- Market sentiment and media influence

- Macroeconomic indicators (e.g., inflation, interest rates)

- Crypto-specific regulations and technology

- Whale movements and trading volumes

If I Invest $1000 in Bitcoin Today, How Much Is It Worth 2025?

Bitcoin has become a global asset, and in 2025, a $1,000 investment could grow 7x–30x long-term, according to analysts.

If I Invest 1000 in Bitcoin Today How Much Is It Worth 2025?

The Current State of Bitcoin

Bitcoin maintains a leading position among digital assets, setting the pace for overall digital asset growth. As of June 2025, Bitcoin is trading around $65,000. Institutional adoption is rising, especially after multiple spot Bitcoin ETFs launched in the U.S. and Europe. The asset is widely viewed as digital gold, with major banks, hedge funds, and governments holding BTC. This form of cryptocurrency investment remains a top asset class for growth-seeking investor portfolios.

Expert Insight: According to Mike Novogratz, CEO of Galaxy Digital, “Bitcoin is now a macro asset, influenced by the same factors that drive the broader financial markets.” If you’re wondering, if i invest 1000 in bitcoin today how much is it worth 2025, the answer depends heavily on institutional momentum, the effects of the Bitcoin halving, and broader market conditions.

Bitcoin Price Forecast and Historical Context

Here’s how Bitcoin has evolved over time:

| Year | Price |

|---|---|

| 2010 | <$0.01 |

| 2013 | ~$100 |

| 2017 | ~$20,000 |

| 2021 | ~$69,000 (ATH) |

| 2022 | ~$16,000 (crash) |

| 2024 | ~$40,000 (post-halving recovery) |

| 2025 | ~$65,000 |

This trajectory reflects Bitcoin’s volatility but also its potential for significant Bitcoin ROI.

Investment Trends

With increasing integration into portfolios and the growing crypto ETF market, the environment for cryptocurrency investment in Bitcoin is more sophisticated than ever. Many investors ask, “how much is it worth in 2025 if i put 1000 in bitcoin today” or “if i invest $1,000 in bitcoin today how much is it worth 2025?”

Crypto Volatility: A Defining Feature of Bitcoin. What Causes Bitcoin’s Crypto Volatility?

Bitcoin’s volatility stems from:

Expert Quote: “Volatility is the price you pay for performance,” says Cathie Wood of ARK Invest. “Bitcoin’s long-term trajectory is still intact despite the short-term swings.”

Historical Volatility Patterns

Past events impacting Bitcoin’s price include:

- Bitcoin halving events (2012, 2016, 2020, 2024)

- China’s mining ban (2021)

- Spot ETF approvals (2024)

Risk Management Strategies

- Diversify your crypto portfolio

- Use ETFs or stablecoin hedging

- Apply stop-loss and take-profit rules

- Engage in dollar-cost averaging (DCA)

Want to reduce volatility risk?

Evaluating Bitcoin as an Investment

Any sound Bitcoin price forecast must consider the fundamental investment thesis for the asset.

Investment Thesis for Bitcoin

Bitcoin offers:

- A decentralized store of value

- Hedge against fiat currency devaluation

- Transparent supply (max 21 million BTC)

- Increasing integration with traditional finance

Comparing Bitcoin to Traditional Investments

Bitcoin vs Traditional Assets

| Asset | Returns (5Y) | Risk | Liquidity |

|---|---|---|---|

| Bitcoin | ~700% | High | High |

| S&P 500 | ~70% | Medium | High |

| Gold | ~30% | Low | High |

Insight: Bitcoin offers asymmetric upside, critical for modern portfolios.

Unique Insight: While traditional assets provide stability, Bitcoin offers asymmetric upside potential–essential for modern portfolio theory in 2025.

