- Signaling Power: 27 other institutions applied for BTC allocation rights within 60 days of IBIT’s debut.

- Price Movement: Purchases from the fund align with 82% of days showing positive price action.

- Legitimacy Boost: Since IBIT’s launch, the number of institutional wallets holding over 100 BTC grew by 43%.

- Regulatory Leverage: The SEC accelerated approval timelines following the ETF submission.

- Infrastructure Evolution: Seven major banks added custody solutions within three months of IBIT’s approval.

Definitive Analysis of How Much Bitcoin Does BlackRock Own

Curious about how much Bitcoin BlackRock owns? The world’s largest asset manager has made a huge move into the cryptocurrency market, and its Bitcoin holdings could reshape the entire landscape. Dive into this article to discover exactly how much Bitcoin BlackRock owns, how it’s influencing the market, and what this means for investors like you. Don’t miss out on the latest in institutional cryptocurrency adoption!

Article navigation

- BlackRock’s Bitcoin Journey: From Skepticism to Major Holder

- The Firm’s Watershed Moment: Reshaping the Market

- Current Holdings: How Much Bitcoin Does BlackRock Own?

- Influence on the Crypto Market: The Real Impact

- Latest News on BlackRock (as of April 2025)

- Trade Bitcoin on Pocket Option

- Conclusion: The Institutional Era Is Here

BlackRock’s Bitcoin Journey: From Skepticism to Major Holder

The world’s largest asset manager, overseeing $10.5 trillion as of April 2024, has undergone a profound transformation in its attitude toward digital assets. The question of how much Bitcoin does BlackRock own and how much btc does BlackRock own has become central for those monitoring institutional adoption of crypto. Once dismissive, this financial giant is now among the strongest institutional supporters of the coin.

CEO Larry Fink’s stance changed drastically—from calling BTC an “index of money laundering” in 2017 to describing it as “an international asset” by December 2023. This evolution coincided with the asset’s rise as a reliable store of value during the economic turbulence of 2020–2021, when institutional interest surged.

The Firm’s Watershed Moment: Reshaping the Market

A defining moment came on June 15, 2023, when the firm filed for a spot ETF with the SEC. This move from such a prominent player shifted the regulatory narrative after years of resistance. Following approval on January 10, 2024, its iShares Bitcoin Trust (IBIT) began acquiring the cryptocurrency at remarkable speed. On platforms like Pocket Option, BTC trading volume jumped 43% in the week after IBIT launched.

Current Holdings: How Much Bitcoin Does BlackRock Own?

To fully answer how many Bitcoin does BlackRock own, it’s important to distinguish between direct holdings and those tied to investment vehicles. The asset manager’s exposure spans several channels, each with different implications for the market.

Primary Holdings via iShares Bitcoin Trust (IBIT)

As of April 15, 2024, SEC reports and blockchain analytics confirm that IBIT directly controls 215,692 BTC. These digital coins are stored in cold wallets secured by Coinbase Custody. With a valuation of roughly $61,200 per unit, the trust has become the largest Bitcoin ETF globally, with total assets worth $13.2 billion.

| Investment Vehicle | Exact BTC Holdings | Market Share | Daily Avg Inflow |

|---|---|---|---|

| iShares Bitcoin Trust (IBIT) | 215,692 | 42.4% | 378 BTC |

| Fidelity Wise Origin Bitcoin Fund | 132,857 | 26.1% | 196 BTC |

| Ark 21Shares Bitcoin ETF | 43,891 | 8.6% | 62 BTC |

| Bitwise Bitcoin ETF | 29,145 | 5.7% | 41 BTC |

| Other Spot ETFs (Combined) | 87,438 | 17.2% | 132 BTC |

Additional Exposure via Mining and Private Funds

Beyond IBIT, BlackRock also holds indirect exposure through strategic equity stakes in mining firms like Riot Platforms and Marathon Digital Holdings. Private funds managed by the institution are estimated to contain 12,500–18,000 BTC, based on allocations within their Strategic Income Opportunities and Global Allocation funds.

