- Halving-cycle positioning – systematically increasing exposure 12-18 months before each halving event, when new coin issuance is cut by 50%

- Supply-shock capitalization – building positions during post-halving consolidation periods before the reduced supply impacts market pricing

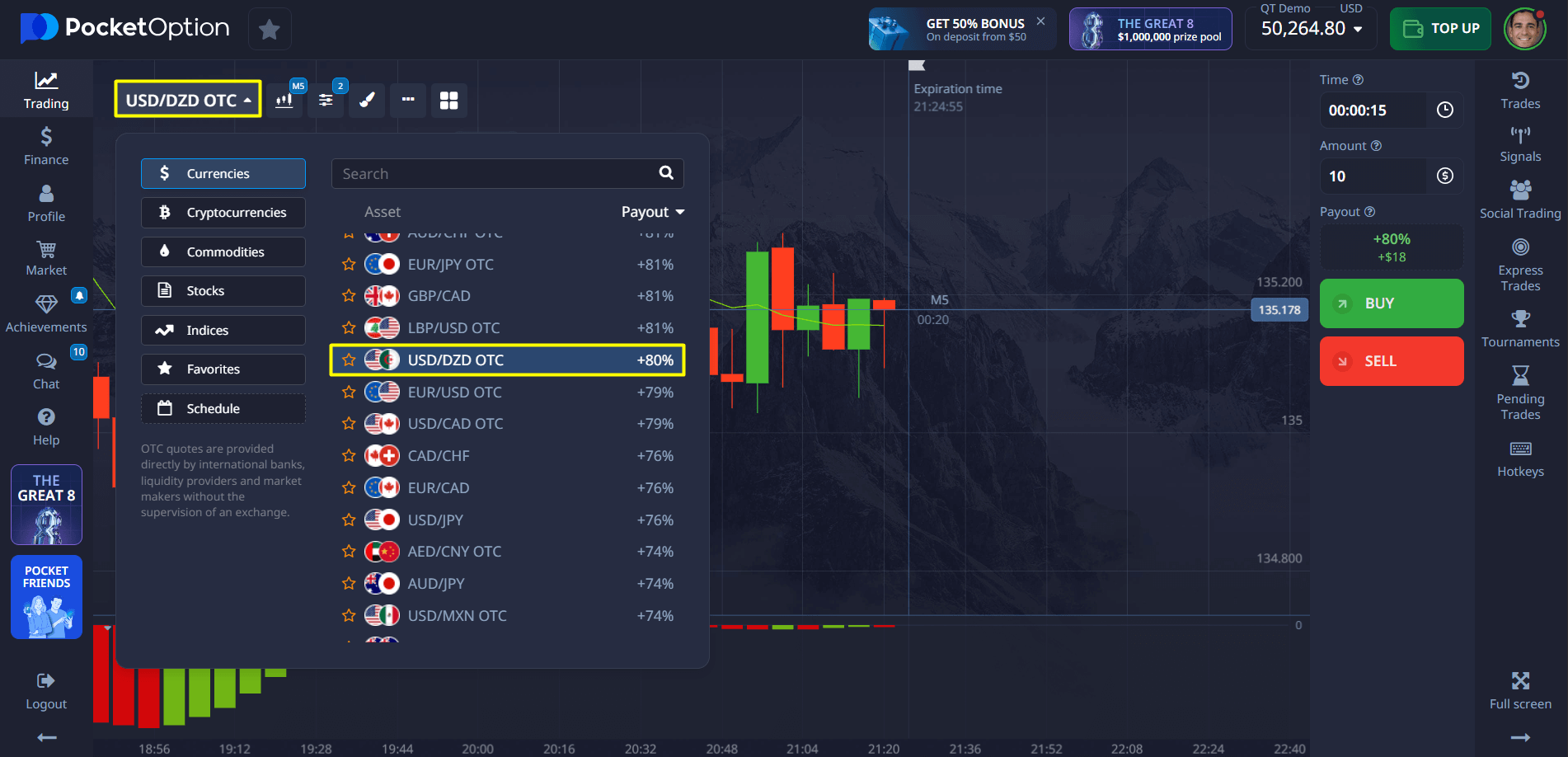

- Scarcity-premium trading – leveraging Pocket Option’s options instruments to capture volatility spikes that typically follow supply reductions

- Strategic accumulation – implementing algorithmic buying during bearish periods when prices temporarily disconnect from the fundamental scarcity narrative

- Supply-constrained breakout trading – identifying technical breakouts amplified by the inability of miners to introduce significant new supply

Pocket Option: Unlocking the Investment Potential of How Much Bitcoin Is Left to Mine

The question of how much Bitcoin is left to mine sits at the heart of the cryptocurrency's value proposition. As we approach Bitcoin's finite supply limit, understanding the remaining mining potential becomes crucial for investors seeking to position themselves in this digital asset class. This article delves into the current state of Bitcoin mining, scarcity mechanics, and what it means for future market dynamics.