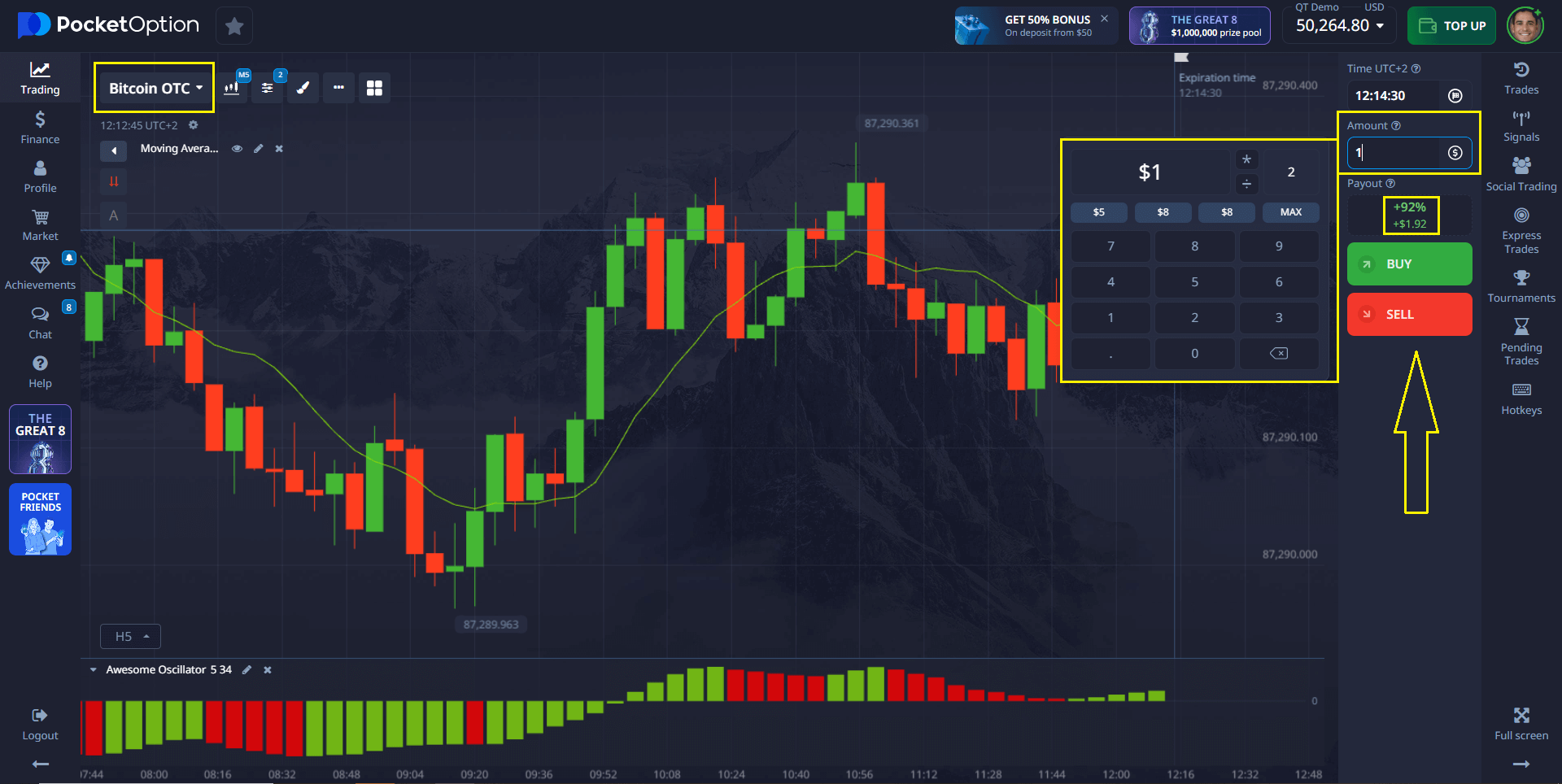

Long vs. Short-Term Investment Perspectives

If you invest 1000 in bitcoin today, you have two main approaches:

- Long-term: Accumulate and hold for years, e.g., until 2030

- Short-term: Use technical analysis and tools (like Pocket Option) to speculate on price moves

