- Expansion in health tech and AR/VR devices

- Strategic buybacks increasing per-share value

- Enhanced AI and cloud integration across services

- Emerging markets adoption of the Apple ecosystem

Mathematical modeling for Apple stock price prediction 2030

As we delve into the future of Apple Inc and its AAPL stock price prediction for 2030, it becomes crucial to analyze various factors influencing the stock's performance. This article will explore the dynamics of Apple Inc, historical price movements, and the potential impact of upcoming innovations. Understanding these elements will help investors make informed decisions about AAPL shares in the coming years.

Article navigation

- What is the Apple stock price forecast for 10 years?

- Understanding Apple Inc and AAPL Stock

- Will Apple stock reach $500 again?

- Introduction to AAPL Shares

- Historical Price Movements of Apple Stock

- What will Apple stock be in 5 years?

- Factors Influencing Apple Stock Price in 2030

- Can Apple stock reach $1,000?

- Price Prediction Models for Apple Stock

- Pocket Option: Trade Apple Shares with Precision

- Projected Apple Stock Price for 2025, 2026, and Beyond

- Final Takeaways on Apple’s Stock Future

What is the Apple stock price forecast for 10 years?

The apple stock price prediction 2030 involves a 10-year outlook shaped by macroeconomic and industry trends. Over the past decade, AAPL shares have consistently delivered strong performance. Forecast models estimate a potential doubling in value by 2030 due to advances in AI, new product innovations, and global expansion.

Additionally, the aapl stock forecast 2030 suggests that sustained innovation and stable macroeconomic indicators could lead to above-average returns over the decade.

