- Network upgrades: Ethereum 2.0 and other technical improvements drive investor confidence and adoption.

- Smart contract adoption: The more dApps and DeFi platforms that use Ethereum, the higher the demand for ETH.

- Gas fees: Lower transaction costs attract more users to the network, potentially affecting price positively.

- Market trends: ETH often follows broader cryptocurrency market movements, including Bitcoin price action.

- Regulatory developments: Changes in global cryptocurrency regulations can impact ETH’s value significantly.

Ethereum: What It Is and How to Trade It Step-by-Step for Beginners

Curious about how to buy Ethereum but unsure where to begin? This article explains what Ethereum is and how to trade it in just a few simple steps -- perfect for beginners who want to start trading cryptocurrency with minimal investment.

What is Ethereum?

Ethereum is a decentralized blockchain platform that enables the creation of smart contracts and decentralized applications (dApps). Launched in 2015 by Vitalik Buterin, it introduced the concept of programmable money through its native cryptocurrency, ETH.

Unlike Bitcoin, which primarily functions as digital currency, Ethereum serves as a technology platform where developers can build applications that run exactly as programmed without downtime, censorship, or third-party interference. ETH is used to pay transaction fees (called “gas”) and interact with these applications.

For those wondering how to buy Ethereum, it’s important to understand that you’re investing in both a currency and the technology behind it, which offers significantly more use cases than traditional cryptocurrencies.

How Currency Quoting Works (Simple Explanation)

Ethereum is typically quoted as ETH/USD, showing how much one ETH is worth in US dollars.

Example: ETH/USD = 2,200 means 1 ETH equals 2,200 USD.

Here, ETH is the base currency and USD is the quote currency. If ETH/USD rises, Ethereum is gaining value relative to the dollar.

Think of it like this: When ETH climbs from 2,200 to 2,300, your ETH is worth more dollars. If it drops to 2,100, it’s losing value.

Factors That Influence Ethereum Price Movement

Several critical elements influence the value of Ethereum, including:

For instance, when Ethereum completed its transition to Proof-of-Stake in 2022, interest and activity increased substantially–impacting price directly as the network became more energy-efficient.

How to Read Ethereum Price Movements

Understanding ETH/USD movement is key for anyone looking to trade Ethereum effectively.

- If the price goes from 2,200 to 2,300, ETH is strengthening against USD.

- If it falls to 2,100, the USD is gaining strength or ETH is weakening.

Put simply: “When ETH rises, your token becomes more valuable. When it drops, it’s worth less in USD.”

These changes can happen within minutes or seconds in volatile markets–use real-time charts and platform tools to stay updated when learning how to trade Ethereum.

Try Ethereum Trading Without Risk — Free $50,000 Demo

Not ready to invest real funds yet? After signing up on Pocket Option, you’ll receive $50,000 in virtual demo funds.

With this demo account, you can:

- Practice trading Ethereum in real market conditions

- Test different trading strategies without financial risk

- Explore all platform features and tools

- Learn how price movements affect your trades

When you’re ready to switch to real trading, start from just $5 and unlock features like:

- Copy Trading to follow experienced traders

- Trade Cashback programs for additional benefits

- Trading tournaments with prize pools

- Advanced indicators and professional charting tools

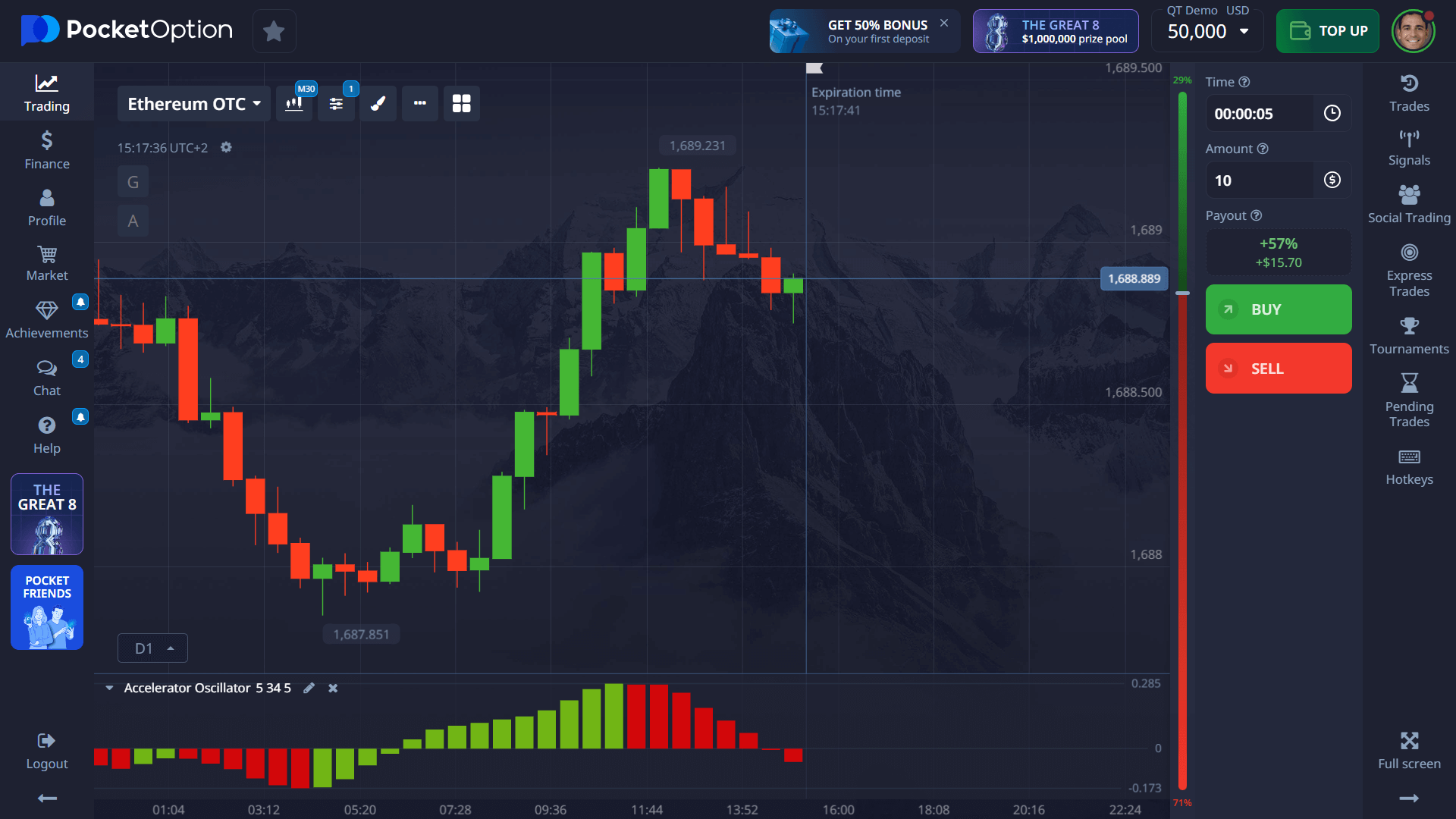

Ethereum Quick Trading Tutorial on Pocket Option

Here’s a straightforward process for how to invest in Ethereum using Pocket Option’s platform:

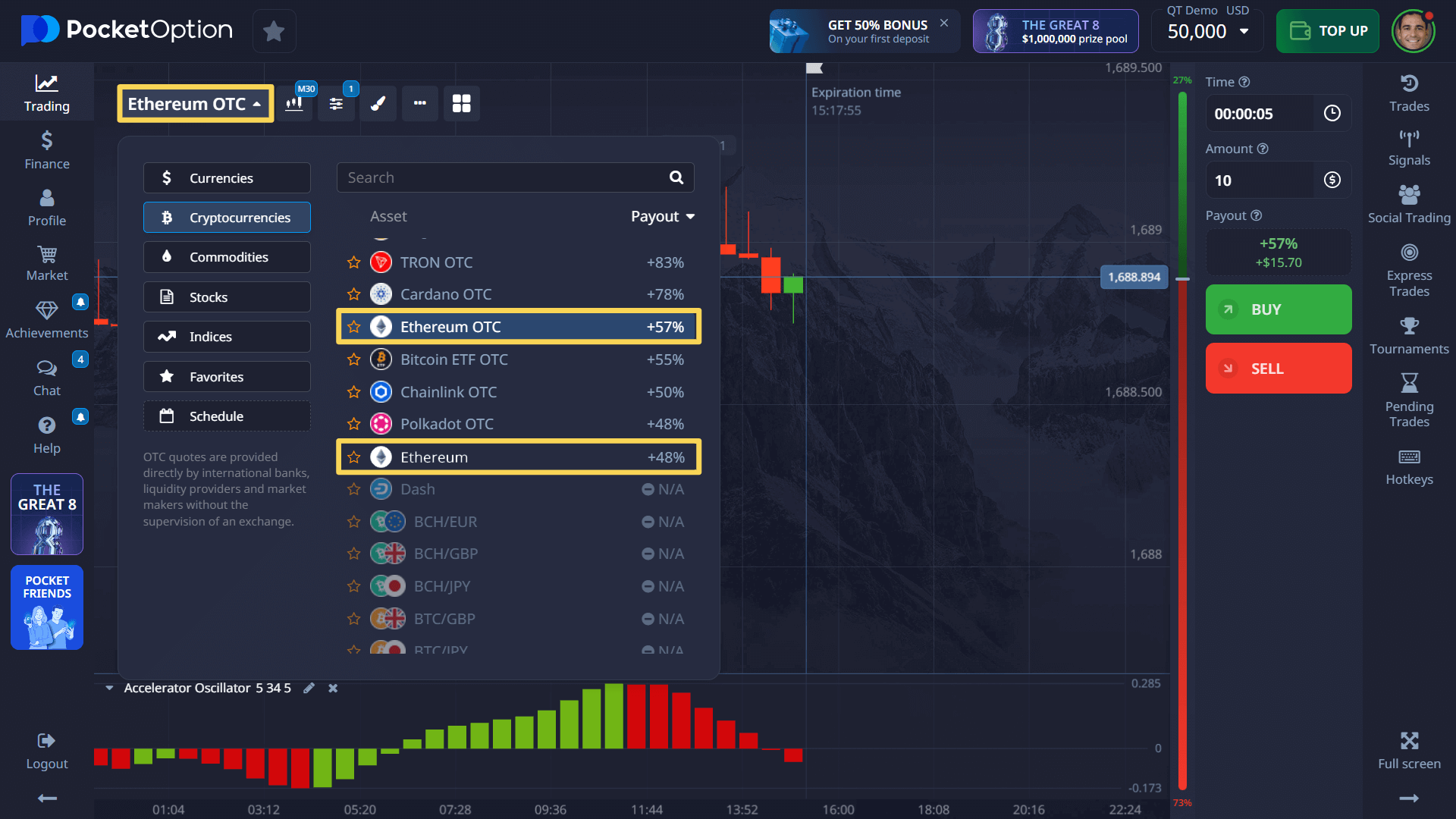

- Locate the asset: Choose Ethereum or Ethereum OTC in the platform’s asset list.

- Analyze the chart: Use technical indicators like RSI, Bollinger Bands, or check market sentiment.

- Set trade amount: You can begin with as little as $1 per trade.

- Select timeframe: With OTC assets, you can start from as short as 5 seconds.

- Make your forecast:

- If you think ETH will rise, click BUY/UP

- If you believe it will drop, click SELL/DOWN

- Review potential returns: Earn up to 92% on accurate forecasts (exact rate shown before placing the trade).

Getting started is straightforward–register, deposit from $5 (minimum may vary depending on payment methods), or practice first using the demo mode to learn how to trade Ethereum effectively.

FAQ

How to buy Ethereum quickly?

Register on Pocket Option, deposit funds (starting from $5), select Ethereum from the asset list, and start trading. The entire process takes less than 5 minutes for new users.

How to invest in Ethereum for the long term?

You can trade ETH with a flexible strategy on Pocket Option or buy and hold using cryptocurrency exchanges. Consider dollar-cost averaging by investing small amounts regularly rather than one large sum.

How to trade Ethereum effectively?

Use technical analysis tools available on Pocket Option, monitor real-time charts, start with small trades to learn the basics, and consider practicing on the demo account before using real funds.

What's the minimum to trade Ethereum?

On Pocket Option, you can trade from just $1 per position, and deposit as little as $5 to start trading with real funds.

Is Ethereum suitable for beginners?

Yes--Ethereum is a major cryptocurrency with strong market liquidity, extensive documentation, and is available on beginner-friendly platforms like Pocket Option that offer intuitive interfaces and educational resources.