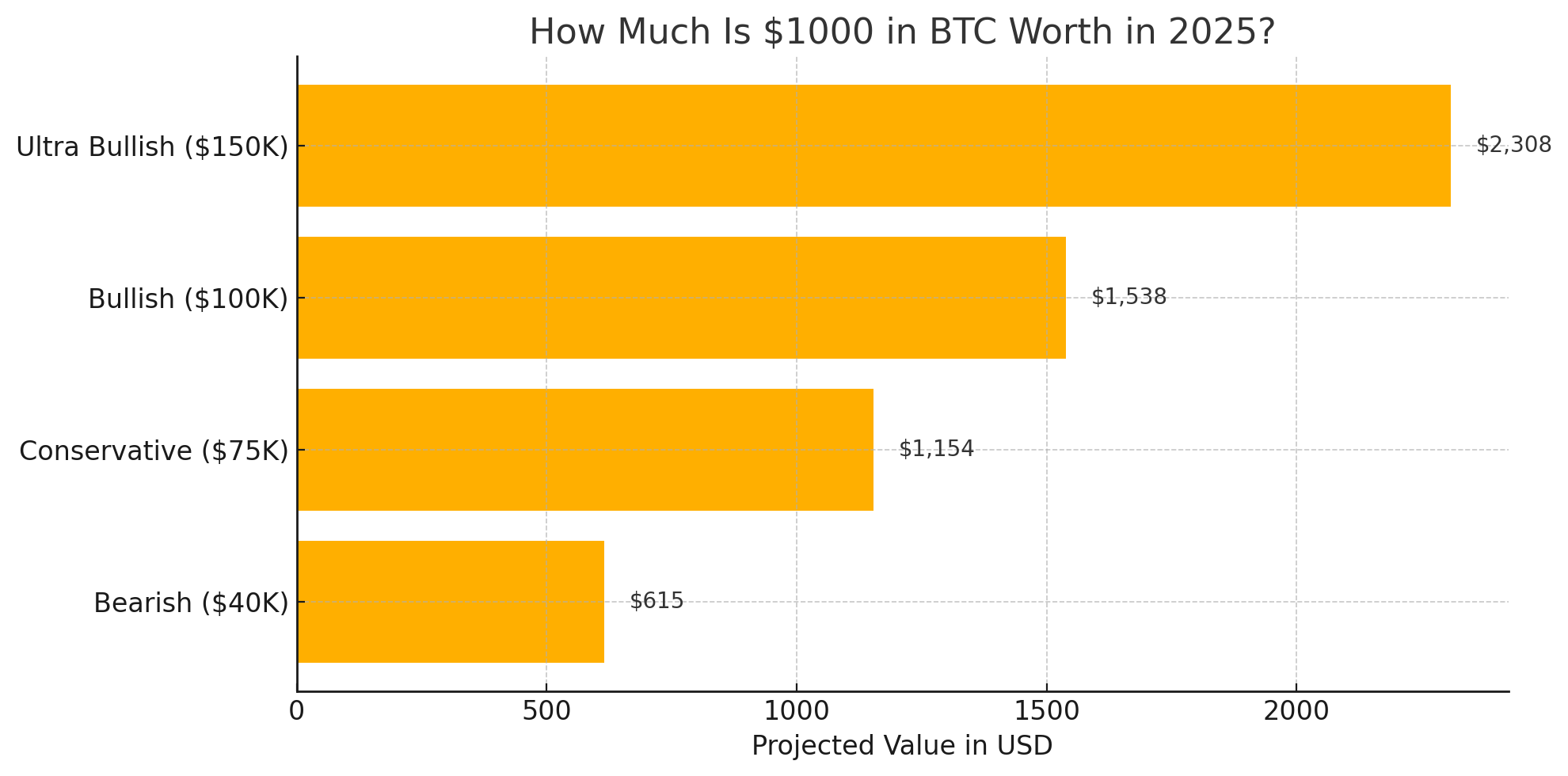

HBitcoin Price Forecast: How Much Is It Worth in 2025?

Projected Bitcoin ROI: Value of a $1000 Investment

Here are a few scenarios for the question, how much is it worth in 2025?

| Scenario | BTC Price 2025 | Value of $1000 Today |

|---|---|---|

| Bearish | $40,000 | ~$615 |

| Conservative | $75,000 | ~$1,154 |

| Bullish | $100,000 | ~$1,538 |

| Ultra Bullish | $150,000 | ~$2,308 |

Insight: Analysts expect a 2x–6x return from 2025 levels if Bitcoin maintains post-halving momentum and breaks past its all-time high.