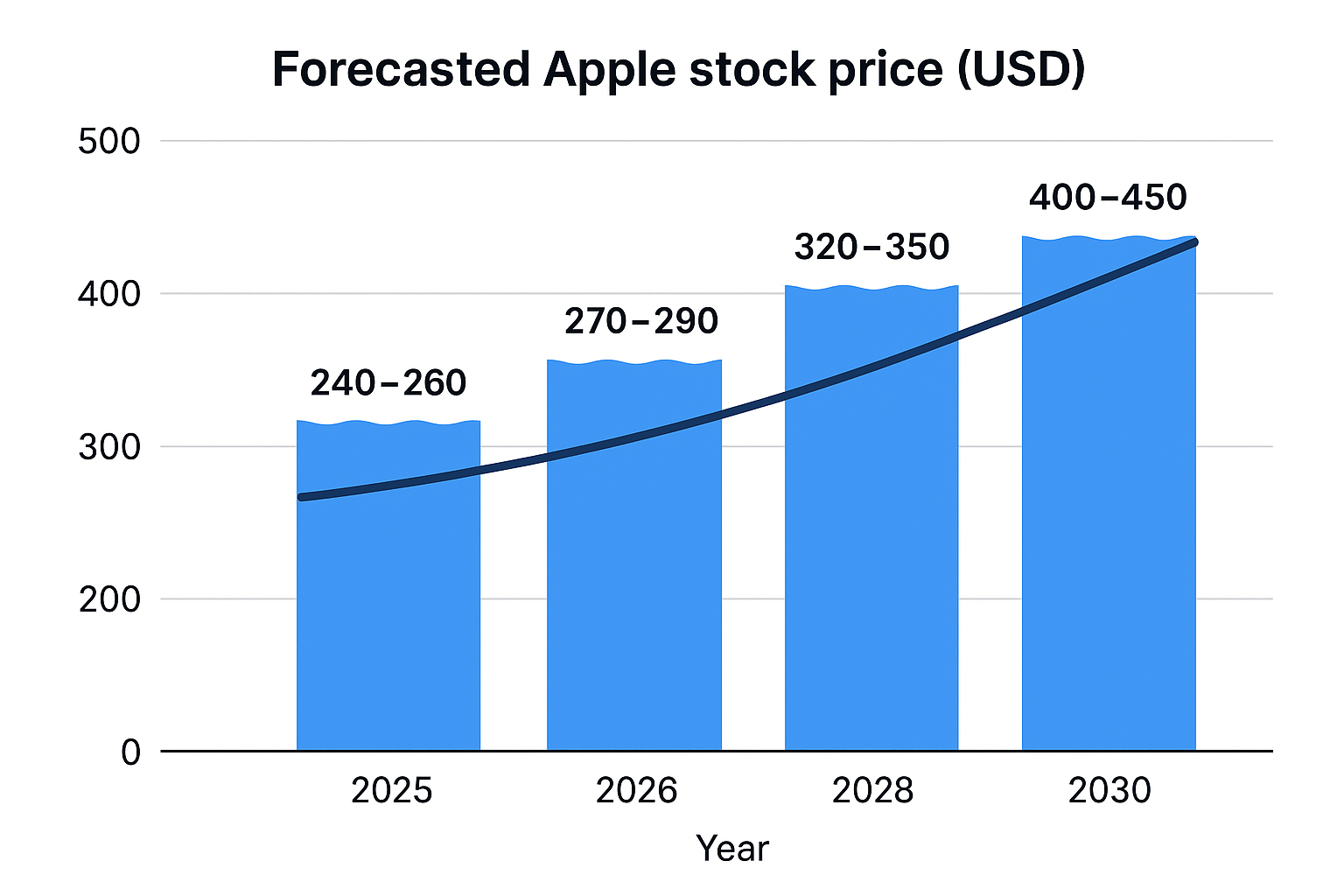

| Year | Forecasted Price (USD) |

|---|---|

| 2025 | 240–260 |

| 2026 | 270–290 |

| 2028 | 320–350 |

| 2030 | 400–450 |

These projections align with expert sentiment from institutions like Morgan Stanley and Goldman Sachs, highlighting continued innovation as a growth driver for Apple stock in 2030.

Understanding Apple Inc and AAPL Stock

Apple Inc, a leading technology company, has transformed the smartphone market and continues to innovate with products like the iPad, Apple Watch, and Apple Music. As of now, its market cap has reached an impressive 1 trillion, making it one of the most valuable companies globally. Analysts anticipate that Apple’s commitment to artificial intelligence and expansion into new markets will further enhance its stock performance over the next five years.

Overview of Apple Inc

Founded in 1976, Apple Inc has consistently led the technology sector with groundbreaking innovations. The company’s focus on design, user experience, and ecosystem integration has established a loyal customer base. With a strong revenue growth trajectory and a robust average price for AAPL shares, Apple remains a dominant player in both hardware and software markets, setting a solid foundation for future stock price predictions.

Will Apple stock reach $500 again?

Reaching the $500 mark is a topic of interest for long-term investors. Analysts suggest that apple stock in 2030 could surpass $500 if the company sustains its innovation pace and market dominance. Factors supporting this include:

Introduction to AAPL Shares

AAPL shares represent ownership in Apple Inc and have become a staple in many investment portfolios. The current price of AAPL stock reflects the company’s strong earnings and market sentiment, which can fluctuate due to broader economic conditions. Investors keep a close eye on the stock price forecast and price targets, especially with the approaching 2024 and 2025 fiscal years, as analysts weigh potential impacts on future valuations.

Historical Price Movements of Apple Stock

Examining historical price movements provides insight into AAPL stock’s volatility and resilience. Over the years, Apple stock has experienced significant fluctuations, influenced by product launches, earnings announcements, and market conditions. While some periods showed bearish trends, others have been bullish, particularly following successful new product introductions and advancements in technology, which have consistently driven AAPL stock prices higher.

What will Apple stock be in 5 years?

The apple stock forecast 2030 suggests strong growth over the next five years. Between 2025 and 2030, the stock could see a compounded annual growth rate (CAGR) of 8%–12%, assuming favorable conditions. Based on historical growth and planned innovations, experts foresee:

- $250–$290 per share by 2026

- Continued rise with strong EPS from new services

- Stability supported by dividend yield and cash reserves

Factors Influencing Apple Stock Price in 2030

Market Sentiment and Economic Conditions

Market sentiment plays a pivotal role in determining the stock price of Apple Inc in 2030. Investor perceptions, influenced by economic conditions such as inflation rates, employment statistics, and consumer spending, can lead to bullish or bearish trends for AAPL shares. As the global economy evolves, the performance of Apple stock will likely reflect these sentiments. Additionally, interest rates and monetary policies will impact the stock’s attractiveness compared to other investments, thereby shaping its future price trajectory.

Technological Advancements and AI Integration

Technological advancements, particularly in artificial intelligence, are set to significantly influence Apple stock price predictions. Innovations such as AI-driven features in products like the iPad and Apple Watch can enhance user experience, boosting sales and revenue growth. Furthermore, Apple’s commitment to integrating AI across its platforms, including iCloud and Apple Music, positions the company to capture a larger market share. As these technologies evolve, they will not only improve operational efficiencies but also contribute to a higher average price for AAPL shares.

