- Oil and Gas Prices: As ExxonMobil’s primary revenue source, crude oil and natural gas price movements significantly impact profitability. When West Texas Intermediate (WTI) or Brent crude prices rise, ExxonMobil’s upstream operations typically generate higher margins.

- OPEC+ Decisions: Production quotas and supply agreements among major oil-producing nations directly affect global energy prices and ExxonMobil’s revenues.

- Energy Transition Policies: Regulatory changes regarding carbon emissions, renewable energy mandates, and fossil fuel restrictions impact long-term business prospects.

- Quarterly Earnings Reports: Financial performance metrics, particularly revenue growth, profit margins, and capital expenditure plans, drive short-term price movements.

How to Buy ExxonMobil Stock: Complete Investment Strategy

ExxonMobil (NYSE: XOM) ranks among the world's largest publicly traded energy companies with a market capitalization exceeding $400 billion. For investors seeking exposure to the energy sector, understanding how to buy ExxonMobil stock represents a valuable opportunity. This article provides a comprehensive breakdown of ExxonMobil's market position, price influences, and practical trading strategies to help you make informed investment decisions.

What is ExxonMobil?

ExxonMobil is a multinational oil and gas corporation formed in 1999 through the merger of Exxon and Mobil. With operations spanning exploration, production, refining, and marketing across 21 countries, it’s one of the world’s “supermajor” oil companies. The corporation produces approximately 2.3 million barrels of oil equivalent daily and maintains proved reserves of 18.5 billion barrels of oil equivalent.

The company’s extensive business portfolio includes upstream exploration, downstream refining, chemicals manufacturing, and retail fuel distribution. For anyone looking to invest in ExxonMobil, understanding its diversified business model is essential for evaluating its market resilience and growth potential in the evolving energy landscape.

How ExxonMobil Stock Pricing Works

ExxonMobil shares trade on the New York Stock Exchange under the ticker symbol XOM. Each share represents partial ownership in the company, with prices quoted in USD. When ExxonMobil trades at $100, this indicates investors value one share at $100 based on current market conditions.

The stock follows standard market hours (9:30 AM to 4:00 PM Eastern Time), with prices determined by supply and demand dynamics. ExxonMobil’s substantial market presence means its stock typically maintains strong liquidity, allowing investors to enter and exit positions with minimal price impact during normal trading conditions.

Factors Affecting ExxonMobil Stock Prices

Several key factors directly influence ExxonMobil’s share price performance:

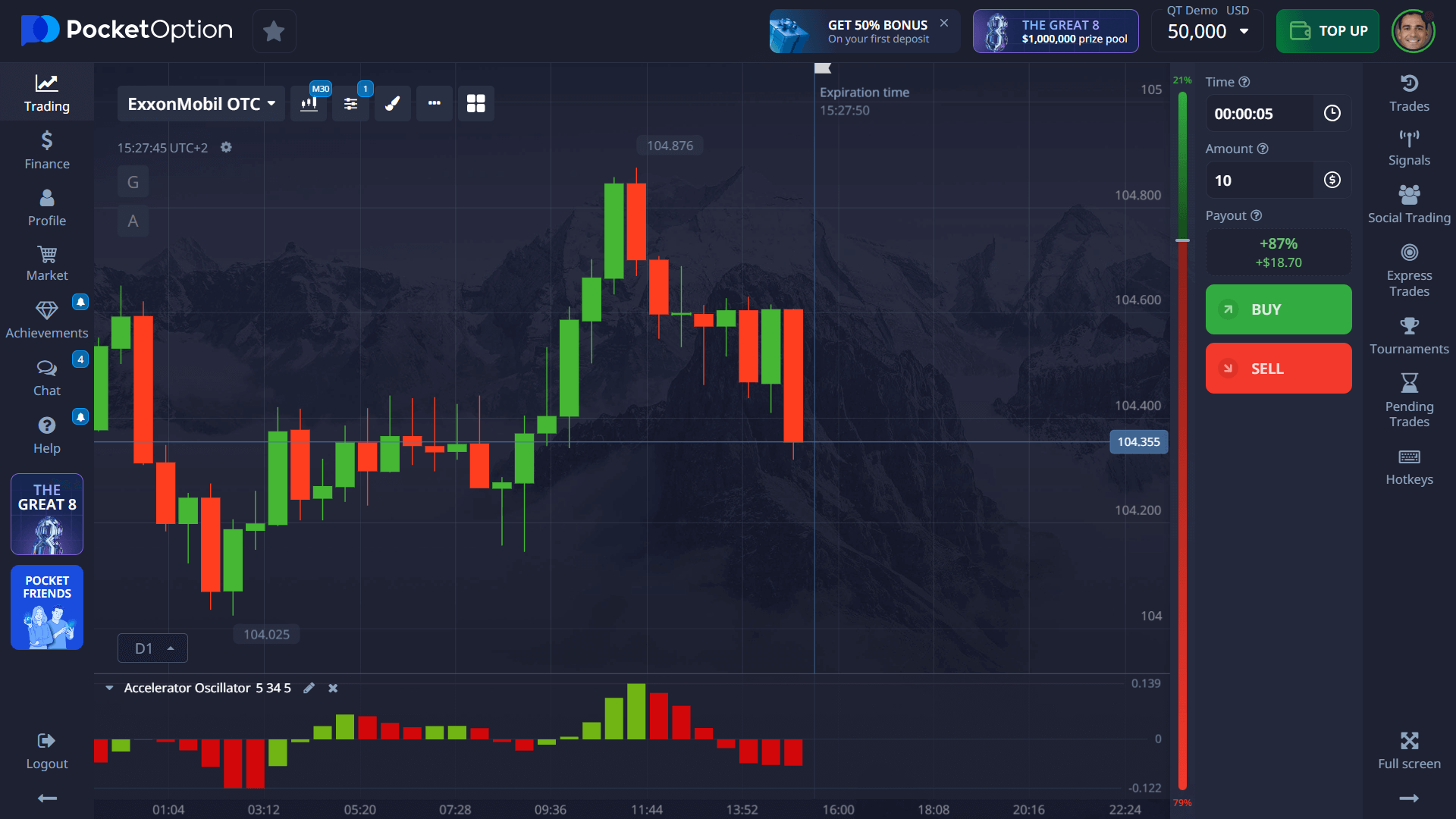

How to Read ExxonMobil Stock Charts

Effective chart analysis helps investors identify optimal entry and exit points when trading ExxonMobil:

- Price Trends: Upward trajectories (higher highs and higher lows) indicate bullish momentum, while downward patterns suggest bearish sentiment.

- Volume Patterns: Increasing volume during price movements confirms trend strength. For example, when ExxonMobil’s stock rises from $100 to $105 with high volume, this suggests strong buyer conviction.

- Support/Resistance Levels: Historical price points where ExxonMobil stock repeatedly bounces (support) or struggles to break through (resistance) offer valuable trading signals.

For technical analysis, many traders apply 50-day and 200-day moving averages to identify ExxonMobil’s long-term price direction and potential reversal points.

Step-by-Step: How to Buy ExxonMobil Stock

Follow these steps to start trading ExxonMobil on Pocket Option:

- Create an Account: Register with Pocket Option and complete verification requirements.

