- Volatility driven by political events

- Closely linked to Donald Trump’s public exposure and legal developments

- Truth Social adoption remains the company’s primary growth driver

DJT Stock Price Prediction 2025: Price Forecast for Trump Media

Trump Media and Technology Group Corp (DJT) was formed with the mission of challenging mainstream social media platforms. Its flagship product, Truth Social, offers a censorship-free alternative targeting users disillusioned with big tech. This vision has attracted both political supporters and speculative investors.Despite DJT not being listed on major exchanges like Nasdaq, its visibility and potential impact are undeniable. With media coverage closely tied to political developments, the company's trajectory is both unique and unpredictable.

Article navigation

- Start trading

- Current Market Position

- DJT Historical Performance & Market Sentiment

- DJT Stock Price Prediction 2025

- Technical Analysis and Indicators

- DJT Forecast 2025 Compared to Peers

- Beyond 2025: Outlook to 2030

- Expert Opinions on DJT Forecast

- Investment Strategy: Buy, Hold, or Sell DJT?

- Final Thoughts

Current Market Position

DJT has gained substantial retail attention through over-the-counter (OTC) trading, despite not being listed on major exchanges like Nasdaq or NYSE. As of mid-2025, DJT stock is hovering around $27, according to unofficial data aggregated from OTC sources.

Key Observations:

DJT Historical Performance & Market Sentiment

DJT Stock Trajectory Since Inception

DJT stock has shown erratic movement, with sharp increases following Trump-related news and declines after broader market corrections or tech slowdowns. Early 2024 saw a speculative rally pushing the stock to nearly $70, followed by a steady decline.

DJT Historical Stock Prices

| Year | Price Range (USD) | Major Event |

| 2022 | $10 – $32 | SPAC merger announcement |

| 2023 | $15 – $45 | Launch of Truth Social app |

| 2024 | $28 – $70 | Trump campaign updates |

| 2025 (YTD) | $22 – $30 | Truth Social stagnation, election influence |

Market Sentiment and Public Perception

Market Sentiment and Public Perception

DJT’s value is highly sentiment-driven. Unlike blue-chip tech stocks, it lacks diversified revenue sources or institutional backing. Investor emotion, meme potential, and political association dominate trading behavior.

Key Challenges:

- Lack of consistent user growth for Truth Social

- Limited advertising revenue

- Regulatory scrutiny

Key Drivers:

- Political events, especially U.S. elections

- Endorsements or controversies involving Donald Trump

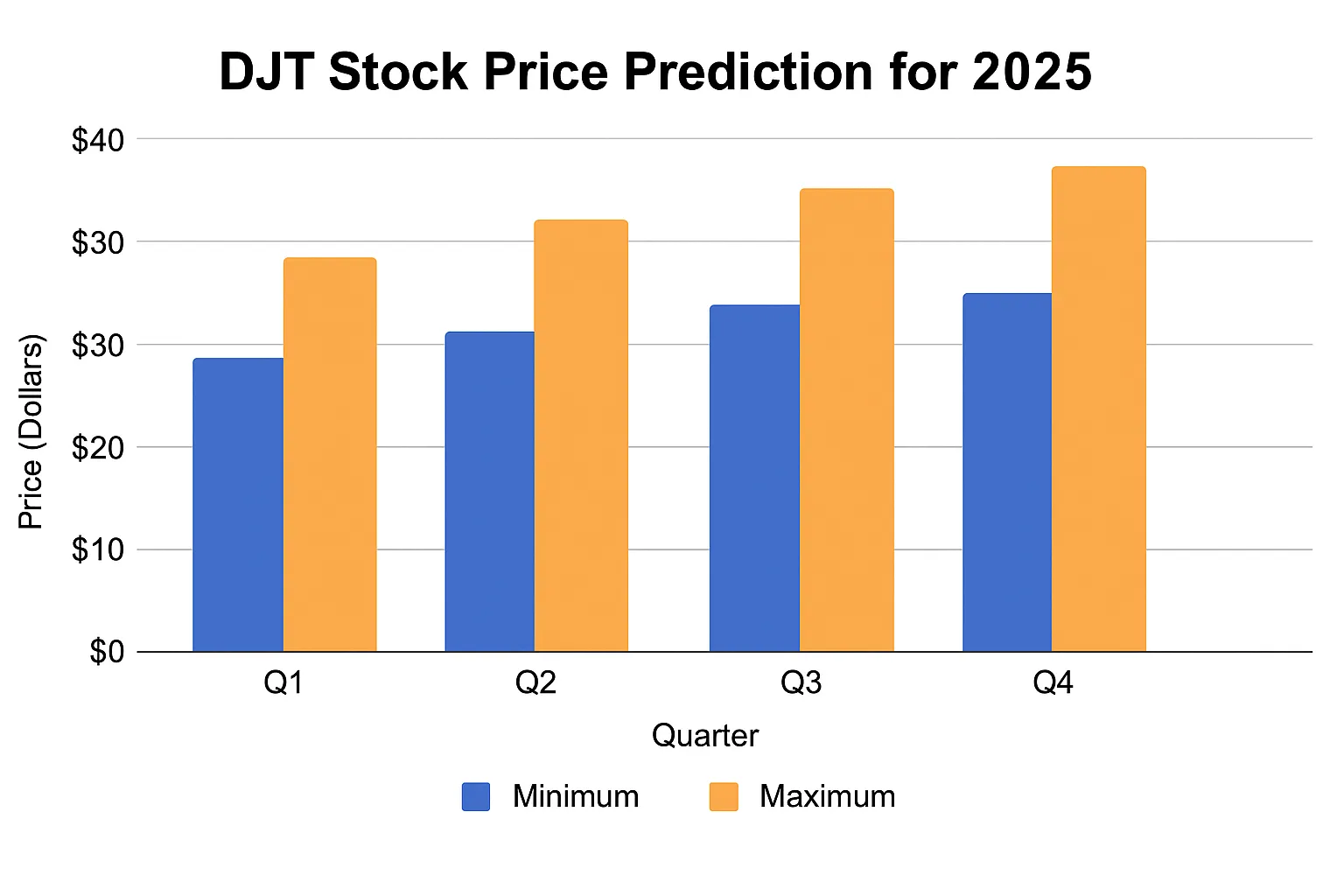

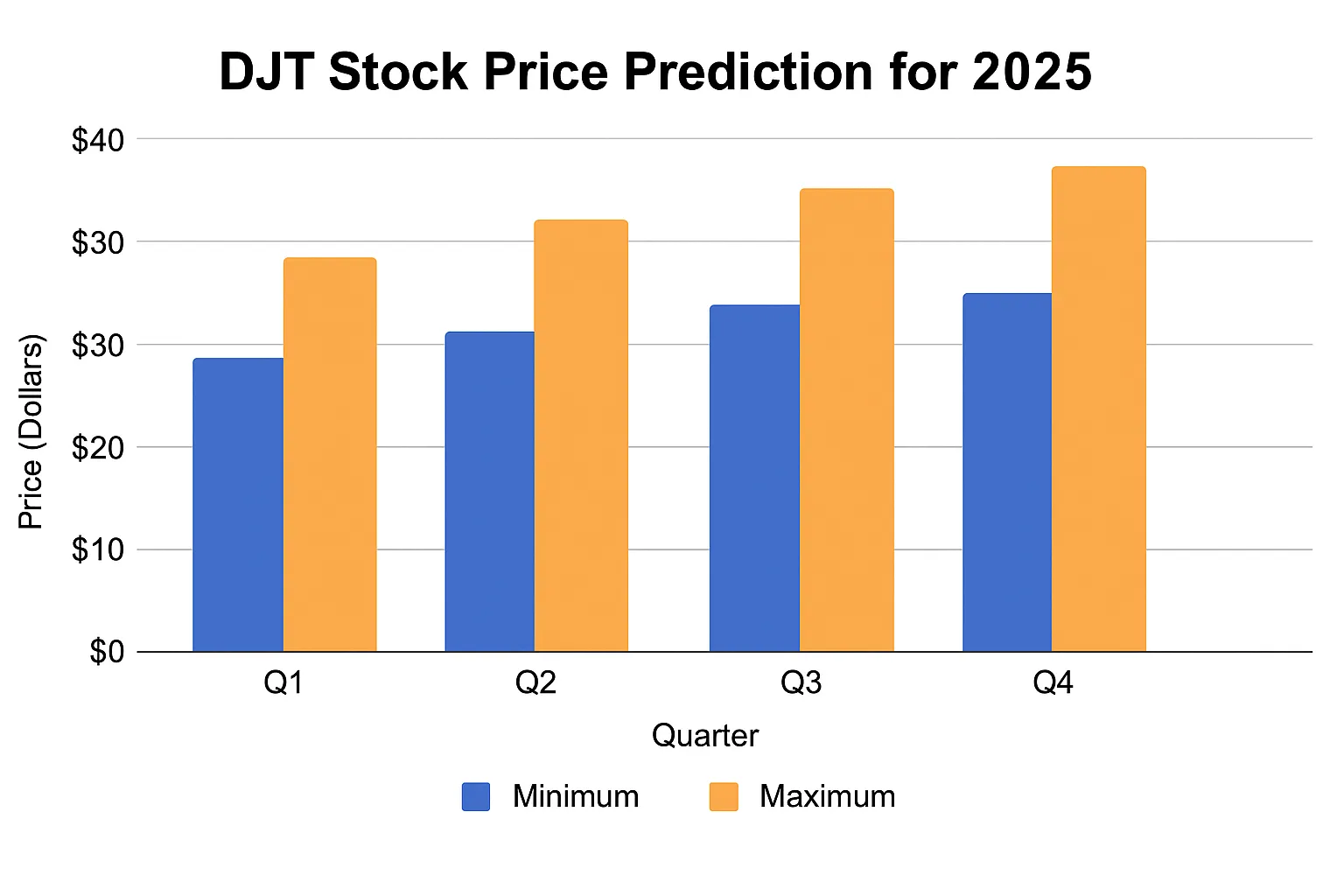

DJT Stock Price Prediction 2025

Analytical Approach

To forecast the DJT stock price prediction 2025, analysts use both technical indicators and fundamental insights. Sources like WalletInvestor, Reddit discussions, and independent fintech analysts all provide models based on various assumptions.

2025 Price Prediction Range by Source

| Source | Prediction (USD) | Commentary |

| WalletInvestor | $15 – $40 | Neutral, medium volatility expected |

| CNN Analysts | $12 – $50 | Dependent on election outcomes |

| Reddit Consensus | $10 – $80 | Highly speculative, meme-driven |

- One of the key references used in this analysis is the DJT stock price prediction 2025 WalletInvestor model. WalletInvestor projects a price range of $15–$40 for the year, driven by medium-term sentiment indicators and platform performance metrics.

- According to the DJT stock price prediction 2025 CNN assessment, the forecast is highly dependent on post-election policy developments and Trump’s political momentum. Analysts suggest DJT could benefit from a renewed media push, though downside risks remain due to legal and operational uncertainties.

Key Factors Influencing the Forecast

- Truth Social Growth:

The number of monthly active users (MAUs) on Truth Social will be pivotal. If it crosses 10 million MAUs with higher engagement, DJT could see a bullish breakout. - 2024 U.S. Election Aftermath:

Trump’s political presence in 2025 will significantly affect public sentiment toward DJT. Legal battles or wins could either suppress or uplift the stock. - Platform Monetization:

Advertising revenue and potential partnerships will determine the business model’s viability. As of 2025, monetization has not scaled effectively. - Non-listing Effects:

The lack of listing on Nasdaq or NYSE limits institutional access, reducing liquidity but increasing retail-driven volatility.

Bonus Insight: DJT Stock Price Prediction 2025 by Month

While exact monthly predictions remain speculative, WalletInvestor’s algorithm projects the following trend:

| Month | Low (USD) | High (USD) |

| January 2025 | $22.50 | $28.00 |

| April 2025 | $23.20 | $29.50 |

| July 2025 | $24.00 | $33.00 |

| October 2025 | $20.50 | $35.00 |

| December 2025 | $18.00 | $40.00 |

Technical Analysis and Indicators

Key Trends

Technical analysis reveals resistance near $35 and support around $20. RSI levels have frequently shown overbought signals following news bursts.

MACD Trendline: Shows declining momentum since Q2 2024.

Moving Averages (50/200-day):

- 50-day MA: $26

- 200-day MA: $32

Volatility Assessment

DJT exhibits a beta of ~2.3 (unofficial), signaling much higher volatility than the S&P 500.

DJT vs Peer Stocks (2025)

| Company | Stock Ticker | Volatility (Beta) |

| Trump Media | DJT | 2.3 |

| Meta Platforms | META | 1.1 |

| Snap Inc. | SNAP | 1.5 |

| Reddit Inc. | RDDT | 1.8 |

Truth Social Stock Price Chart

Although not officially tracked on major indexes, several financial aggregators like MarketWatch and TradingView offer community-sourced Truth Social stock price charts, reflecting DJT’s trading activity based on OTC data. These visualizations can help identify momentum bursts and reversal signals.

