- Trades are open-ended: you decide when to exit

- Your profit/loss depends on how far price moves

- You can set stop-loss and take-profit levels

- Leverage is often used to amplify results

Forex vs Binary Options: Complete Trading Comparison Guide

If you're new to trading, chances are you’ve already stumbled across both Forex vs binary options.

Article navigation

- Start trading from $1

- ⚖️ Basic Definitions: What Are You Actually Trading?

- 📈 Profit Potential: How Money Is Made (and Lost)

- ⚠️ Risk Exposure: Managing the Downside

- ⏰ Time Commitment: Scalping vs Fixed Expirations

- The Pocket Option platform

- 🧠 Learning Curve & Strategy Complexity (Forex vs Binary Options)

- 🧾 Conclusion

At first glance, they may seem similar — charts, predictions, trades. But under the surface, they’re very different games with different rules, risks, and rewards. Some traders love the flexibility of Forex. Others prefer the speed and structure of binary options. Neither one is “better” — but one might be better for you. This article won’t pick a side. Instead, it will help you understand how these two markets work, how they compare in terms of risk, profit, strategy, and time — and most importantly, how to choose the one that fits your personality and lifestyle as a trader. This trading comparison will clarify the practical pros and cons of each model. Forex vs Binary Options: Let’s Break It Down!

⚖️ Basic Definitions: What Are You Actually Trading?

💱 What Is Forex?

Forex (foreign exchange) is the global marketplace where currencies are traded in pairs — like EUR/USD or GBP/JPY. When you trade Forex, you’re speculating on whether one currency will strengthen or weaken against another.

🎯 What Are Binary Options?

Binary options are fixed-outcome trades. You’re not trying to catch a long trend — just predict whether price will be higher or lower after a set time (like 60 seconds or 5 minutes).

- You know your profit/loss before the trade starts

- If you’re right, you earn a fixed payout (e.g., 80%)

- If you’re wrong, you lose the amount you risked

- No need to manage open trades — everything runs on a timer

In simple terms:

- Forex is a race with no finish line until you choose to stop

- Binary options are yes/no bets with a stopwatch

📈 Profit Potential: How Money Is Made (and Lost)

Both Forex and binary options offer real earning potential — but the way you make (or lose) money is completely different.A binary options comparison shows clearly how fixed payouts differ from floating profits in Forex.

Let’s look at how profit is structured in each market.

💰 Forex Profit Model

- Your gain depends on how far price moves in your favor

- You can scale in/out of positions

- With leverage, even small moves can lead to big profits — or big losses

- No limit to upside or downside unless you define it with stops

💡 Binary Options Profit Model

- Your payout is fixed in advance (e.g., 80–90% on a winning trade)

- You either win or lose the set amount — no partial outcomes

- No leverage — your entire risk is what you stake on the trade

- Fast, clear outcomes — ideal for quick decision-makers

📊 Quick Comparison Table

| Aspect | Forex | Binary Options |

| Profit size | Variable, depends on movement | Fixed, based on entry stake |

| Risk per trade | Variable (managed by stop) | Fixed (predefined) |

| Trade duration | Open-ended | Set expiration (e.g., 1–5 mins) |

| Upside potential | Unlimited | Capped (usually 70–90%) |

| Loss potential | Can exceed initial risk | Limited to initial stake |

⚠️ Risk Exposure: Managing the Downside

Profit gets the headlines — but risk is what keeps traders in the game. And the way Forex and binary options handle risk is one of their biggest differences.

⚠️ Forex Risk: Floating and Flexible

In Forex, your potential loss depends on:

- How far the market moves against you

- Whether you’ve placed a stop-loss

- The size of your trade and leverage used

This flexibility can be powerful — but also dangerous if you don’t have strict rules. A poorly managed trade can spiral quickly, especially during high volatility.

🛡 Binary Options Risk: Fixed and Clear

In binary options, your maximum risk is locked in before you click “Buy” or “Sell.” There’s no surprise. If the trade loses, you lose what you staked — nothing more.

There are no stop-losses or margin calls. This makes binaries especially appealing for beginners who want tight control over their exposure.

🔍 Which One Is Safer?

It depends on you.

- Forex gives you tools to manage risk — but it puts more responsibility on the trader

- Binary options give you preset boundaries — no risk of overexposure if you stick to a consistent position size

The better you are at self-control, the more freedom you can handle. The less experience you have, the more structure you’ll need.

