- Smart contract adoption: Increased implementation by decentralized applications (dApps) and DeFi projects directly drives demand for Chainlink services.

- Market correlation: LINK typically follows broader cryptocurrency market movements, particularly those of market leaders Bitcoin and Ethereum.

- Strategic partnerships: Collaborations with established platforms and enterprises significantly enhance investor confidence and token valuation.

- Development milestones: Network upgrades, new protocol features, and institutional adoption announcements frequently trigger price movements.

Chainlink: Understanding What It Is and How to Buy Chainlink on Pocket Option

New to cryptocurrency trading? This comprehensive overview explains what Chainlink is and shows how to trade Chainlink effectively, even if you're a complete beginner.

What is Chainlink?

Chainlink (LINK) is a decentralized oracle network that bridges smart contracts with real-world data sources. Simply put, it enables blockchain systems to securely communicate with external data like price information, weather reports, and financial market statistics.

LINK, the native cryptocurrency token, fuels this network and serves as payment for system services. With the expansion of decentralized finance (DeFi) and smart contracts, Chainlink’s importance–and popularity among investors–continues to grow.

How Currency Quoting Works (Simple Explanation)

When learning how to invest in Chainlink, understand that it typically trades against the US dollar as LINK/USD.

For example: When LINK/USD = 12.50, one Chainlink token equals $12.50.

In this pair, LINK represents the base asset, while USD functions as the quote currency. When this number rises, it indicates Chainlink is increasing in value.

Visualize it this way: If LINK/USD climbs from $12.50 to $13.00, each Chainlink token now commands more dollars. Conversely, if the price falls, each token exchanges for fewer dollars.

Factors That Influence Chainlink Price Movement

Several key factors influence Chainlink’s market value, including:

For instance, when major financial platforms like Aave or Compound integrate Chainlink’s oracle services, LINK typically experiences significant price appreciation.

How to Read Chainlink Price Movements

Mastering price action interpretation improves your ability to trade Chainlink effectively:

- When LINK/USD rises from $12.50 to $13.20, this 5.6% increase indicates strengthening market confidence in Chainlink.

- Conversely, if the price drops to $11.80, representing a 5.6% decrease, this suggests either USD strengthening or declining Chainlink momentum.

Trading insight: Price increases mean each LINK token exchanges for more USD, creating potential profit opportunities for traders holding Chainlink. Price decreases result in lower USD exchange value per token.

For optimal results when trading Chainlink, monitor real-time price charts, implement technical indicators like RSI or MACD, and utilize Pocket Option’s analytical tools.

Chainlink Quick Trading Tutorial on Pocket Option

Follow these steps to start trading Chainlink on Pocket Option immediately:

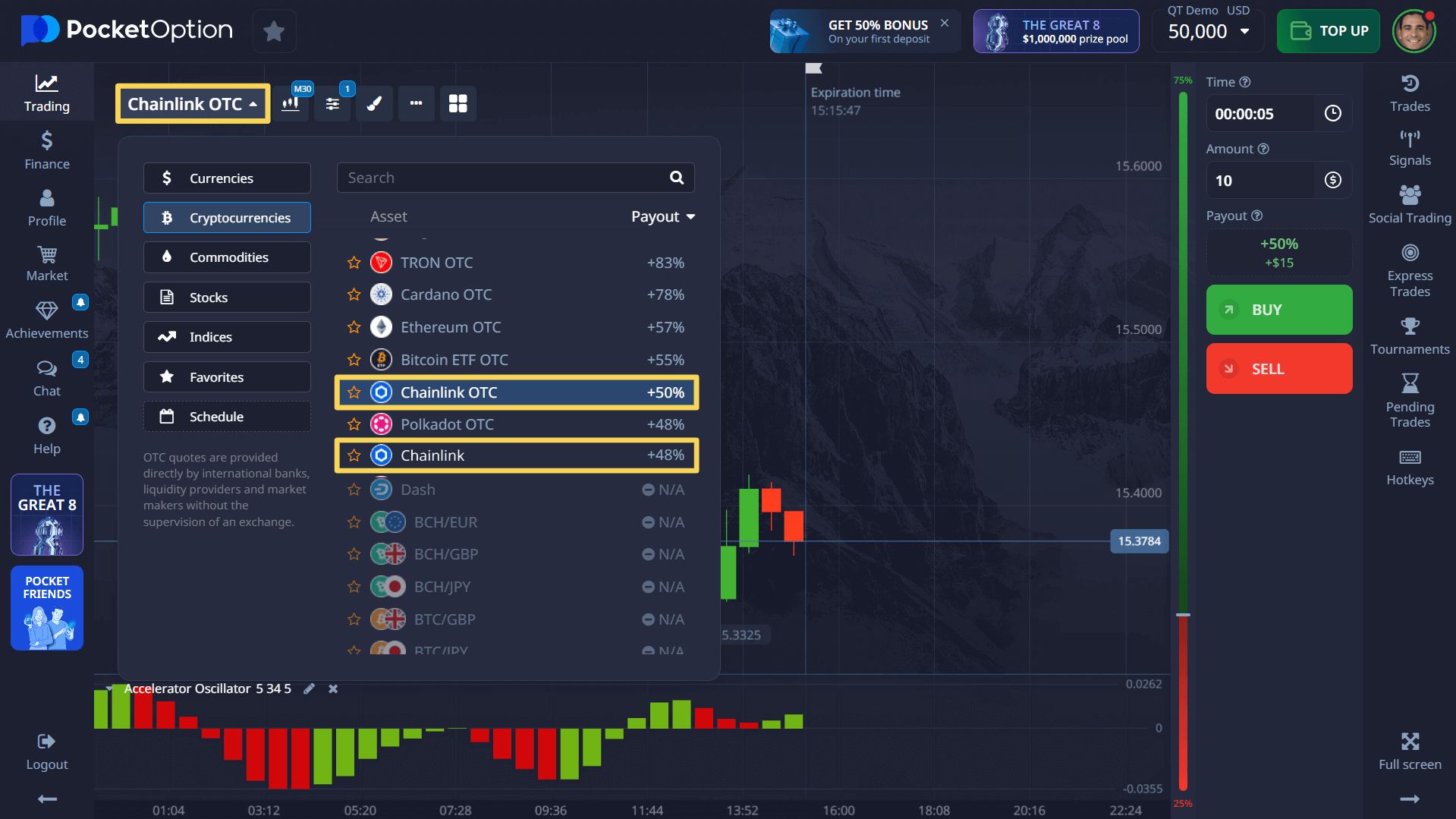

- Locate the asset: Navigate to the asset selection panel and choose either Chainlink or Chainlink OTC from the available cryptocurrency options.

