- Federal Reserve policy decisions – interest rate changes typically move the index 1-3% on announcement days

- Corporate earnings reports – quarterly results from constituent companies

- Macroeconomic indicators – particularly U.S. employment figures, GDP reports, and inflation data

- Geopolitical developments – trade agreements, sanctions, or international conflicts

- Sector rotations – when investors shift capital between different economic sectors

DJI30: Essential Trading and Investment Strategies

The Dow Jones Industrial Average (DJI30) represents 30 of America's most influential blue-chip companies. This comprehensive overview explains how to trade DJI30 effectively, how to invest in DJI30 for long-term growth, and practical strategies for both beginners and experienced traders looking to diversify their portfolios.

Article navigation

- What is DJI30?

- Understanding DJI30 Price Calculation

- Key Factors Affecting DJI30 Movement

- How to Read DJI30 Market Signals

- Practical Tutorial: How to Trade DJI30 in 6 Steps

- How to Invest in DJI30 Through Different Methods

- Risk-Free Practice: $50,000 Demo Account

- DJI30 Trading Strategies for Market Conditions

- Conclusion

What is DJI30?

DJI30, commonly known as the Dow Jones Industrial Average, tracks 30 major U.S. blue-chip companies including Apple, Microsoft, and Boeing. Created in 1896, it remains one of the world’s most watched financial benchmarks, representing approximately 25% of the value of the entire U.S. stock market. Trading DJI30 allows investors to gain exposure to America’s industrial leaders without purchasing individual stocks.

Understanding DJI30 Price Calculation

Unlike most indices that use market capitalization weighting, DJI30 employs a price-weighted methodology. This means higher-priced stocks have greater influence on the index regardless of company size. For example, when UnitedHealth Group (trading around $500) moves 1%, it impacts the index roughly ten times more than Intel (trading around $50) moving 1%. This unique calculation method creates specific trading opportunities not found in other indices.

When DJI30 rises from 34,500 to 35,000, it represents approximately 1.45% growth across these industrial leaders, often reflecting broader economic optimism.

Key Factors Affecting DJI30 Movement

Several critical factors influence DJI30 price movements:

For example, when the Federal Reserve indicated potential rate cuts in early 2024, DJI30 gained over 500 points in a single trading session, demonstrating how monetary policy directly impacts trading opportunities.

How to Read DJI30 Market Signals

Interpreting DJI30 movements requires understanding both technical and fundamental factors:

- Price-to-earnings ratio comparison – the historical average P/E for DJI30 is approximately 15-18

- Dividend yield evaluation – typically ranges between 1.8-2.5% annually

- Volume analysis – daily average trading volume exceeds 300 million shares

- Volatility index (VIX) correlation – often moves inversely to DJI30

When DJI30 moves from 34,500 to 35,000 with increasing volume and declining VIX, this typically signals strong bullish momentum. Conversely, price declines with expanding volume often indicate potential further downside.

Practical Tutorial: How to Trade DJI30 in 6 Steps

Follow this streamlined process to begin trading DJI30:

