- Industry trends in cinema attendance

- Technological advancements in theater experiences

- Competition from streaming services

- AMC’s ability to diversify revenue streams

- Macroeconomic conditions

AMC Stock Price Prediction 2030: Projecting Future Value

As investors look to the future, many are curious about the potential trajectory of AMC Entertainment Holdings, Inc. (AMC) stock. This article delves into the amc stock price prediction 2030, examining various factors that could influence the company's valuation over the next decade.

Understanding AMC’s Current Position

Before we explore the amc stock price prediction 2030, it’s essential to understand AMC’s current market position and recent performance. AMC Entertainment Holdings is one of the largest movie theater chains globally, with a significant presence in the United States and Europe.

| Metric | Value (as of 2023) |

|---|---|

| Market Capitalization | Approximately $2.5 billion |

| Revenue | $3.9 billion (2022) |

| Number of Theaters | 950+ |

| Number of Screens | 10,500+ |

The company has faced significant challenges in recent years, including the impact of the COVID-19 pandemic and the rise of streaming services. However, AMC has shown resilience through strategic initiatives and a loyal customer base.

AMC Stock Price Prediction for 2030 – Summary Based on 30+ Sources

AMC Entertainment Holdings, Inc. (AMC) stock price forecasts for 2030 vary significantly depending on the source and methodology used. Below is a comparison of projections from various reputable platforms:

| Source | Min Price | Avg Price | Max Price | Notes |

|---|---|---|---|---|

| CoinCodex | $0.45 | $1.39 | $3.45 | Predicts growth until 2029 followed by a decline in 2030. |

| BTCC | $6.15 | $7.07 | $8.63 | Expects gradual growth over time. |

| Skilling | $14.59 | $223.36 | $432.13 | Extremely wide range showing high uncertainty. |

| Stockscan.io | $8.55 | $12.09 | $15.63 | Forecasts notable price increase. |

| CoinPriceForecast (coinpriceforecast.com) | $12.22 | $13.14 | $14.05 | Expects stable upward trend. |

Factors Influencing AMC Stock Price Prediction 2030

Several key factors will likely play a role in shaping the amc stock price prediction 2030:

Let’s examine each of these factors in more detail to better understand their potential impact on AMC’s long-term stock performance.

1. Cinema Attendance Trends

The future of cinema attendance is a crucial factor in the amc stock forecast 2030. While streaming services have gained popularity, there’s still a strong demand for the theatrical experience.

| Year | Global Box Office Revenue (Billions USD) |

|---|---|

| 2019 (Pre-pandemic) | 42.5 |

| 2020 | 12.0 |

| 2021 | 21.3 |

| 2022 | 25.9 |

As the industry continues to recover, innovations in film production and marketing could drive increased attendance, potentially boosting AMC’s revenue and stock price.

2. Technological Advancements

AMC’s investment in cutting-edge theater technology could significantly impact the amc stock prediction 2030. Enhanced viewing experiences, such as IMAX, Dolby Cinema, and 4DX, may attract more moviegoers and justify premium pricing.

- Virtual Reality (VR) and Augmented Reality (AR) integration

- Improved sound systems and screen quality

- Interactive elements in theaters

These technological advancements could help AMC differentiate itself from home viewing options and maintain a competitive edge.

3. Streaming Service Competition

The rise of streaming platforms presents both challenges and opportunities for AMC. While it may impact traditional movie attendance, AMC has shown adaptability by partnering with streaming services for exclusive screenings and events.

| Strategy | Potential Impact |

|---|---|

| Exclusive theatrical windows | Maintain initial box office draw |

| Partnerships with streaming platforms | New revenue streams and audience engagement |

| Premium in-theater experiences | Differentiation from home viewing |

AMC’s ability to navigate this changing landscape will be crucial for the amc stock 2030 outlook.

4. Revenue Diversification

To achieve a positive amc stock 5 year forecast and beyond, the company may need to explore additional revenue streams. Some potential areas for diversification include:

- Event hosting and live entertainment

- E-sports and gaming tournaments

- Private theater rentals for corporate events

- Expanded food and beverage offerings

Successfully branching out into these areas could provide AMC with more stable and diverse income sources, potentially improving investor confidence and stock performance.