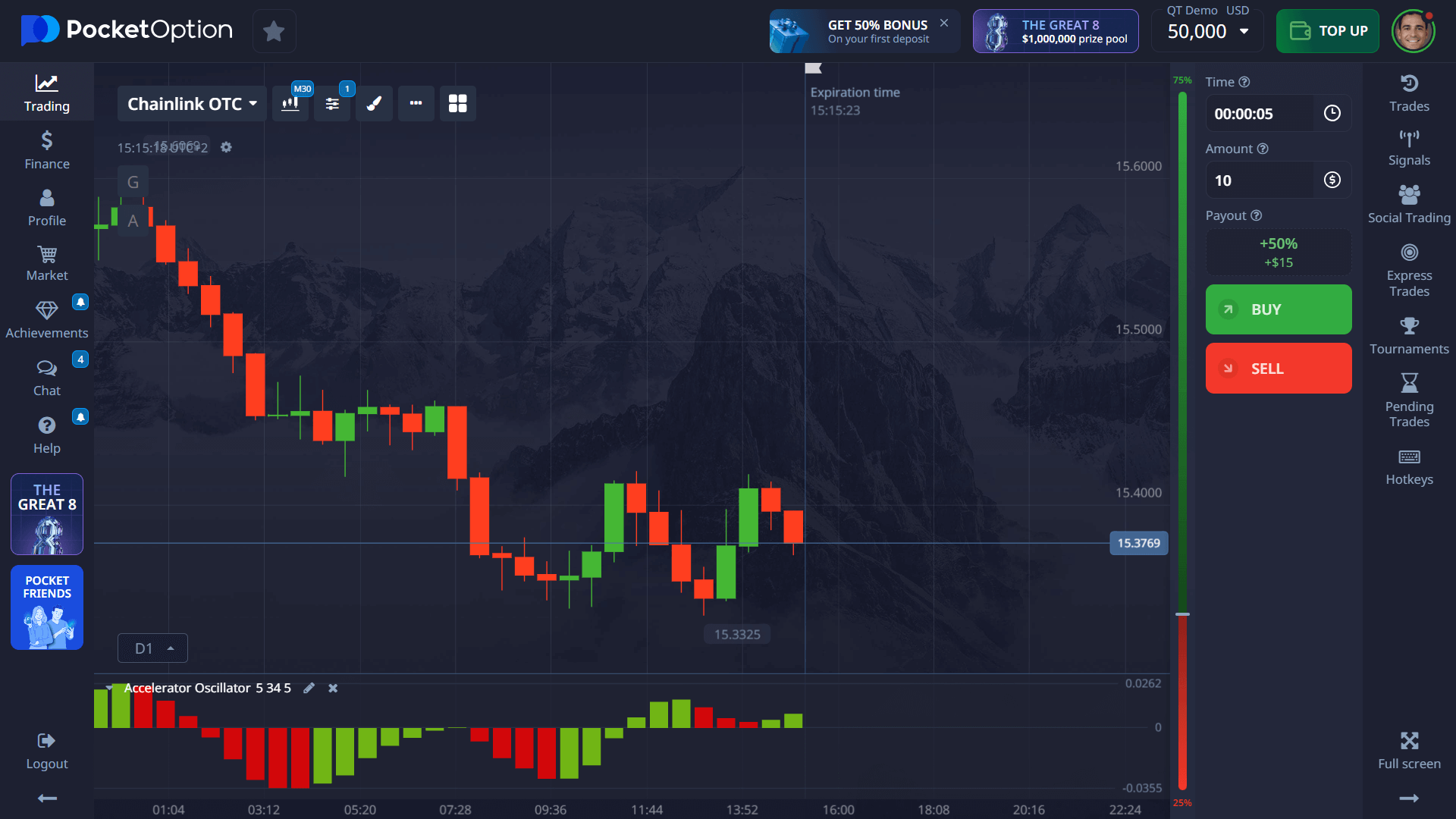

- Analyze the price chart: Apply technical indicators such as Stochastic Oscillator, MACD, or Relative Strength Index, and review overall market sentiment indicators.

- Set your investment amount: Begin conservatively with just $1 per trade while learning how to trade Chainlink effectively.

- Define your timeframe: For Chainlink OTC assets, select trading durations ranging from ultra-short 5-second intervals to longer-term positions.

- Execute your market forecast: Select BUY (UP) when anticipating price increases, or SELL (DOWN) when expecting price decreases based on your analysis.

- Review potential profits: Earn returns up to 92% on accurate market forecasts (exact percentage displayed before trade execution).

Begin your Chainlink trading journey by creating an account with a minimum $5 deposit (amount may vary by payment method), or first practice risk-free using the demo environment.

Try Chainlink Trading Without Risk — Free Demo Account

Still considering how to invest in Chainlink? Practice without financial risk. Upon registration, Pocket Option provides $50,000 in virtual funds to perfect your strategy.

Utilize this opportunity to:

- Master how to buy Chainlink through practical experience

- Experiment with various trading approaches and timing strategies

- Navigate and familiarize yourself with Pocket Option’s trading interface and tools

When confident in your abilities, transition to a live trading account starting from just $5, which unlocks premium features including:

- Social Copy Trading

- Progressive cashback rewards program

- Competitive trading tournaments with prize pools

- Complete suite of advanced analytical and trading instruments

FAQ

How to buy Chainlink with no experience?

Sign up on Pocket Option and start trading LINK using the free demo or a small deposit.

How to invest in Chainlink safely?

Learn how the platform works with demo funds, then begin live trading from just $5.

How to buy Chainlink stock?

Chainlink is a cryptocurrency, not a stock. You can trade it as an asset like LINK/USD, but it's not listed on stock markets.

What's the minimum to trade Chainlink?

On Pocket Option, you can trade with as little as $1 per deal, and deposit from $5.

Is Chainlink good for beginners?

Yes -- it's popular, easy to follow, and supported by real-time tools and demo access.