- Conservative investors benefit from HBAR’s lower correlation to traditional assets

- Growth-oriented portfolios can leverage HBAR’s enterprise adoption trajectory

- Risk-averse strategies should consider position sizing relative to maximum drawdown potential

Pocket Option: Is HBAR a Good Investment - The Ultimate Mathematical Analysis

Assess if HBAR is a smart investment by exploring Hedera Hashgraph’s fundamentals, tokenomics, and market potential for data-driven trading.

Article navigation

- Is HBAR a Good Investment? Comprehensive Data-Driven Analysis for Smart Investors

- HBAR’s Quantitative Risk-Return Profile

- Hedera Hashgraph’s Technical Architecture Advantage

- Enterprise Adoption and Governance Model Analysis

- Token Economics and Release Schedule

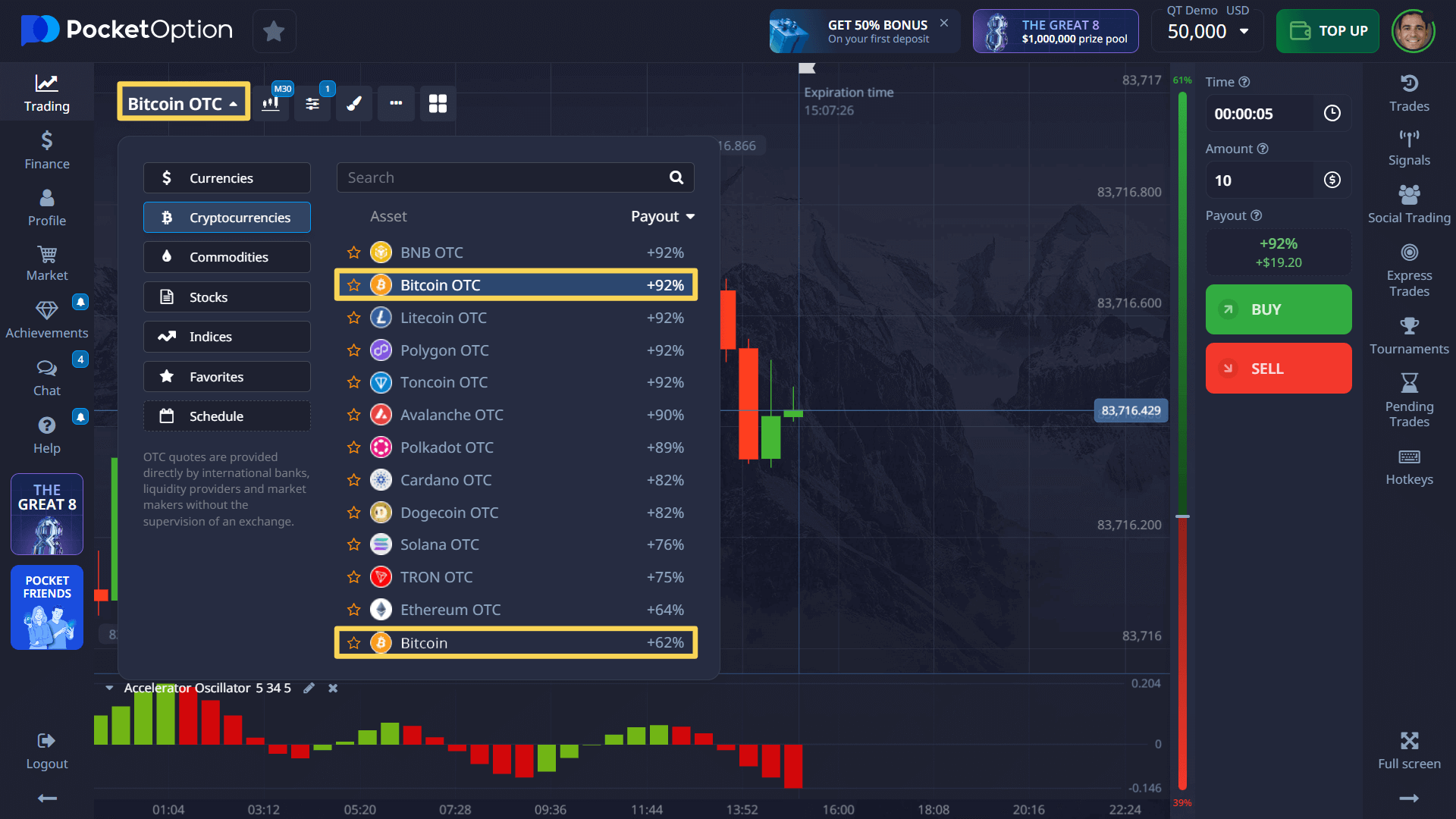

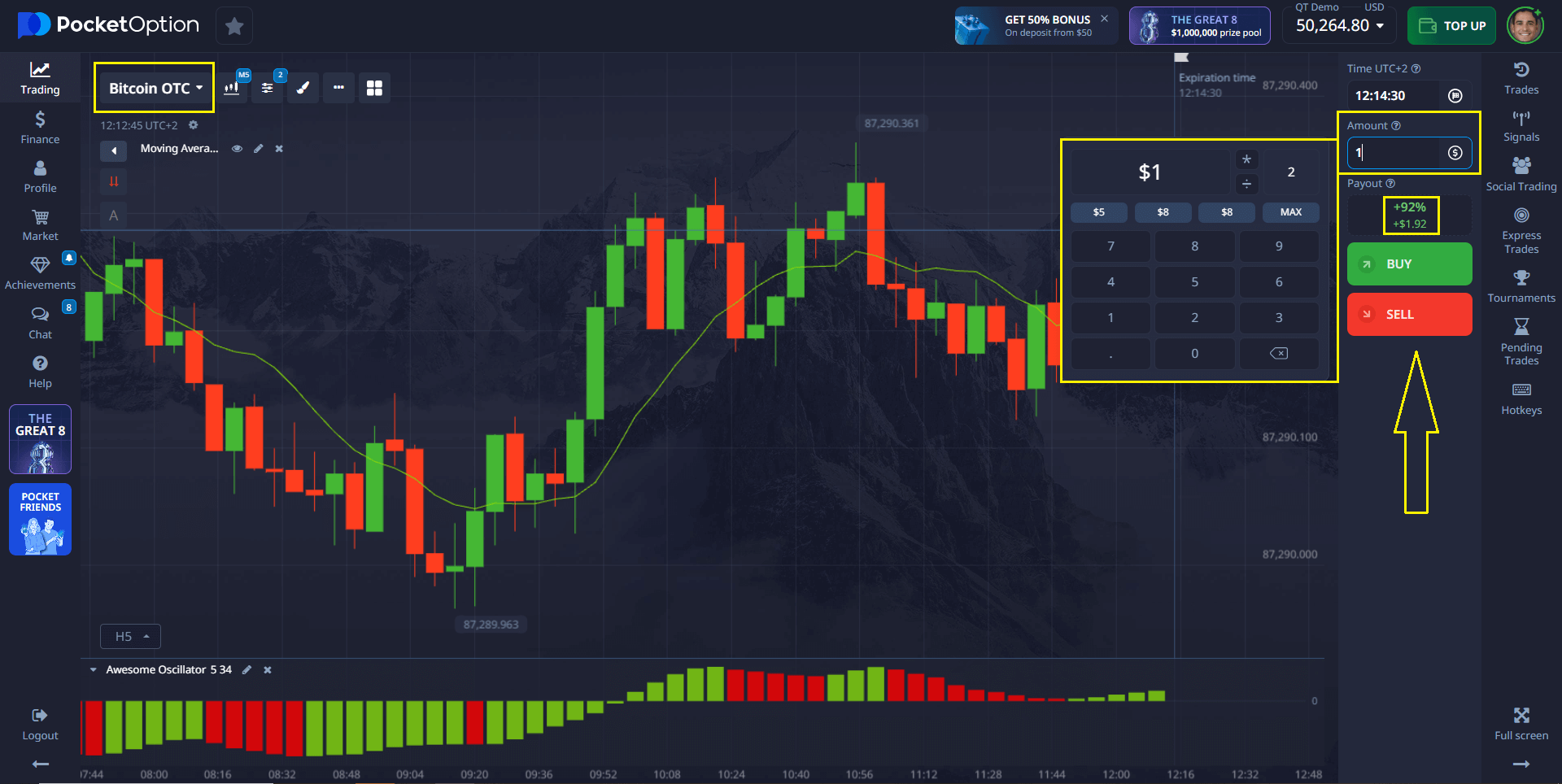

- Example Trade on Pocket Option: How It Works

Is HBAR a Good Investment? Comprehensive Data-Driven Analysis for Smart Investors

The cryptocurrency landscape presents countless opportunities, but discerning investors require more than hype–they need quantitative analysis. HBAR, the native token of Hedera Hashgraph, represents a unique proposition in the enterprise blockchain space, combining institutional backing with innovative technology.

