- AUD is the base currency

- CHF is the quote currency

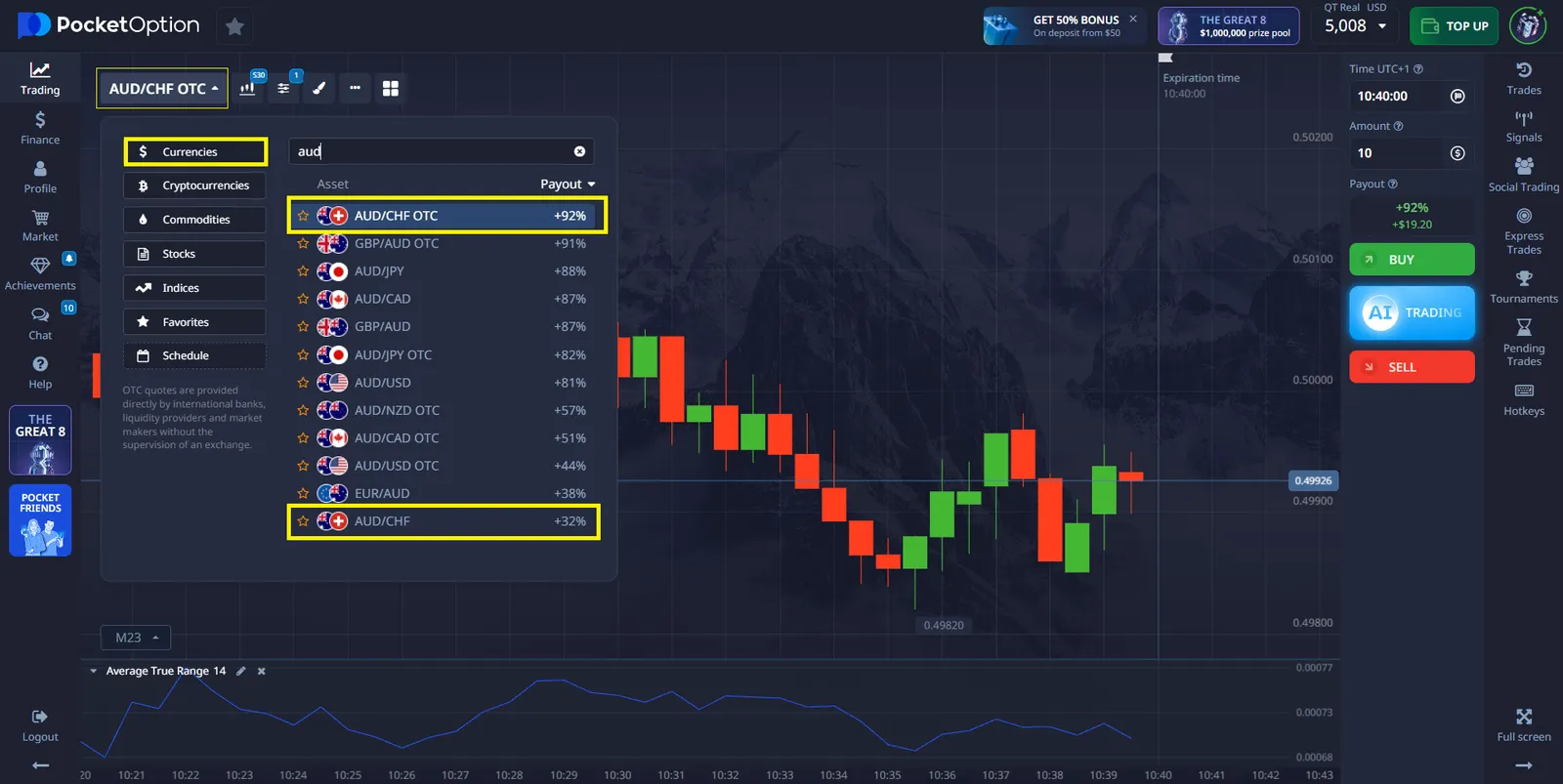

AUD/CHF: What This Instrument Is and How to Start Trading Step by Step

The currency pair AUD/CHF might seem unfamiliar to beginner traders, but in reality, it gives access to an interesting combination of two economies — Australia and Switzerland. In this article, we will explore what this asset is, how its price quote works, and what factors affect its value. We will also go through the steps of a possible trade and explain how you can get started with a demo account.

