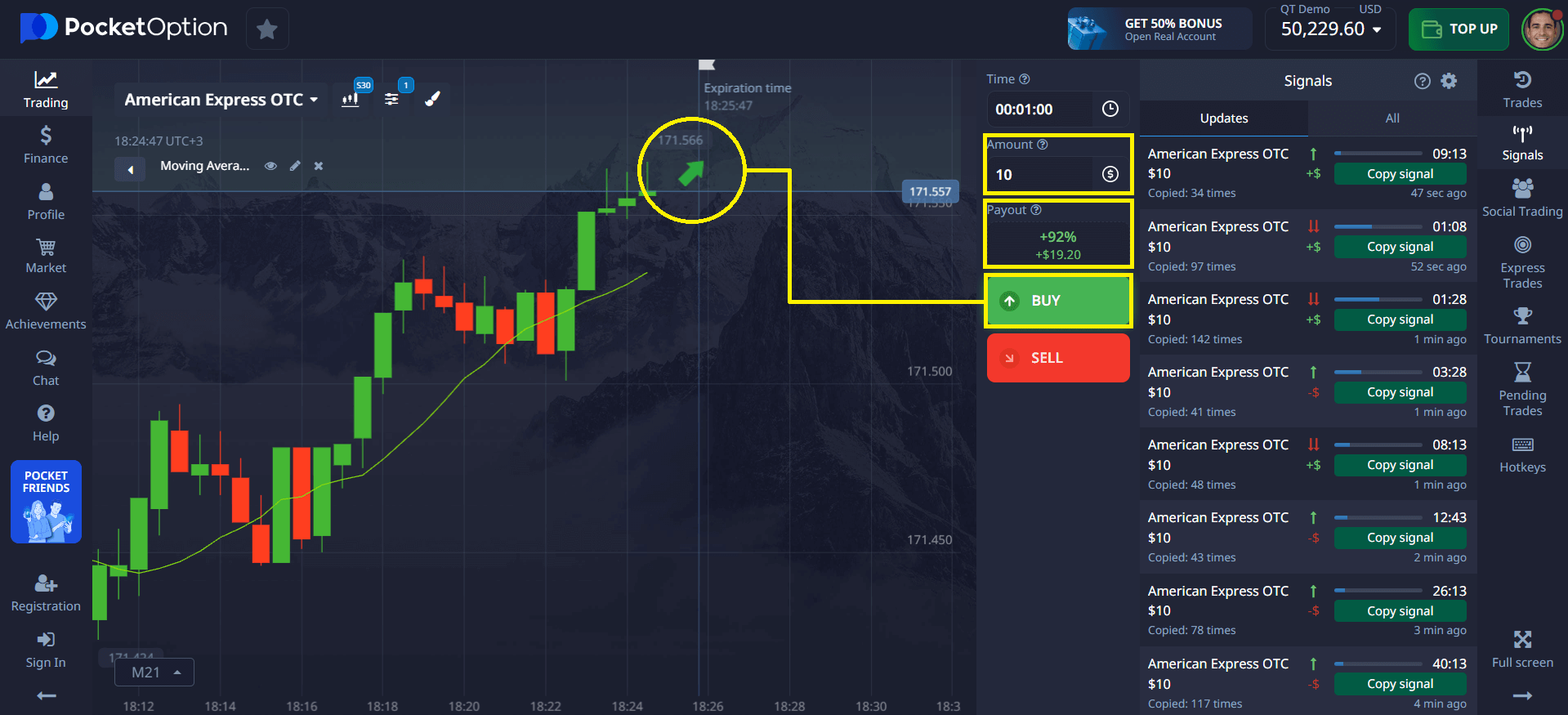

- For anticipated price increases, select the Green (Buy) option.

- For anticipated price decreases, select the Red (Sell) option.

