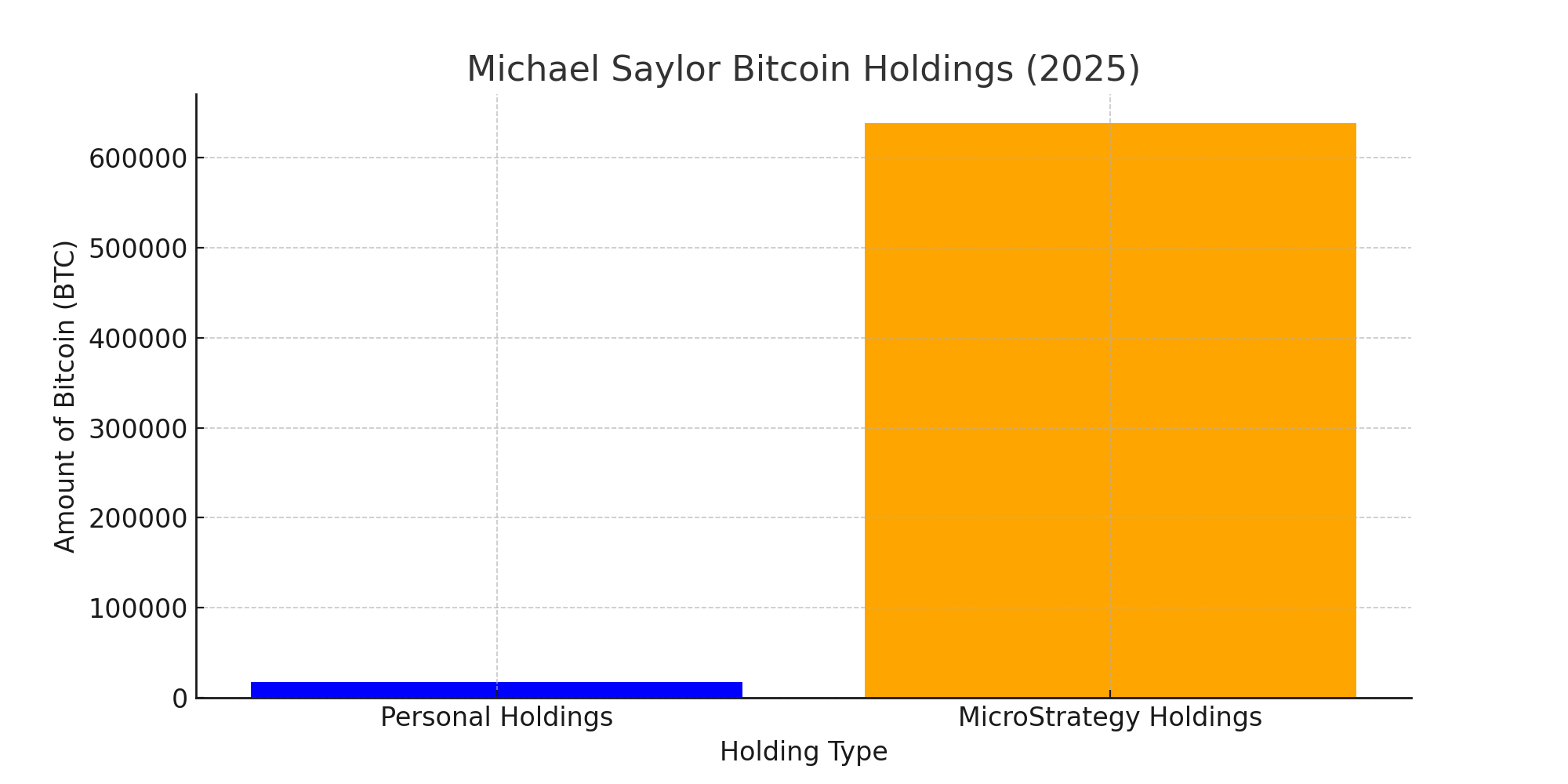

- 17,732 Personal BTC Holdings

- ~$1.8B Estimated Value (at $100k BTC)

- 638,985 MicroStrategy Holdings

How Much Bitcoin Does Michael Saylor Own? Top Insights and Strategies

As of January 2025, MicroStrategy holds over 638,000 Bitcoin while its CEO maintains his personal holdings separately, making both significant players in the crypto market.