If I Invest $1,000 in Bitcoin Today Calculator:

Formula:

Future Value = (Target Price / Current Price) * Investment

Example: ($100,000 / $65,000) * $1000 = $1,538

A Longer-Term Bitcoin Price Forecast: What Will $1000 of Bitcoin Be Worth in 2030?

| Scenario | BTC Price 2030 | Value of $1000 Today |

|---|---|---|

| Conservative | $150,000 | ~$2,308 |

| Moderate Growth | $250,000 | ~$3,846 |

| Aggressive | $500,000 | ~$7,692 |

Expert Prediction: According to Raoul Pal, macro investor, “If crypto achieves mass adoption, Bitcoin’s price of $1M is not unrealistic by 2030.”

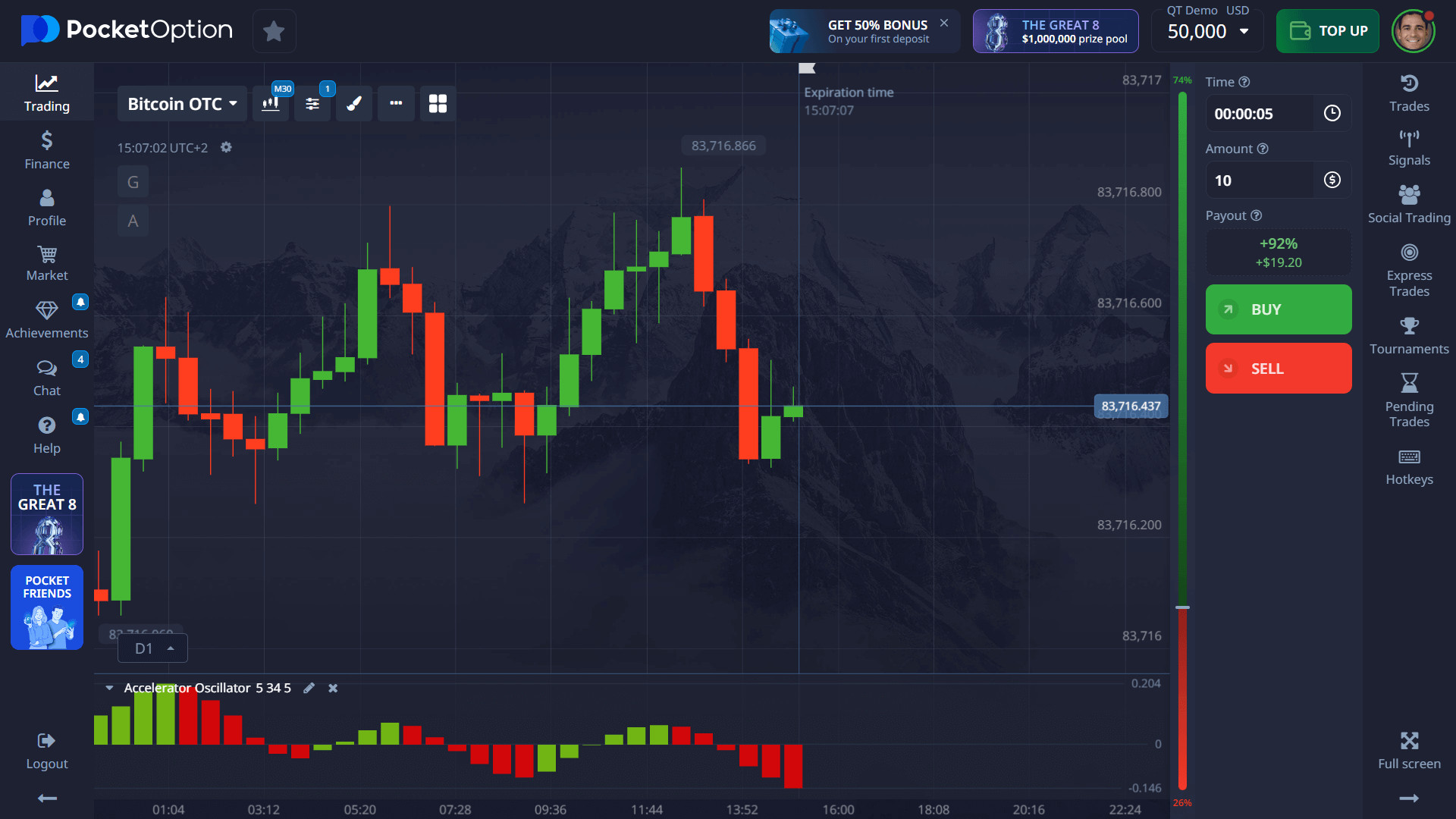

Real Trading Example: If I Buy $1,000 dollars worth of bitcoin today

Suppose you’re trading Bitcoin on Pocket Option using the Quick Trading feature. If you believe BTC will rise in the next 5 minutes:

- You click Buy with $100

- If your prediction is correct, and the payout is 85%

- You earn $185 ($100 stake + $85 profit)

This flexible system allows traders to speculate on short-term movements without buying full Bitcoin units.