How to Choose Good Stocks for Day Trading

Identifying good stocks for day trading demands mastering volatility patterns, liquidity requirements, and precise technical signals for profitable entries and exits. This article equips you with practical criteria to consistently find ideal day trading candidates, regardless of market conditions.

Article navigation

- What Makes a Stock Suitable for Day Trading?

- Understanding Day Trading with Pocket Option

- A Day Trade in Quick Trading on Pocket Option: How it Works

- Best Sectors for Day Trading Today

- Technical Analysis for Good Stock for Day Trading

- Risk Management Essentials

- Optimal Trading Windows

- Creating Your Focused Watchlist

- Market Adaptation

What Makes a Stock Suitable for Day Trading?

The most profitable day trading opportunities share five essential characteristics:

| Characteristic | Why It Matters | Example |

|---|---|---|

| High Liquidity | Ensures rapid position entry/exit without price impact | AAPL, MSFT, AMZN |

| Sufficient Volatility | Creates intraday profit opportunities | AMD, TSLA, NVDA |

| Moderate Share Price | Enables larger position sizes with limited capital | Stocks in $20-$100 range |

| Heavy Trading Volume | Reduces slippage and execution risks | >1M daily shares traded |

| Clear Technical Patterns | Provides reliable entry/exit signals | Stocks forming momentum patterns |

Pocket Option traders consistently report that focusing on these five characteristics significantly improves trading results compared to random stock selection or following social media trends.

Understanding Day Trading with Pocket Option

Day trading involves executing trades that open and close within a single trading day — sometimes lasting only minutes. Pocket Option delivers a simple day trading format: rapid-fire trades with brief expiration windows (ranging from 5 seconds to 4 hours). Traders can exit positions during the initial seconds or hold until predetermined expiration.

A Day Trade in Quick Trading on Pocket Option: How it Works

Follow these steps to execute day trades using Pocket Option’s Quick Trading feature:

✅ Access Your Dashboard — Enter your Pocket Option account using your secure login credentials.

✅ Navigate to Quick Trading — Locate and select the “Quick Trading” module within the platform interface.