DJT Forecast 2025 Compared to Peers

Competitive Positioning

Trump Media has a distinct brand edge due to its political affiliation, but lags in tech innovation, user base, and monetization compared to:

- Meta (Instagram, Threads)

- X (formerly Twitter)

- Reddit (community engagement)

Truth Social Stock Price Prediction 2025 depends largely on whether it evolves from a niche political platform into a broader user-driven ecosystem.

Beyond 2025: Outlook to 2030

DJT Stock Price Prediction 2026–2027

- Base Case: $25 – $40 (Assuming moderate growth and status quo)

- Bullish Case: $50+ (If Truth Social user base doubles or monetization surges)

- Bearish Case: <$15 (Legal or reputational damage)

Long-Term DJT Price Prediction (2030)

Analyst views diverge:

- WalletInvestor Long-Term Model: $38.20 (conservative estimate)

- Truth Social Max Projection (Reddit): $100 (optimistic, assumes platform explosion)

- Institutional Analysts: Warn of downside if growth fails to materialize

Truth Social Stock Price Prediction 2030 hinges on factors like regulation, digital ad market trends, and political influence sustainability.

Expert Opinions on DJT Forecast

What Analysts Say

- Morningstar (2025): “DJT lacks predictable cash flows, making valuation speculative.”

- Bloomberg: “Investor enthusiasm for DJT is more political than financial.”

- The Motley Fool: “Truth Social needs more than name recognition to compete with top-tier platforms.”

- Jim Cramer (CNBC): “It’s a trading vehicle, not a fundamental investment. Tread carefully.”

- Dan Ives, Wedbush Securities: “Unless they diversify and scale monetization, it’s tough to model sustainable upside.”

Investment Strategy: Buy, Hold, or Sell DJT?

DJT represents a high-risk, event-driven opportunity. Depending on your risk tolerance and view of the upcoming election cycle, your strategy might vary:

| Buy DJT Stock If | Sell DJT Stock If | Hold DJT Stock If |

| You anticipate a Trump 2028 campaign boost and media resurgence | You require revenue-backed, stable companies in your portfolio | You are hedging on potential political momentum through 2026 |

| You believe in Truth Social’s growth and unique market niche | You expect regulatory scrutiny or platform stagnation | You’re awaiting Q3–Q4 results for monetization clarity |

| You are experienced in trading volatile, sentiment-driven stocks | You want to lock in gains from previous rallies | You believe Truth Social may attract buyout interest or partnerships |

Expert Insight: David Trainer, CEO of New Constructs, notes: “DJT is pure speculation right now. Without real revenue traction, the stock trades on headlines. That can benefit short-term traders but is risky for long-term investors.”

