- A high TIE ratio means the company has substantial operating income to cover interest payments.

- A low times interest earned ratio can raise concerns about the firm’s solvency and financial risk.

- This ratio appears on the income statement and gives insight into how many times over a company can pay its total interest obligations using its EBIT.

- According to a 2024 report from Bloomberg, 78% of companies with TIE ratios above 4 had access to better credit terms than peers with ratios below 2.

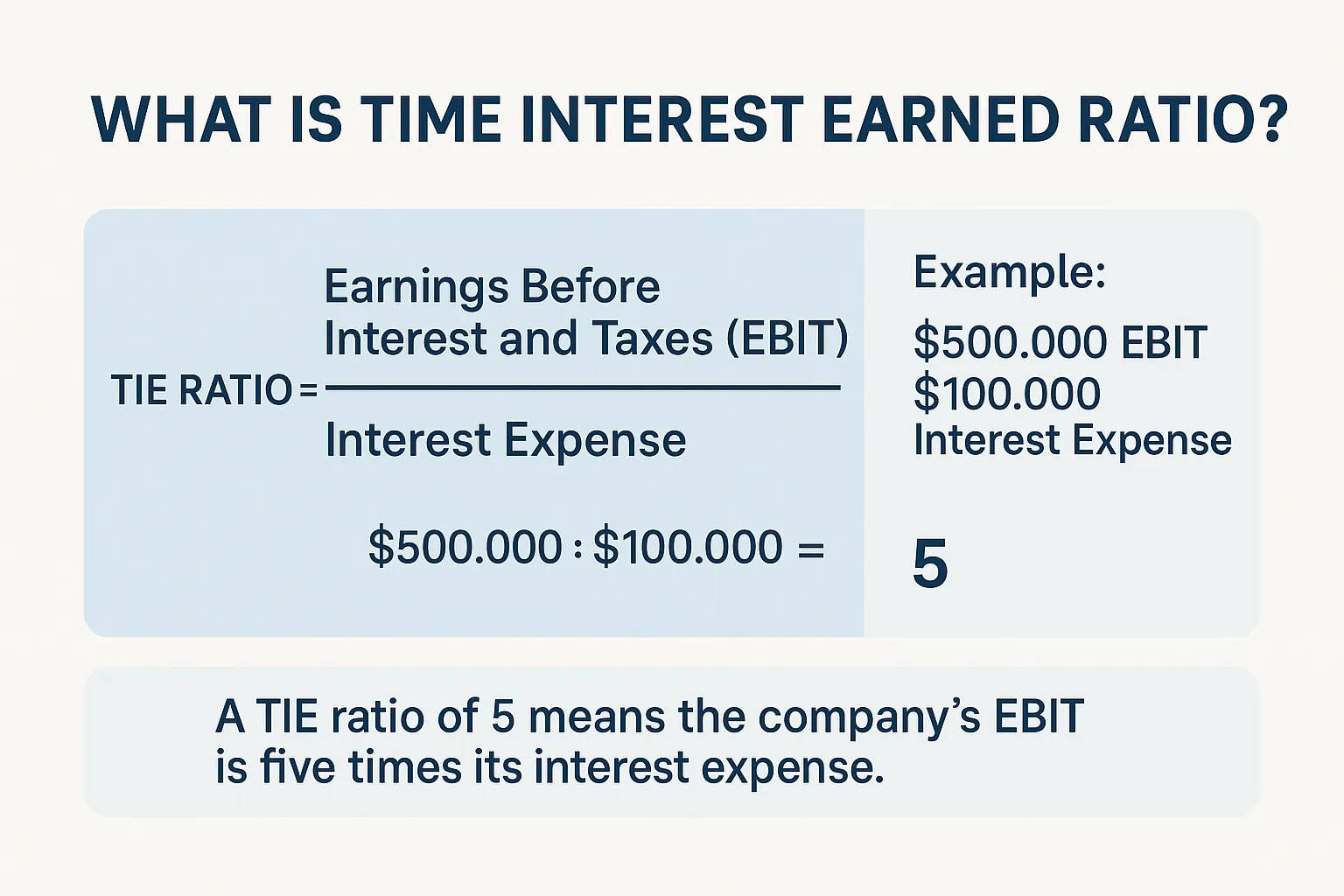

What is Time Ratio? Understanding the Time Interest Earned Ratio

Understanding what is time ratio is crucial for evaluating a company’s solvency. Specifically, this refers to the Time Interest Earned (TIE) ratio, a financial metric that measures how easily a company can meet its interest expense using its earnings before interest and taxes (EBIT). Often called the interest coverage ratio, the TIE ratio serves as a valuable gauge of a firm’s ability to handle its debt obligations. A high TIE ratio reassures investors and creditors that the company can pay its interest with ease, signaling strong financial health.

Article navigation

- Key Highlights of the Time Interest Earned Ratio

- Times Interest Earned Ratio Formula

- Components of the Time Interest Earned Ratio

- Importance of the Time Interest Earned Ratio

- Interpreting the TIE Ratio

- Real-World Applications of the TIE Ratio

- Limitations of the TIE Ratio

- Pocket Option: Trade with Confidence

- Learn More With Pocket Option

- Glossary

- Final Thoughts

“In today’s volatile markets, solvency indicators like the TIE ratio are not just metrics–they’re survival tools,” says Sarah Lin, Senior Analyst at Moody’s.

Key Highlights of the Time Interest Earned Ratio

Times Interest Earned Ratio Formula

The times interest earned ratio formula is straightforward:

EBIT / Total Interest Expense

Where:

- EBIT (Earnings Before Interest and Taxes) = Operating income

- Total Interest Expense = Interest payments due within the period

Example Calculation:

Let’s consider a company with:

- EBIT = $500,000

- Total Interest = $100,000

Then, TIE Ratio = 500,000 / 100,000 = 5

This implies the company can cover its interest expenses five times over, indicating robust financial stability.