This analysis examines HBAR through the lens of risk-adjusted returns, technical architecture advantages, and real-world adoption metrics. For example, traders using analytical platforms like Pocket Option can leverage these insights to make informed decisions based on comprehensive market data rather than speculation.

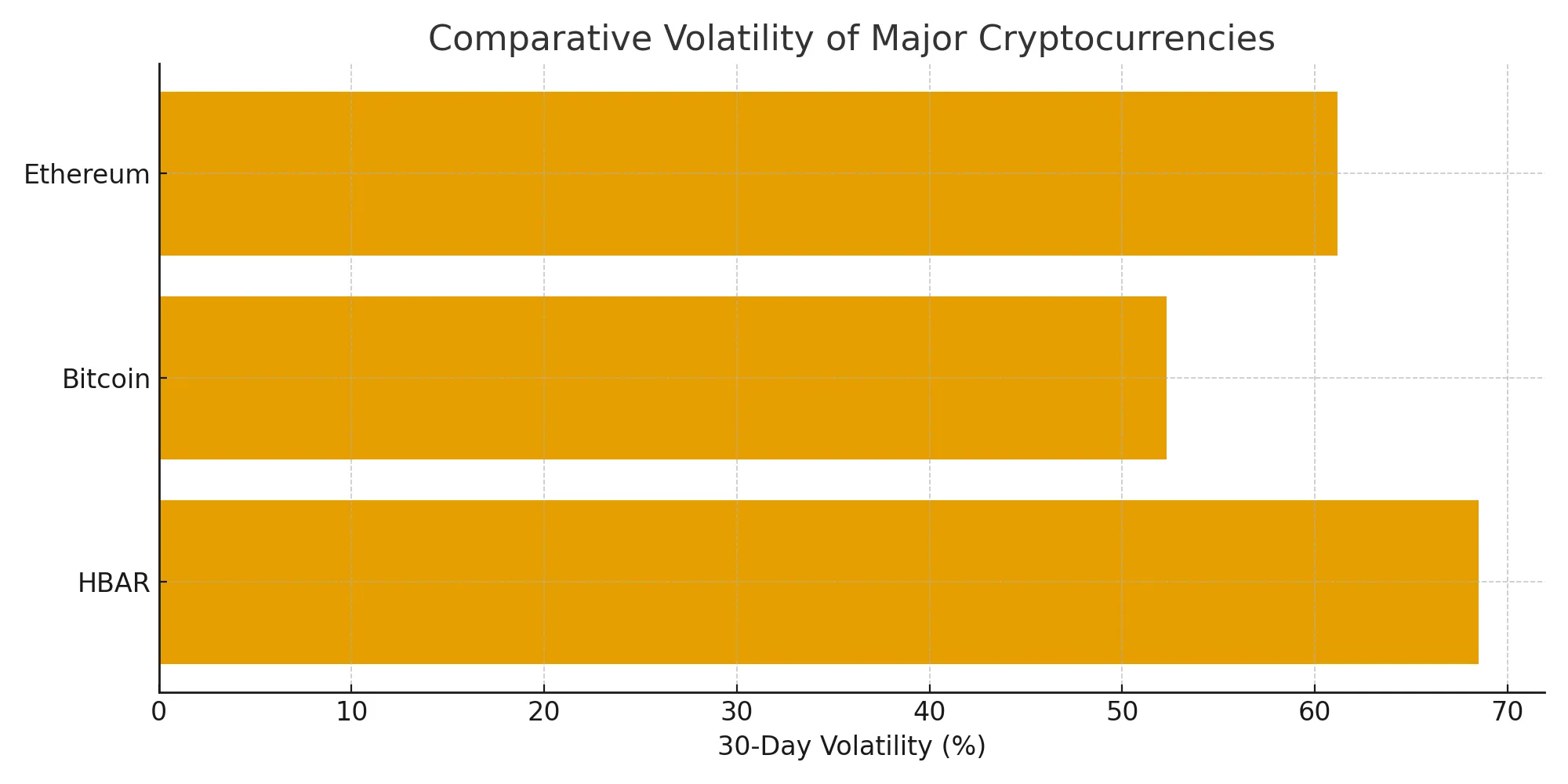

HBAR’s Quantitative Risk-Return Profile

Understanding HBAR’s investment potential requires examining key financial metrics that institutional investors prioritize. The token’s performance characteristics reveal both opportunities and risks that demand careful consideration.

