- Dividend yield is attractive

- Strong brand and truck segment

- Big EV investment (but slow ROI)

- Exposure to tariffs, international risk

Why is Ford Stock So Cheap: Understanding the Value and Investment Potential

Ford stock remains surprisingly low despite the company’s legacy and market presence. This article explores the factors behind its valuation, from industry cycles to structural challenges.

Article navigation

- Historical Context of Ford’s Stock Performance

- Current Market Performance of Ford Stock

- Key Factors Affecting Ford’s Stock Price

- Is Ford a Good Stock to Buy Today?

- Is Ford a Dividend Trap?

- Why Is Ford Stock So Low Compared to GM?

- Long-Term vs. Short-Term Valuation Perspectives

- Investor Perception and Market Positioning

- The Role of Tariffs in Ford’s Profitability

- Potential Catalysts for Ford’s Stock

- Expert Opinions on Ford’s Valuation Outlook

- Final Takeaways on Ford Stock

Historical Context of Ford’s Stock Performance

Current Market Performance of Ford Stock

Ford’s current stock price remains well below historic highs, reflecting investor caution despite stable sales volume. While included in the S&P 500, Ford underperforms the index, highlighting challenges in profitability and revenue growth. The persistent gap between Ford’s valuation and its historical peak continues to raise concerns among value and income investors.

To understand the current valuation, we must examine Ford’s journey through market cycles. Traditional automakers like Ford Motor have historically traded at lower price-to-earnings ratios than companies in other sectors, reflecting the capital-intensive nature of the business and narrow profit margins. Many investors analyzing why Ford stock so low point to these industry-specific characteristics.

| Time Period | Key Events | Stock Price Impact |

|---|---|---|

| 2008–2009 | Financial Crisis | Severe decline, unlike GM, avoided bankruptcy |

| 2010–2015 | Recovery & Growth | Gradual improvement in valuation |

| 2016–2020 | EV Transition Begins | Stagnant prices amid disruption |

| 2021–Present | EV Investments & Supply Chain Issues | Volatile performance with limited upside |

Key Factors Affecting Ford’s Stock Price

Why is Ford stock so low? Several fundamental factors help explain why Ford stock is so cheap compared to both tech companies and even some automotive peers.

Industry Transformation and EV Transition

The automotive industry is undergoing a profound transformation toward electrification. While Ford Motor Company has committed billions to electric vehicle development, investors remain concerned about its ability to compete with EV-native companies like Tesla and BYD.

Ford’s Model E initiative, intended to streamline EV operations and establish a dedicated electric brand architecture, has faced operational delays. Production ramp-up for models like the Mach-E and F-150 Lightning has been slower than expected, with supply chain pressures compounding execution risks.

| EV Investment Area | Ford’s Commitment | Market Perception |

|---|---|---|

| Manufacturing Facilities | $11.4B in new plants | Positive but costly |

| Battery Technology | Partnership with SK Innovation | Behind leaders like Tesla |

| EV Models | Mustang Mach-E, F-150 Lightning | Strong initial demand |

| Software Development | Growing spend | Lags tech competitors |

Debt Burden and Financial Structure

Ford Motor carries significant debt, which many analysts cite as a reason for the low valuation. This reduces flexibility and raises perceived risk.

| Financial Metric | Ford’s Position | Industry Average |

|---|---|---|

| Debt-to-Equity Ratio | Higher than optimal | Moderate |

| Interest Coverage | Adequate but pressured | Stronger |

| Credit Rating | Lower investment grade | Varies |

| Dividend Yield | Attractive but risky | Lower but stable |

Is Ford a Good Stock to Buy Today?

As of 2025, Ford stock offers both value and risk. Its low valuation could attract value investors, especially those interested in EV without Tesla’s premium.

Is Ford a Dividend Trap?

Ford Motor’s dividend yield is among the highest in the automotive industry. But some analysts worry it’s not sustainable due to capital spending and debt.

In 2024, Ford maintained its dividend, but any earnings disruption in 2025 could threaten future payouts.