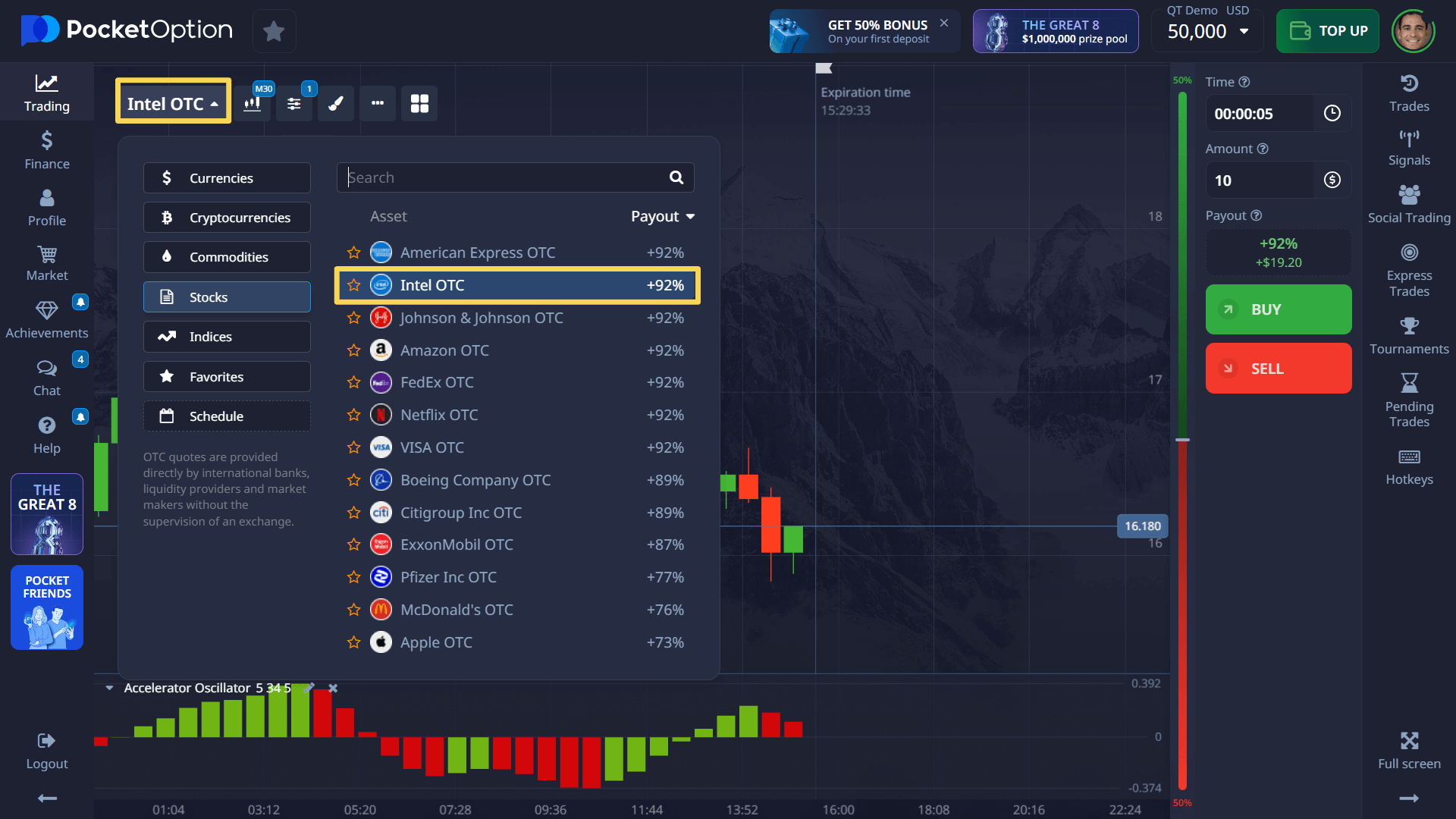

✅ Select Your Stock — Choose your preferred stock from the extensive collection of tradable assets available on Pocket Option — for example, Intel stock.

✅ Configure Trade Parameters — Determine your investment amount (for instance, $10) and set your desired expiration timeframe (example: 1 minute).

✅ Conduct Market Analysis — Utilize available charts and technical indicators to identify market direction. For example, your analysis might suggest your preferred stock is positioned for upward movement.

✅ Execute Your Position

✅ Monitor Until Expiration — Allow your trade to reach its predetermined conclusion — in this example, after 1 minute.

✅ Review Trade Outcome — Upon expiration, the platform displays your prediction accuracy. Correct forecasts generate profits according to the asset’s established payout percentage.

Best Sectors for Day Trading Today

Technology and Financial Leaders

Technology stocks dominate day trading activity due to their news sensitivity, product announcements, and technical trader interest. Financial stocks react predictably to economic reports and Federal Reserve decisions, creating exploitable intraday patterns.

Other productive sectors include:

- Biotech (during FDA announcements)

- Retail (during earnings seasons)

- Energy (during supply/demand shifts)

- Transportation (during economic transitions)

The best stocks for day trading today often emerge from sectors experiencing temporary volatility catalysts rather than from specific permanent categories.

Technical Analysis for Good Stock for Day Trading

Experienced day traders at Pocket Option use these high-probability technical setups:

| Setup Type | Entry Signal | Exit Strategy | Success Rate |

|---|---|---|---|

| Breakout | Price exceeding resistance with volume | Take profit at measured move | 65-70% |

| Reversal | Double bottom with divergence | Take profit at prior resistance | 60-65% |

| VWAP Bounce | Price rejection from VWAP | Take profit at next support/resistance | 70-75% |

Focus on these key technical elements:

- Support/resistance levels with multiple confirmations

- Volume spikes validating price movements

- 9/20 EMA crossovers for trend confirmation

- RSI divergences signaling potential reversals

A practical strategy involves scanning pre-market movers with elevated volume, then watching for consolidation patterns after the opening bell.