5. Macroeconomic Factors

Broader economic conditions will play a significant role in the amc stock price prediction 2030. Factors such as inflation, consumer spending habits, and overall economic growth can impact AMC’s performance and stock valuation.

| Economic Factor | Potential Impact on AMC Stock |

|---|---|

| Inflation | May affect ticket prices and operating costs |

| Consumer discretionary spending | Influences movie attendance and concession sales |

| GDP growth | Can impact overall market sentiment and stock valuations |

Investors considering long-term positions in AMC should monitor these macroeconomic trends and their potential effects on the company’s financial health.

Expert Opinions on AMC Stock Price Prediction 2030

While it’s challenging to provide a precise amc stock price prediction 2030, financial analysts and industry experts offer varying perspectives on the company’s long-term prospects.

| Analyst Sentiment | Key Points |

|---|---|

| Bullish | – Recovery in cinema attendance- Successful diversification efforts- Technological innovations driving growth |

| Neutral | – Balanced view of challenges and opportunities- Emphasis on adaptability to market changes |

| Bearish | – Concerns about long-term cinema industry trends- Competition from streaming services- Debt management challenges |

It’s important to note that these predictions are speculative and subject to change based on various factors affecting the company and the broader market.

Strategies for Long-Term Investors

For those considering AMC as a long-term investment with an eye on the amc stock price prediction 2030, consider the following strategies:

- Diversify your portfolio to manage risk

- Stay informed about industry trends and AMC’s strategic initiatives

- Monitor quarterly earnings reports and key performance indicators

- Consider dollar-cost averaging to mitigate market volatility

Why Wait Until 2030? Trade on Pocket Option Today

Long-term forecasts like the AMC stock price prediction for 2030 require years of patience, market shifts, and constant uncertainty. But why wait for a decade to see results, when you can trade price movements today and manage your capital in real time?

Pocket Option is a global trading platform launched in 2017. It gives you instant access to over 100 financial instruments — including stocks like AMC, currencies, and crypto — all without downloads or complex installations.

✔️ Forecast the direction — up or down — and earn up to 92% profit per trade if your forecast is correct.

What You Get with Pocket Option:

- Trade Now, Not Later Forget decade-long forecasts — act on AMC’s price trends today.

