- Economic indicators: Australia’s GDP growth (currently around 2.1% annually), unemployment rate (approximately 3.7% as of 2024), and inflation metrics directly impact index performance.

- Reserve Bank of Australia decisions: Changes to the cash rate (currently at 4.35%) can dramatically shift market sentiment toward Australian equities.

- Corporate performance: Earnings reports from heavyweight companies like BHP, Commonwealth Bank, and CSL can single-handedly move the index.

- Global economic trends: As a resource-heavy index, AUS 200 is particularly sensitive to commodity prices and Chinese economic data.

AUS 200: Understanding What It Is and How to Trade AUS 200 Successfully

Want to learn how to trade AUS 200 effectively? This comprehensive resource provides everything you need to know about Australia's premier stock index. Whether you're just beginning or have some market experience, you'll discover how to invest in AUS 200, understand its price movements, and develop strategies to potentially profit from this market.

What is AUS 200?

AUS 200, officially known as the ASX 200, represents Australia’s 200 largest publicly traded companies by market capitalization. As Australia’s benchmark stock index, it provides investors with a snapshot of the country’s economic health. When you learn how to trade AUS 200, you’re gaining access to Australia’s entire market with a single investment vehicle, making it an efficient way to diversify your portfolio with exposure to Australia’s economy.

How Does AUS 200 Pricing Work?

Understanding AUS 200 pricing is essential when learning how to invest in AUS 200. The index is quoted in points, not dollars. For example, if AUS 200 is quoted at 7,200 points, this reflects the weighted average value of all 200 companies in the index. A 100-point increase to 7,300 would represent approximately a 1.39% rise in the collective value of these companies, potentially creating opportunities for traders who correctly anticipated this movement.

Factors Affecting AUS 200 Movement

Several key factors drive AUS 200 price movements, which is critical knowledge for anyone wanting to know how to trade AUS 200 successfully:

Interpreting AUS 200 Market Trends

When learning how to trade AUS 200 effectively, understanding price action is crucial. A rising AUS 200 typically indicates:

- Robust economic growth in Australia

- Strong corporate earnings

- Positive investor sentiment

Conversely, a falling index may signal economic concerns or sector-specific challenges. For example, during March 2020, AUS 200 dropped nearly 37% in just 22 days as pandemic fears gripped markets. Those who knew how to invest in AUS 200 during the subsequent recovery potentially captured significant gains as the index climbed over 70% in the following months.