Article navigation

- How Much Bitcoin Does Michael Saylor Own? Complete Holdings Analysis

- Michael Saylor’s Personal Bitcoin Holdings

- MicroStrategy vs Personal Holdings: Understanding the Difference

- Impact on the Cryptocurrency Market

- Comparison with Other Major Bitcoin Holders

- Investment Philosophy and Strategy

- Key Insight for Traders on Pocket Option

How Much Bitcoin Does Michael Saylor Own? Complete Holdings Analysis

When discussing major Bitcoin holders and crypto whales, Michael Saylor consistently ranks among the most influential figures in the cryptocurrency space. As the Executive Chairman of MicroStrategy and a prominent Bitcoin maximalist, Saylor’s personal Bitcoin holdings have become a subject of intense curiosity among investors and crypto enthusiasts worldwide.

Understanding Saylor’s Bitcoin ownership requires distinguishing between his personal holdings and those of MicroStrategy, the publicly traded company he leads. Both represent substantial investments in Bitcoin, but they serve different purposes and follow different strategies in the broader cryptocurrency ecosystem.

Ready to trade on Bitcoin’s volatility like the whales? 🚀 On Pocket Option, you can make a forecast on Bitcoin’s price and earn up to 92% profit in as little as 5 seconds!

Michael Saylor’s Personal Bitcoin Holdings

According to the most recent publicly available information, Michael Saylor personally owns approximately 17,732 Bitcoin. This figure represents his individual investment in cryptocurrency, separate from MicroStrategy’s corporate Bitcoin treasury strategy.

“Bitcoin is digital scarcity, and digital scarcity is the most powerful force in the universe when channeled by a network of 8 billion people.” – Michael Saylor, 2025

For example, traders on Pocket Option often analyze whale movements and major holder positions when making Quick Trading decisions, as these large holdings can significantly impact Bitcoin’s price movements and market sentiment.

MicroStrategy vs Personal Holdings: Understanding the Difference

The distinction between Michael Saylor’s personal Bitcoin holdings and MicroStrategy’s corporate holdings is crucial for understanding his overall influence in the Bitcoin ecosystem:

| Holding Type | Amount (BTC) | Purpose | Average Purchase Price |

|---|---|---|---|

| Personal Holdings | 17,732 BTC | Personal Investment | ~$9,900 (estimated) |

| MicroStrategy Holdings | 638,985 BTC | Corporate Treasury | $66,384.56 |

| Combined Influence | 656,717 BTC | Market Impact | Varied |

While Saylor holds for the long term, you can capitalize on short-term market movements. 📈 With Pocket Option, trading Bitcoin is simple–predict the direction and profit from market swings.

