- 24-hour trading during weekdays

- Liquidity exceeding $6.6 trillion daily

- Transaction costs below 0.1% per trade

- Profit potential in both bullish and bearish markets

- Over 70 tradable currency pairs

Forex-Trading Mastery

The $6.6 trillion daily forex market offers lucrative opportunities for informed traders. This article reveals three specific forex-trading entry methods, five risk management techniques, and practical currency pair selection strategies that both newcomers and veterans can implement immediately to enhance their trading performance.

Article navigation

- Currency Trading Evolution: From Elite Clubs to Global Access

- Comprehensive Trading Tools for Every Forex Trader

- Three High-Probability Forex-Trading Setups

- The 1% Rule: Professional Risk Management

- Economic Data: Timing Your Forex-Trading

- Building Your Trading Method: The 3-Step Process

- How to Trade Forex Using Micro Accounts on Pocket Option

- Modern Trading Tools on Pocket Option

- Conclusion

Currency Trading Evolution: From Elite Clubs to Global Access

Before 2000, forex-trading was limited to banks and hedge funds. Today, platforms like Pocket Option have democratized access, allowing individual traders to participate with minimal capital. The forex market’s unique advantages include:

The Trader’s Mind: Psychological Edge in Forex

Research from the Journal of Behavioral Finance reveals that psychological discipline accounts for approximately 80% of consistent trading success. Pocket Option’s top traders emphasize emotional control over technical indicators.

Three critical psychological challenges:

| Challenge | Real-World Example | Solution |

|---|---|---|

| FOMO (Fear of missing out) | Jumping into EUR/USD after missing a 100-pip move | Set specific entry criteria and stick to your trading plan |

| Loss aversion | Closing a winning GBP/JPY trade at +15 pips while letting losers run to -50 pips | Implement automatic 1:2 risk-reward ratios on all trades |

| Revenge trading | Doubling position size after losing on USD/CAD | Enforce a 3-hour cooling period after any losing trade |

Comprehensive Trading Tools for Every Forex Trader

The Pocket Option platform provides traders with all the necessary tools for successful trading on the currency market. Among them there are more than 100 trading assets, which allows diversifying the investment portfolio, including:

- Currency pairs

- Commodities

- Stocks

The intuitive interface makes it easy to navigate and set trading parameters. Popular indicators and signals are available for analyzing the market to help you make informed decisions.

Beginners are offered a demo account with virtual funds in the amount of $50,000 for practicing strategies without risk. In addition, the platform supports various payment methods for convenient commission-free deposit and withdrawal of funds.

Three High-Probability Forex-Trading Setups

Instead of overwhelming yourself with dozens of strategies, master these three high-probability setups used by professional forex traders:

- The London Breakout: Enter at the breakout of the pre-London session range (5:00-7:00 GMT) with a stop below/above the range. This strategy captures the volatility surge when European markets open.

- Interest Rate Differential Play: Trade currency pairs where central banks are moving in opposite directions (like CAD/JPY in 2023 when Bank of Canada paused while Bank of Japan remained dovish).

- Retracement to Value: Enter when price pulls back to the 50-61.8% Fibonacci level during strong trends, particularly on the 4-hour timeframe.

Decoding Price Action: The Universal Language of Markets

Price action trading strips away indicators to focus on raw price movements. On Pocket Option, 72% of profitable traders primarily use price action strategies.

The three most reliable patterns:

| Pattern | Example Setup | Win Rate | Typical Return |

|---|---|---|---|

| Pin Bar at Support/Resistance | EUR/USD daily pin bar at 1.1000 psychological level | 67% | 1:2.5 risk-reward |

| Engulfing Candle | USD/JPY 4-hour bullish engulfing after FOMC announcement | 73% | 1:2.8 risk-reward |

| Double Rejection | GBP/USD hourly double rejection of 1.3500 | 78% | 1:2.2 risk-reward |

The 1% Rule: Professional Risk Management

The difference between amateur and professional forex-trading isn’t entry technique—it’s position sizing. Never risk more than 1% of capital per trade, regardless of confidence level.