Influence on the Crypto Market: The Real Impact

The question how much Bitcoin does BlackRock have is about more than numbers—it’s about influence. With over $10 trillion in assets under management, the firm’s moves send shockwaves through both traditional finance and crypto. Within the $1.2 trillion cryptocurrency space, the effect is even more amplified.

The institution’s involvement impacts the market in key ways:

Pocket Option’s trading data confirms that since the trust launched, corrections have become more shallow and less frequent, with the average drawdown period shortening by 34%.

Latest News on BlackRock (as of April 2025)

This year, the company expanded its suite of cryptocurrency products, introducing new ETFs focused on institutional investors. Collaborations with Fidelity and Coinbase have further opened the gates for large-scale crypto adoption.

The manager’s exploration of BTC-backed credit products has also made headlines. As demand for this digital currency rises among institutions, the firm is playing an active role in discussions with the SEC and global regulators. Its buying strategy through IBIT continues to support the asset’s price and liquidity on major exchanges.

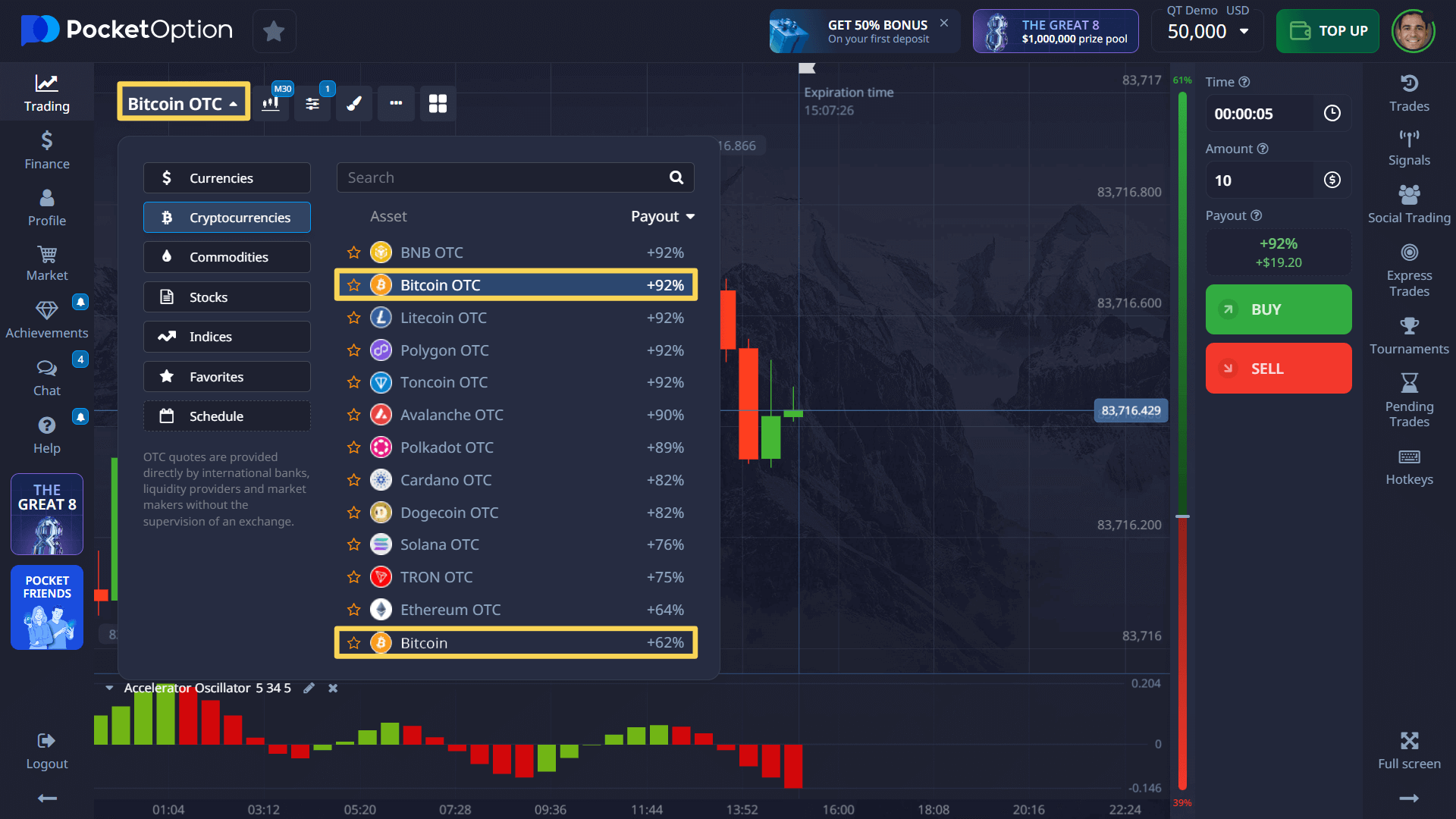

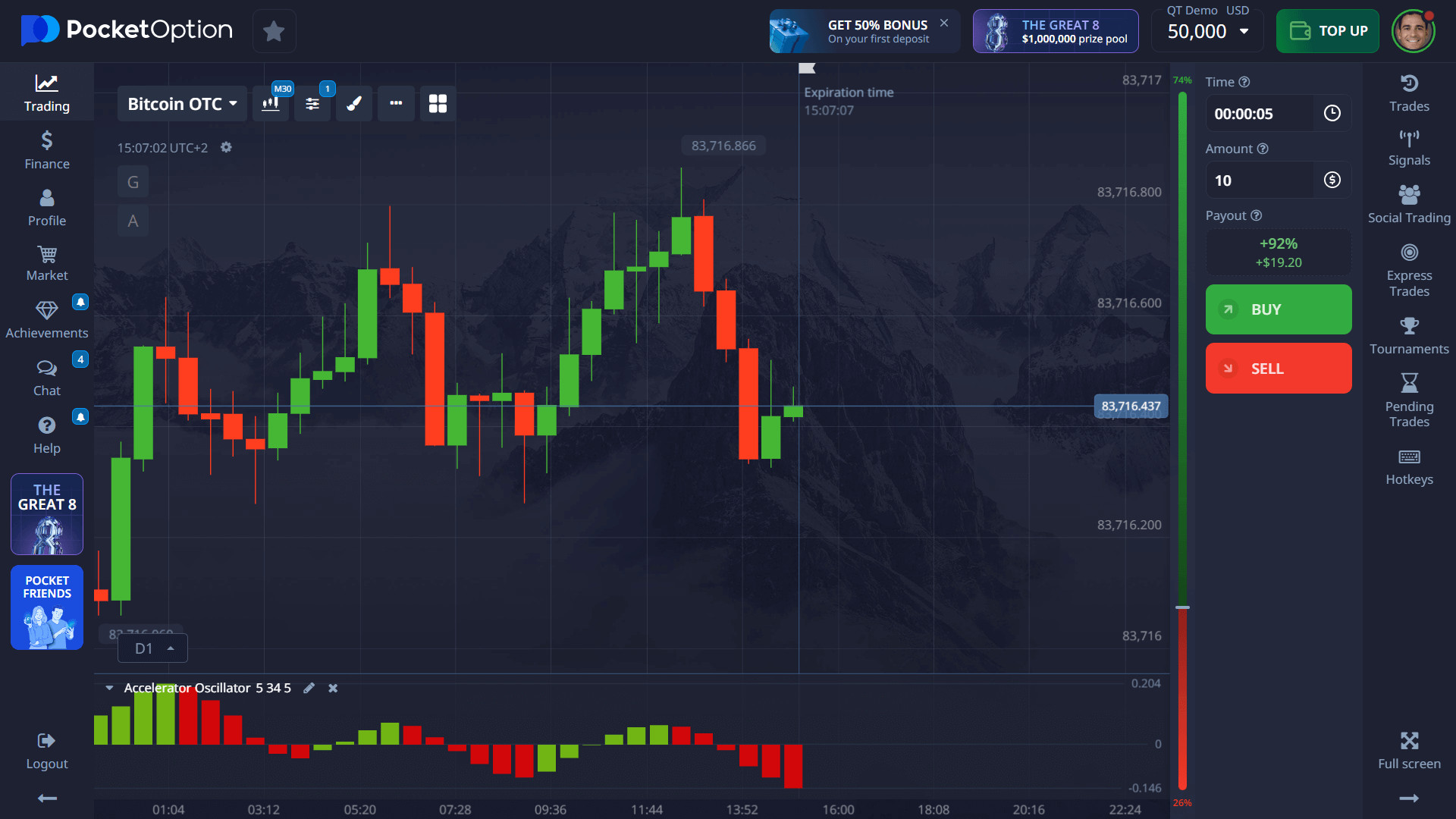

Trade Bitcoin on Pocket Option

You can trade this asset right now on Pocket Option. Create an account and access a $50,000 demo balance with no risk. When ready, make a deposit from just $5 and open trades starting at only $1.

Our platform features over 30 built-in indicators, drawing tools, an economic calendar, customizable charts, and real-time news feeds—everything you need to make smarter trading decisions.