Risk Management Essentials

Even when trading the best stocks for day trading, proper risk controls determine your longevity:

- Risk maximum 1% per trade

- Maintain minimum 2:1 reward-to-risk ratio

- Size positions based on volatility (ATR)

- Set pre-determined profit targets and stop-losses

- Implement time-based exits for non-performing trades

Pocket Option provides risk calculation tools that automatically suggest position sizes based on your account balance and stop placement. To help traders master these risk management principles before risking real capital, Pocket Option offers a Free Demo account loaded with $50,000 in virtual funds, allowing you to practice and refine your strategies in real market conditions without financial exposure.

Optimal Trading Windows

Day trading effectiveness varies dramatically throughout the session:

| Time Period | Strategy Approach |

|---|---|

| Pre-market (4:00-9:30 AM EST) | Identify potential gap plays on news |

| Opening hour (9:30-10:30 AM EST) | Trade breakouts and reversals with market momentum |

| Midday (11:30 AM-2:00 PM EST) | Reduce size or avoid trading during consolidation |

| Closing hour (3:00-4:00 PM EST) | Trade with institutional money flow direction |

Most professional day traders concentrate on the first and last trading hours, when nearly 65% of daily trading opportunities occur. Pocket Option offers you an OTC version of assets that trade 24/7 so you don’t have to adjust to a volatile market.

Creating Your Focused Watchlist

Rather than monitoring hundreds of potential candidates, build a focused watchlist:

- Scan for stocks meeting your liquidity/volatility criteria

- Filter for clear technical setups

- Prioritize those with relevant news catalysts

- Limit your primary list to 10-15 stocks maximum

- Develop specific trading plans for your top 3-5 prospects

Market Adaptation

What stocks are good for day trading shifts with market conditions. During high-volatility periods, focus on large-caps for safer execution. In quieter markets, mid-caps often provide better opportunities.

Finding good stocks for day trading requires combining technical analysis, fundamental awareness, and proper risk management. The ideal candidates offer sufficient liquidity, reasonable volatility, and clear technical patterns for efficient entry and exit.

