- Quarterly Earnings Reports: FedEx’s financial performance can significantly impact stock prices. For instance, in September 2023, FedEx shares jumped 5% after reporting better-than-expected earnings, while disappointing results in December 2022 led to a 7% decline.

- Fuel Price Fluctuations: As a transportation company with thousands of vehicles and aircraft, FedEx’s operational costs are directly tied to fuel prices. When oil prices surged in early 2022, FedEx’s stock fell by nearly 12% due to concerns about profit margins.

- E-commerce Trends: The growth of online shopping directly affects FedEx’s package volumes. During the 2020 pandemic, FedEx stock rose over 65% as e-commerce adoption accelerated globally.

- Competitive Landscape: Rivalries with companies like UPS and Amazon’s expanding delivery network impact investor sentiment. When Amazon announced expansion of its delivery fleet in 2019, FedEx shares dropped 4%.

- Economic Indicators: GDP growth, consumer spending, and global trade volumes serve as indicators for FedEx’s business prospects. Economic downturns typically lead to reduced shipping volumes and lower stock prices.

How to Buy FedEx Stock: Investment Strategies for Optimal Returns

In this comprehensive article, we will explain how to invest in FedEx and provide you with essential knowledge about this valuable asset. Whether you want to learn how to buy FedEx shares, how to trade FedEx effectively, or how to invest in FedEx for long-term growth, our analysis equips you with everything needed to make informed trading decisions.

What is FedEx?

FedEx Corporation (NYSE: FDX), founded in 1971, is a multinational delivery services company headquartered in Memphis, Tennessee. With a market capitalization exceeding $70 billion, it’s one of the world’s largest logistics companies, specializing in overnight shipping, ground delivery, and freight services. When you trade FedEx stock, you’re speculating on the price movements of shares in this transportation giant, which are influenced by various economic and company-specific factors. The company’s extensive global network of aircraft, vehicles, and sorting facilities makes it a significant player in global commerce and a frequently traded asset on stock exchanges.

How Stock Quotations Work (Simple Explanation)

When trading FedEx stock, you’ll encounter price quotations that reflect its current market value. For example:

FedEx (FDX) = $270.50

This indicates that one share of FedEx is valued at $270.50. Like other publicly traded stocks, FedEx’s price constantly fluctuates based on market supply and demand, investor sentiment, and broader economic conditions.

Here’s a practical example: If FedEx’s stock price rises to $285.00, it represents a 5.4% increase in value–potentially profitable for those who bought at the lower price. Conversely, if the price falls to $255.00, it shows a 5.7% decrease, which might signal a selling opportunity for short-term traders.

Factors Influencing FedEx’s Price Movements

When considering how to buy FedEx stock, it’s crucial to understand these key factors affecting its price:

How to Read FedEx Stock Charts

Understanding price movements is essential when learning how to invest in FedEx:

- When FedEx’s stock price rises from $270 to $285, it indicates strengthening market confidence, potentially signaling a buying opportunity.

- When the price falls from $270 to $255, it suggests weakening sentiment, which might present a selling opportunity for short positions.

For effective analysis, many traders use technical indicators like:

- Moving Averages (50-day and 200-day) to identify long-term trends in FedEx stock

- Relative Strength Index (RSI) to determine if FedEx is overbought or oversold

- Volume indicators to confirm the strength of price movements

Example: In March 2023, when FedEx’s stock crossed above its 200-day moving average with high trading volume, it preceded a 20% price increase over the following quarter, rewarding traders who recognized this bullish signal.