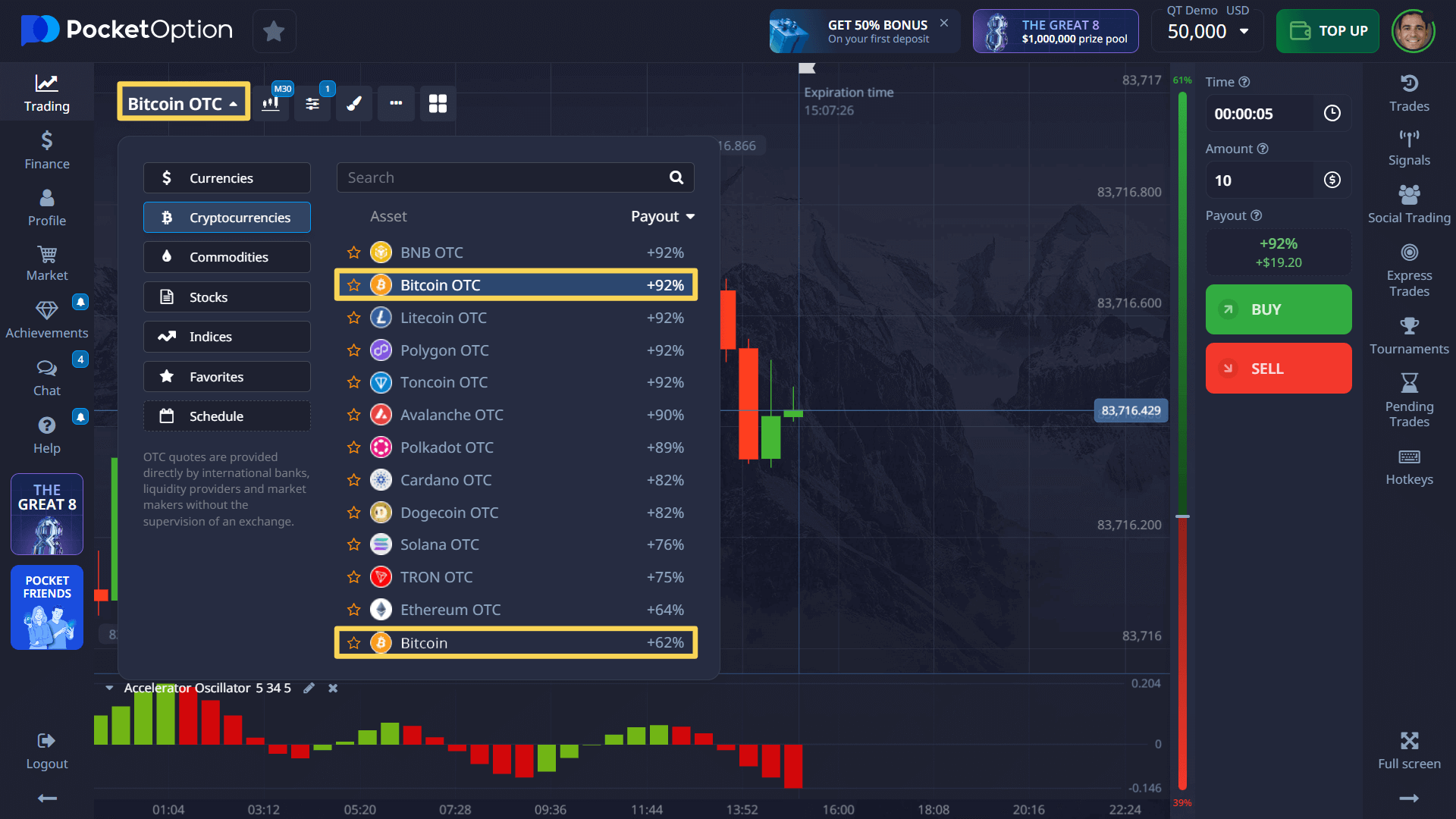

Why Trade Bitcoin on Pocket Option?

