- Never risk over 1–2% per trade

- Track your margin level to avoid a margin call

- Adjust leverage based on volatility

Forex Trading Leverage Example: Maximize Trades with Minimum Capital

Discover a clear Forex trading leverage example with real-world calculations, expert insights, and margin strategies. Learn how leverage works in Forex, explore its risks and benefits, and get practical advice on trading with Pocket Option.

Forex Trading Leverage Example: Understanding How to Use Leverage Effectively

Leverage is one of the most powerful—and risky—tools in a trader’s arsenal. This Forex trading leverage example will help beginners and experienced traders understand how to control large positions with smaller capital. We’ll explore FX trading leverage, margin requirements, trading risks, real-world scenarios, and professional insights to help you trade smarter. Platforms like Pocket Option offer customizable leverage options, making it essential to grasp the mechanics before using it in live markets.

📌 Expert Quote:

“Leverage is a double-edged sword. It can exponentially boost returns—or magnify losses. Understanding your risk threshold is critical.” — Dr. Marcus Lane, Chartered Financial Analyst (CFA)

What is Leverage in Forex Trading?

Leverage in Forex trading allows traders to open positions larger than their actual capital using borrowed funds from a broker. It’s commonly used through a margin account, where only a fraction of the trade value is required as margin.

What is leverage in Forex for beginners?

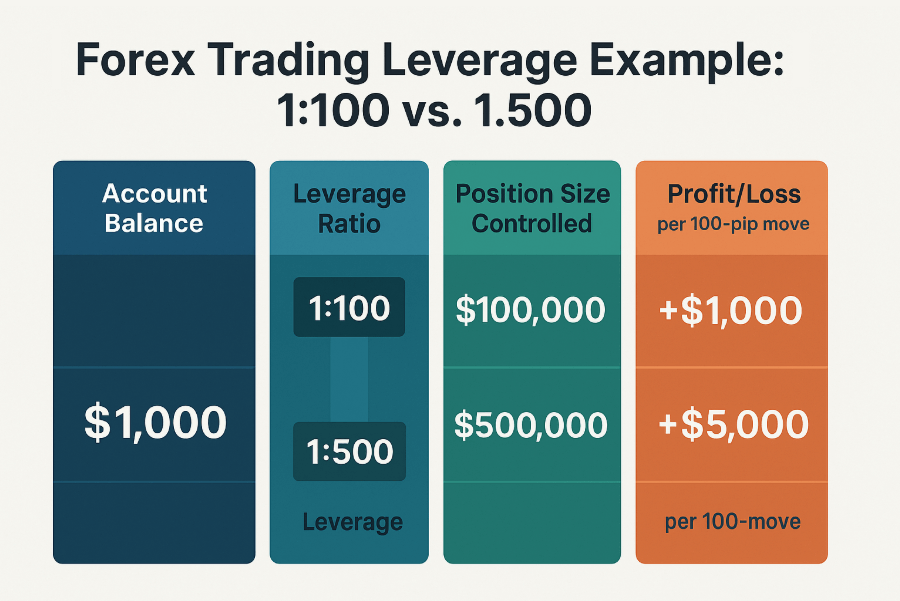

It’s the ability to amplify your market exposure without needing the full trade capital. Understanding how does leverage affect Forex trading is critical. The chart below illustrates different leverage ratios:

| Leverage Ratio | Account Balance | Position Size Control |

|---|---|---|

| 1:50 | $1,000 | $50,000 |

| 1:100 | $1,000 | $100,000 |

| 1:500 | $1,000 | $500,000 |

How Does Leverage Work in Forex?

With 1:100 leverage, $1,000 can control a $100,000 trade. However, this magnifies both potential profits and losses. Even minor pip changes significantly impact your balance. A 100-pip move in a 0.1 lot position could lead to a $100 profit or loss.

| Price Change | Profit/Loss (0.1 lot) | Return on $1,000 |

|---|---|---|

| +100 pips | +$100 | +10% |

| -100 pips | -$100 | -10% |

📌 Expert Tip:

“A margin call can liquidate your positions if not managed. Plan trades and adjust leverage to avoid this.” — Yasmin O’Reilly, Senior Forex Strategist

Practical Forex Trading Leverage Example for Beginners

Here’s a Forex trading leverage example for beginners using Pocket Option:

| Action | Position Size | Required Margin (1:100) |

|---|---|---|

| Buy EUR/USD | 0.1 lot (10,000) | $100 |

| Buy EUR/USD | 0.5 lot (50,000) | $500 |

| Buy EUR/USD | 1 lot (100,000) | $1,000 |

Managing Risk with FX Trading Leverage

Leverage boosts your exposure—but also your risk. Here’s how to manage it:

| Account Size | Max Risk (2%) | Stop Loss (0.1 lot) |

|---|---|---|

| $1,000 | $20 | 20 pips |

| $5,000 | $100 | 100 pips |

| $10,000 | $200 | 200 pips |

🎯 Insider Insight: Using a Forex leverage calculator ensures your trade sizes align with your risk tolerance.