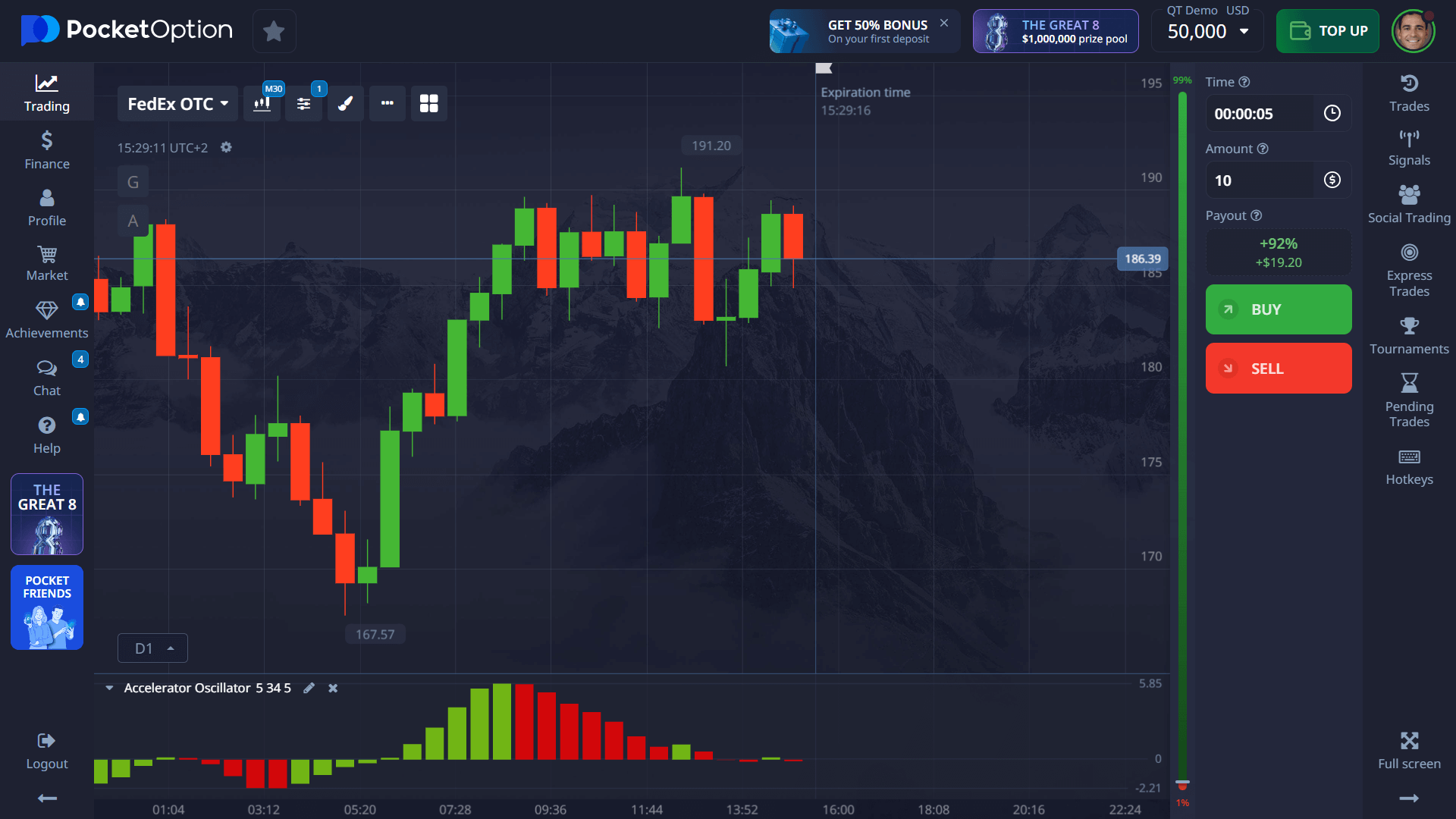

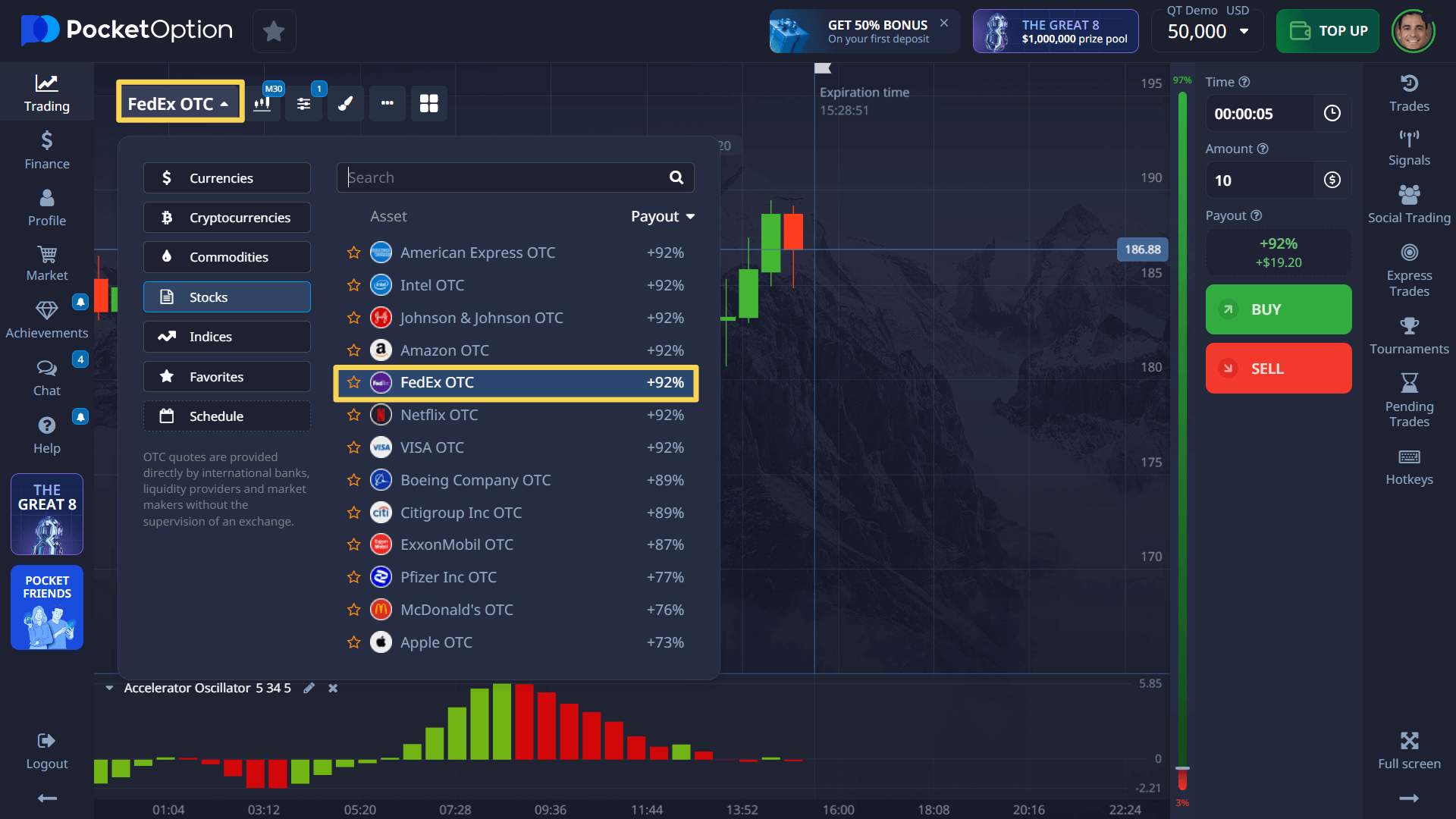

Step-by-Step Tutorial: How to Trade FedEx on Pocket Option

- Find the asset: Search for “FedEx OTC” or its ticker symbol “FDX” in Pocket Option’s asset list. Ensure you’re selecting the correct instrument (stock, CFD, or options depending on your trading preferences).

- Analyze the market: Study FedEx’s recent price action, check upcoming earnings announcements, and evaluate industry news affecting logistics companies. Apply technical indicators like RSI, MACD, or Bollinger Bands to identify potential entry points.

- Set your position size: Determine how much capital to allocate to this trade, starting from a minimum of $1 for some platforms. Never risk more than 1-2% of your trading capital on a single FedEx position.

- Choose your timeframe: Decide whether you’re day trading (holding positions for minutes or hours), swing trading (days or weeks), or investing long-term in FedEx (months or years).

- Enter your position: Based on your analysis, place a BUY order if you expect FedEx’s price to rise or a SELL order if you anticipate a decline. Consider using limit orders to get better entry prices.

- Manage your risk: Always set stop-loss orders to protect your capital against unexpected price movements. For example, a 5-8% stop-loss is common for FedEx stock positions.

- Monitor and exit: Track your position’s performance and exit according to your trading plan. With accurate forecasts on FedEx’s movement, returns can reach significant percentages.

After mastering these steps with virtual funds, you can start trading with real capital, with minimum deposits as low as $5 (amounts may vary based on your chosen payment method).

Try Trading FedEx Without Risk on Pocket Option Demo Account!

Before committing real funds to FedEx trading, consider starting with a virtual practice account loaded with $50,000. This risk-free environment allows you to:

- Test various trading strategies specific to FedEx’s market behavior

- Become familiar with the platform’s tools and features

- Practice analyzing FedEx’s price movements using different technical indicators