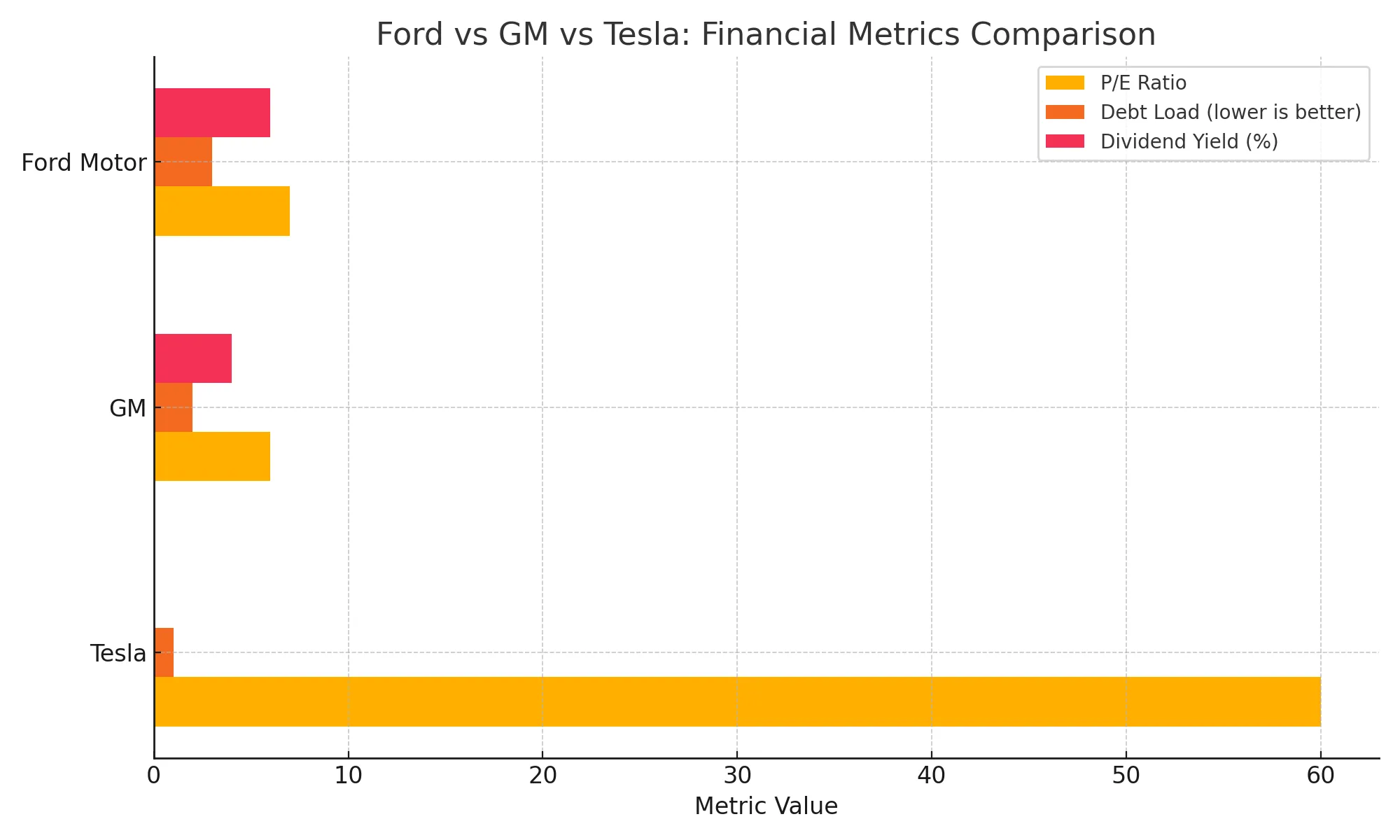

Why Is Ford Stock So Low Compared to GM?

Compared to General Motors (GM), Ford stock trades at a lower multiple. GM often gets more credit for clear EV execution and efficiency.

| Company | P/E Ratio | EV Focus | Debt Load | Dividend Yield |

|---|---|---|---|---|

| Ford Motor | ≈6–8 | Transition | High | High |

| GM | ≈5–7 | Accelerated | Moderate | Moderate |

| Tesla | ≈60+ | Pure EV | Low | None |

Long-Term vs. Short-Term Valuation Perspectives

Investor opinions on Ford vary widely. Some analysts remain optimistic about the automaker’s long-term prospects, driven by its shift to electric vehicles and digital services. Others focus on short-term hurdles such as high debt, tariff risk, and execution delays in the EV space. This divergence fuels stock price volatility and makes valuation analysis more nuanced.