Position sizing formula:

Position Size (lots) = (Account × Risk%) ÷ (Stop-Loss in pips × Pip Value)

Example with $5,000 account trading EUR/USD with 20-pip stop:

- Risk amount: $50 (1% of $5,000)

- Standard lot pip value: $10

- Position size: 0.25 lots ($50 ÷ (20 pips × $10))

Economic Data: Timing Your Forex-Trading

While technical analysis drives entry decisions, economic releases create the biggest moves. Three critical reports for major currency pairs:

- Non-Farm Payrolls: Released first Friday monthly at 8:30 AM EST. Moves USD pairs 50-100 pips within minutes.

- Interest Rate Decisions: Scheduled 8 times yearly for major central banks. ECB decisions typically move EUR/USD 80-150 pips.

- GDP Reports: Quarterly releases that can move currency pairs 30-70 pips, particularly USD/JPY and GBP/USD.

Pocket Option provides an economic calendar with expected impact ratings for each release, helping you avoid entering trades before major announcements.

Building Your Trading Method: The 3-Step Process

Creating a personalized forex-trading system doesn’t require complexity. Follow these steps:

- Choose your battleground: Select 2-3 currency pairs and 1-2 timeframes maximum. For beginners, EUR/USD and USD/JPY on 4-hour charts offer optimal balance between noise and opportunity.

- Define entry rules: Create objective criteria using price action, key levels, and maximum of one indicator. Example: Enter when price creates a pin bar at daily support coinciding with oversold RSI (below 30).

- Set mechanical exits: Determine profit targets and stop-losses before entering trades. Simple approach: fixed risk-reward of 1:2 (e.g., 30-pip stop, 60-pip target).