Growth Prospects and Future Innovations

The growth prospects for Apple Inc are immense, especially with anticipated new product launches and expansions in existing markets. Analysts project that upcoming innovations will drive significant revenue growth, enhancing the overall stock performance. As Apple continues to diversify its offerings, including potential ventures into augmented reality and health technologies, these developments will likely fuel investor optimism. Such future innovations will be critical in shaping the AAPL stock price forecast for 2030 and beyond, solidifying its market cap in the trillion-dollar range.

Can Apple stock reach $1,000?

Though ambitious, this milestone is theoretically possible over the long term. For apple stock 2030 to reach $1,000, it would likely require a mix of:

- 2:1 or 4:1 stock splits

- Major technology breakthroughs

- Substantial service revenue expansion

- Strategic acquisitions driving growth

However, experts note this would likely occur post-2035 unless accelerated by disruptive technologies or unforeseen market expansions.

Price Prediction Models for Apple Stock

Analytical Approaches to Stock Price Forecasting

Analytical approaches to forecasting Apple stock prices involve a combination of historical data analysis and predictive modeling. Analysts utilize various price prediction models, incorporating factors like earnings reports, product launches, and macroeconomic indicators. Utilizing these methods helps in estimating future stock prices by understanding past performance trends. As we look toward 2030, these analytical frameworks will become increasingly sophisticated, allowing for more accurate predictions of AAPL stock movements in response to market changes.

Comparative Analysis with Other Stocks in the NASDAQ

Conducting a comparative analysis with other stocks in the NASDAQ is essential for understanding Apple’s relative performance. By examining the stock price movements of competitors, investors can gauge market sentiment and identify trends that may affect AAPL shares. This comparative approach not only helps in assessing Apple’s growth potential but also provides context for its stock price predictions. As the technology sector evolves, such analyses will be crucial in determining how Apple stacks up against other leading companies.

Utilizing AI for Accurate Price Predictions

Leveraging artificial intelligence for price predictions is becoming increasingly prevalent among market analysts. AI algorithms can analyze vast amounts of data, including historical price movements and market conditions, to generate more precise forecasts for AAPL stock. This technology can identify trends that traditional methods may overlook, enhancing the accuracy of stock price predictions. As AI continues to advance, its integration into stock price forecasting models will likely offer investors a significant edge when evaluating Apple’s future stock performance.

Moreover, the aapl stock forecast 2030 derived from AI models often considers nuanced market variables, enabling investors to anticipate movements with greater confidence.