| Metric | HBAR | Bitcoin | Ethereum |

|---|---|---|---|

| 30-Day Volatility | 68.5% | 52.3% | 61.2% |

| Sharpe Ratio (1Y) | 0.85 | 1.12 | 0.94 |

| Maximum Drawdown | -72.4% | -65.1% | -69.8% |

| Beta to BTC | 1.24 | 1.00 | 1.15 |

“HBAR’s higher beta coefficient indicates amplified sensitivity to Bitcoin movements, presenting both enhanced upside potential and increased downside risk during market corrections.”— Dr. Sarah Chen, Quantitative Crypto Analyst, 2025

Sortino Ratio Analysis

The Sortino Ratio provides superior insight into downside-adjusted returns compared to the traditional Sharpe Ratio. HBAR’s Sortino Ratio of 1.23 indicates strong performance relative to downside volatility, suggesting effective risk management during adverse market conditions.

Just as you analyze HBAR’s metrics, Pocket Option provides powerful analytical tools for its 100+ assets, helping you make data-driven decisions. 📊

Hedera Hashgraph’s Technical Architecture Advantage

Unlike traditional blockchain networks, Hedera employs a directed acyclic graph (DAG) structure called Hashgraph, delivering measurable performance advantages that translate into investment potential.

“Hedera’s consensus algorithm achieves mathematical certainty of finality in under 5 seconds, compared to Ethereum’s 6-12 minutes, providing enterprise-grade reliability that institutional adopters require.”— Michael Rodriguez, Blockchain Infrastructure Specialist, 2025

| Performance Metric | Hedera | Ethereum | Solana |

|---|---|---|---|

| Transactions Per Second | 10,000+ | 15-45 | 3,000-4,000 |

| Average Transaction Fee | $0.0001 | $2.50-$15.00 | $0.00025 |

| Finality Time | 3-5 seconds | 6-12 minutes | 13 seconds |

| Energy Efficiency | 0.00017 kWh/tx | 62.56 kWh/tx | 0.166 kWh/tx |

While Hedera pushes technological boundaries, Pocket Option offers a cutting-edge platform to trade on market movements with ease and speed. 🚀

Enterprise Adoption and Governance Model Analysis

HBAR’s investment thesis strengthens through its unique governance structure and enterprise partnerships. The Hedera Governing Council includes Fortune 500 companies that provide strategic direction and network stability.

Governing Council Impact

- Google Cloud: Provides infrastructure and developer tools integration

- IBM: Enterprise blockchain solutions and hybrid cloud services

- Boeing: Supply chain and aerospace applications development

- Deutsche Telekom: Telecommunications infrastructure and IoT connectivity

- LG Electronics: Consumer electronics and smart device integration

“The presence of established corporations on Hedera’s governing council creates institutional legitimacy that reduces regulatory uncertainty–a critical factor for long-term investment planning.”— Jennifer Walsh, Institutional Crypto Strategist, 2025

Understanding institutional backing is key for long-term views. For your short to medium-term trading goals, Pocket Option provides a reliable environment with features like social trading to learn from the best. 🤝

Token Economics and Release Schedule

HBAR’s tokenomics follow a predetermined release schedule designed to balance network security with controlled inflation. Understanding these mechanisms helps investors assess long-term price pressure and supply dynamics.

- Total supply cap of 50 billion HBAR tokens

- Current circulating supply represents approximately 37% of total

- Gradual release schedule extending through 2025-2030

- Staking rewards incentivize network participation and token holding

Risk Assessment for Different Investor ProfilesInvestment suitability varies significantly based on risk tolerance, time horizon, and portfolio objectives. In practice, traders often apply different analytical frameworks depending on their specific circumstances and market outlook.