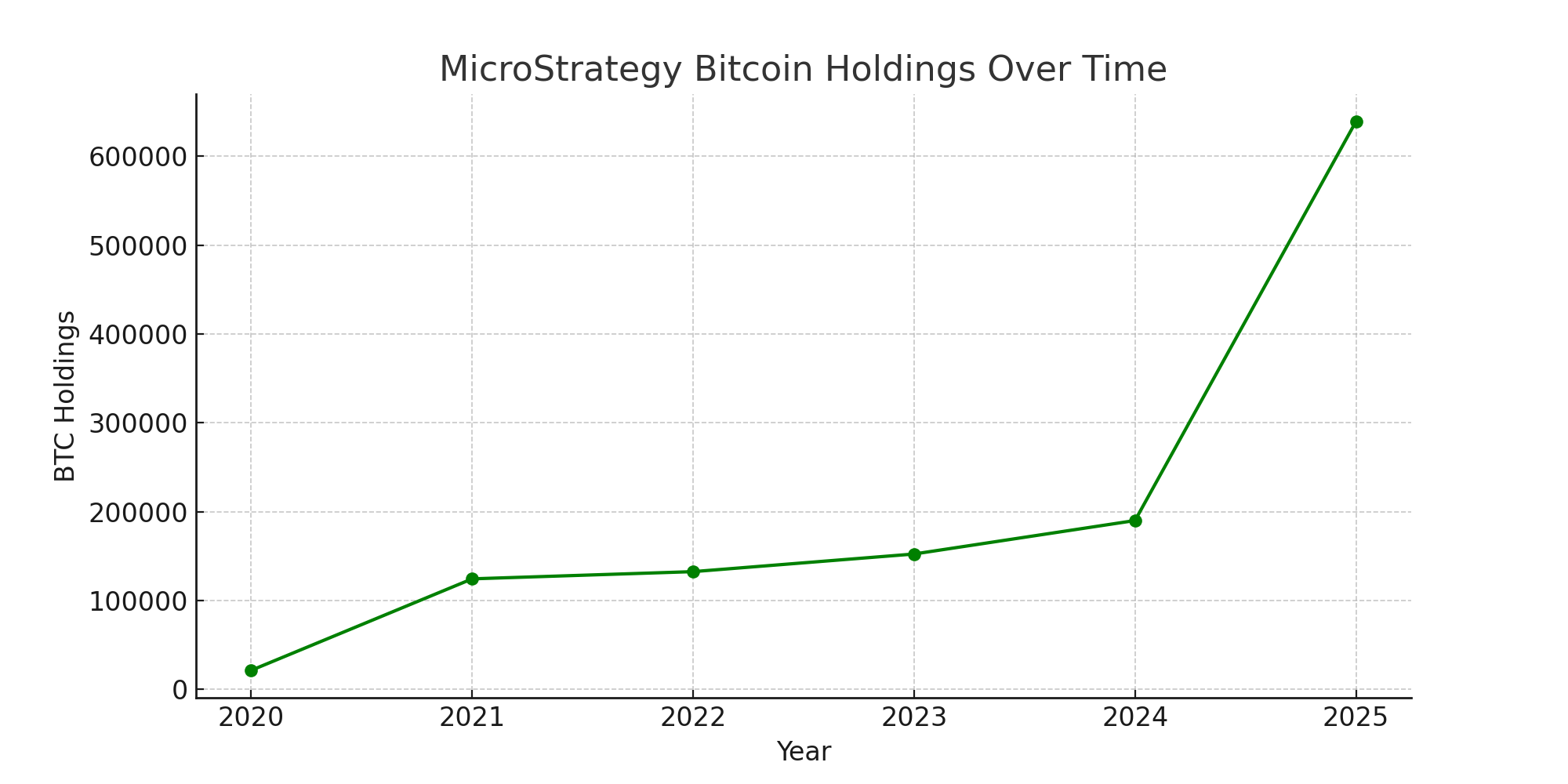

Timeline of Saylor’s Bitcoin Journey

- 2020: Saylor begins advocating for Bitcoin as a store of value

- August 2020: MicroStrategy makes its first Bitcoin purchase

- 2021-2024: Continuous accumulation through various market cycles

- 2025: Maintains position as one of the largest individual Bitcoin holders

Impact on the Cryptocurrency Market

Michael Saylor’s Bitcoin holdings, both personal and corporate, represent approximately 3.1% of all Bitcoin in circulation. This substantial position makes him one of the most influential voices in cryptocurrency policy and market direction.

“Our strategy is to buy Bitcoin and hold it forever. We view Bitcoin simply as a treasury reserve asset and our policy is to never sell.” – Michael Saylor, 2025

In practice, when Saylor makes public statements about Bitcoin or when MicroStrategy announces additional purchases, markets often respond with increased volatility. Traders frequently monitor these announcements for potential trading opportunities.

When whales like Saylor make a move, the market reacts instantly. Be ready to act on that volatility with Pocket Option’s quick trading platform and see returns in seconds. ⏱️

Comparison with Other Major Bitcoin Holders

| Holder | Estimated Holdings | Type | Public Status |

|---|---|---|---|

| Satoshi Nakamoto | ~1,000,000 BTC | Creator Holdings | Inactive |

| Michael Saylor | 17,732 BTC | Personal | Public Figure |

| Winklevoss Twins | ~70,000 BTC | Personal/Business | Public |

| Tim Draper | ~30,000 BTC | Investment | Public |

Storage and Security Strategies

Given the substantial value of his Bitcoin holdings, security represents a critical concern for Michael Saylor. While specific details about his storage methods remain private for security reasons, industry experts typically recommend:

- Hardware wallet solutions for long-term storage

- Multi-signature setups for additional security layers

- Geographic distribution of backup systems

- Professional custody services for institutional-grade security

“Bitcoin is the apex property of the human race. It’s digital real estate backed by energy.” – Michael Saylor, 2025

Investment Philosophy and Strategy

Michael Saylor’s approach to Bitcoin ownership reflects his broader investment philosophy centered on digital scarcity and store of value principles. His strategy involves:

- Long-term holding: Never selling Bitcoin regardless of market conditions

- Dollar-cost averaging: Regular purchases during market cycles

- Educational advocacy: Promoting Bitcoin adoption through conferences and media

- Corporate integration: Implementing Bitcoin strategies at MicroStrategy

Key Insight for Traders on Pocket Option

Understanding major holder positions like Saylor’s can provide valuable context for market analysis. While long-term holding is one strategy, traders on platforms like Pocket Option can capitalize on the market volatility these large players create.