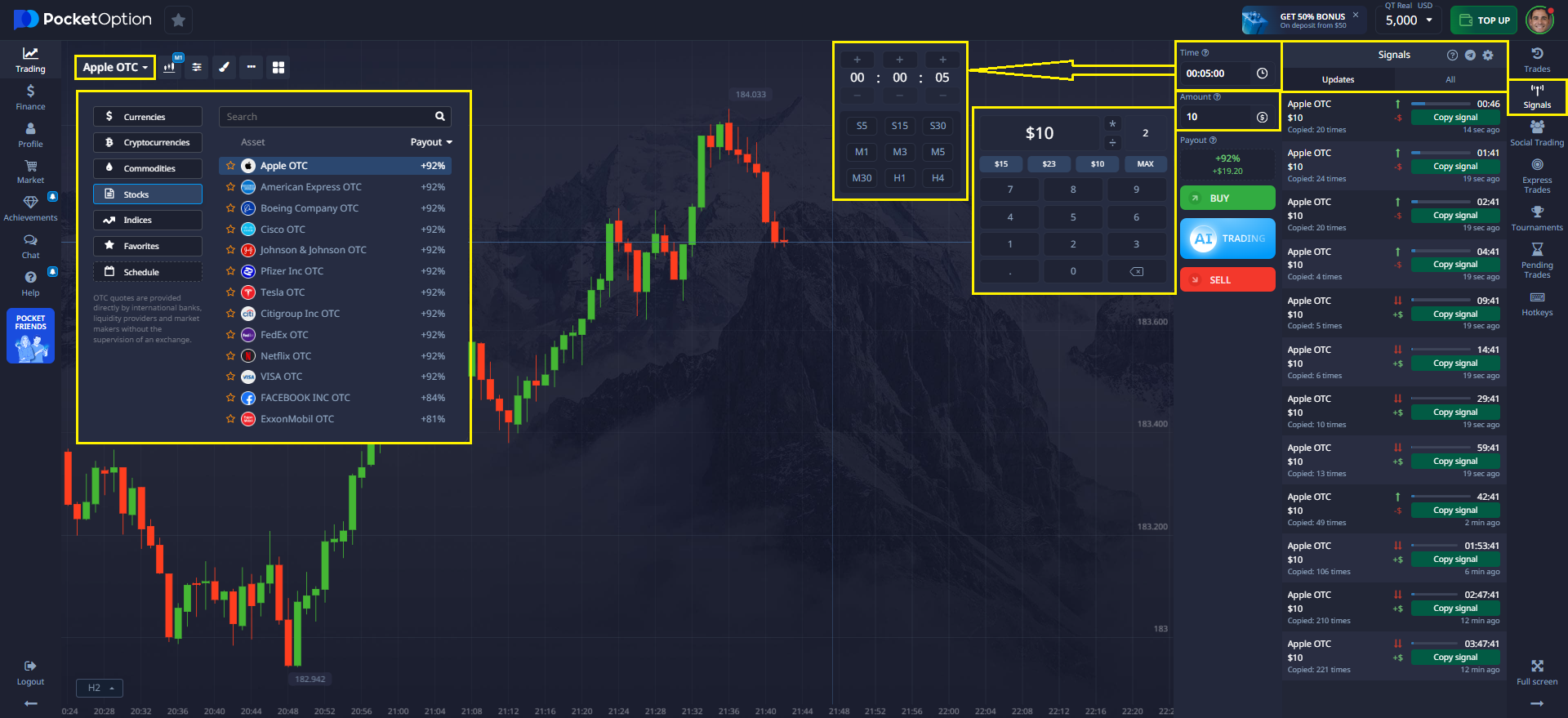

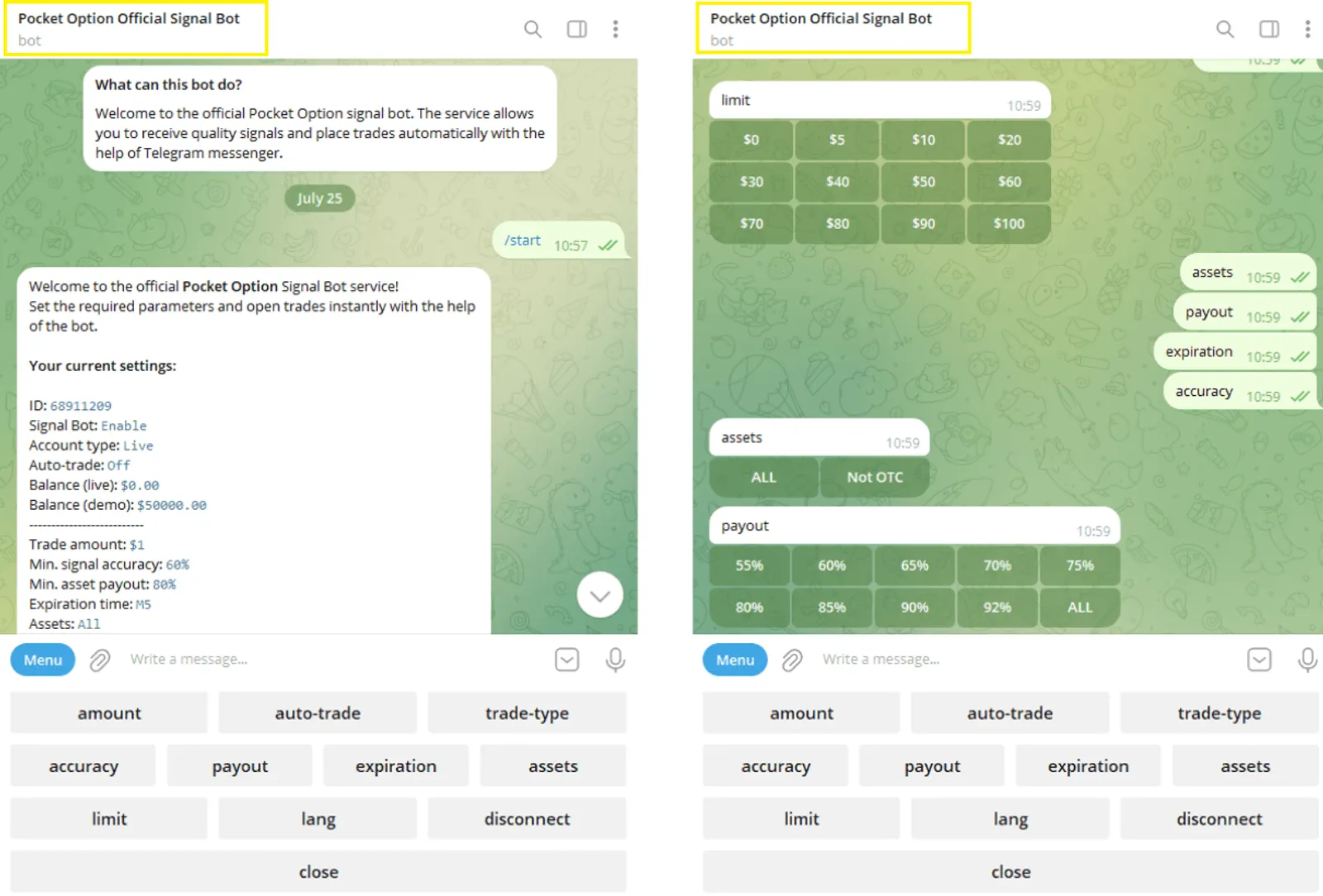

Pocket Option: Trade Apple Shares with Precision

Pocket Option offers traders the ability to engage in Quick Trading on Apple shares, making use of both Buy and Sell positions depending on expected price direction. The platform is accessible via web and mobile, supports demo and live accounts, and allows entry with as little as $5.

- Real-time price charts and technical indicators

- Copy trading from top-performing traders

- Fast deposit and withdrawal options

- Mobile app for iOS/Android

Trader testimonial: “Pocket Option helped me time my Apple trades with better accuracy. The signal bot and mobile tools are game-changers.” – Luis Mendez

Projected Apple Stock Price for 2025, 2026, and Beyond

Stock Price Forecast for 2025

The forecast for Apple stock price in 2025 hinges on various critical factors, including market dynamics, anticipated product launches, and the integration of artificial intelligence. Analysts predict a bullish trend in AAPL shares as Apple’s continuous commitment to innovation enhances its revenue growth potential. With a current price that reflects strong earnings, the average price for Apple stock could see substantial increase, particularly with the introduction of new products such as the next-generation iPad and enhancements to Apple Music.

How much will Apple stock be in 2025?

According to consensus estimates, the apple stock forecast 2030 starts building momentum in 2025. Experts project:

- Conservative range: $230–250

- Optimistic case: $260–280

This range factors in macroeconomic stability and continued earnings growth from service segments.

Predictions for 2026 and 2028

As we project into 2026 and 2028, expectations around AAPL stock remain optimistic. Analysts anticipate that Apple’s market cap will consistently hover around the 1 trillion mark, driven by robust earnings and strategic market expansions. With ongoing developments in AI and health technology, the stock price could experience significant appreciation. A combination of new product launches and the success of existing offerings like Apple Pay is expected to further enhance AAPL stock price forecasts during these years.

Long-term Forecasts: Price in 2030 and 2040

