- On the bus heading to work

- While sipping your morning coffee

- Before bed when you’ve got 5 spare minutes

What is Copy Trading: Unlocking Social Investment Potential

In the ever-evolving world of financial markets, innovative strategies continue to emerge, offering new opportunities for investors. One such approach that has gained significant traction in recent years is copy trading. But what is copy trading, and how can it benefit both novice and experienced investors?

Article navigation

- What is Copy Trading: Unlocking Social Investment Potential

- How Does It Actually Work?

- Copy Trading on the Go: Pocket Option in Your Pocket

- Popular Platforms: How Pocket Option Compares

- Benefits of Copy Trading: Why It Works

- Risks and What to Watch Out For

- Starting Copy Trading: Step-by-Step

- Picking the Right Trader: What to Look For

- Copy Trading vs Traditional Trading: A Quick Look

- Best Practices to Boost Results

- Final Thoughts: What’s Copy Trading in 2025?

What is Copy Trading: Unlocking Social Investment Potential

What is copy trading, really? And why are so many people using it to step into trading with confidence? In simple terms, copy trading (also called social trading or mirror trading) is a system that allows you to automatically copy the trades of more experienced traders. ✔️

That’s the copy trading meaning — you connect your account to a pro, and when they trade, your account does the same. Automatically. Proportionally. No need to analyze charts or stare at price movements for hours.

You’re still in control — but now you’ve got someone else doing the heavy lifting.

How Does It Actually Work?

When you copy trade, you select a trader (also called a signal provider). Every time they open or close a position, the same action happens in your account. If they win, you win. If they lose — well, it’s proportional to your investment, and you control your limits.

✅ No need for deep market knowledge

✅ Ideal for learning by watching

✅ Can be started with small amounts

Copy Trading on the Go: Pocket Option in Your Pocket

One of the easiest ways to start is via mobile — and Pocket Option makes it surprisingly smooth.

You can open real trades literally from your phone:

“I open the Pocket Option app while my tea brews. Choose a trader, set copy rules — done.”

Start copying trades with as little as $5. Yes, the minimum deposit depends on the payment method, but it’s designed to be beginner-friendly.

Popular Platforms: How Pocket Option Compares

| Platform | Key Features | Min Deposit | Assets Supported |

|---|---|---|---|

| eToro | Big trader network, user-friendly interface | $200 | Stocks, Forex, Crypto, Commodities |

| Pocket Option | Quick setup, mobile-first, low entry barrier | From $5 | Copy Trading, Quick Trading, CFDs |

| ZuluTrade | Custom risk controls, broker flexibility | Varies | Forex, Cryptocurrencies |

| NAGA Trader | Multi-asset copy trading, social feed | $250 | Stocks, Crypto, Commodities, ETFs |

✔️Pocket Option stands out for its accessibility and speed — plus, it’s fully mobile-friendly for those who want to copy trades without a desktop setup.

Benefits of Copy Trading: Why It Works

- Beginner-friendly — No need to be an expert

- ⏳ Time-saving — Set it, forget it (but monitor!)

- Diversification — Copy different traders and strategies

- Learning tool — Observe how experienced traders operate

- Passive potential — Your money works while you focus elsewhere

Risks and What to Watch Out For

Of course, copy trading isn’t magic. It comes with risks — but smart users manage them.

| Risk | What It Means | Tip to Handle It |

|---|---|---|

| Past ≠ future | Good history doesn’t mean future profits | Diversify — don’t follow just one trader |

| Low control | Trades execute automatically | Set copy limits and stop balance |

| Complacency trap | You might stop learning | Use copy trading as a learning aid |

| Extra fees | Some platforms take a cut | Check fee policies before you start |

The takeaway? Stay aware, set rules, and review your account regularly.

Starting Copy Trading: Step-by-Step

Ready to give it a try? Here’s how you begin:

- Pick a platform — like Pocket Option

- Fund your account (remember: from just $5!)