Article navigation

- The Fundamental Scarcity of Bitcoin: Understanding the 21 Million Cap

- Real Mining Economics: Case Studies from the Field

- The Final Bitcoin: Projections and Timeline

- The Lost Coins Factor: How Many Bitcoin Are Truly Available?

- Success Stories: Those Who Recognized Bitcoin’s Limited Supply Early

- Trading Strategies Based on Bitcoin Supply Dynamics

- The Economic Implications of Bitcoin’s Fixed Supply

- Future Scenarios: What Happens When All Bitcoin Are Mined?

- Conclusion: The Strategic Importance of Bitcoin’s Remaining Supply

The Fundamental Scarcity of Bitcoin: Understanding the 21 Million Cap

Bitcoin’s revolutionary design introduces something unprecedented in monetary history: absolute, verifiable scarcity. Unlike traditional currencies that central banks can print indefinitely, Bitcoin has a hard-coded maximum supply of exactly 21 million coins. This immutable limit forms the foundation of the critical question: how much Bitcoin is left to mine?

The numbers tell a compelling story: as of April 2025, miners have already extracted 19.68 million bitcoins – 93.7% of the total supply. This leaves just 1.32 million coins yet to enter circulation, representing a mere 6.3% of Bitcoin’s ultimate supply. For traders using Pocket Option’s cryptocurrency markets, this dwindling supply creates a powerful economic force that shapes price action and trading opportunities across multiple timeframes.

The Mathematics Behind Bitcoin’s Diminishing Supply

To grasp the true significance of how much Bitcoin remains unmined, we need to examine the elegant mathematical model controlling its issuance. Bitcoin doesn’t simply release new coins at a steady rate – instead, it follows a predetermined halving schedule that cuts the mining reward in half approximately every four years (precisely every 210,000 blocks).

| Halving Event | Date | Block Reward (BTC) | New Supply Per Day | % of Total Supply Mined |

|---|---|---|---|---|

| Genesis | 2009 | 50 | 7,200 | 0% |

| 1st Halving | November 2012 | 25 | 3,600 | ~50% |

| 2nd Halving | July 2016 | 12.5 | 1,800 | ~75% |

| 3rd Halving | May 2020 | 6.25 | 900 | ~87.5% |

| 4th Halving | April 2024 | 3.125 | 450 | ~93.75% |

| Projected 5th | ~2028 | 1.5625 | 225 | ~96.875% |

This halving mechanism doesn’t just slow Bitcoin’s issuance – it creates a predictable scarcity that grows more pronounced with time. Today’s miners receive 3.125 BTC per block, less than one-sixteenth of the original 50 BTC reward. Each future halving will further constrict new supply, intensifying Bitcoin’s scarcity premium and potentially amplifying price volatility that traders on Pocket Option can leverage for strategic positions.

Real Mining Economics: Case Studies from the Field

The abstract question of how much Bitcoin is left to mine transforms into concrete reality when examining actual mining operations. Northern Digital, a North American mining company, provides a revealing case study of the evolving economics in this competitive industry.

| Year | Hash Rate | BTC Mined | Operational Costs | Revenue (at year-end prices) | ROI |

|---|---|---|---|---|---|

| 2017 | 5 PH/s | 55 BTC | $750,000 | $1,100,000 | 46.7% |

| 2019 | 12 PH/s | 42 BTC | $840,000 | $302,400 | -64% |

| 2021 | 25 PH/s | 28 BTC | $1,200,000 | $1,344,000 | 12% |

| 2023 | 48 PH/s | 18 BTC | $1,680,000 | $792,000 | -52.9% |

| 2025 (est.) | 85 PH/s | 13 BTC | $2,100,000 | ? | ? |

Northern Digital’s trajectory reveals a stark reality: despite a massive 1,600% increase in computing power from 2017 to 2025, their Bitcoin production dropped by 76%. This dramatic decline reflects both the impact of halving events and the fierce global competition for the remaining unmined coins. Pocket Option traders gain a competitive edge by monitoring these mining economics, which often foretell price movements before they appear on charts.