Pocket Option Leverage and Trader Feedback

Pocket Option allows traders to choose leverage levels from 1:10 up to 1:500. This flexibility supports different strategies:

🗣️ Trader Reviews:

“With 1:200 leverage on Pocket Option, I maintained consistent gains while avoiding margin calls.” — Carlos V.

“The stop-loss tools saved me during market spikes. I’m more confident trading live now.” — Mei H.

Comparing Forex Leverage Scenarios

| Scenario | 1:50 Leverage | 1:100 Leverage | 1:500 Leverage |

|---|---|---|---|

| $1,000, 100 pip move | $100 | $200 | $500 |

| Margin call threshold | 200 pips | 100 pips | 40 pips |

Types of Leverage in Forex

Brokers may offer:

- Fixed leverage: Always the same (e.g., 1:100)

- Variable leverage: Adjusts with trade size

- Tiered leverage: Changes by asset class or exposure

Choosing the Right Forex Broker for Leverage

Your broker dictates leverage availability, margin policy, and execution speed. Choose platforms with clear terms, strong support, and robust tools.

Trading Forex Without Leverage

No leverage = no margin calls. While returns are lower, your capital remains fully in your control. This method suits conservative or beginner traders.

| Margin Trading | No Margin Trading |

|---|---|

| Amplifies profits/losses | Lower but controlled risk |

| Requires small deposit | Requires full capital |

When to Use Higher vs. Lower Leverage

- High leverage (1:200 – 1:500): Day trading, scalping, advanced users

- Moderate leverage (1:50 – 1:100): Swing traders, balanced risk

- Low leverage (1:10 – 1:20): Beginners, long-term strategies

Conclusion

This Forex trading leverage example highlights how small capital can control large positions using broker-provided leverage. However, risk increases proportionally. Whether using 1:100 leverage vs 1:500, success depends on managing positions, using stop-loss, and planning trades.

🎯 Pro Tip: Start small, test often, and always protect your capital.

By combining tools like Forex leverage calculator, demo accounts, and smart lot sizing, traders can balance risk and reward more effectively. You can discuss leverage strategies in our community!

FAQ

What is the best leverage ratio for beginners in forex trading?

For beginners, it's advisable to start with lower leverage ratios like 1:10 or 1:20. This reduces the risk of significant losses while you're learning to trade. As you gain experience and develop reliable strategies, you can gradually increase your leverage if appropriate for your trading style.

Can I change my leverage ratio after opening an account?

Yes, most brokers allow you to adjust your leverage ratio. However, the process varies between brokers. Some allow changes through your account dashboard, while others require you to contact customer support. Remember that changing leverage may affect open positions.

How does fx trading leverage affect margin requirements?

Higher leverage reduces margin requirements. For example, with 1:100 leverage, you only need 1% of the total position value as margin. With 1:50 leverage, you need 2%. Lower leverage means higher margin requirements but provides more buffer against market fluctuations.

Is it possible to lose more than my deposit when using leverage?

This depends on your broker's policy. Some brokers offer negative balance protection, which means you cannot lose more than your deposit. Without this protection, in fast-moving markets where stop-losses might not execute at expected prices, losses could exceed your account balance.

How do different currency pairs affect leverage risks?

More volatile currency pairs (like exotic pairs) carry higher risk when using leverage as they can make larger unexpected moves. Major pairs (EUR/USD, GBP/USD) typically have lower volatility and are generally more suitable for leveraged trading, especially for beginners.

What leverage is good for $100?

For $100, 1:10 or 1:20 allows safer trade sizes with limited exposure.

What is leverage in Forex trading with an example?

Leverage lets $1,000 control $100,000 with 1:100 leverage. A 0.1 lot trade yields $100 on a 100-pip move.

What is a 1:500 leverage in Forex?

It means $1,000 controls $500,000. It’s high-risk, suitable only with strict risk control.