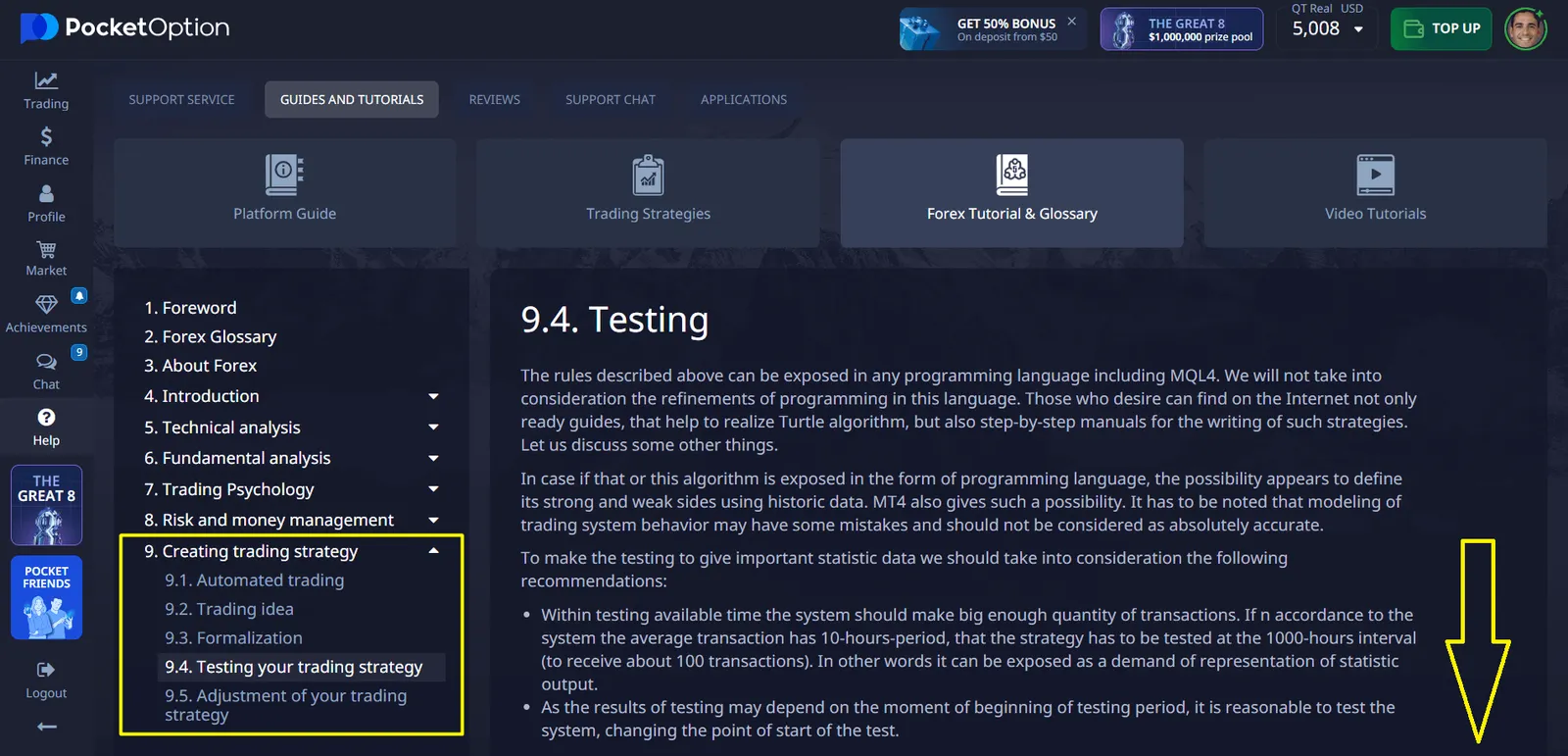

Validation Through Backtesting

Before risking real capital, test your strategy on historical data. Pocket Option’s backtesting tool allows you to simulate your strategy across different market conditions.

Minimum testing requirements:

- 100+ trades across different market conditions

- Track win rate, average win/loss, and maximum drawdown

- Only proceed with strategies showing at least 40% win rate with 1:2 risk-reward