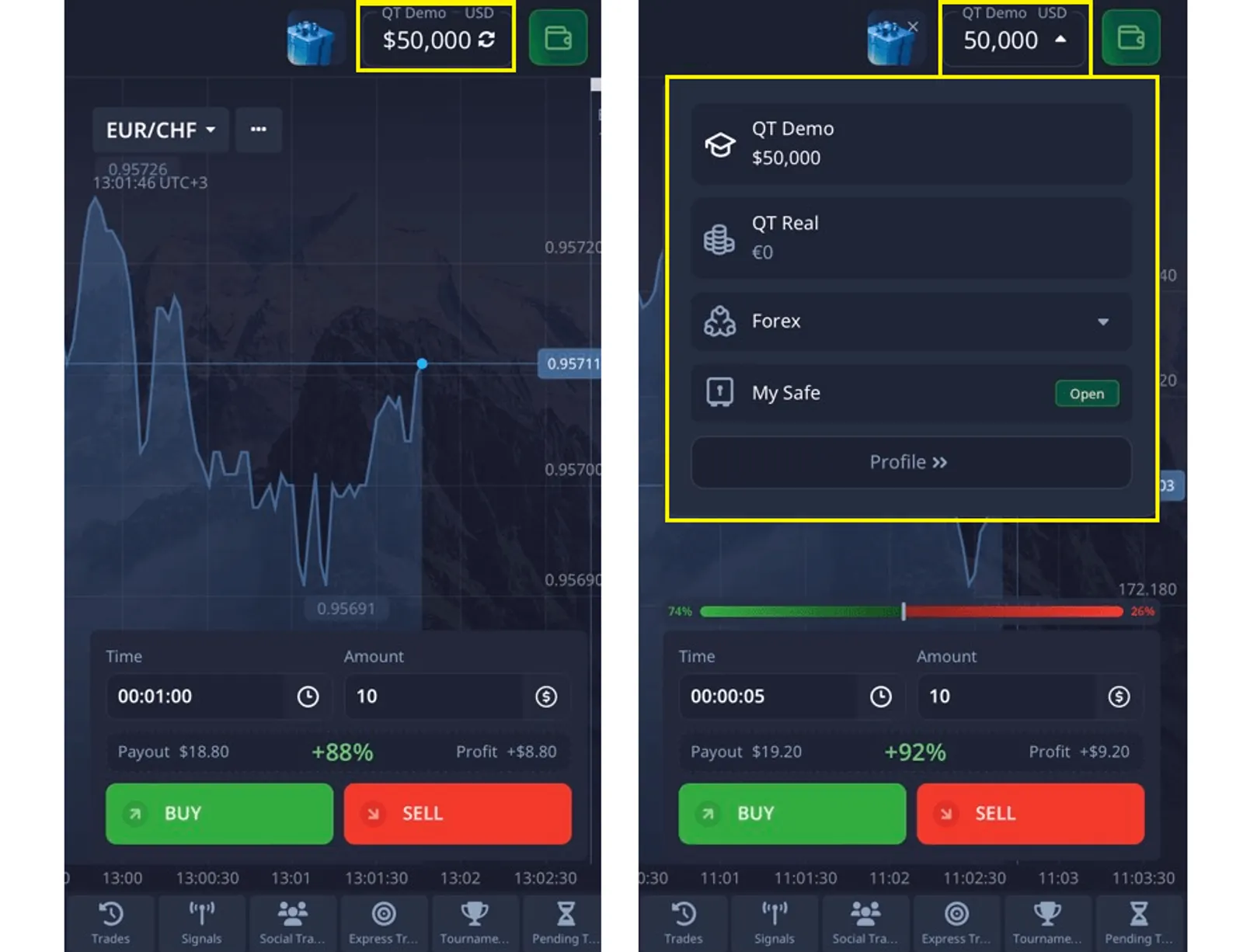

- $50,000 Demo Mode Learn and practice with virtual funds before investing real money.

- 100+ Assets Available Trade stocks, crypto, forex, and more with just $5 to start.

- No Installation Needed Access directly from your browser or mobile app.

Tools Built for Smarter Trading:

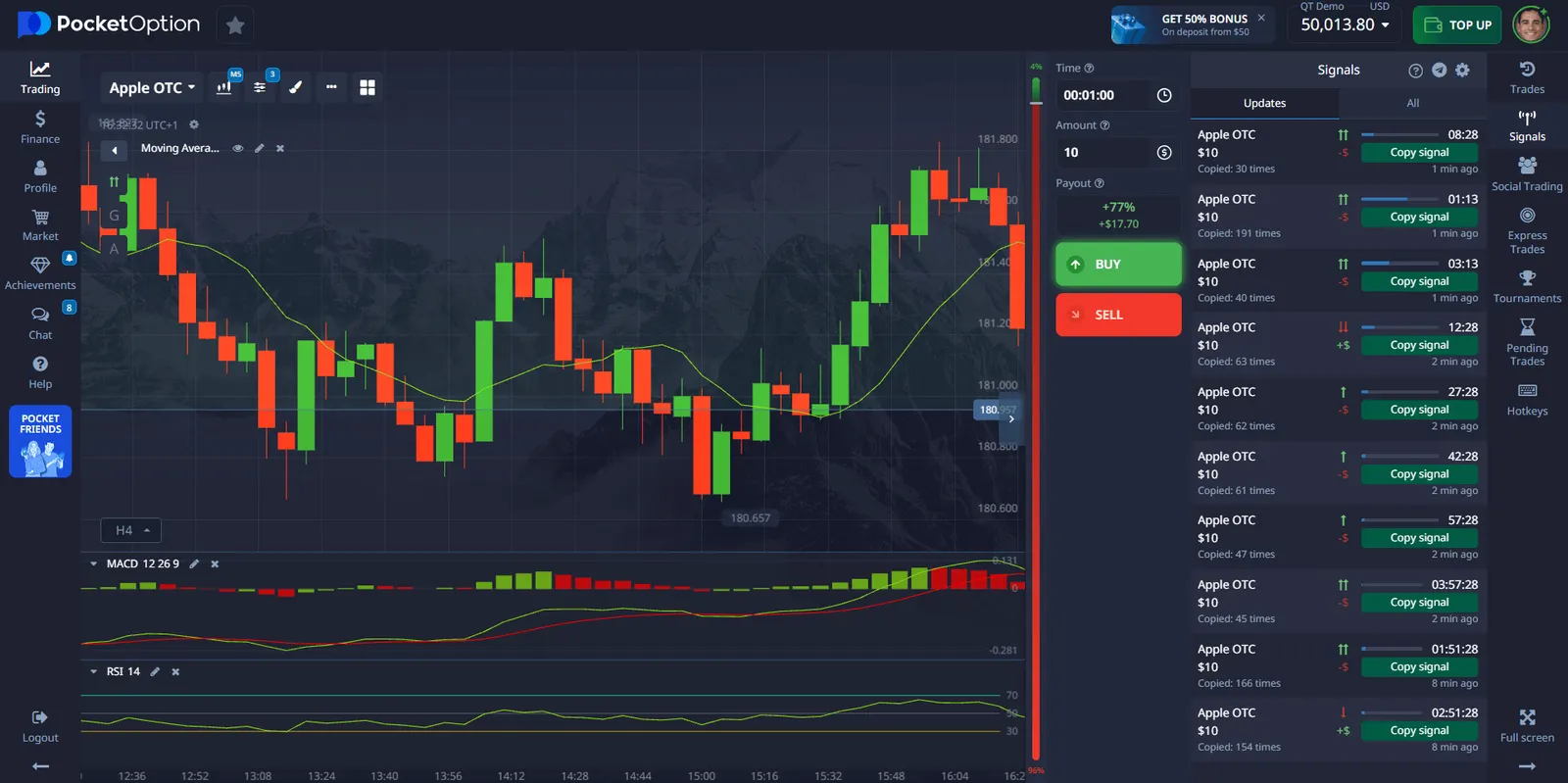

- Custom Charts & Indicators Analyze AMC stock trends with advanced tools and multiple timeframes.

- AI and Bots Automate your trading with smart strategies and algorithms.

- Copy Trading Follow experienced traders and grow your account while you learn.

- Trading Tournaments Compete, test your skills, and win real prizes.

Extra Perks for Every Trader:

- Bonuses & Promotions Boost your capital with seasonal offers and incentives.

- Flexible Transactions Choose from over 50 deposit and withdrawal methods.