Although Pocket Option doesn’t provide direct crypto trading, you can predict price movements of Bitcoin using CFDs or short-term forecasts via MetaTrader integration—potentially earning up to 92% profit from accurate calls.

Conclusion: The Institutional Era Is Here

Many investors are closely watching one critical question: how much btc does BlackRock own, as it directly reflects the scale of institutional involvement in the crypto market. This firm’s rapid rise as a major BTC holder—215,692 coins and counting—has shifted the crypto landscape. With consistent weekly growth of over 2,600 BTC, it has positioned itself as one of the most dominant forces in the ecosystem.

As the coin moves further into institutional hands, retail traders must adapt to new volatility patterns, growing correlation with traditional markets, and tighter supply dynamics. For those navigating this evolving market, understanding how much btc does BlackRock own is essential.

Platforms like Pocket Option give traders the data tools to analyze institutional behavior and adjust strategies accordingly.

FAQ

How much Bitcoin does BlackRock own through its ETF?

As of April 2024, BlackRock's iShares Bitcoin Trust (IBIT) holds approximately 215,000 Bitcoin, valued at over $12 billion depending on Bitcoin's current price. This makes IBIT the largest Bitcoin ETF by assets under management, representing about 1% of Bitcoin's total supply. BlackRock may have additional Bitcoin exposure through other investment vehicles and funds, though these holdings are less transparent and harder to quantify precisely.

Does BlackRock own Bitcoin directly or only through ETFs?

BlackRock primarily owns Bitcoin through its iShares Bitcoin Trust (IBIT) ETF, which holds Bitcoin on behalf of the ETF investors rather than as a corporate treasury asset. While BlackRock itself may maintain some Bitcoin for operational or investment purposes across its various funds, the vast majority of its Bitcoin influence comes through the ETF structure. This differs from companies like MicroStrategy, which hold Bitcoin directly on their corporate balance sheets.