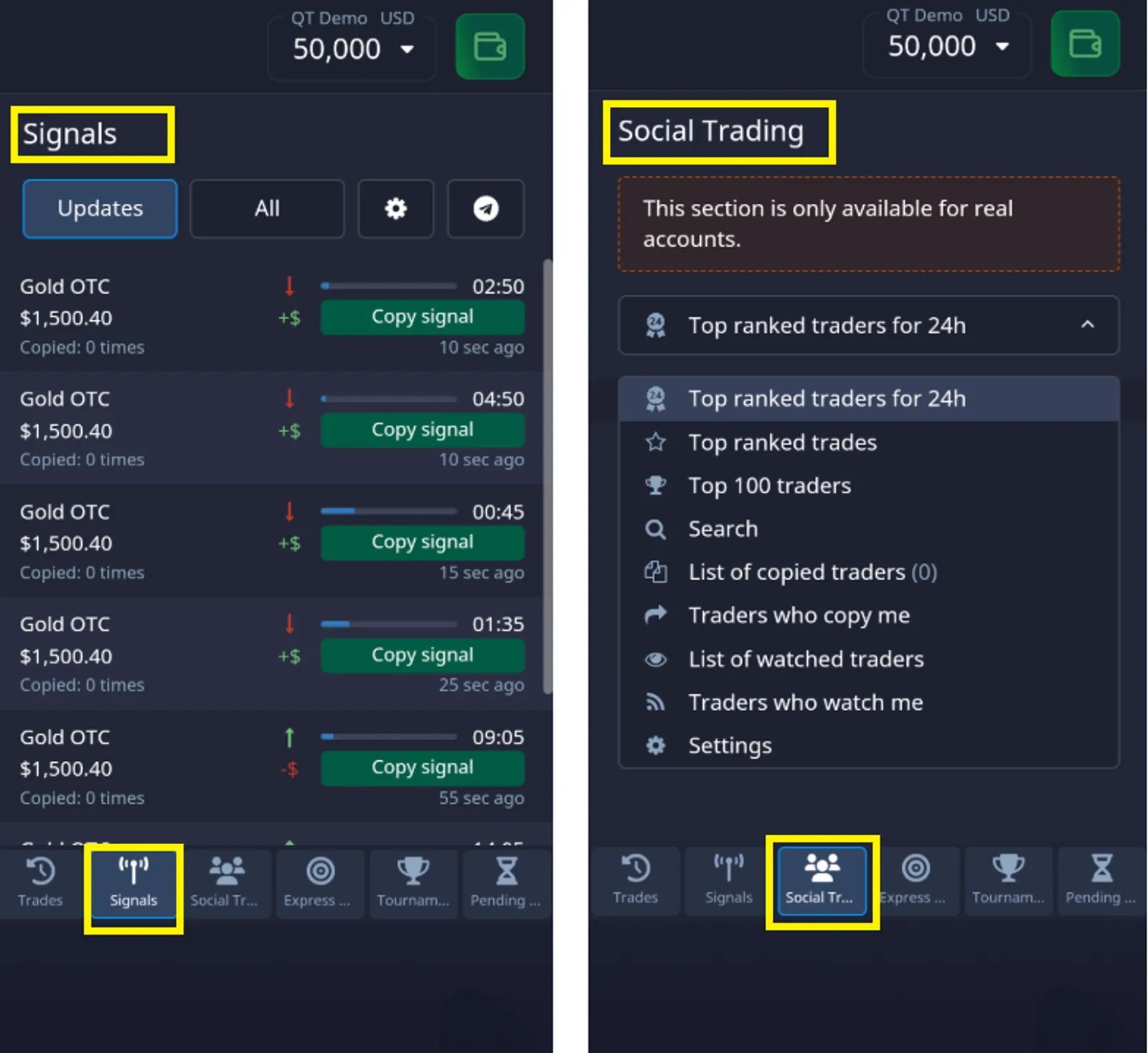

- Tap “Social Trading” and browse available traders

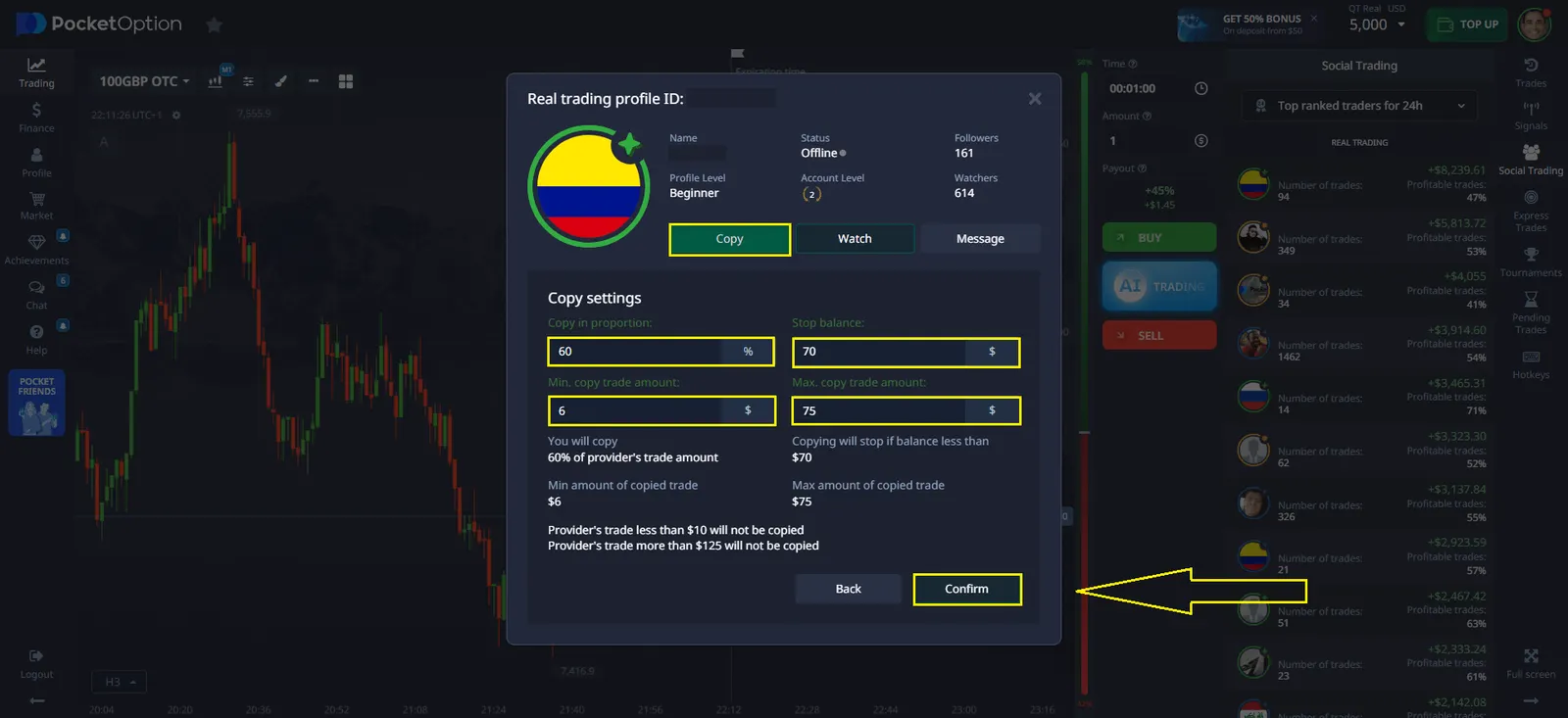

- Choose who to copy, set copy ratio, limits, and stop-balance

- Tap “Copy” — your setup is complete!

✅ You can stop copying at any time

✅ You can monitor in real time

✅ You’re always in control

Picking the Right Trader: What to Look For

Don’t just go for the biggest numbers. Look deeper.