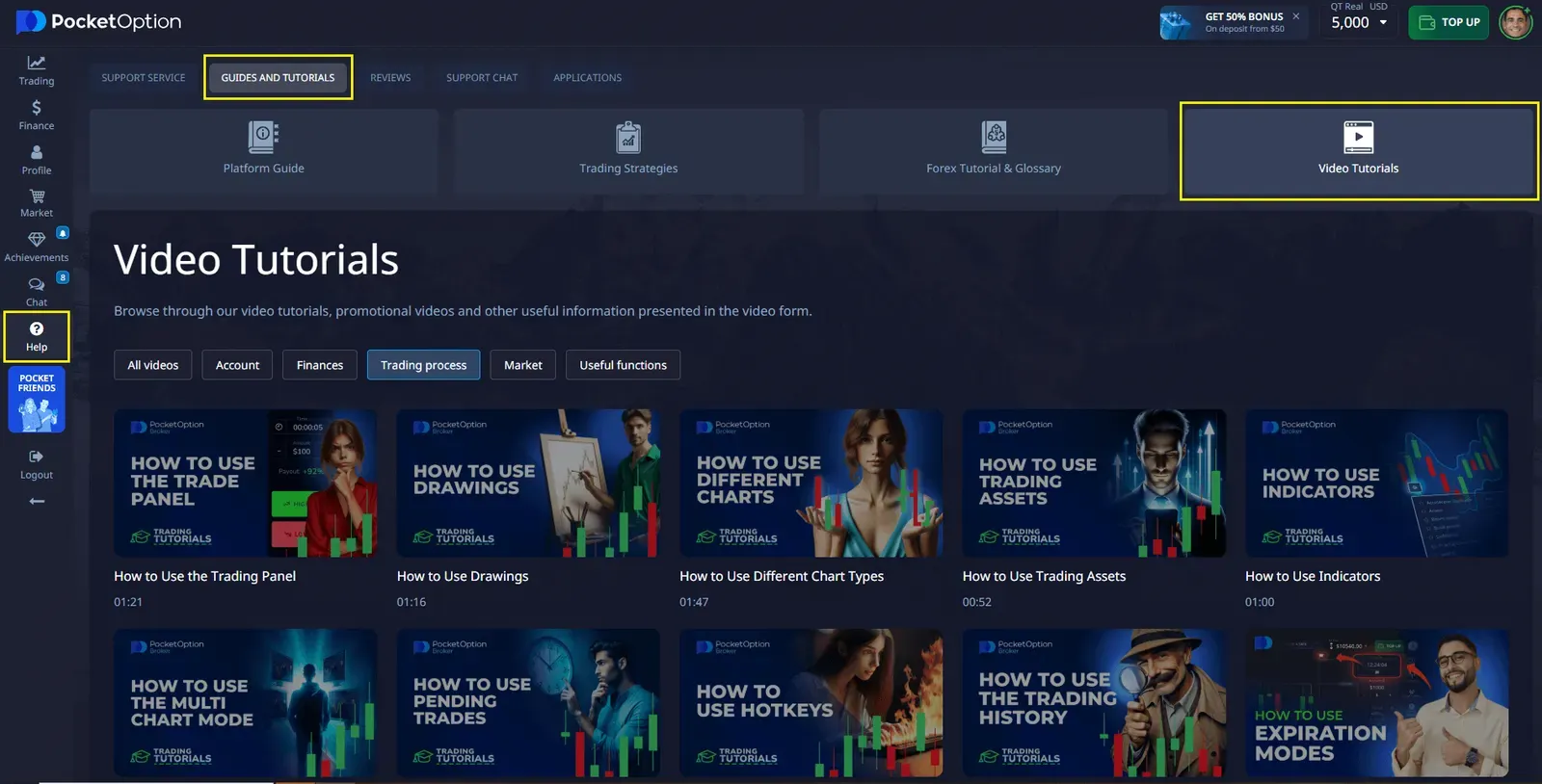

- Educational Hub Access trading strategies, trend analysis, and how-to videos.

Trade On the Go:

Use the Pocket Option mobile app to stay in the market from anywhere — during a coffee break or on your commute. Open trades in just seconds.

✔️ Practice with $50,000 in demo mode or start live with only $5.