How many Bitcoin does BlackRock own compared to other institutions?

BlackRock's approximately 215,000 Bitcoin through IBIT places it among the largest institutional Bitcoin holders, comparable to MicroStrategy's approximately 214,000 BTC corporate treasury holdings. However, BlackRock's ETF holdings represent assets managed on behalf of investors rather than proprietary assets. All spot Bitcoin ETFs combined hold about 508,000 BTC, with BlackRock's IBIT representing roughly 42% of that total.

How much Bitcoin does BlackRock have compared to Bitcoin's total supply?

BlackRock's approximate 215,000 Bitcoin holdings through IBIT represent roughly 1% of Bitcoin's total supply of 21 million coins, or about 1.1% of the current circulating supply of approximately 19.68 million BTC. If BlackRock's ETF continues its current growth trajectory, projections suggest it could hold between 2-4% of Bitcoin's total supply by the end of 2025, potentially creating significant supply pressure in the market.

How has Pocket Option responded to BlackRock's Bitcoin investments?

Pocket Option has enhanced its trading platform with analytical tools specifically designed to track institutional Bitcoin flows, including those related to BlackRock's ETF. These tools help traders identify potential market-moving events connected to large ETF creations and redemptions. Additionally, Pocket Option provides educational resources explaining how institutional adoption impacts market dynamics, helping traders adapt their strategies to the evolving Bitcoin ecosystem shaped by major players like BlackRock.