The Shift to Mining Pools: Democratizing Access to Remaining Bitcoin

As the competition intensifies for how many Bitcoin remain unmined, individual mining operations have largely become obsolete. Mining pools – collaborative networks where participants combine resources and share rewards – now dominate the landscape, allowing even modest participants to capture fractions of the diminishing block rewards.

Michael Chen’s experience illustrates this evolution perfectly. In 2020, Chen deployed two ASIC miners independently, producing approximately 0.015 BTC monthly. When network difficulty spiked in 2021, his production plummeted to 0.008 BTC. By joining SlushPool and combining his resources with thousands of others, he restored and even improved his yield to 0.022 BTC monthly – a 175% increase over solo mining despite worsening network conditions.

| Mining Pool | Market Share | Minimum Hash Power | Fee Structure | Payout Method |

|---|---|---|---|---|

| Foundry USA | ~28% | None | 2-4% | PPLNS |

| AntPool | ~15% | None | 0.5-2.5% | PPS+ |

| F2Pool | ~13% | None | 2.5-3% | PPS |

| Binance Pool | ~12% | None | 0.5-2% | FPPS |

| ViaBTC | ~8% | None | 2-4% | PPS+ |

The Final Bitcoin: Projections and Timeline

Bitcoin’s design introduces a fascinating paradox: while 93.7% of all bitcoins have already been mined in just 16 years, the remaining 6.3% will take over 115 years to extract. This stretching timeline results directly from the halving mechanism that systematically reduces the mining reward.

According to Bitcoin’s protocol, miners will extract the final satoshi (0.00000001 BTC) around the year 2140. However, this long tail is extremely thin – miners will extract 99% of all bitcoins by 2035, leaving just 210,000 bitcoins (1% of supply) to be distributed over the following century.

| Year | % of Total Supply Mined | Amount Left to Mine | Daily Issuance (BTC) | Block Reward |

|---|---|---|---|---|

| 2025 | ~93.7% | ~1.32 million | ~450 | 3.125 |

| 2028 | ~96.9% | ~651,000 | ~225 | 1.5625 |

| 2032 | ~98.4% | ~336,000 | ~112.5 | 0.78125 |

| 2036 | ~99.2% | ~168,000 | ~56.25 | 0.390625 |

| 2140 (est.) | 100% | 0 | 0 | ~0 |

This extended timeline for mining the final bitcoins creates unique trading opportunities on Pocket Option. Savvy traders can position themselves around halving events, which have historically preceded major bull runs as markets adjust to the new supply reality. The gradual but certain reduction in new supply forms a backdrop against which all price movements play out.

The Lost Coins Factor: How Many Bitcoin Are Truly Available?

When calculating how much Bitcoin is left to mine, we must confront an additional layer of scarcity: permanently lost coins. Based on blockchain forensics and wallet activity analysis, experts estimate that between 3-4 million bitcoins (15-20% of total supply) are irretrievably lost due to forgotten passwords, misplaced private keys, and deceased owners who never shared access information.

James Howells’ notorious case exemplifies this phenomenon. In 2013, during routine house cleaning, Howells accidentally discarded a hard drive containing the private keys to 8,000 BTC – worth over $450 million at 2025 prices. Despite years of petitioning his local council to allow excavation of the landfill where his fortune lies buried, those bitcoins remain inaccessible, effectively removed from the circulating supply forever.

| Category | Estimated Amount | Percentage of Total Supply | Notes |

|---|---|---|---|

| Satoshi’s Coins | ~1.1 million BTC | ~5.2% | Unmoved since mining |

| Confirmed Lost | ~1.5 million BTC | ~7.1% | Documented cases |

| Presumed Lost | ~1.3 million BTC | ~6.2% | Long-dormant addresses |

| Strategically Hodled | ~4.2 million BTC | ~20% | Unmoved for 5+ years |

| Actively Circulating | ~12.9 million BTC | ~61.5% | Moved within last 5 years |

For Pocket Option traders formulating Bitcoin strategies, these lost coins transform the supply picture dramatically. The functional supply isn’t just limited by how many Bitcoin remain to be mined, but further constrained by how many existing coins are actually accessible. This dual scarcity effect amplifies potential price movements, especially during periods of high demand.

Success Stories: Those Who Recognized Bitcoin’s Limited Supply Early

Understanding how much Bitcoin is left to mine has generated life-changing wealth for early adopters who grasped the implications of this mathematical certainty before the broader market.