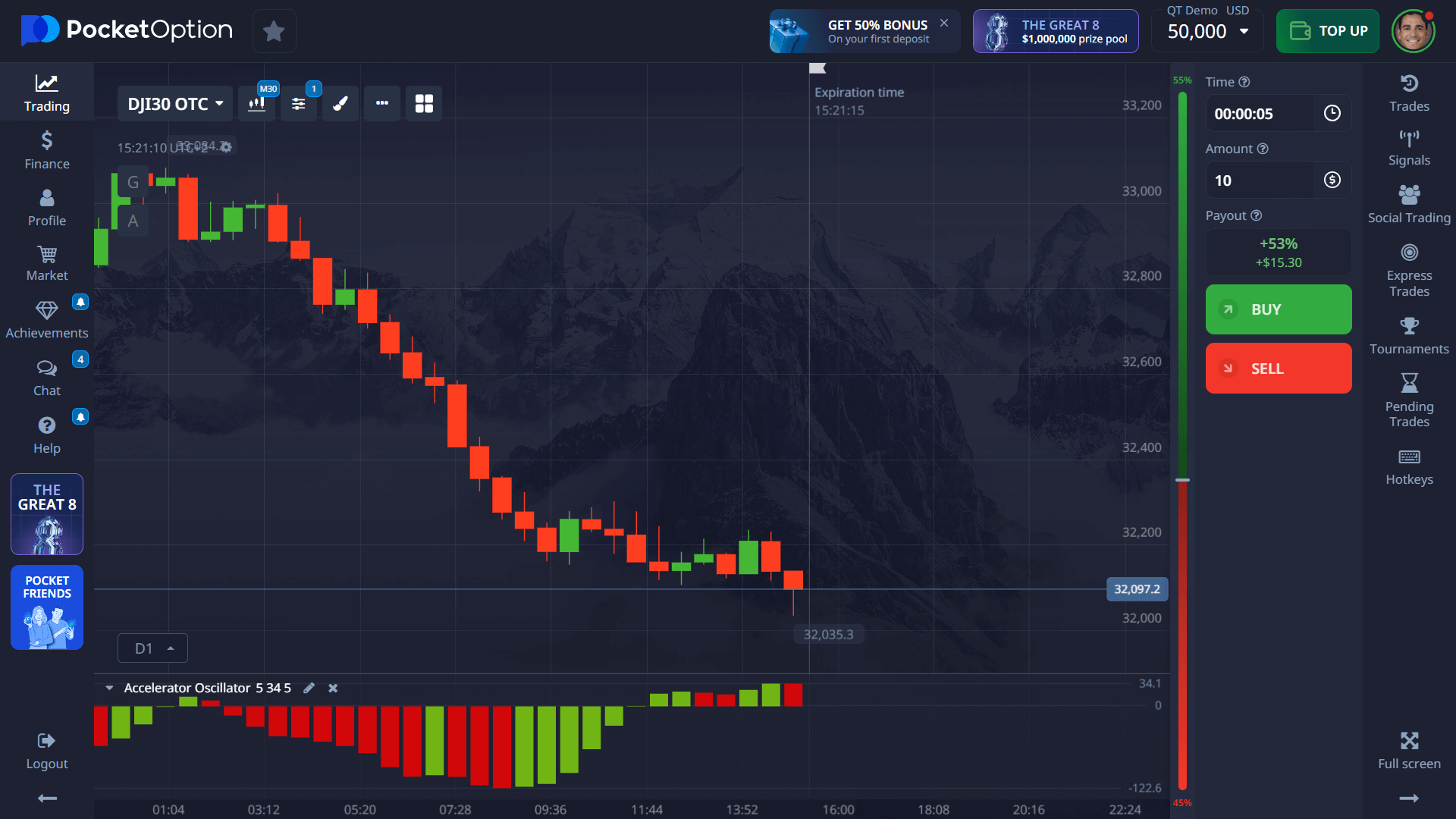

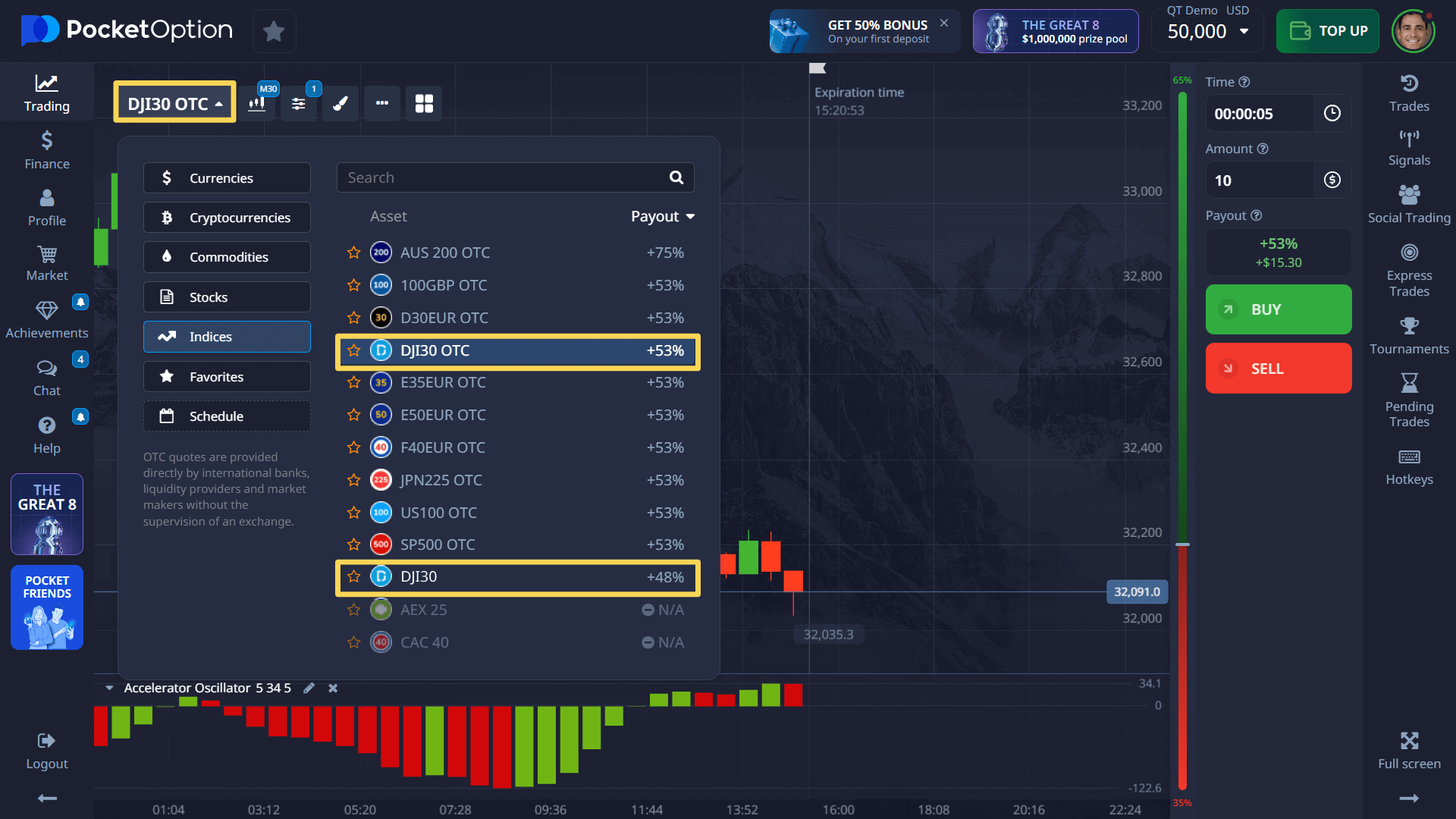

- Select DJI30 from the asset menu (available as DJI30 or DJI30 OTC for extended hours)

- Analyze current chart patterns using key technical indicators (RSI, MACD, moving averages)

- Set your position size (minimum $1, recommended 1-3% of trading capital)

- Define your timeframe (from 5 seconds for OTC to longer-term positions)

- Execute your trade based on analysis (BUY for anticipated rises, SELL for expected declines)

- Manage your position with defined stop-loss and take-profit levels

Successful DJI30 traders typically achieve returns of up to 92% on accurate market direction forecasts, making proper analysis essential before opening positions.

How to Invest in DJI30 Through Different Methods

Investors can gain exposure to DJI30 through multiple approaches:

- Direct index trading – speculating on price movements

- ETFs – funds like DIA (SPDR Dow Jones Industrial Average ETF Trust)

- Options contracts – for leveraged exposure or hedging

- Futures contracts – standardized agreements for future delivery

Each method offers distinct advantages for different investment goals. For example, ETF investing provides dividend income and lower volatility, while direct index trading allows for shorter-term profit opportunities with potential returns of up to 92% per transaction.

Risk-Free Practice: $50,000 Demo Account

Before risking real capital, develop your DJI30 trading skills using a $50,000 virtual account. This simulation provides authentic market conditions for testing strategies, analyzing price action, and gaining confidence. The demo environment includes:

- Real-time DJI30 price data

- Complete technical analysis toolkit

- Strategy testing capabilities

- Risk-free experimentation

Once comfortable with your strategy, transition to live trading with a minimum deposit of $5 (varies by payment method). Live accounts provide additional benefits including Copy Trading functionality, performance Cashback, and access to Trading Tournaments with prize pools.

How to buy DJI30 exposure with minimal capital remains one of the platform’s key advantages for new traders looking to build experience with blue-chip U.S. stocks.

DJI30 Trading Strategies for Market Conditions

Adapt your approach based on prevailing market conditions:

| Market Condition | Recommended Strategy | Technical Indicators |

|---|---|---|

| Trending Markets | Trend Following | Moving Averages, ADX |