- Experience the emotional aspects of trading without financial consequences

Many successful FedEx traders spent 1-3 months practicing on demo accounts before transitioning to live trading. When you feel confident in your abilities, you can easily switch to a real account with a minimum deposit of just $5 (exact amount depends on your payment method). This unlocks additional features like social trading functionality, cashback rewards, and participation in trading competitions.

FAQ

How do I buy FedEx stock?

To buy FedEx stock, create an account with a broker that offers FDX shares, deposit funds, search for FedEx using the ticker symbol FDX, analyze the current price, and place a buy order for your desired number of shares. You can also trade FedEx through CFDs or other derivatives on trading platforms.

How to invest in FedEx for long-term growth?

To invest in FedEx for long-term growth, research the company's fundamentals, consider dollar-cost averaging by purchasing shares at regular intervals, reinvest any dividends, and maintain a holding period of several years to benefit from the company's potential expansion in the logistics industry and global commerce.

What is the best strategy for trading FedEx stock?

The best strategy for trading FedEx depends on your risk tolerance and goals. For beginners, trend-following strategies work well, buying when FedEx breaks above resistance levels and selling when it falls below support. Others prefer swing trading around earnings announcements or using fundamental analysis to identify undervalued opportunities.

Can I practice trading FedEx without risking real money?

Yes, most reputable trading platforms offer free demo accounts with virtual funds ranging from $10,000 to $50,000, allowing you to practice trading FedEx without any financial risk until you feel confident enough to transition to real trading.

What is the minimum amount needed to start trading FedEx shares?

The minimum amount needed varies by platform, but typically starts at $5-$10 for CFD trading. For actual stock ownership, you'll need enough to purchase at least one share (currently around $270) unless your broker offers fractional shares, which allow investments with as little as $1.