Wences Casares exemplifies this insight-driven success. Growing up in Argentina, Casares witnessed his family’s savings evaporate through repeated currency devaluations. This firsthand experience with monetary inflation made Bitcoin’s fixed supply instantly compelling to him. In 2011, when Bitcoin traded below $10, Casares began systematically acquiring coins, recognizing that the halving schedule would eventually constrain new supply while demand continued growing. This conviction led him to found Xapo, a Bitcoin custody service later acquired for $55 million, while personally accumulating a Bitcoin position now valued at hundreds of millions.

Another instructive case is the Norwegian student who, while researching encryption for his master’s thesis in 2009, purchased 5,000 bitcoins for a total of $27. Initially forgetting about this minimal investment, he rediscovered his digital wallet in 2013 when Bitcoin first crossed $1,000. Understanding both how much Bitcoin was left to mine and the significance of the upcoming halving, he implemented a strategic selling plan across multiple market cycles rather than liquidating immediately. This disciplined approach to managing his position transformed a $27 investment into generational wealth.

Institutional Recognition of Bitcoin’s Supply Mechanics

Corporate treasuries have increasingly recognized the strategic advantage of securing Bitcoin before the mining supply dwindles further. MicroStrategy’s approach under Michael Saylor represents the most aggressive institutional Bitcoin accumulation strategy, directly tied to understanding Bitcoin’s diminishing issuance schedule.

| Institution | Bitcoin Holdings | Initial Purchase Date | Strategy Basis | Performance (as of Q1 2025) |

|---|---|---|---|---|

| MicroStrategy | ~215,000 BTC | August 2020 | Treasury Reserve Asset | +380% |

| Tesla | ~10,000 BTC | January 2021 | Balance Sheet Diversification | +130% |

| Block Inc. | ~8,000 BTC | October 2020 | Strategic Investment | +210% |

| Marathon Digital | ~13,000 BTC | Self-mined since 2017 | Mining & Holding | Varies by acquisition date |

| Grayscale Bitcoin Trust | ~640,000 BTC | Accumulated since 2013 | Investment Vehicle | Varies by entry point |

These institutional strategies didn’t develop in a vacuum – they emerged from a deep understanding of Bitcoin’s supply mechanics. As corporations continue competing for the remaining unmined bitcoins, Pocket Option traders can gain valuable insights from monitoring these institutional movements, which often presage broader market trends.

Trading Strategies Based on Bitcoin Supply Dynamics

For Pocket Option traders, Bitcoin’s predictable supply schedule unlocks several high-probability trading strategies that directly leverage the decreasing mining output:

These strategies aren’t theoretical – they’ve generated substantial returns for disciplined traders. One Pocket Option user identified as “Satoshi2023” programmed an algorithmic trading system that automatically increases position sizes after each halving event. “My analysis of the three previous halvings showed that markets typically underestimate the impact of supply reduction for 6-8 months before price discovery accelerates dramatically,” he explains. “By gradually scaling into positions during this lag period, I captured 340% returns following the 2020 halving while minimizing drawdown exposure.”

The Economic Implications of Bitcoin’s Fixed Supply

Beyond trading opportunities, the question of how much Bitcoin is left to mine carries profound economic implications that may reshape our understanding of money itself.

Bitcoin’s capped supply of 21 million introduces a monetary property unseen in modern economies: absolute scarcity. Unlike fiat currencies that expand continuously, or even precious metals whose supply increases annually through mining, Bitcoin will eventually stop issuing new units entirely. This property creates deflationary pressure that intensifies as adoption increases while new supply decreases and ultimately ceases.

| Economic Characteristic | Fiat Currency | Gold | Bitcoin |

|---|---|---|---|

| Supply Cap | Unlimited | Unknown, but limited | 21 million |

| Annual Inflation Rate | 2-10% (varies by country) | ~1.5% | ~0.9% (2025), halving every 4 years |

| Supply Predictability | Low (policy-dependent) | Medium (mining-dependent) | High (algorithmically defined) |

| Divisibility | Limited (cents) | Practical limitations | High (satoshis = 0.00000001 BTC) |

| Supply Verification | Requires trust in institutions | Difficult, requires assaying | Instantly verifiable by anyone |

For Pocket Option traders positioning for long-term Bitcoin exposure, this unique economic property creates an investment thesis fundamentally different from traditional assets. While all investments carry risk, Bitcoin’s supply certainty removes one significant variable from the equation: monetary inflation. This certainty stands in stark contrast to fiat currencies and even commodities like gold, whose future supply remains subject to technological advances in mining or extraction.

Future Scenarios: What Happens When All Bitcoin Are Mined?

Though we stand more than a century away from mining the final bitcoin, forward-thinking investors are already analyzing the economic implications of a post-mining Bitcoin network. When block rewards eventually diminish to zero, how will Bitcoin maintain its security and incentive structure?