| Ranging Markets | Range Trading | RSI, Bollinger Bands |

| Volatile Markets | Breakout Trading | Volume, Support/Resistance |

| News-Driven Markets | Fundamental Analysis | Economic Calendar Events |

For example, in trending markets, traders might use the 50/200 EMA crossover strategy to identify potential entry points with confirmation from the ADX indicator showing readings above 25.

Conclusion

Trading DJI30 provides access to America’s industrial backbone through a single instrument. By understanding its price calculation mechanism, key influencing factors, and implementing appropriate strategies, both new and experienced traders can capitalize on this market benchmark. Start with the risk-free demo account to practice how to trade DJI30, then progress to live trading as your skills develop. Remember that consistent success requires disciplined risk management, continuous education, and adaptation to changing market conditions.

FAQ

How do I trade DJI30?

To trade DJI30, select it from the asset list, analyze current market conditions using technical indicators, set your position size (minimum $1), define your timeframe, and enter a BUY position for anticipated price increases or SELL for expected decreases. Successful trades can yield returns up to 92%.

What are the best methods to invest in DJI30?

You can invest in DJI30 through direct index trading, ETFs like DIA (SPDR Dow Jones), options contracts for leveraged exposure, or futures contracts. Each method offers different advantages depending on your investment goals, timeline, and risk tolerance.

What factors affect DJI30 price movements?

DJI30 movements are influenced by Federal Reserve policy decisions, corporate earnings reports from constituent companies, macroeconomic indicators (employment, GDP, inflation), geopolitical developments, and sector rotations in the market.

What is the minimum deposit to start trading DJI30?

The minimum deposit is $5, though this may vary depending on your chosen payment method. Before investing real capital, you can practice with a $50,000 virtual demo account.

How does DJI30 differ from other market indices?

Unlike most indices that use market capitalization weighting, DJI30 employs a price-weighted methodology where higher-priced stocks have greater influence regardless of company size. It specifically tracks 30 major U.S. blue-chip companies representing approximately 25% of the entire U.S. stock market value.