- Zero delay: You’re either right now, or you’re not

- Emotionally charged: Every trade feels personal because it’s over so fast

- No time for confirmation: You act on setups — not on full patterns

The Complete Manual to 60-Second Binary Options Trading: Strategy, Setup & Execution

If you’ve ever stared at a chart and thought, “I just need one good minute,” — 60-second binary options might be your thing.

Article navigation

- Start trading

- ⚡ The Nature of 60-Second Binary Options

- 🛠 Technical Setup for Ultra-Short Trades

- 📱 Platform Choice: Why Pocket Option Works

- 🧭 Chart Timeframes

- 💹 Asset Selection

- 🕒 Timing = Edge

- 📊 Indicators That Work for 60-Second Trades

- 🔧 Top Indicators (with Use Cases)

- 🧪 Sample Strategy: EMA + Stochastic Pullback

- 📃 Final Tips: Risk, Mindset s Mistakes to Avoid

- 📚 Sources & References

⚡ The Nature of 60-Second Binary Options

Trading in 60-second windows isn’t just fast — it’s intense. Each candle on the chart represents a full trade cycle. One small move, and your outcome is sealed.

This format isn’t about long-term trends or deep market analysis. It’s about instant momentum, microstructure, and timing precision. In one minute, news can spike, volume can dry up, or a sudden move can hit your stop.

Here’s what makes 60-second binaries unique:

What affects price at this scale?

- Sudden volume bursts

- News ticks (especially on forex pairs)

- Session open/close volatility

- Micro-order flow around key levels

To trade 60-second binaries effectively, you’re not reacting — you’re anticipating. It’s like chess in fast-forward.

This is where high-frequency thinking meets retail execution — and where having a clear, repeatable system becomes your edge.

🛠 Technical Setup for Ultra-Short Trades

When trading 60-second binaries, your environment matters as much as your strategy. One-second delays or messy charts can cost you the trade. So before you even click “Call” or “Put,” get your setup dialed in.

📱 Platform Choice: Why Pocket Option Works

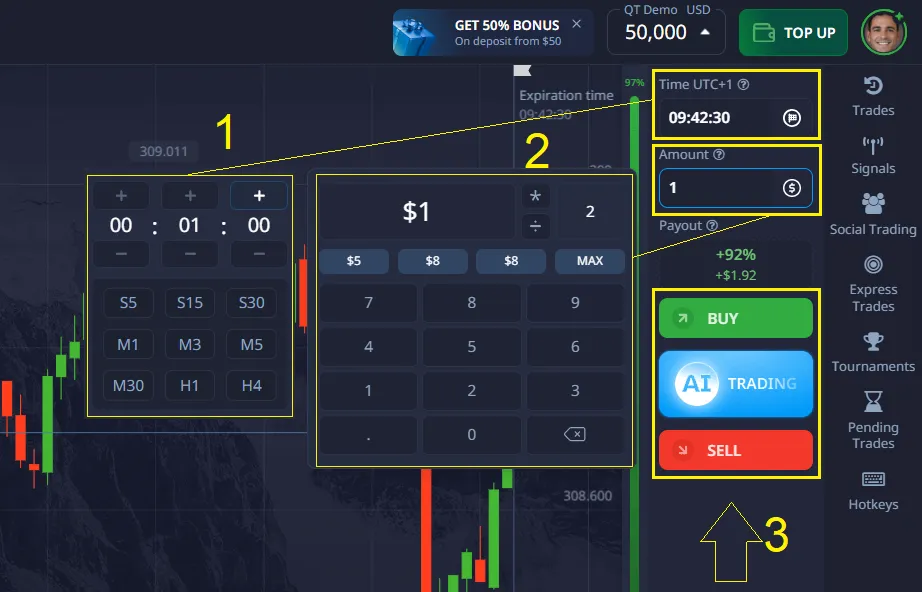

Pocket Option doesn’t offer traditional binary options in the traditional sense. Instead, our platform offers a unique Quick Trading interface that gives you a similar experience. With Quick Trading, instead of directly buying or selling an asset, you enter into a contract based on whether the asset’s price will rise or fall over a short period.

For speed-based trading, execution is everything. Pocket Option is one of the few platforms optimized for this kind of high-frequency rhythm:

- Near-instant order execution

- Clear one-click interface

- Precise expiration controls down to the second

- Built-in indicators and compact layout

Whether you’re on mobile or desktop, the response time is tight — and that matters.

Try Quick Trading on a real account starting from $5 or for free on a demo account.

🧭 Chart Timeframes

Use ultra-low frames to read price action clearly. Recommended:

- 5-second candles for real-time entry signals

- 15-second candles for spotting short patterns

- 1-minute candles for broader micro-trend context

Always zoom out briefly before zooming in. A trade that looks strong on 5s might be weak on the 1m.

💹 Asset Selection

Choose instruments with tight spreads and constant movement. Favorites:

Avoid slow pairs or low-volume windows — they’ll eat your setup alive.

🕒 Timing = Edge

Some of the best short-term trades happen at:

- Market opens (first 30 minutes of London or New York)

- News releases (with reduced size and wider SL)

- Breakouts from tight ranges

60-second binaries aren’t about “more trades.” They’re about better timed trades.