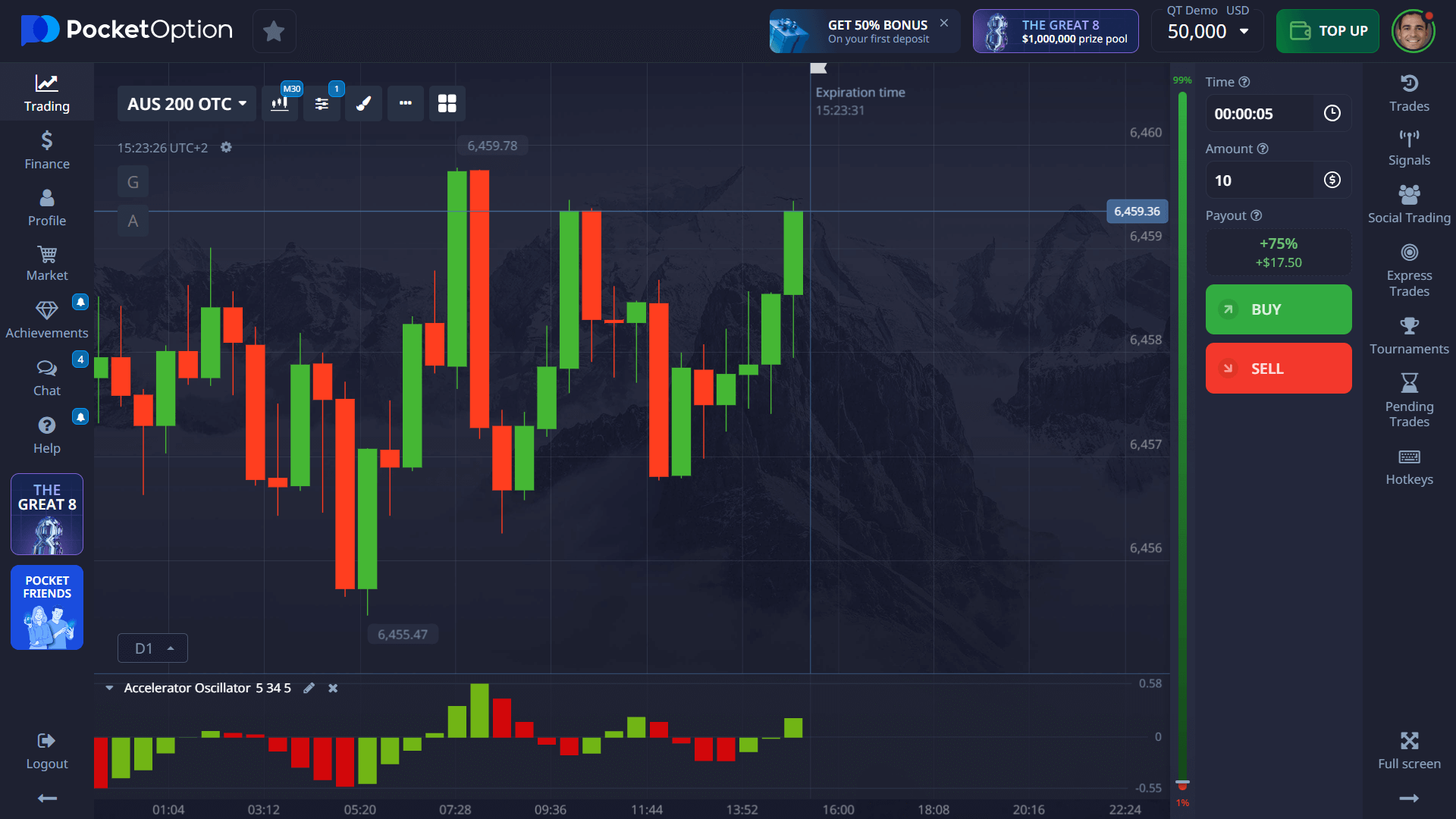

5-Step Process: How to Trade AUS 200 on Pocket Option

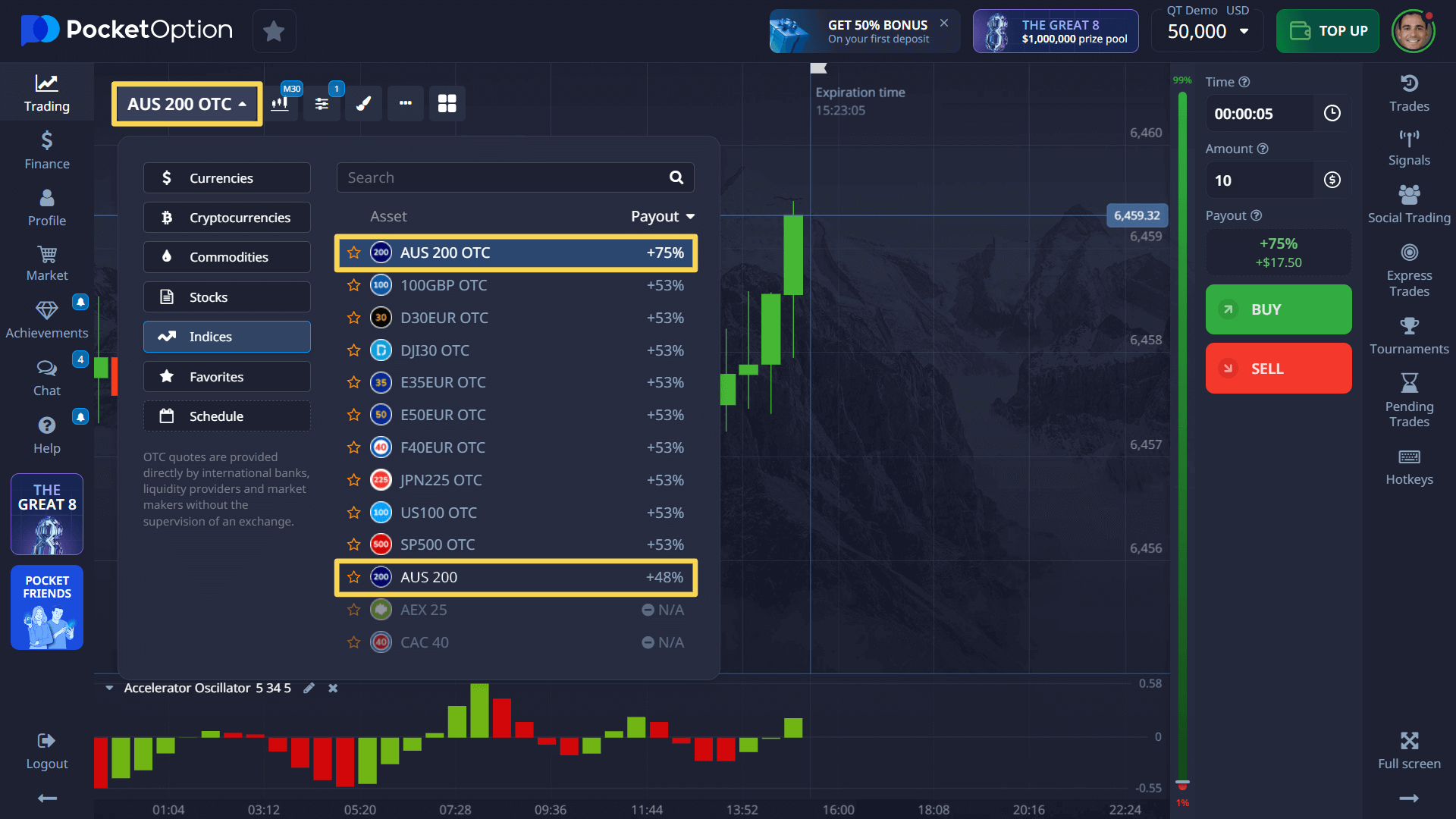

- Locate AUS 200 on Pocket Option’s asset list (found under ‘Indices’ category)

- Analyze the chart using technical indicators like RSI, MACD or moving averages

- Determine your position size based on your risk management strategy (minimum $1)

- Select your timeframe, from quick 5-second trades to longer-term positions

- Execute your trade: select ‘UP’ if you forecast price will rise or ‘DOWN’ if you anticipate a decline

Expected return: up to 92% with a correct forecast.

Practice Trading AUS 200 with a $50,000 Demo Account

Before committing real capital, perfect your AUS 200 trading strategies with Pocket Option’s comprehensive demo account. With $50,000 in virtual funds, you can practice how to trade AUS 200 in real market conditions without financial risk. Test various strategies, timeframes, and position sizes to develop confidence. When ready, transition to live trading with a minimum deposit of just $5. Live account holders also gain access to advanced features including Copy Trading, Trading Tournaments, and Cashback programs that can enhance your trading experience.

FAQ

How do I trade AUS 200?

To trade AUS 200, first select it from Pocket Option's index assets list, analyze the price chart, determine your trade amount (starting from $1), choose your preferred timeframe, then make your UP/DOWN forecast based on your analysis of market conditions.

What factors affect the movement of AUS 200?

The AUS 200 index is primarily influenced by Australia's economic performance indicators (GDP, employment data), RBA interest rate decisions, corporate earnings from major Australian companies, global commodity prices, and international market trends, especially from China.

How much can I earn by trading AUS 200?

With correct market forecasts on Pocket Option, AUS 200 trades can generate returns up to 92% of your investment amount, though actual returns vary based on market conditions.

What is the minimum deposit to start trading AUS 200?

Pocket Option allows you to start trading AUS 200 with a minimum deposit of just $5, although this minimum may vary slightly depending on your selected payment method.

Can I try trading AUS 200 without risk?

Yes, Pocket Option provides a comprehensive demo account with $50,000 in virtual funds where you can practice trading AUS 200 under real market conditions without risking actual money.