| Criteria | Why It Matters |

|---|---|

| Consistent performance | Steady results are better than lucky spikes |

| Risk profile | Lower drawdown means safer behavior |

| Trading style | Does it match your timeframe/goal? |

| Transparency | Good traders explain their approach |

| History length | Avoid newbies with no track record |

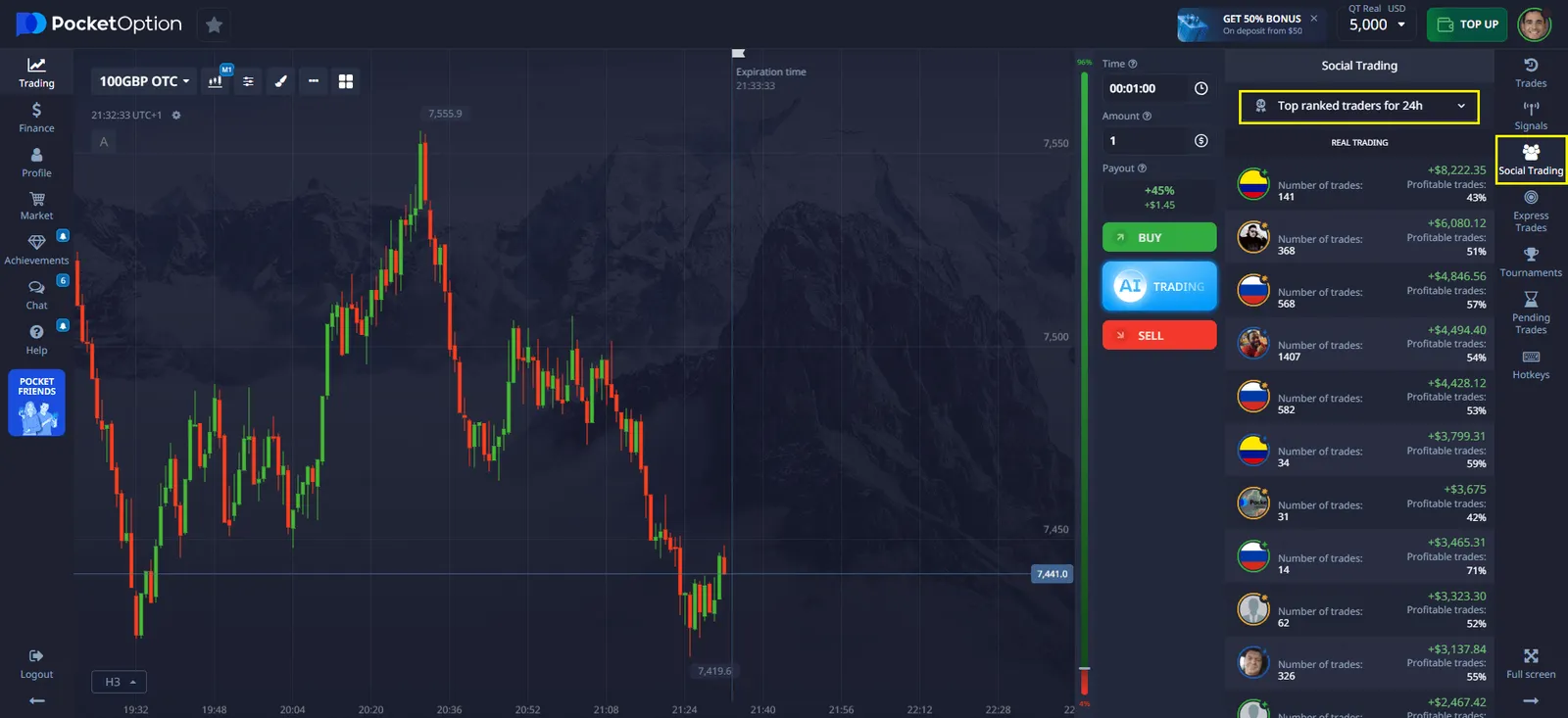

On Pocket Option, you can explore:

- Top 100 traders (real-time)

- Best performers over last 24h or 7d

- Search by trader ID

Copy Trading vs Traditional Trading: A Quick Look

| Topic | Copy Trading | Traditional Trading |

|---|---|---|

| Time needed | Low — set and monitor | High — constant learning/research |

| Experience | Not required to start | Essential from the beginning |

| Emotional impact | Reduced (no impulsive trades) | Can be overwhelming |

| Control | Medium (automated, but with settings) | Full — every trade is manual |

| Learning speed | Fast if you observe and analyze others | Slow — all self-driven |

Copy trading is like training wheels — steady and guided — while you prepare for more advanced strategies later.

Best Practices to Boost Results

- Diversify your copied traders

- Set a stop balance to limit downside

- Review performance weekly

- Use it to learn market logic over time

Remember, even automation works better when you stay involved.

Final Thoughts: What’s Copy Trading in 2025?

So, what’s copy trading today?

It’s no longer a niche trick — it’s a mainstream way to start trading smarter. For beginners, it’s a powerful gateway. For experienced users, it’s a way to scale, experiment, and diversify.

And if you’re still wondering where to start?

- Open your Pocket Option account now — just $5 to activate real trading.

- Download the app, go to “Social Trading”, and choose your trader.

- ✨ Start copying in 3 taps — from your phone, wherever you are.

Don’t just watch others trade. Copy them. Learn from them. Grow with them.

FAQ

What's copy trading and how does it differ from traditional trading?

Copy trading is a method where investors automatically replicate the trades of experienced traders in their own accounts. It differs from traditional trading in that it allows investors to benefit from others' expertise without directly executing trades themselves, potentially reducing the time and knowledge required for active trading.

Is copy trading suitable for beginners?

Yes, copy trading can be suitable for beginners as it allows them to participate in financial markets without extensive knowledge or experience. However, it's important for newcomers to understand the risks involved and start with a demo account before investing real money.

How do I choose the right traders to copy?

When selecting traders to copy, consider factors such as their performance history, risk management approach, trading style, and consistency. Look for traders whose strategies align with your investment goals and risk tolerance.

What are the main risks associated with copy trading?

The main risks of copy trading include the potential for losses if copied traders perform poorly, lack of direct control over individual trades, and the possibility of becoming overly reliant on others' strategies. It's important to diversify across multiple traders and maintain realistic expectations.

Can I use Pocket Option for copy trading?

Yes, Pocket Option offers copy trading features, particularly focused on forecast options.