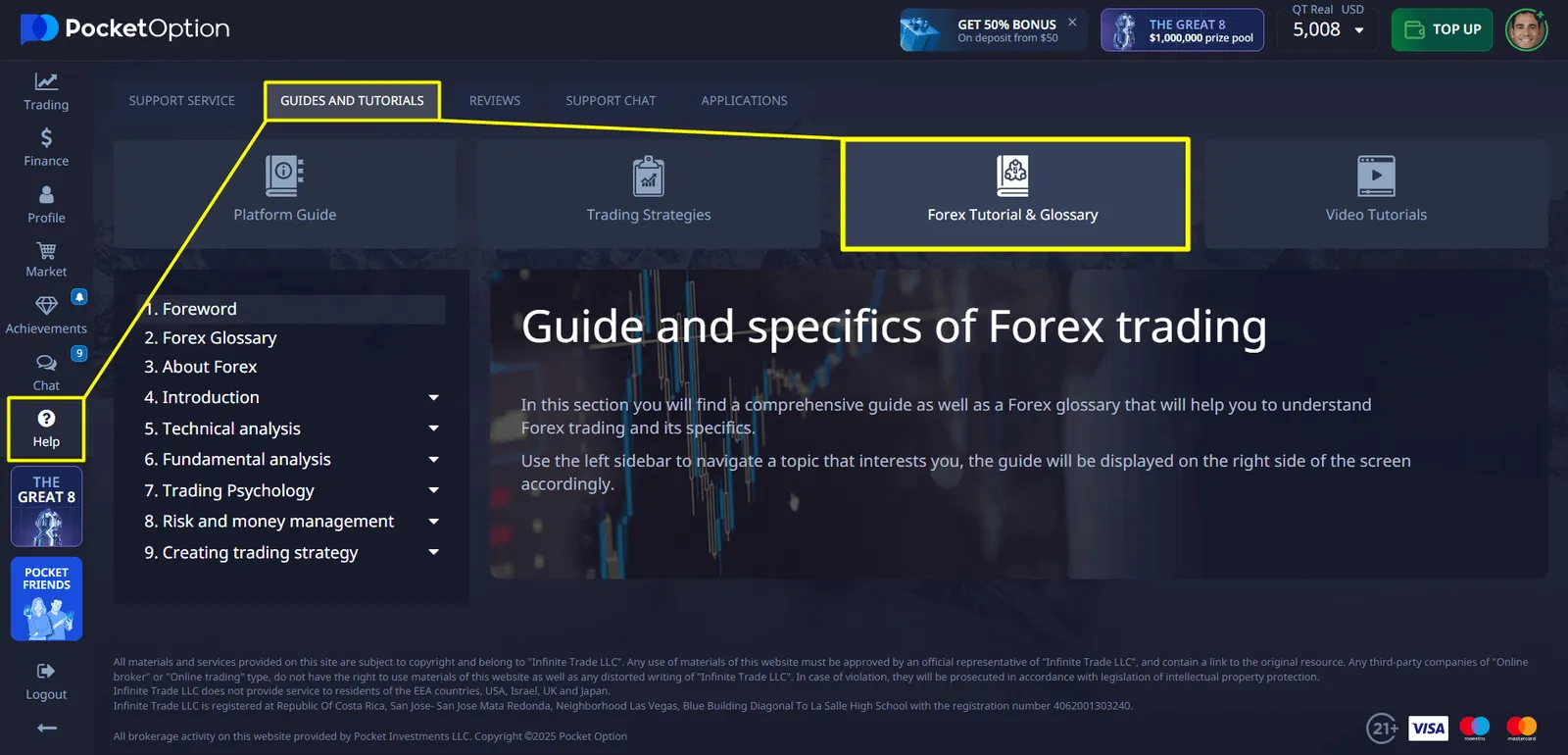

Pocket Option features a dedicated Forex Tutorial section designed specifically for beginners.

This resource helps new traders understand the basics of currency trading, platform tools, and key strategies — making it easier to start trading with confidence.

After reading our Forex tutorial, you can try out different strategies without risking your real assets — in Free Demo mode.

How to Trade Forex Using Micro Accounts on Pocket Option

Pocket Option provides two convenient ways to trade Forex with small amounts of money – a great choice for beginners and those who want to control risk with minimal positions. Whether you’re using $1 for each trade or testing a new strategy, both options provide access to the international forex market.

✔️ Method 1: Instant Forex Trading (OTC Available 24/7)

This built-in mode is designed for those who appreciate speed, simplicity and instant trades.

- Log in: Log in to your Pocket Option account.

- Select an asset: Find “Forex” among the available instruments.

- Set up a trade: Start at $1, set the direction and duration of the trade.

- Open a position: Make a price movement forecast and activate an order.

- Follow the market: Watch the market dynamics in real time and, with a successful prediction, get up to 92% profit.

This option is ideal for those who prefer fast and affordable trades at any time – including weekends via OTC Forex.