Investor Perception and Market Positioning

Perception heavily influences stock price. Many investors still view Ford Motor Company as a legacy carmaker rather than an innovation leader.

| Investor Type | View on Ford | Stock Impact |

|---|---|---|

| Growth Investors | Lacks innovation | Negative |

| Value Investors | Cheap but risky | Mixed |

| Income Investors | High yield, uncertain | Cautious |

| ESG Investors | Improving, not leading | Neutral |

“Pocket Option made it simple for me to speculate on stocks ups and downs during earnings season. The platform is intuitive and their indicators helped me time short trades profitably.” — Elena M., day trader

The Role of Tariffs in Ford’s Profitability

Tariffs on raw materials and imported parts significantly impact Ford’s margins, especially in truck production where U.S.-based assembly depends on global components. In recent years, trade policy shifts have contributed to input cost volatility, making Ford stock more sensitive to geopolitical headlines compared to peers like GM and Tesla.

Potential Catalysts for Ford’s Stock

Even with obstacles, Ford stock could rise if certain developments occur:

- Scaled EV production

- Better tariff negotiation

- Software subscription growth

- Global partnerships

- Successful restructuring

Expert Opinions on Ford’s Valuation Outlook

Analysts remain divided.

“Ford has the infrastructure and brand strength, but execution is everything. If they can’t scale EVs with consistent margins, the stock will lag peers for years.” — Nathan Bloom, equity strategist, Apex Capital

“Ford’s transformation is undervalued. Once operating margins stabilize in the EV segment, re-rating will follow.” — Priya Desai, senior analyst, Velocity Research

Final Takeaways on Ford Stock

Ford stock reflects a blend of legacy challenges and EV transformation potential. The company must prove it can evolve faster, handle tariffs, and preserve dividends. For some, that’s opportunity — for others, it’s caution.

Disclosure policy: This article includes references to Ford Motor, GM, and Tesla (TSLA). Stocks mentioned are for educational purposes and do not constitute financial advice.

While Pocket Option does not allow direct trading of Ford Motor shares, the platform offers over 100 tradable assets, including major stock, forex, indices, and cryptocurrencies. ⚡ Main Pocket Option feature: Instead of buying or selling shares, you predict whether an asset’s price will rise or fall — and if you’re right, you can earn returns of up to 92%. Pocket Option works directly from your browser with no installation required, making it easy to trade on the go. Discuss this and other topics in our community!

FAQ

Why does Ford stock trade at a lower P/E ratio than tech companies?

Automotive companies typically trade at lower multiples due to their capital-intensive nature, cyclical business patterns, thin profit margins, and significant debt requirements for manufacturing operations.

Is Ford's dividend sustainable given its low stock price?

Ford's dividend has fluctuated historically based on profitability. The company aims to maintain its dividend but may adjust it based on cash flow needs, especially as it invests heavily in electric vehicle development.

How might Ford's EV transition affect its stock price?

Successful EV implementation could improve Ford's valuation over time, but the transition period involves high investment costs, uncertain margins, and competition that may continue to pressure stock performance short-term.

Does Ford's debt level significantly impact its stock price?

Yes, Ford's substantial debt burden increases perceived risk for investors and limits financial flexibility, contributing to lower stock multiples compared to less leveraged competitors.

How can investors analyze whether Ford stock is undervalued?

Investors should examine Ford's price-to-book ratio, dividend yield, cash flow generation, EV strategy progress, and compare these metrics to both historical norms and industry peers when assessing potential value.

Why is Ford stock so cheap despite strong sales?

Capital needs, tariff exposure, and legacy costs deter investors.

Is Ford a safe dividend stock?

Its dividend yield is high, but payout safety is debated by analysts.

Is Ford undervalued in 2025?

Yes, on metrics. But growth is less certain than Tesla or GM.