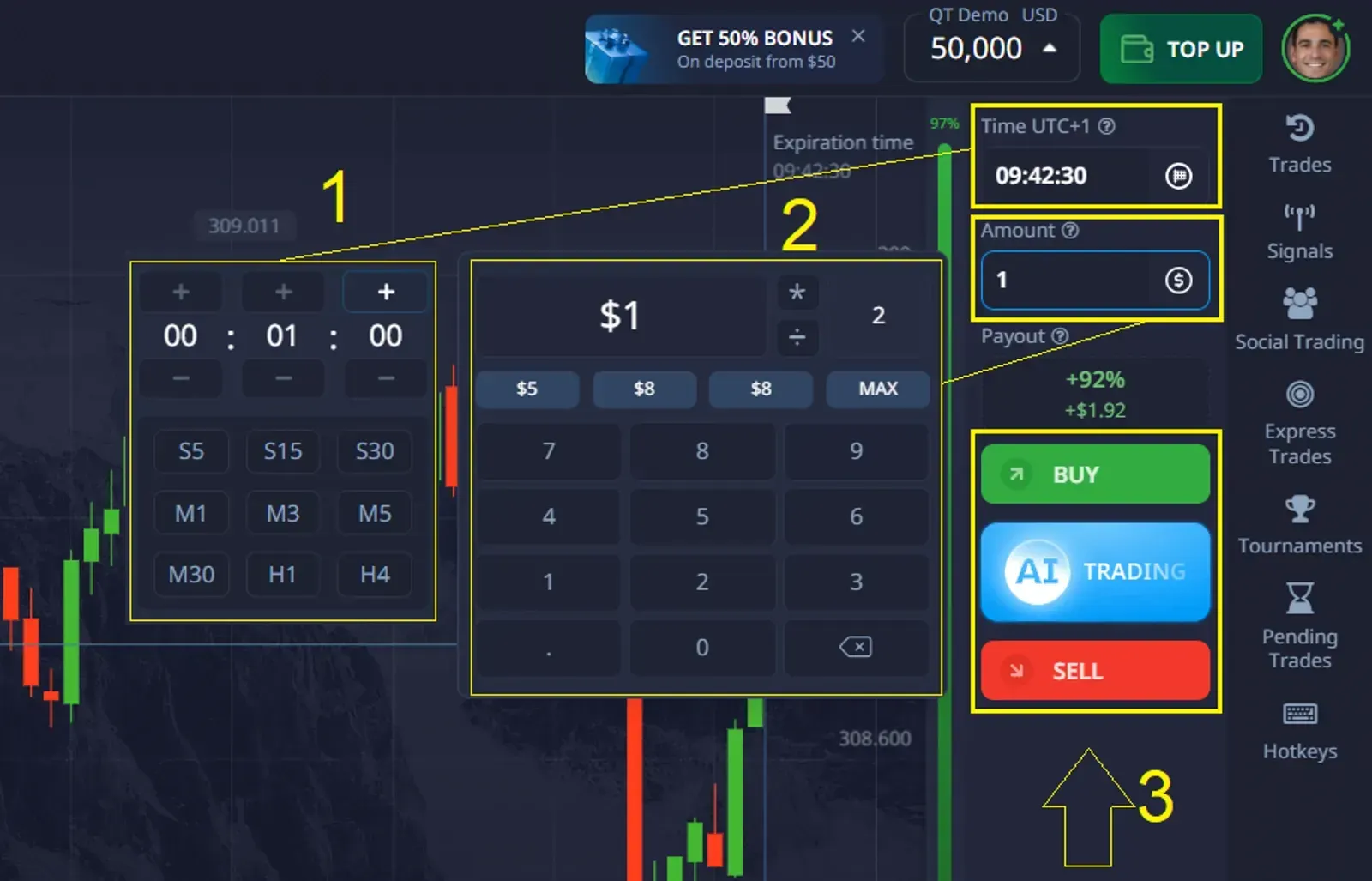

How to Open a Trade on Pocket Option:

- Choose your asset from 100+ instruments

- Analyze the chart using the market watch tool or technical indicators.

- Set your trade amount — from $1.

- Pick the trade duration — from 5 seconds to several hours.

- Make your forecast:

- If you think the price will rise, click BUY.

- If you think it will fall, click SELL.

- If your prediction is correct, you’ll earn up to 92% profit, which is shown before the trade.

✔️With a real account starting from just $5, you’ll unlock extra features like copy trading, cashback rewards, and more.

Conclusion

The AMC stock price prediction 2030 is subject to numerous variables and potential market shifts. While the company faces challenges from changing consumer habits and technological disruption, it also has opportunities for growth through innovation and diversification. Investors should carefully consider AMC’s adaptive strategies, industry trends, and broader economic factors when making long-term investment decisions. As with any investment, thorough research and consultation with financial advisors are recommended before making significant portfolio allocations.

FAQ

What factors will most significantly influence the AMC stock price in 2030?

Key factors include cinema attendance trends, technological advancements in theater experiences, competition from streaming services, AMC's revenue diversification efforts, and overall macroeconomic conditions.

Is AMC stock a good long-term investment?

The potential of AMC stock as a long-term investment depends on the company's ability to adapt to changing market conditions, manage debt, and capitalize on new opportunities. Investors should carefully assess their risk tolerance and conduct thorough research before making investment decisions.

How might streaming services impact AMC's future stock performance?

While streaming services present challenges to traditional cinema, AMC has shown adaptability by partnering with these platforms for exclusive screenings and events. The company's success in navigating this changing landscape will likely influence its stock performance.

What new revenue streams might AMC explore to boost its stock value by 2030?

Potential new revenue streams for AMC include event hosting, e-sports tournaments, private theater rentals for corporate events, and expanded food and beverage offerings.

How can I use Pocket Option to inform my AMC stock investment strategy?

Pocket Option offers various tools and resources that can help investors analyze market trends, access real-time data, and make informed decisions stock and other securities. However, always conduct your own research and consider consulting with a financial advisor before making investment choices.