⏰ Time Commitment: Scalping vs Fixed Expirations

Trading isn’t just about skill — it’s about how much time you can give to the market.

This is where Forex and binary options take very different paths.

🕰 Forex: Active Monitoring Required

Forex trading can be intensive, especially for intraday or scalping strategies. You’ll often need to:

- Watch price movements in real time

- Adjust stops or targets as things change

- React to news, volatility, and liquidity shifts

Longer-term trading (like swing or position trading) is less demanding — but still requires regular analysis and patience.

⏳ Binary Options: Set and Wait

With binary options, the timer does the work for you. You choose your expiration — say, 1 or 5 minutes — enter the trade, and wait for the result.

- No need to monitor once the trade is placed

- Each position is self-contained — no manual exit

- Sessions can be structured (e.g., 30 mins per day)

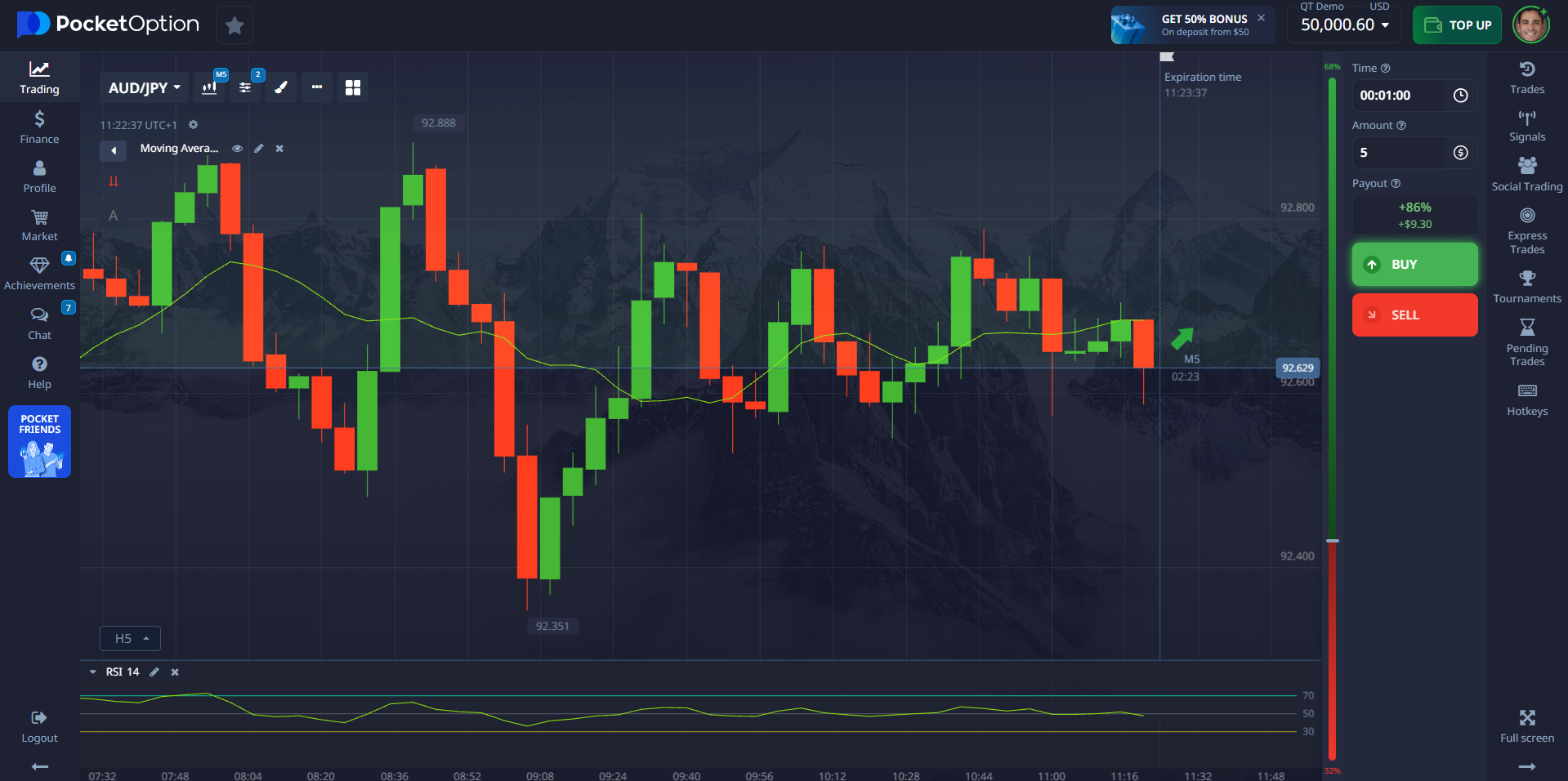

The Pocket Option platform

The Pocket Option platform offers its own interpretation of binary options – Quick Trading with up to92% profit!. Instead of purchasing an asset, the user enters into a contract based on the assumption that the price will rise or fall over a short period of time. This format retains the simplicity and speed of decision-making characteristic of binary trading, but is implemented through the platform’s unique interface.

🔑 Time Efficiency Tip:

- Have hours to watch charts? → You’ll feel at home in Forex

- Want fast setups with defined duration? → Binary options are more efficient

🧠 Learning Curve & Strategy Complexity (Forex vs Binary Options)

| Category | Forex | Binary Options |

| Analysis required | High – price action, news, indicators | Moderate – mostly technical patterns |

| Strategy complexity | Medium to high | Low to medium |

| Learning duration | Weeks to months | Days to weeks |

| Emotional control | Critical for large floating losses | Important, but with more fixed limits |

| Tools required | Charting software, broker platforms | Built-in tools on platforms |

📊 Overall Comparison Table

📊 Overall Comparison Table

| Feature | Forex | Binary Options |

| Risk per trade | Variable (stop loss needed) | Fixed and known before entry |

| Profit potential | Unlimited (but requires control) | Capped, usually 70–90% payout |

| Time needed | Varies by style – can be hours daily | Compact sessions, even 15–30 minutes |

| Trade duration | Flexible (seconds to days) | Fixed (60s, 5m, etc.) |

| Skill barrier | Higher – technical + fundamental mix | Lower – mostly timing-based |

| Best for | Experienced traders, analysts | Fast thinkers, disciplined short-termers |