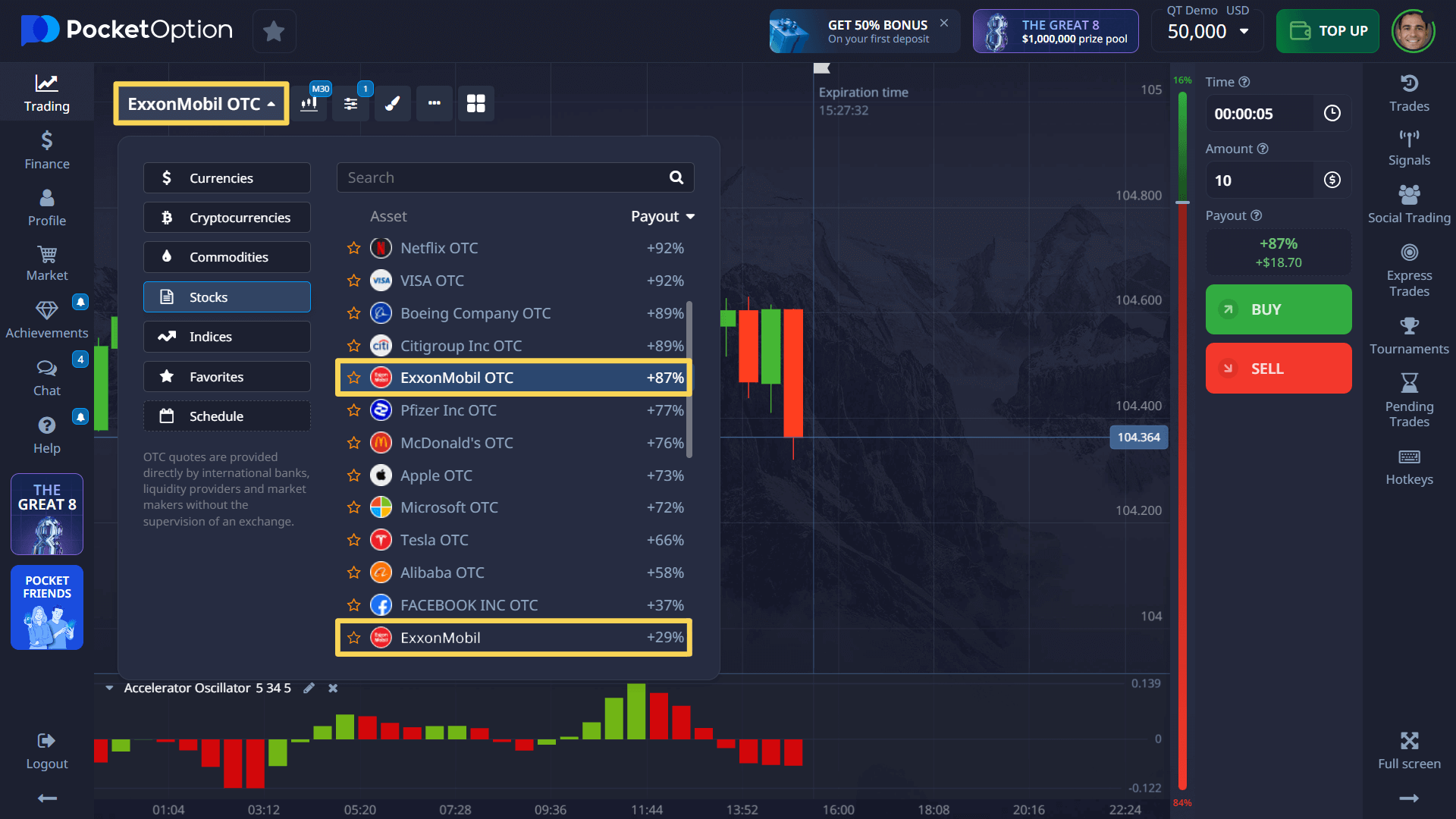

- Locate ExxonMobil: Find XOM in the platform’s asset list under “Stocks” or “Energy” category.

- Analyze Current Market: Review ExxonMobil’s recent price action and apply technical indicators like RSI or MACD to identify potential entry points.

- Set Position Size: Determine your investment amount (minimum $1) based on your risk management strategy.

- Choose Direction: Select “Buy” if you anticipate price increases or “Sell” if you expect decreases.

- Set Duration: For ExxonMobil OTC assets, select timeframes ranging from 5 seconds to several days.

When executing your first trade, remember that different market conditions require different strategies. For example, during earnings announcements, ExxonMobil often experiences increased volatility, creating both higher risk and potential rewards.

Try Trading Without Risk on Demo Account

Before investing real capital, practice how to buy ExxonMobil stock risk-free using Pocket Option’s demo environment. New users receive $50,000 in virtual funds to simulate real market conditions without financial exposure.

This simulation allows you to test various trading strategies, practice timing entries and exits, and become familiar with how ExxonMobil stock responds to market news. Once confident in your approach to trading ExxonMobil, transition to a live account with a minimum deposit of $5 (amount may vary by payment method).

How to Invest in ExxonMobil for Long-Term Growth

For investors seeking longer-term exposure to ExxonMobil, consider these strategies:

- Dividend Reinvestment: ExxonMobil has increased its dividend for 39 consecutive years, making it an attractive option for dividend growth investors.

- Dollar-Cost Averaging: Invest fixed amounts at regular intervals to reduce the impact of price volatility.

- Portfolio Allocation: Consider ExxonMobil as part of a diversified energy sector exposure, alongside renewable energy investments.

When evaluating how to trade ExxonMobil for longer timeframes, monitor the company’s strategic investments in carbon capture technology and renewable energy initiatives, which may influence its long-term market position.

FAQ

What is ExxonMobil's position in the global energy market?

ExxonMobil ranks among the world's largest publicly traded energy companies with operations in 21 countries, producing approximately 2.3 million barrels of oil equivalent daily and maintaining 18.5 billion barrels in proved reserves.

How to buy ExxonMobil stock for beginners?

Beginners can buy ExxonMobil stock by creating a Pocket Option account, locating XOM in the asset list, analyzing current market conditions, setting their investment amount, choosing a trading direction, and selecting an appropriate timeframe.

What factors influence ExxonMobil's stock price?

Key factors include global oil and gas prices, OPEC+ production decisions, energy transition policies, quarterly earnings reports, and macroeconomic conditions affecting energy demand.

How to invest in ExxonMobil for long-term growth?

Long-term investors should consider dividend reinvestment strategies, dollar-cost averaging, and monitoring ExxonMobil's adaptation to energy transition trends including investments in carbon capture and renewable technologies.

Can I practice how to trade ExxonMobil without risk?

Yes, Pocket Option offers a free demo account with $50,000 in virtual funds to practice trading ExxonMobil stock in real market conditions without financial risk.