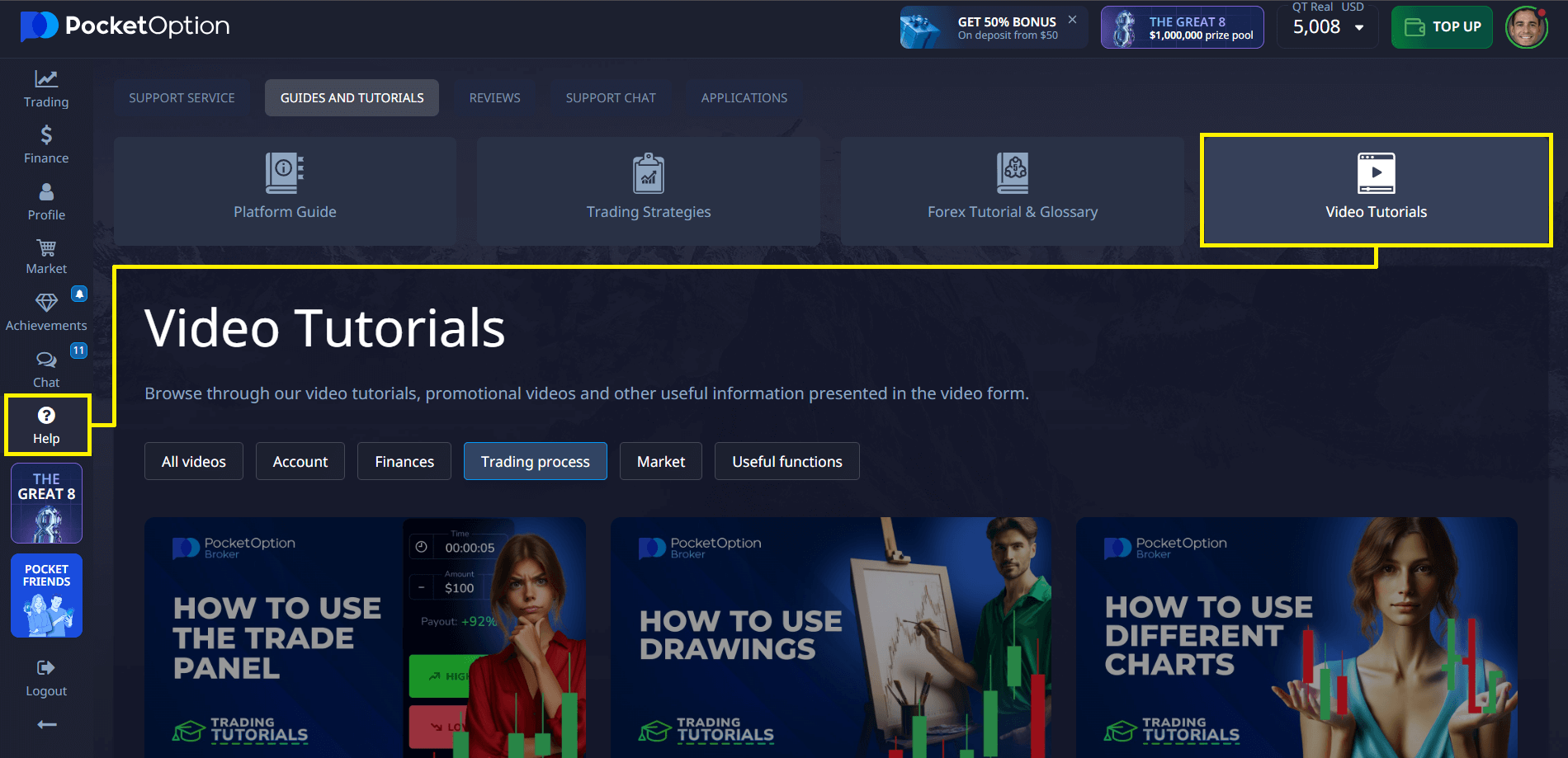

Pocket Option provides comprehensive tools and a free education section to help you identify these opportunities, but successful execution demands personal discipline and strategic focus.

FAQ

What makes a stock good for day trading?

Best stocks day trading typically have high liquidity, reasonable volatility, significant trading volume, and clear technical patterns. These characteristics allow traders to enter and exit positions quickly with minimal slippage while still capturing meaningful price movements.

How much money do I need to start day trading stocks?

While pattern day trader rules in the US require at least $25,000 in a margin account, you can start with smaller amounts on quick trading platforms. For example, you can start with a minimum deposit of $5 (may vary depending on your payment method) on Pocket Option. However, having adequate capital is important for proper position sizing and risk management regardless of requirements.

What time of day is best for day trading stocks?

The first hour after market open (9:30-10:30 AM EST) and the final hour before close (3:00-4:00 PM EST) typically offer the best opportunities. These periods feature higher volume and volatility, creating more potential trading setups.

Should I day trade penny stocks or large-cap stocks?

Large-cap and mid-cap stocks generally offer better reliability for day trading due to their liquidity and tighter spreads. While penny stocks may show larger percentage moves, they often come with increased risk, wider spreads, and potential manipulation concerns.

How many stocks should I watch for day trading?

Focus on 10-15 stocks for your primary watchlist, with detailed trading plans for your top 3-5 candidates each day. Trying to monitor too many stocks simultaneously can lead to missed opportunities and poor execution.

Conclusion

Start with smaller positions while mastering one or two setups before expanding your approach. Remember that consistent day trading profits come from rigorous process rather than prediction or luck.

Start trading