🧾 Conclusion

There’s no universal winner in the battle of Forex vs binary options. It all comes down to how you think, how much time you have, and how you handle risk.

- If you enjoy deep analysis, flexible setups, and managing trades actively — Forex gives you the space to grow.

- If you prefer structure, speed, and fast outcomes — binary-style formats, especially through platforms that offer Quick Trading, provide a focused way to trade with clarity and control — ideal for fast thinkers and those with limited time.

- The best choice? The one that fits your personality — not someone else’s results.

FAQ

Is Forex more profitable than binary options?

It can be — but only if you manage risk properly. In binary options, your profits are fixed, but so are your losses. In Forex, the potential is higher, but so is the danger.

Which one is easier to start with?

Binary options are more beginner-friendly. You don’t need to understand macroeconomics or set take-profits and stops — just a clear direction and good timing.

Do I need special software for either?

Forex often uses MT4 or MT5. Binary options platforms work directly in your browser or mobile device and have built-in tools and demo mode. Pocket Option has the advantages of binary options, speed and simplicity and also offers built-in MetaTrader platforms.

Can I trade both at the same time?

Yes — many traders do. Just make sure your strategies don’t overlap or confuse your execution style.

Do I need a lot of time to trade Forex or binary options?

Forex often demands more screen time and active management, especially for intraday traders. Binary options can be traded in short, structured sessions — even just 30 minutes per day.

Which is better for beginners: Forex or binary options?

Binary options are generally easier for beginners due to their simplicity, fixed outcomes, and fast learning curve. Forex requires more time, analysis, and risk management skills.

Can you make more money with Forex or binary options?

Forex offers unlimited profit potential based on market trends, but also higher risk. Binary options provide fixed payouts, making them more predictable but with capped profits.

Which is riskier: Forex or binary options?

Forex carries variable risk depending on market movement and leverage. Binary options have fixed risk, as you know exactly how much you can lose or gain before placing a trade.

What is the main difference between Forex and binary options?

Forex involves buying and selling currency pairs with open-ended trade duration, where profits depend on how far the price moves. Binary options are fixed-return contracts where you predict if the price will be higher or lower at a specific time.