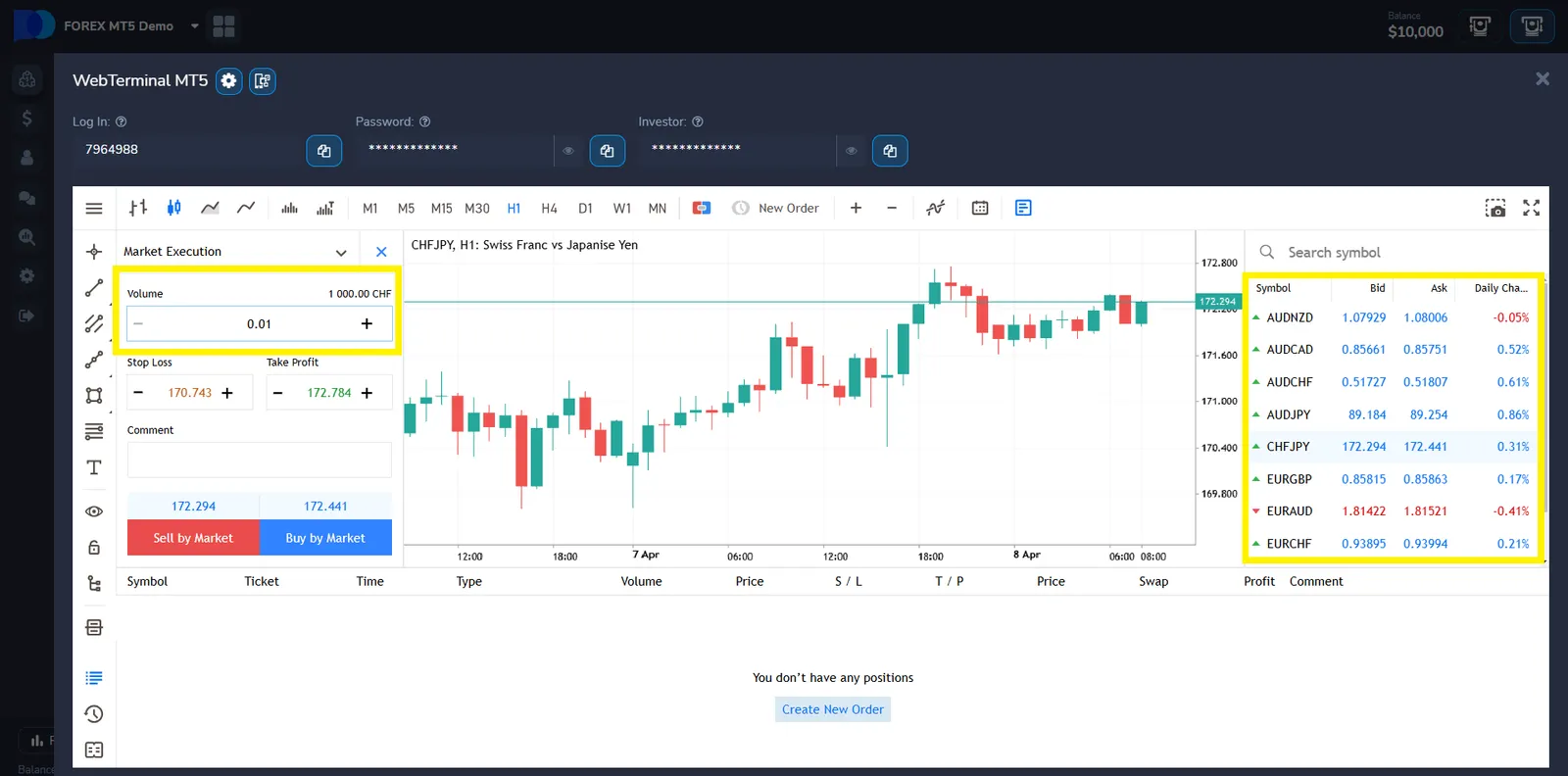

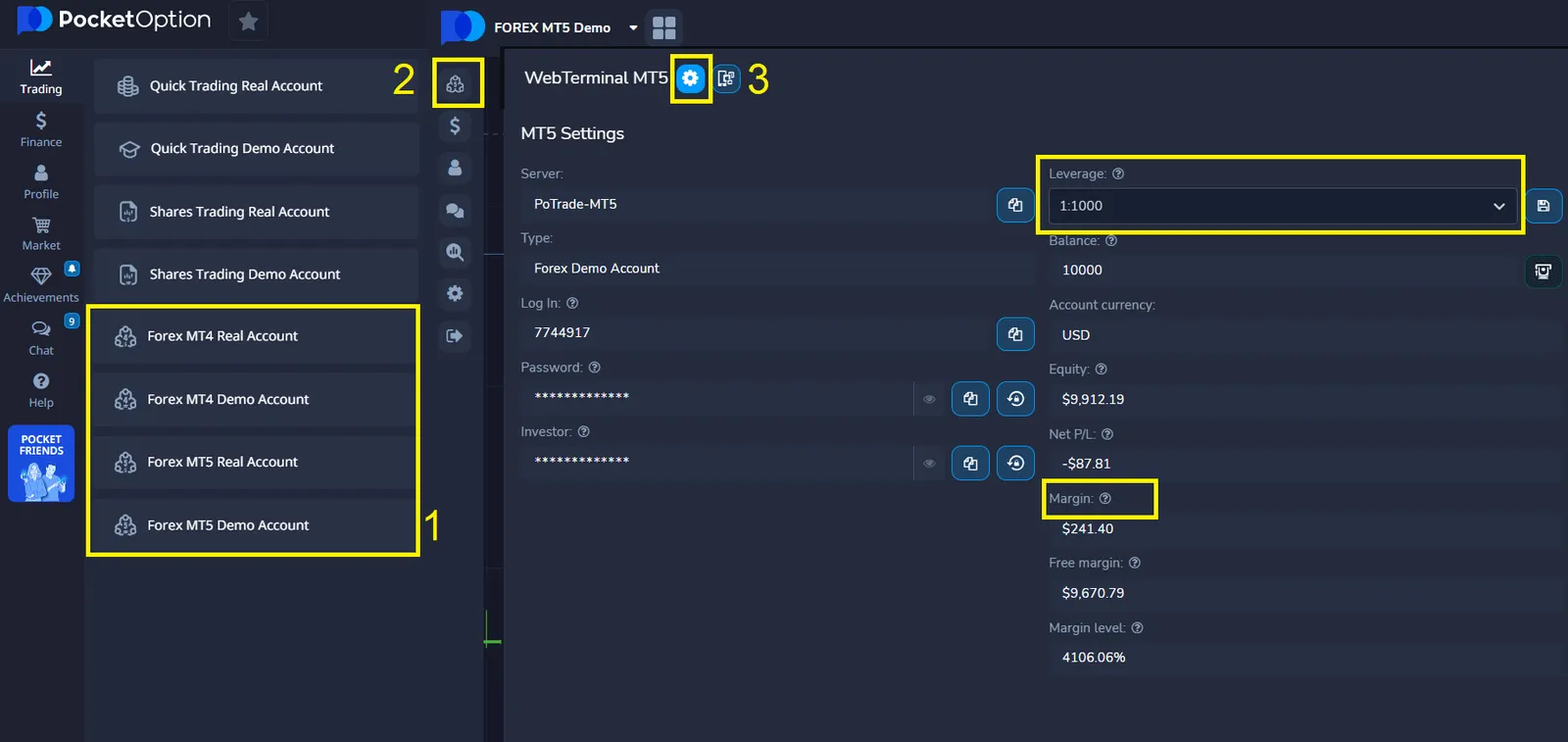

⚙️ Method 2: Professional Forex Trading via MetaTrader 5 (MT5)

For users who prefer more advanced tools, trading via MetaTrader 5, the recognized standard in Forex analysis, is available.

- Open MT5: Launch the MetaTrader 5 platform via the web version or Pocket Option desktop.

- Log in to the terminal: Use your MT5 data from Pocket Option.

- Select currency pairs: Both major and exotic assets are available.

- Customize your parameters: Choose your lot size and leverage level up to 1:1000.

- Analyze and trade: Use charts, indicators and built-in Expert Advisors for accurate decisions.

Quick Trading offers simplicity and convenience, whereas MT5 caters to advanced analysis and seasoned traders.

Modern Trading Tools on Pocket Option

Pocket Option provides specific tools that enhance forex-trading effectiveness:

- Multi-timeframe dashboard: View the same currency pair across 4 timeframes simultaneously

- Correlation matrix: Avoid overexposure by identifying which currency pairs move together

- Risk calculator: Automatically determine position size based on account percentage risk

- Trading journal: Track performance metrics and identify improvement areas

Conclusion

Successful forex-trading requires three key elements: psychological discipline to follow your rules, strategic entry methods based on price action, and strict risk management limiting exposure to 1% per trade. Instead of seeking the “perfect” strategy, focus on consistent execution of a simple method aligned with your personality.

Pocket Option provides all necessary tools for implementing these principles, but ultimately your success depends on treating forex-trading as a profession requiring dedicated practice. Start with small position sizes, master one strategy before adding others, and prioritize risk management over profit maximization.