Final Thoughts

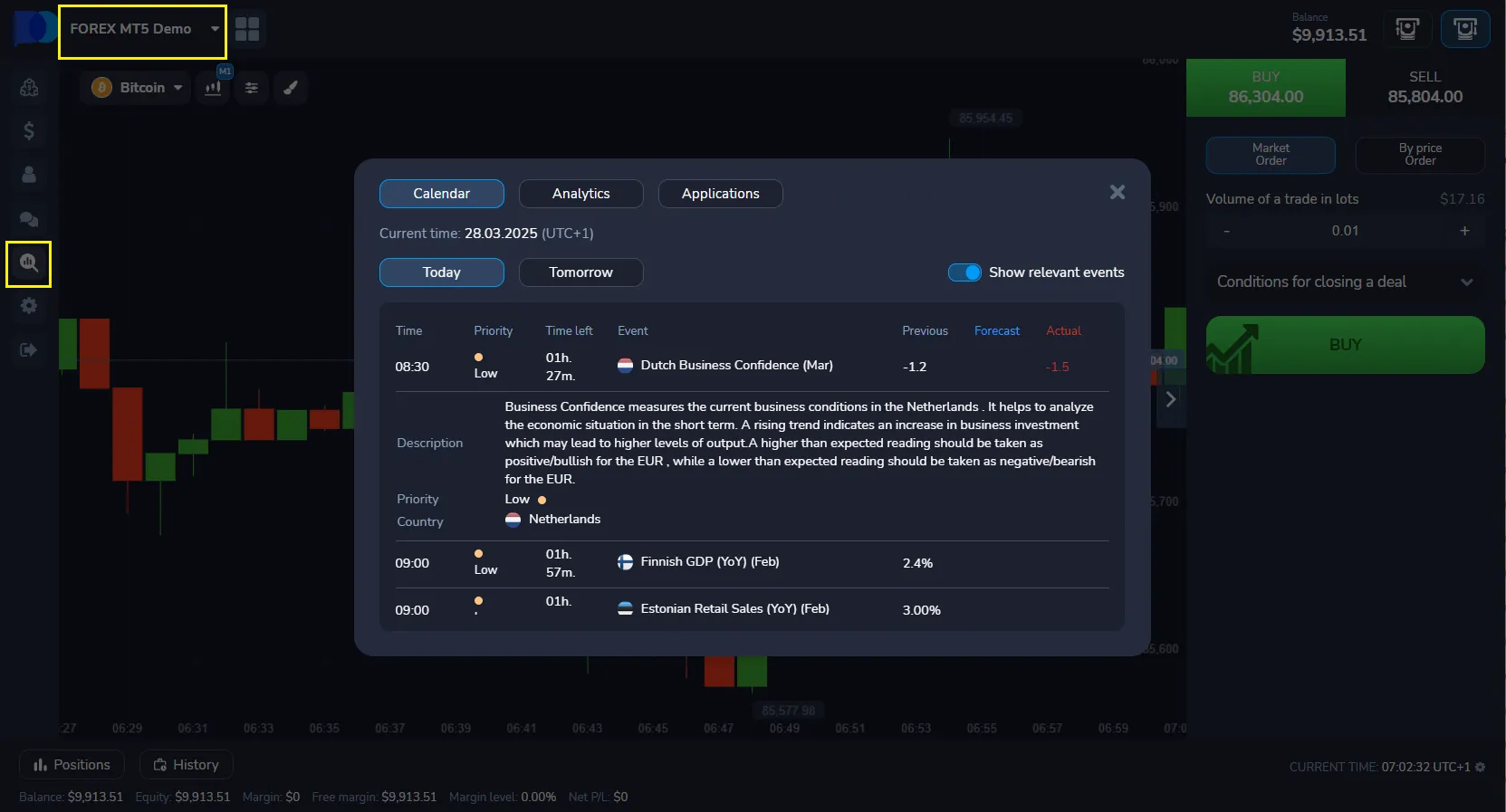

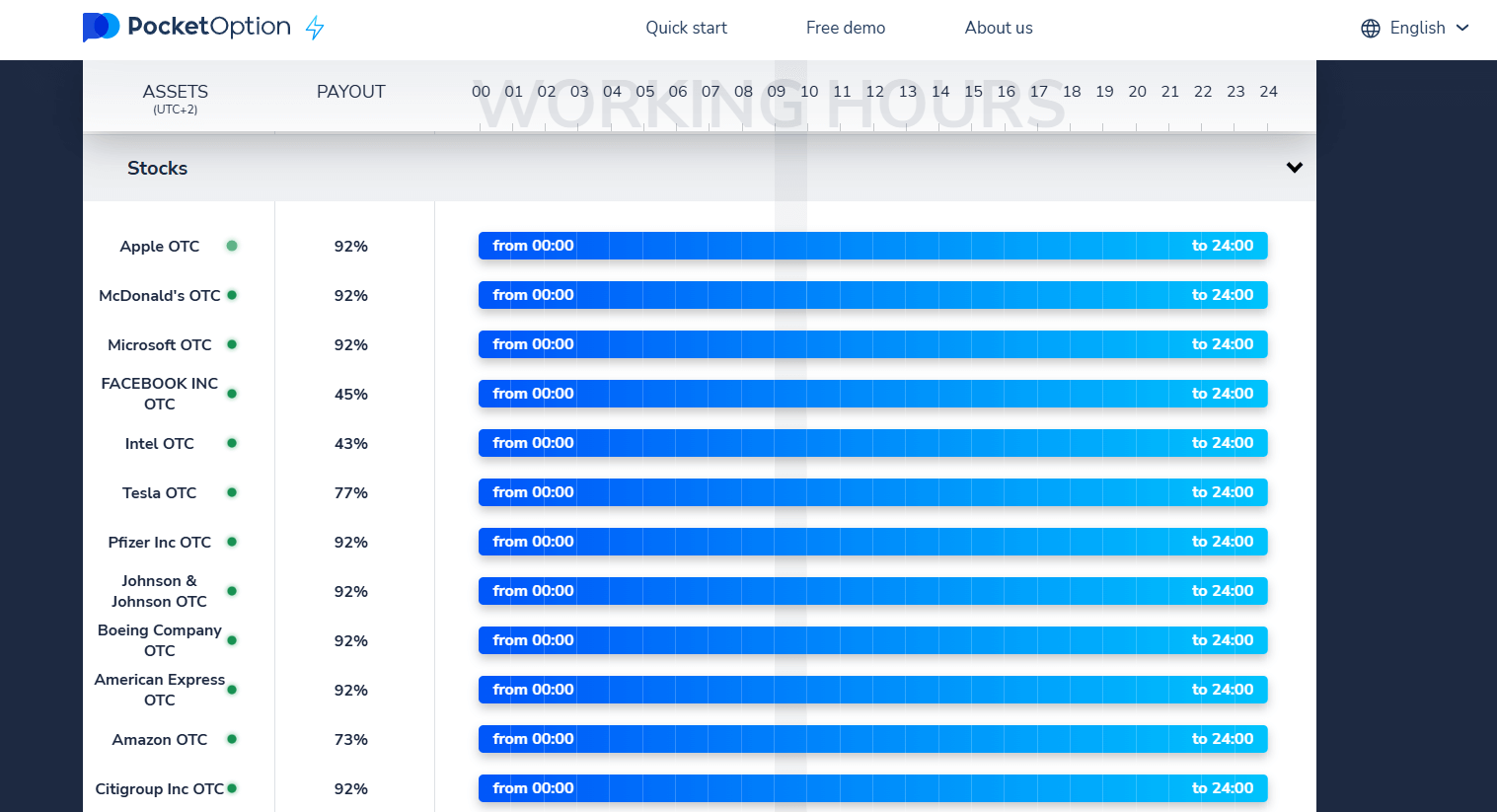

Why start trading on Pocket Option?

Open a real account today and use promo code 50START to get a $25+ bonus on your first deposit. Unlock access to AI trading bots, social copy trading, tournaments, cashback, and more — all designed to enhance your profit potential.

Advantages of Quick Trading with Pocket Option:

- AI Trading and Bots – Automate trades with smart algorithms for faster execution.

- Social and Tournament Trading – Learn from top traders and compete for prizes.

- Bonuses and Flexible Payments – Use promo codes and enjoy 50+ deposit methods.

- Mobile Convenience – Trade anywhere, anytime, without buying or selling assets — just forecast direction.

⚡ Forecast price direction only — no need to own the asset. Earn up to 92% profit with the correct prediction.

The DJT stock price prediction 2025 USA offers a volatile but intriguing opportunity. For high-risk investors willing to endure dramatic swings, the potential rewards may be substantial. However, the speculative nature of DJT stock demands caution and a well-diversified portfolio.

While DJT isn’t available on Pocket Option, traders can access 100+ stocks and indices, 24/7, via OTC markets for diversified exposure.

FAQ

What is the future of DJT stock?

The future of DJT stock largely depends on the performance of Truth Social, Donald Trump’s political presence, and the company’s ability to generate sustainable revenue. Analysts expect continued volatility, with upside potential tied to platform growth and media exposure, but warn of risks tied to weak fundamentals and lack of diversification.

What is the price target for DIS in 2025?

While this article focuses on DJT, Disney (DIS) is forecasted by analysts such as Bank of America and Goldman Sachs to reach a price target of $110–$135 by the end of 2025, depending on content success, theme park performance, and streaming profitability.

Who is investing in DJT stock?

DJT stock is primarily held by retail investors and political supporters of Donald Trump. Major institutional investors remain largely absent due to the stock’s speculative profile and OTC nature. Trading activity is highly driven by social media sentiment and political news cycles.

What is the stock price prediction for DJT in 2026?

The 2026 forecast ranges from $25 to $50 depending on monetization progress and Truth Social adoption. If Trump remains a dominant public figure and the platform gains traction, bullish scenarios predict over $50. Bearish forecasts, however, suggest sub-$20 prices if engagement drops or regulatory issues intensify.