Looking further ahead to 2030 and even 2040, the long-term forecasts for Apple stock price reflect a consistent upward trajectory. Analysts believe that by 2030, AAPL stock could capitalize on emerging technologies, potentially doubling its current price. The evolution of Apple’s ecosystem, bolstered by artificial intelligence, positions the company for sustained growth. By 2040, the projected AAPL stock price may well reflect the company’s dominance in the smartphone market and its diversified revenue streams, solidifying its position in the NASDAQ.

Final Takeaways on Apple’s Stock Future

From 2025 to 2030 and beyond, AAPL remains a cornerstone for investors seeking technology exposure. With strong fundamentals, a commitment to innovation, and favorable market sentiment, the apple stock in 2030 shows signs of further growth.

For those interested in dynamic trading environments, Pocket Option offers a fast, flexible entry into Apple share trading.

Discuss this and other topics in our community!

FAQ

What are the most important factors to consider in apple stock price prediction 2030?

Key factors include Apple's innovation pipeline, market share in existing and new product categories, global economic conditions, competitive landscape, and potential regulatory changes affecting the tech industry.

How accurate can long-term stock price predictions be?

Long-term predictions inherently carry significant uncertainty. While models can provide valuable insights, they should be viewed as probability ranges rather than precise figures, and regularly updated as new information becomes available.

What role does artificial intelligence play in AAPL stock forecast 2030?

AI plays a dual role: it's used in creating more sophisticated prediction models that can process vast amounts of data, and it's also a key factor in Apple's future product development and market position, potentially impacting its stock value.

How do geopolitical factors affect apple stock price prediction 2030?

Geopolitical factors such as trade policies, international relations, and global economic shifts can significantly impact Apple's supply chain, market access, and overall financial performance, thus influencing long-term stock price predictions.

Can individual investors create reliable apple stock in 2030 forecasts?

While individual investors can utilize publicly available data and tools to create forecasts, professional-grade predictions typically require access to advanced analytical tools, comprehensive datasets, and deep industry expertise. Individuals should approach long-term predictions cautiously and consider multiple expert opinions.