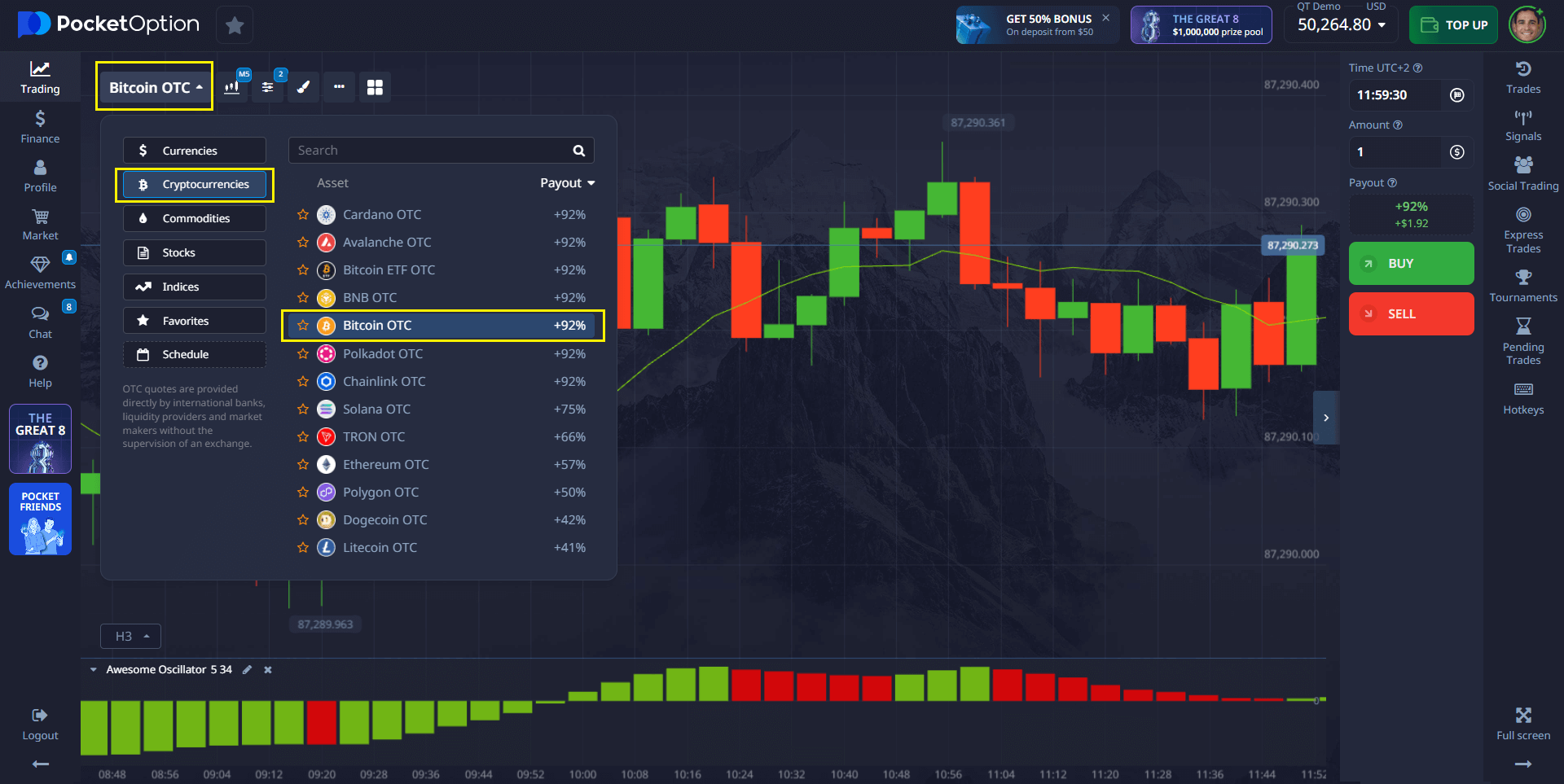

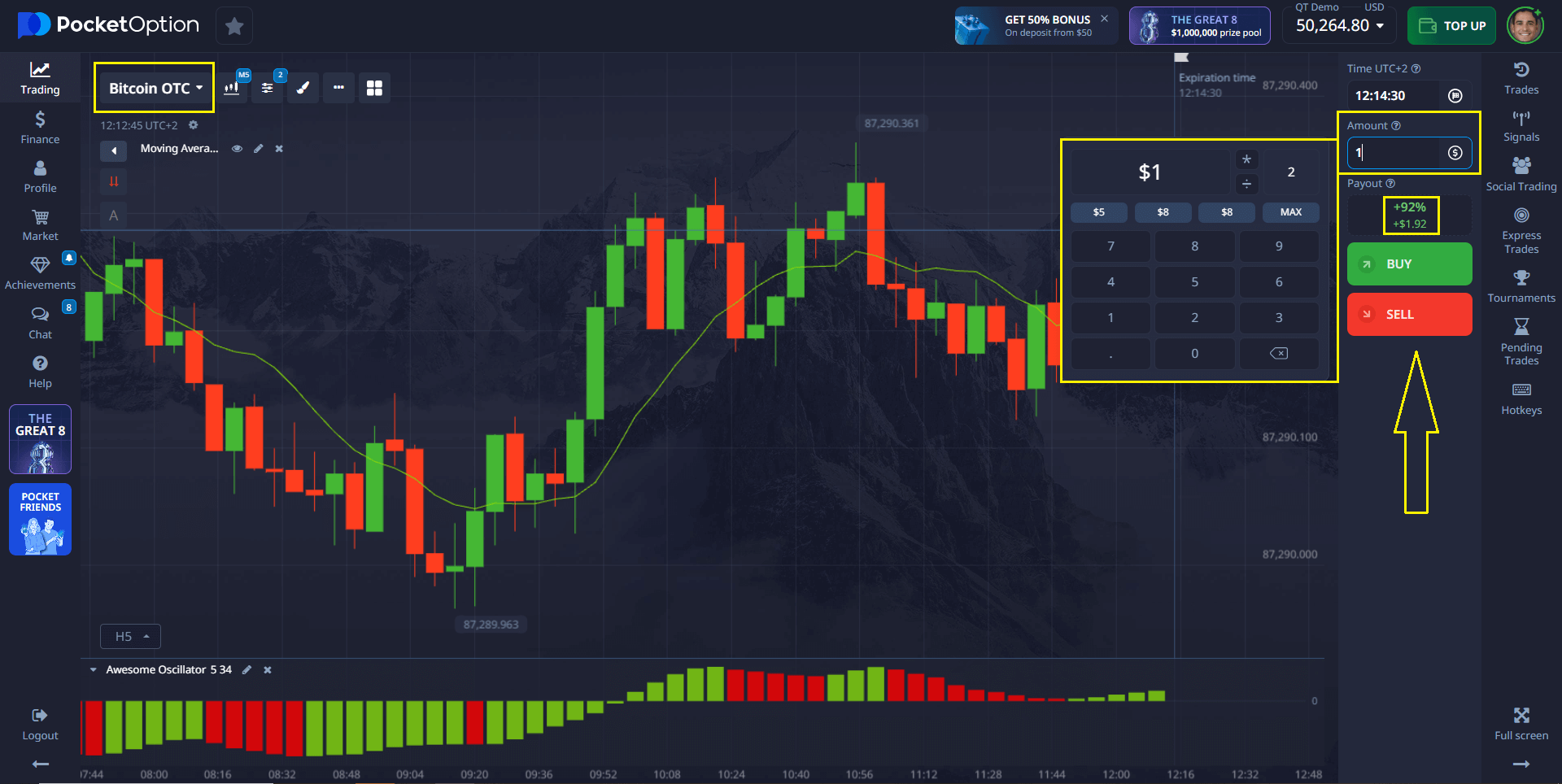

Here is a simple example of how to open a Bitcoin trade on Pocket Option:

- Choose your asset: Select Bitcoin from the list of available cryptocurrencies.