Bitcoin is available for trading on Pocket Option alongside numerous crypto assets. Users benefit from:

- Fast deposits starting at $5

- Copy trading, demo account with $50000

- Access to expert tools like signals, bot

Expert Take: According to analysts at Bloomberg Crypto, “Platforms that offer both demo accounts and micro-deposits lower the barrier to entry, making crypto trading accessible to all.”

Final Thoughts and Actionable Insights

If you’re asking, “If I invest 1000 in Bitcoin today, how much is it worth 2025?” the answer depends on the market trajectory, your entry price, and how you manage the inherent crypto volatility. Conservative estimates suggest ~$1,154, while optimistic forecasts reach over $2,000.

Recommendations:

- Use tools like Pocket Option for real-time BTC trading

- Consider dollar-cost averaging for long-term growth

- Stay updated on macroeconomic news and factors affecting digital asset growth.

- Monitor all-time trends and Bitcoin halving cycles for entry opportunities

Open a live account on Pocket Option and start trading Bitcoin today!

Disclaimer: This article does not constitute financial advice. Always do your own research and consult with professionals before making investment decisions.

FAQ

What if I invested $1000 in Bitcoin 5 years ago?

If you had invested $1000 in Bitcoin in mid-2020, when BTC traded around $9,000, your investment would now be worth approximately $7,222 based on a 2025 price of $65,000. That’s more than a 7x return, showcasing the power of long-term holding in the cryptocurrency market.

Can Bitcoin reach $200,000 in 2025?

While not guaranteed, several experts believe Bitcoin has the potential to reach $200,000 in a highly bullish scenario. This would require sustained institutional adoption, favorable macroeconomic trends, and post-halving momentum. Analysts at Fundstrat and ARK Invest have both projected long-term price targets above $200,000.

How much will I get if I put $1000 dollars in Bitcoin?

The value of a $1000 investment depends on Bitcoin’s future price. At $100,000 per BTC, your $1000 becomes approximately $1,538. At $150,000, it would grow to ~$2,308. Use our calculator in the article to estimate based on different price targets.

Is it smart to invest in Bitcoin right now?

It can be, provided you understand the risks. Bitcoin remains a high-risk, high-reward asset. Investors with a long-term horizon and a diversified portfolio may benefit from allocating a portion to BTC, especially as it gains legitimacy through ETFs and institutional backing.

What happens if i buy $1,000 dollars worth of bitcoin today?

If you invest 1000 in Bitcoin today, your return by 2025 will depend on how the BTC price evolves post-2024 halving. Conservative estimates put the 2025 price at $75,000, which would mean a potential value of approximately $1,154 for your investment.

If I invest $1000 in Bitcoin today how much is it worth in 2030?

If you invest $1000 in Bitcoin today, how much it is worth in 2030 depends on various growth projections. Assuming BTC reaches $250,000 by 2030, your investment would be worth approximately $3,846. In more aggressive forecasts (e.g., $500,000 per BTC), it could rise to ~$7,692.

If I invest $5000 in Bitcoin today, how much is it worth 2025?

At a projected 2025 Bitcoin price of $100,000, a $5000 investment today would be worth approximately $7,692. At $150,000 per BTC, it could rise to ~$11,538.

If I invest $10,000 in Bitcoin today how much is it worth 2025?

If BTC reaches $100,000, your $10,000 investment today may be worth around $15,385. At $150,000 per coin, it could be as high as $23,077.

If I invest $5000 in Bitcoin today how much is it worth 2030?

$11,538–$38,462 (if BTC is $150k–$500k in 2030)

If I invest $100 in Bitcoin today, how much is it worth 2025?

$61–$231 (if BTC is $40k–$150k in 2025)

If i put $1,000 in bitcoin today how much is it worth?

$615–$2,308 (if BTC is $40k–$150k in 2025)

If i invest $2,000 in bitcoin today how much is it worth 2025?

$1,231–$4,615 (if BTC is $40k–$150k).