- Transaction fee market development – as block subsidies decrease, transaction fees will likely increase to compensate miners, potentially transforming Bitcoin into a high-value settlement layer

- Mining industry consolidation – only the most energy-efficient operations with access to extremely low-cost or stranded energy sources will remain profitable

- Layer-2 scaling solutions – most everyday transactions will likely occur on second-layer protocols that periodically settle to the Bitcoin blockchain

- Mining security model transition – network security will shift from being subsidized by new coin issuance to being funded directly by users through transaction fees

- Value threshold emergence – Bitcoin may naturally develop a minimum transaction value threshold as fees increase, reinforcing its role as “digital gold” rather than a payment system for small purchases

This transition has already begun. Adam Back, CEO of Blockstream and pioneering Bitcoin developer, notes: “The fee market isn’t some distant theoretical concern – it’s developing right now. During the 2021 and 2024 bull markets, we observed peak periods where transaction fees exceeded block rewards, giving us a preview of Bitcoin’s future economic model. Each halving accelerates this transition from subsidy-based to fee-based security.”

For Pocket Option users developing long-term Bitcoin investing strategies, this evolving economic model offers both challenges and opportunities that smart traders can position for years in advance.

Conclusion: The Strategic Importance of Bitcoin’s Remaining Supply

The question of how much Bitcoin is left to mine stands as the mathematical foundation of Bitcoin’s value proposition. With just 1.32 million bitcoins remaining to be mined and 93.7% of the total supply already circulating, we’re witnessing the final stages of Bitcoin’s initial distribution phase – a once-in-history event with profound implications for the global financial system.

For traders and investors using Pocket Option’s cryptocurrency markets, this supply constraint creates a unique framework for developing high-probability strategies. While price volatility will continue reflecting Bitcoin’s maturation process, the underlying supply mechanics operate with mathematical certainty unmatched by any other financial asset.

Understanding these mechanics – from the halving schedule to mining economics to permanent coin loss – provides Pocket Option users with strategic insights that go beyond technical analysis. Whether implementing halving-cycle accumulation strategies, trading supply-shock breakouts, or positioning for the long-term transition to a fee-based security model, traders who grasp Bitcoin’s supply dynamics enjoy significant advantages in this emerging asset class.

As the final bitcoins are mined over coming decades, their extraction will become increasingly difficult and expensive. This guaranteed scarcity stands in stark contrast to the unlimited issuance capacity of traditional monetary systems – creating what many analysts consider the single most asymmetric investment opportunity in modern financial history. For Pocket Option traders willing to look beyond short-term volatility, Bitcoin’s supply mechanics offer a mathematical certainty rare in financial markets: we know precisely how much bitcoin left to mine, and exactly when the last satoshi will enter circulation.

FAQ

How much Bitcoin is actually left to mine?

As of April 2025, approximately 1.32 million bitcoins remain to be mined out of the total 21 million cap. This represents about 6.3% of the total supply. The rate at which new bitcoins enter circulation continues to slow due to the halving mechanism, with the current block reward at 3.125 BTC following the April 2024 halving event.

When will the last Bitcoin be mined?

Based on the current protocol design and block time, the last bitcoin is projected to be mined around the year 2140. However, 99% of all bitcoins will be mined much sooner - by approximately 2035. The final 1% of the supply will take over a century to mine due to the exponentially decreasing block reward.

How do Bitcoin halvings affect the mining supply?

Bitcoin halvings reduce the block reward by 50% approximately every four years (or precisely every 210,000 blocks). This mechanism systematically reduces the rate of new bitcoin issuance, creating increasing scarcity over time. The most recent halving in April 2024 reduced the reward from 6.25 to 3.125 BTC per block, with the next halving expected around 2028.

Can Bitcoin's supply cap of 21 million ever change?

While technically possible through a consensus change to the Bitcoin protocol, increasing the 21 million supply cap would require overwhelming support from the Bitcoin community. Such a change would fundamentally alter Bitcoin's value proposition of absolute scarcity, making it extremely unlikely to gain support. Any attempt to change this limit would likely result in a contentious fork rather than a change to Bitcoin itself.

Is Bitcoin mining still profitable in 2025?

Bitcoin mining profitability in 2025 depends on numerous factors including electricity costs, hardware efficiency, operational scale, and Bitcoin's market price. With the block reward now at 3.125 BTC following the 2024 halving, mining operations require greater efficiency to remain profitable. Large-scale operations with access to low-cost renewable energy maintain an advantage, while smaller miners typically join mining pools to receive more consistent, albeit smaller, rewards.