- Analyze the chart: Use the built-in traders’ mood indicator or advanced technical tools right on your screen to analyze price trends.

- Choose your trade amount: You can start with as little as $1 per trade.

- Choose your trade time: Select a duration from as little as 5 seconds (on OTC assets) up to several hours.

- Make your forecast: Predict where the price will go in your chosen time. If you believe it will rise, press the BUY button. If you think it will fall, press the SELL button.

- Collect your profit: If your forecast is correct, you earn a profit of up to 92%. The exact profit percentage is shown upfront, so you know your potential return before you start.

Furthermore, a real account, which can be opened with a deposit from just $5, unlocks powerful features like:

- $50,000 Demo Account: Practice your strategies risk-free.

- 100+ Assets: Trade not only crypto but also stocks, forex, and commodities.

- Copy Trading: Automatically copy the trades of top-performing users.

- Cashback: Get a percentage of your trading volume back.

- Free Knowledge Base: Learn new strategies for Forex and other markets.

- Tournaments: Compete with other traders for prizes.

Future Outlook and Market Implications

As Bitcoin continues to mature as an asset class, Michael Saylor’s substantial holdings position him as a key figure in cryptocurrency’s future development. His influence extends beyond mere ownership to include:

“Bitcoin will eventually become the base layer of value in the digital economy. Every company will need a Bitcoin strategy.” – Michael Saylor, 2025

Market analysts often view Saylor’s continued accumulation as a bullish signal for Bitcoin’s long-term prospects. His public commitment to never selling reinforces Bitcoin’s narrative as digital gold and a superior store of value compared to traditional assets.

“The greatest trade in human history is buying Bitcoin and holding it forever. There is no second-best strategy.” – Michael Saylor, 2025

FAQ

How much is Michael Saylor's Bitcoin worth?

At current Bitcoin prices, Saylor's personal holdings of 17,732 BTC are worth approximately $1.8 billion, while MicroStrategy's holdings exceed $60 billion in value.

When did Michael Saylor first buy Bitcoin?

Saylor began purchasing Bitcoin personally before MicroStrategy's first corporate purchase in August 2020. His personal accumulation likely began in late 2019 or early 2020.

What is MicroStrategy's Bitcoin strategy?

MicroStrategy employs a "buy and hold forever" strategy, using Bitcoin as a treasury reserve asset. The company regularly purchases additional Bitcoin and has no plans to sell.

How does Saylor store his Bitcoin securely?

While specific security details aren't public, Saylor likely uses enterprise-grade storage solutions including hardware wallets, multi-signature setups, and professional custody services.

Is Michael Saylor the largest individual Bitcoin holder?

While Saylor is among the largest known individual Bitcoin holders, the Winklevoss twins and other early investors may hold similar or larger amounts. Satoshi Nakamoto remains the largest holder overall.

How do Saylor's Bitcoin holdings affect the market?

As a major holder and vocal advocate, Saylor's statements and MicroStrategy's purchases often influence Bitcoin's price and market sentiment, making his positions important for traders to monitor.

Will Michael Saylor ever sell his Bitcoin?

Saylor has repeatedly stated his intention to never sell Bitcoin, viewing it as the ultimate store of value and digital property. His strategy remains focused on accumulation rather than trading.

Does Michael Saylor own Bitcoin personally or just through MicroStrategy?

Michael Saylor owns Bitcoin both personally (17,732 BTC) and through MicroStrategy (638,985 BTC). These are separate holdings with different purposes and acquisition strategies.

CONCLUSION

Michael Saylor's personal ownership of 17,732 Bitcoin, combined with MicroStrategy's massive 638,985 BTC treasury, establishes him as one of the most significant figures in the cryptocurrency ecosystem. His combined influence over nearly 660,000 Bitcoin represents approximately 3.1% of all Bitcoin in circulation. Understanding Saylor's holdings provides valuable insight into Bitcoin's institutional adoption and the strategies employed by major crypto whales. His unwavering commitment to Bitcoin as a store of value continues to influence market sentiment and corporate adoption strategies worldwide. For traders and investors, monitoring major holders like Saylor remains crucial for understanding market dynamics and potential price movements. His public statements and MicroStrategy's purchasing activities often serve as leading indicators for broader market trends.

Start Trading Bitcoin