed for long-term success.

FAQ

What's the most effective way to start trading Gold?

The most effective way to start trading Gold is through Pocket Option's demo account with $50,000 in virtual funds. Practice different strategies, then transition to a live account with just $5 (amount may vary by payment method).

When is the optimal time to trade Gold?

The optimal time to trade Gold is during overlapping market hours between New York and London (8:00 AM - 12:00 PM EST), which provides maximum liquidity. Also monitor trading sessions when major economic data is released, especially US inflation reports and Federal Reserve announcements.

How do I interpret Gold price charts accurately?

To interpret Gold price charts accurately, observe price movements relative to the base currency, identify key support and resistance levels, and use technical indicators like moving averages. Rising Gold prices typically indicate economic uncertainty or dollar weakness.

What's the minimum investment needed to start trading Gold?

The minimum investment needed to start trading Gold on Pocket Option is just $5 (amount may vary by payment method), with individual trades starting from $1. Begin with the free $50,000 demo account to practice without risk.

Is Pocket Option available for Gold trading in my region?

Pocket Option offers Gold trading in most countries worldwide. Check the platform's terms of service or contact customer support to confirm availability in your specific region. The platform is accessible in over 95 countries with multiple language options.