📊 Indicators That Work for 60-Second Trades

In ultra-short trading, your indicators need to be fast, reactive, and simple. You don’t have time for complex confluence or waiting for five confirmations.

Below are tools that actually keep up with 60-second binary action — and don’t lag behind price.

🔧 Top Indicators (with Use Cases)

| Indicator | What It Shows | Why It Works in 60s | How to Use It |

| Stochastic | Overbought/oversold momentum | Quick reversal signals | Entry on fast cross at 80/20 |

| EMA (G s 21) | Short-term trend & velocity | Fast crossover alerts | Trade direction after cross |

| Bollinger Bands | Volatility + price extremes | Boundary bounces | Entry on outer band touch |

| Volume | Surge in interest | Confirms breakout setup | Avoid low-volume candles |

| Price Action | Candle size, wick, momentum | Instant visual clarity | Micro-reversals or breakouts |

📌 Pro Tip: Less = More

Stacking too many indicators slows your decision-making. Pick two tools max — ideally, one for trend and one for entry.

Example combo:

EMA + Stochastic → trend direction + reversal timing

You can also trade pure price action, but only if you’ve trained your eye to spot high-probability setups under time pressure.

🧪 Sample Strategy: EMA + Stochastic Pullback

Let’s put the theory into practice. This strategy uses just two fast indicators — a short EMA crossover and a Stochastic oscillator — to catch quick pullbacks in the trend. Perfect for 60-second setups.

🎯 Strategy Concept

You’re not chasing trends. You’re catching mini-dips inside short bursts of momentum — then riding them for 60 seconds.

📊 Indicators Setup

- EMA G (fast)

- EMA 21 (baseline)

- Stochastic (5,3,3) with 80/20 levels

Use 5-second or 15-second candles for entry clarity.

✅ Entry Rules (Call Trade Example)

- EMA G crosses above EMA 21 → short-term bullish momentum

- Stochastic dips below 20 and starts turning up

- Price pulls back near the EMAs → clean entry zone

- Enter 60s CALL on Stochastic upward bounce

- Confirm with strong bullish candle or volume spike

❌ Entry Filter

- No trade if both EMAs are flat

- Avoid entries during news events or at session close

- Skip if volume is low (price is drifting)

🔁 Repeatability

You’re not trying to catch every move. You’re waiting for a clear pullback in a strong micro-trend, then riding the next impulse.

This setup is fast, visual, and easy to drill in demo — until it becomes muscle memory.

📃 Final Tips: Risk, Mindset s Mistakes to Avoid

60-second binary options trading gives you speed — but that comes with responsibility. Here’s what matters most once your strategy is set.

⚖️ 1. Risk Smart, Not Big

Never risk more than 1–3% of your account per trade. Even if trades are fast, losses stack up just as fast. Avoid chasing losses or doubling up — this isn’t poker.

📌 One simple rule: stop after 3 wins or 3 losses in a row. Reset your mindset.

🧠 2. Train Your Focus

These trades demand full attention. Set time limits for trading sessions — 20–30 minutes max. Overtrading leads to burnout, poor judgment, and revenge trades.

Use timers, alerts, and even breathing techniques between trades to stay sharp.

❌ 3. Avoid These Rookie Mistakes

- Trading during low liquidity hours

- Ignoring news releases (big mistake in FX pairs)

- Reacting emotionally to 1–2 losses

- Using random lot sizes or untested signals

Consistency doesn’t come from “more trades” — it comes from better filters.

🧠 Final Word

60-second options aren’t for everyone. But if you approach them like a professional — with structure, patience, and self-control — they can become a powerful tool in your strategy mix.

Test your setups. Respect your limits. And above all — let your system do the talking, not your emotions.

📚 Sources & References

- Pocket Option Education Center

Platform-specific insights on ultra-short-term trading and fast execution tools. - BabyPips – Scalping and Short-Term Strategy Guides Educational materials explaining momentum setups and low- timeframe trading logic.

- Investopedia – Binary Options Overview

Basic definitions and structure of binary contracts with expiration- based models. - CFA Institute – Behavioral Biases in High-Speed Trading

Research on emotion, decision fatigue, and impulse control in short-term trading. - TradingView – User Scripts for 60s Indicators

Real-time community strategies using Stochastic, EMA, and Bollinger setups.

FAQ

Is 60-second trading just gambling?

Not if you treat it like a structured system. Gambling is random. This is about building a repeatable, risk-managed method — with discipline, not hope.

How many trades should I do per day?

Quality over quantity. Even 5–10 well-filtered setups per session can outperform 50 random clicks. More trades ≠ more profit.

Can I use this strategy on any asset?

Not all assets move well in short bursts. Stick to high-volume pairs like EUR/USD, GBP/JPY, or indices during peak hours for cleaner signals.

Why do my signals “almost” work but expire wrong?

Your timing might be right, but your entry is late. In 60s trading, even a 3- second delay matters. Practice execution and avoid slow platforms.

How do I stay calm when trades move so fast?

Trade in short sessions. Use timers. Take breaks. And most importantly — accept your risk before entry, so outcomes don’t shake you.