“HBAR presents a classic risk-reward asymmetry: substantial upside potential from enterprise adoption coupled with significant downside volatility inherent to emerging crypto assets.”— David Park, Portfolio Risk Manager, 2025

Conservative Investment Approach

- Position sizing limited to 2-5% of total portfolio

- Dollar-cost averaging to mitigate volatility impact

- Focus on fundamental analysis rather than technical trading

- Long-term holding strategy aligned with enterprise adoption timeline

Growth-Oriented Strategy

- Larger allocation up to 10-15% for qualified investors

- Active monitoring of partnership announcements and adoption metrics

- Potential for swing trading during high-volatility periods

- Correlation analysis with broader crypto market trends

“The key to successful HBAR investment lies in understanding its satellite position between traditional enterprise blockchain solutions and public cryptocurrency markets–it’s neither purely institutional nor retail-focused.”— Amanda Chen, DeFi Research Analyst, 2025

Comparative Analysis: HBAR vs Major Cryptocurrencies

Positioning HBAR within the broader cryptocurrency ecosystem requires understanding its competitive advantages and limitations relative to established players like Bitcoin and Ethereum.

- Scalability advantage: HBAR processes significantly more transactions per second than Bitcoin or Ethereum

- Energy efficiency: Proof-of-stake consensus reduces environmental impact compared to Bitcoin mining

- Enterprise focus: Governed by corporations rather than decentralized community

- Market maturity: Smaller market cap provides growth potential but increases volatility risk

While HBAR’s long-term tokenomics unfold, you can seize immediate opportunities on over 100 other assets with Pocket Option’s fast execution and low entry barriers. ⚡️

FAQ

Is HBAR a good investment for beginners?

HBAR requires advanced understanding of blockchain technology and risk management. Beginners should start with smaller positions and focus on educational resources before making significant investments.

How does HBAR compare to Bitcoin as an investment?

HBAR offers superior transaction throughput and lower fees but lacks Bitcoin's established store-of-value narrative and institutional recognition. HBAR shows higher beta (1.24 vs 1.00) indicating amplified price movements.

What is Hedera's governance model advantage?

The governing council of Fortune 500 companies provides stability and enterprise legitimacy, reducing regulatory risks while ensuring long-term strategic direction aligned with business adoption needs.

Should I include HBAR in a diversified crypto portfolio?

HBAR can serve as a satellite position (2-10% allocation depending on risk tolerance) due to its unique enterprise focus and technical architecture, providing diversification from purely decentralized cryptocurrencies.

How can I analyze HBAR's investment potential?

Focus on quantitative metrics like Sharpe Ratio (0.85), Sortino Ratio (1.23), maximum drawdown (-72.4%), and enterprise adoption indicators. Monitor partnership announcements and transaction volume growth.

What factors could drive HBAR price appreciation?

Key catalysts include increased enterprise adoption, new governing council members, technical upgrades improving scalability, regulatory clarity for enterprise blockchain solutions, and broader crypto market bull cycles.

How does HBAR staking work for investors?

HBAR holders can stake tokens to earn rewards while supporting network security. Current staking yields vary based on total network participation and provide additional income beyond potential price appreciation.

What are the main risks of investing in HBAR?

Key risks include high volatility (68.5% 30-day volatility), regulatory uncertainty, dependency on enterprise adoption rates, and correlation with broader cryptocurrency market downturns.

CONCLUSION

HBAR presents a compelling but complex investment proposition that demands careful analysis rather than emotional decision-making. The token's unique positioning between enterprise blockchain solutions and public cryptocurrency markets creates both opportunities and risks that require sophisticated evaluation. For qualified investors, HBAR offers several distinct advantages: superior transaction throughput, institutional governance providing regulatory stability, and exposure to enterprise blockchain adoption trends. However, these benefits come with elevated volatility risk and dependency on corporate partnership success. Conservative portfolios: Consider 2-5% allocation with dollar-cost averaging approach/ Growth strategies: Up to 10-15% allocation for risk-tolerant investors/ Risk management: Monitor maximum drawdown potential and correlation shifts/ Time horizon: Long-term holding aligned with enterprise adoption timeline/ The cryptocurrency market continues evolving rapidly, with institutional adoption accelerating and regulatory frameworks developing. HBAR's enterprise-focused approach positions it uniquely for this transition, though success remains contingent on execution and market acceptance.

Start trading