What Is AUD/CHF?

AUD/CHF is a currency pair that includes the Australian Dollar (AUD) and the Swiss Franc (CHF). It shows how many Swiss Francs are needed to buy one Australian Dollar. This pair combines the features of a commodity-based economy and a financially stable country.

The Australian Dollar is often called a “commodity currency” because Australia’s economy heavily depends on the export of raw materials such as iron ore, coal, and gold. The Franc, on the other hand, is considered a “safe haven” — investors tend to choose it during uncertain times due to its reliability and stability.

📌 On our trading platform, the AUD/CHF pair is available in two formats: standard and OTC.

The standard version reflects real market liquidity and pricing from major financial institutions. The OTC version, while based on the same price movements, is executed internally with adjustable conditions such as spread and volume. This allows for flexible trading even during low-liquidity periods, with terms tailored to the platform.

How a Currency Quote Works: Clear and Simple

When you see the quote AUD/CHF = 0.5900, this means that 1 Australian Dollar is worth 0.59 Swiss Francs. In this pair:

If the rate is 0.59, it means that the Australian Dollar is weaker than the Swiss Franc.

A simple example: let’s say you travel from Australia to Switzerland and decide to exchange 100 AUD. At this rate, you would receive 59 CHF.

What Affects the AUD/CHF Rate

There are different factors that influence the price of this pair. Here are the main ones:

For the Australian Dollar:

- Commodity prices — especially for iron ore and coal

- Interest rate decisions by the Reserve Bank of Australia

- Employment and inflation reports

- Trade balance data

For the Swiss Franc:

- Decisions by the Swiss National Bank

- Global risk levels: when markets are unstable, investors tend to buy the Franc

- Inflation data and economic reports

For example, if commodity prices rise, this may strengthen the Australian Dollar. On the other hand, during global uncertainty, the Franc often gains strength because investors are looking for stability.

How to Understand What’s Happening With the Price

Let’s suppose you notice that AUD/CHF rose from 0.5900 to 0.5950. This means:

- The Australian Dollar became stronger compared to the Swiss Franc

- You now get more Francs for 1 AUD than before

But if the price dropped from 0.5900 to 0.5850, it means:

- The Franc has strengthened

- The Australian Dollar became weaker

- You now receive fewer CHF for 1 AUD

These kinds of changes can happen even within a single day, especially after important economic news is released.

Step-by-Step Example of a Trade on AUD/CHF

Here’s how a simple trade might look:

- Open the Pocket Option platform and find the currency pair AUD/CHF or AUD/CHF OTC (outside regular trading hours).

- Look at the chart. You can use technical indicators and also check the traders’ sentiment analysis.

- Choose your trade amount. The minimum is $1.

- Set the trading time. From 5 seconds (for OTC assets) to several hours.

- Make a forecast about the price direction:

- If you think the price will rise — click BUY

- If you expect it to fall — click SELL

✔️If your forecast is correct, the possible return is up to 92%. The exact percentage is shown in advance and depends on market conditions and trade time.

Try It Without Risk — $50,000 Demo Account

There is no need to start trading with real money right away. After registration on Pocket Option, you receive a demo account with $50,000 — a great opportunity to explore how the platform works, test different approaches, and practice.With the demo account:

- You can learn and experiment without financial loss

- You can access charts, indicators, and different types of trades

- You can get used to currency pairs like AUDCHF

And when you are ready — you can switch to a real account. The minimum deposit is from $5. This gives you full access to the platform:

- Copy trading — follow the actions of experienced traders

- Cashback on part of your losses

- Participation in tournaments with prizes and other platform features.

FAQ

What is the AUD/CHF currency pair?

It shows how many Swiss Francs are needed to buy one Australian Dollar.

What affects the AUD/CHF exchange rate?

Key factors include commodity prices, central bank rates, inflation, and global risk sentiment.

How can I trade AUD/CHF on the platform?

You choose the price direction, trade amount, and time — then click BUY or SELL.

Can I try it without risking real money?

Yes, after registration you get a $50,000 demo account for safe practice.

How much do I need to start trading?

The minimum deposit starts from $5 (may vary depending on payment methods), and trades start from $1.