- US Federal Reserve policy: Rate hikes in the U.S. typically strengthen the USD.

- Swiss National Bank (SNB) decisions: SNB intervention can weaken the CHF to support exports.

- Global risk sentiment: The franc strengthens during geopolitical or economic crises.

- Key macroeconomic indicators: Employment, inflation, and GDP data influence both currencies.

USD/CHF -- trading logic, price moves, and a beginner-friendly instructions

Want to understand the USD/CHF currency pair and how to start trading it? In this article, we break down the essentials of forex USDCHF, review usdchf analysis and price dynamics, and offer actionable trading instructions for both demo and real trading on Pocket Option.

What is USD/CHF?

USD/CHF shows how many Swiss Francs (CHF) are needed to buy one US Dollar (USD). The Swiss Franc is widely seen as a safe-haven currency, gaining strength during market turbulence. The USD/CHF pair is commonly traded in both long- and short-term forex usdchf strategies, especially during periods of risk aversion or central bank activity.

How Currency Quotes Work (Simple Breakdown)

Example: USD/CHF = 0.91 means that 1 USD equals 0.91 Swiss Francs. Here, the franc is stronger than the dollar.

Real-life analogy: If you’re exchanging $100, you’ll receive 91 CHF. If the rate changes to 0.95, your dollar now gets you more francs — the CHF has weakened.

Factors Affecting USD/CHF Movement

These factors are crucial when forming a reliable usdchf analysis, especially for traders managing volatility risk in fx usdchf markets.

How to Read USD/CHF Rate Changes

When the rate rises from 0.91 to 0.94, the USD is strengthening. A fall to 0.88 means the CHF is gaining strength.

- Higher USD/CHF = stronger USD

- Lower USD/CHF = stronger CHF

Real-time movements in the usdchf price are typically tracked during SNB press conferences or US Non-Farm Payroll (NFP) releases.

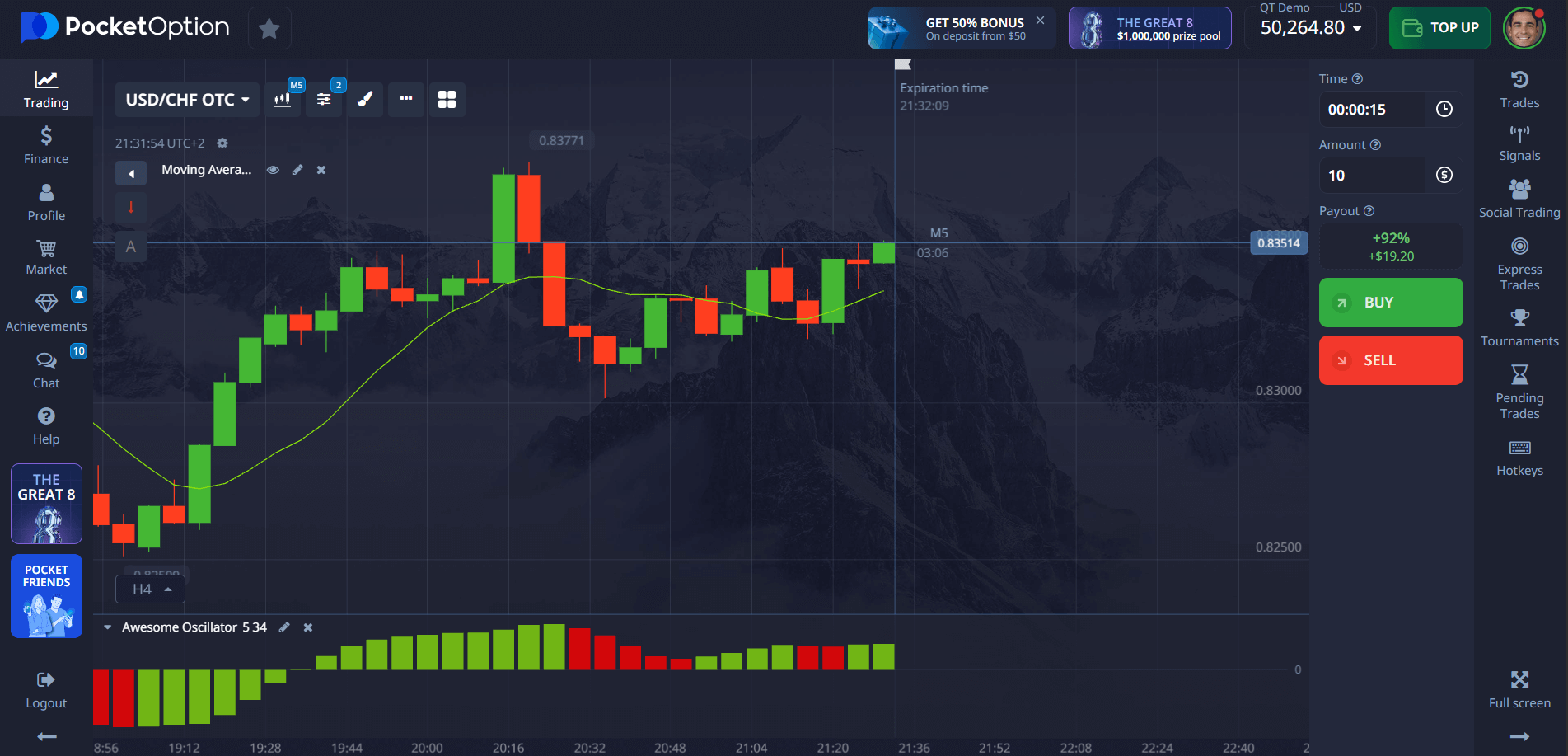

Instructions: How to Trade USD/CHF with Quick Trading

Use this tutorial to start trading USD/CHF on Pocket Option:

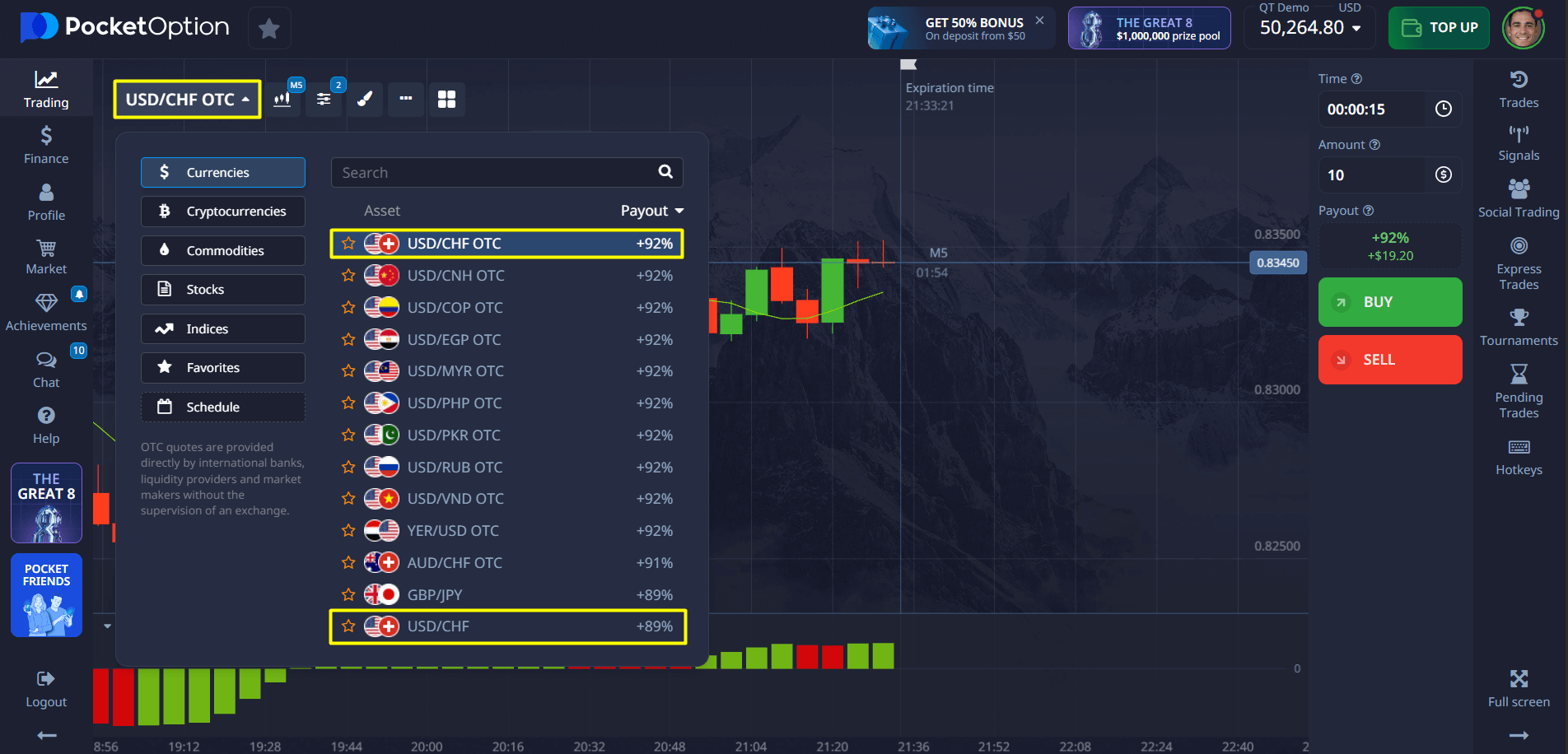

- Select the asset: Choose USD/CHF OTC from the list.

- Analyze the chart: Use technical indicators or trader sentiment tools.

- Enter your trade amount: You can begin with as little as $1.

- Choose expiration: For OTC trades, set time from 5 seconds upward.

- Forecast movement: Click BUY if you expect a rise, or SELL if you expect a drop.

- Review potential return: Earn up to 92% for correct forecasts, as displayed before confirmation.

Try the $50,000 Demo Without Risk

Still unsure about trading real funds? Try Pocket Option’s demo account — you’ll receive $50,000 in virtual currency immediately upon registration.

- Test your USD/CHF strategy with no risk

- Watch fx usdchf price behavior during live market hours

- Explore indicators and entry points

Once ready, switch to a real account from just $5 and unlock:

- Copy Trading capabilities

- Cashback offers

- Entry to trading tournaments

- Advanced tools to identify the best time to trade usdchf

Conclusion

The USD/CHF pair is a powerful indicator of global economic shifts. By combining usdchf analysis with real-time price tracking, traders can better time their entries and build strategies based on economic fundamentals. Whether you’re following forex usdchf headlines or learning the best time to trade usdchf, Pocket Option offers a flexible environment to start — with demo testing and low real account thresholds.

FAQ

What does USD/CHF represent in trading?

It shows how many Swiss Francs are needed to purchase one US Dollar.

How to buy USD/CHF?

Open Pocket Option, find USD/CHF, and place a trade using Quick Trading tools.

How to invest in USD/CHF as a beginner?

Use the demo account to test your approach or invest real money starting from $5.

What affects the USD/CHF price?

US and Swiss interest rates, global risk mood, and key economic indicators.

When is the best time to trade USD/CHF?

Typically during overlapping trading hours for the US and Europe, when liquidity is highest.