FAQ

What minimum capital is needed for effective forex-trading?

Professional traders recommend starting with at least $2,000 on Pocket Option. This allows proper 1% risk management while maintaining adequate position sizes (minimum 0.01 lots) for standard 20-30 pip stop-losses on major pairs.

How many hours does profitable forex-trading require daily?

Day traders need 3-4 dedicated hours during active sessions (London/New York overlap), while swing traders can succeed with 30-45 minutes of analysis after market close. Both approaches can be profitable with proper strategy execution.

Which currency pairs are best for beginners?

Start with EUR/USD, USD/JPY, and GBP/USD. These major pairs offer tight spreads (1-2 pips), high liquidity, and more predictable technical patterns compared to exotic pairs with higher volatility.

Is forex-trading more challenging than stock trading?

Forex-trading offers advantages including lower fees, 24-hour access, and ability to profit in any market direction. However, it requires understanding global economic relationships and managing leverage risks that can amplify losses.

Does Pocket Option offer automated forex-trading solutions?

For those interested in automation, Pocket Option offers an integrated forex-trading solution via its official Telegram Signal Bot. This tool delivers real-time trade signals based on market analysis, helping users react quickly to key movements. Keep in mind that the use of third-party automated software is restricted and may be blocked if it breaches platform guidelines. Always refer to the official Pocket Option bot for compliant automation features.