Expert Insight: “When analyzing small-cap companies, a TIE ratio below 2 can be a deal-breaker unless balanced by exceptional growth prospects,” notes Kevin Dalton, CFA at BNY Mellon.

Components of the Time Interest Earned Ratio

| Component | Description |

|---|---|

| EBIT | Income before taxes and interest expenses |

| Total Interest Expense | Annual interest payable on outstanding debt |

Understanding each component is vital to interpreting what does times interest earned ratio mean and whether the company can pay its obligations efficiently.

Importance of the Time Interest Earned Ratio

The TIE ratio is not just another financial number. It provides meaningful insights:

- Debt Management Indicator

A high TIE ratio suggests the company is well-positioned to manage existing debt, which can help secure favorable lending terms. - Solvency Assessment

Creditors often use tie ratios to determine if a company is a low-risk borrower. If the TIE ratio falls below 2.0, it may indicate potential cash flow issues. - Investment Evaluation

Investors use the TIE ratio to assess financial health. A stable or rising TIE ratio often correlates with solid management and operational performance.

Unique Insight: Companies in capital-intensive industries like utilities or telecom often operate with lower TIE ratios due to predictable cash flows.

Interpreting the TIE Ratio

What Is Considered a Good Time Interest Earned Ratio?

| TIE Ratio Range | Interpretation |

|---|---|

| < 1.5 | High risk of default |

| 1.5 – 2.5 | Moderate coverage, needs attention |

| > 2.5 | Generally considered healthy and low-risk |

Different industries may have different standards, but typically, a TIE ratio of 2.5 or above is considered favorable.

Data Point: S&P Global reports that among Fortune 500 companies, the average TIE ratio in 2023 was 4.2.

Impact of Operating Income

Since EBIT is the numerator in the time interest earned ratio formula, any change in operating income directly influences the ratio. For example, a sudden drop in sales might reduce EBIT, causing the TIE ratio to fall and signaling increased financial risk.

Real-World Applications of the TIE Ratio

- Financial Planning

Companies use the TIE ratio during budgeting to evaluate how much debt they can safely take on. - Loan Approval

Banks and financial institutions look closely at tie ratios when approving corporate loans. - Investment Screening

Investors include TIE analysis in their due diligence before committing capital.

Expert Recommendation: Combine TIE with interest coverage from cash flows to get a more complete picture of debt sustainability, advises Emily Royston, Managing Director at JP Morgan.

Practical Example: Comparing Two Companies

| Company | EBIT ($) | Interest Expense ($) | TIE Ratio |

|---|---|---|---|

| AlphaTech | 600,000 | 100,000 | 6.0 |

| BetaCorp | 400,000 | 200,000 | 2.0 |

While both companies are profitable, AlphaTech shows greater ability to meet debt obligations, making it potentially a more stable investment.

Limitations of the TIE Ratio

While insightful, the TIE ratio has its caveats:

- Does not consider principal repayments

- Excludes taxes that might affect cash flow

- May be distorted by one-time gains or losses

Hence, always use the TIE ratio in combination with other metrics like current ratio, debt-to-equity, or cash flow analysis.

Pocket Option: Trade with Confidence

Whether you’re analyzing the TIE ratio of major tech companies or evaluating small caps, Pocket Option lets you trade 100+ assets 24/7-including stocks, currencies, and cryptocurrencies. Use detailed charts, bots, copy trading and real-time financial data to back your decisions.

Learn More With Pocket Option

Pocket Option offers educational resources, a risk-free demo account, and access to advanced trading tools. Whether you’re new or experienced, we help you trade with clarity and confidence.

Glossary

| Term | Definition |

|---|---|

| EBIT | Earnings Before Interest and Taxes |

| Interest Expense | Total cost of servicing debt |

| Time Interest Earned | Number of times EBIT covers interest expense |

| Income Statement | Financial document showing company performance |

| Operating Income | Profit from business operations before interest/taxes |

Final Thoughts

Understanding what is time ratio and the times interest earned ratio formula equips you to analyze a company’s solvency with confidence. It’s a vital part of any comprehensive financial statement analysis. Whether you’re an investor, analyst, or student, mastering the TIE ratio is essential to making sound financial decisions.

Insider Tip: Use rolling averages of TIE ratios over multiple quarters to identify trends and reduce the impact of temporary fluctuations.

FAQ

How can time ratios be used in day-to-day trading?

Time ratios can be utilized in daily trading by offering insights into a company's operational efficiency over time. For instance, a trader might examine the accounts receivable turnover ratio to assess how swiftly a company collects on its credits, influencing stock price movements and trading decisions.

What is the significance of a TIE ratio below 1?

A TIE ratio below 1 signifies that a company is not generating sufficient earnings to cover its interest expenses, indicating financial distress. This is a warning sign for investors and creditors, as it implies a higher risk of default and financial instability.

How do time ratios compare with profitability ratios?

Time ratios emphasize performance over periods, revealing trends in a company's operations, while profitability ratios provide a snapshot of a company's ability to generate profit from its revenue. Both are essential for a comprehensive financial analysis but serve distinct purposes.

Can time ratios predict future company performance?

While time ratios themselves do not forecast future performance, they offer valuable insights into trends and operational efficiency that can help investors make informed predictions about a company's future financial health.

Why are time ratios important for Pocket Option traders?

For Pocket Option traders, time ratios offer an analytical advantage by providing a deeper understanding of a company's financial performance over time. This can lead to more informed trading decisions, in line with the platform's focus on equipping traders with comprehensive data analysis tools.