- Pattern identification

- Market context analysis

- Practical trading applications

Pocket Option Candlestick Patterns: Practical Use of Candlestick Technical Analysis

Candlestick analysis is key for technical traders. This article explains how to recognize and use Pocket Option candle patterns for smarter trading decisions.

Article navigation

- Aprende patrones de velas en Pocket Option

- What Is a Candlestick Pattern?

- Using Candlestick Technical Analysis on Pocket Option

- Key Candle Patterns Explained with Examples

- Where to Learn Candlestick Patterns on Pocket Option

- Table: Quick Summary of Pocket Option Candle Patterns

- How to Trade Pocket Option Trading Candlestick Technical Analysis

- Critical Observations on Candlestick Usage

What Is a Candlestick Pattern?

A candlestick pattern is a specific formation on a price chart created by one or several candlesticks. These formations provide insights into market sentiment and potential future price movements. Recognizing these patterns can help traders forecast reversals, continuations, or periods of consolidation.

Pocket Option enables users to study candlestick behavior in real-time using built-in charting tools without the need for additional platforms.

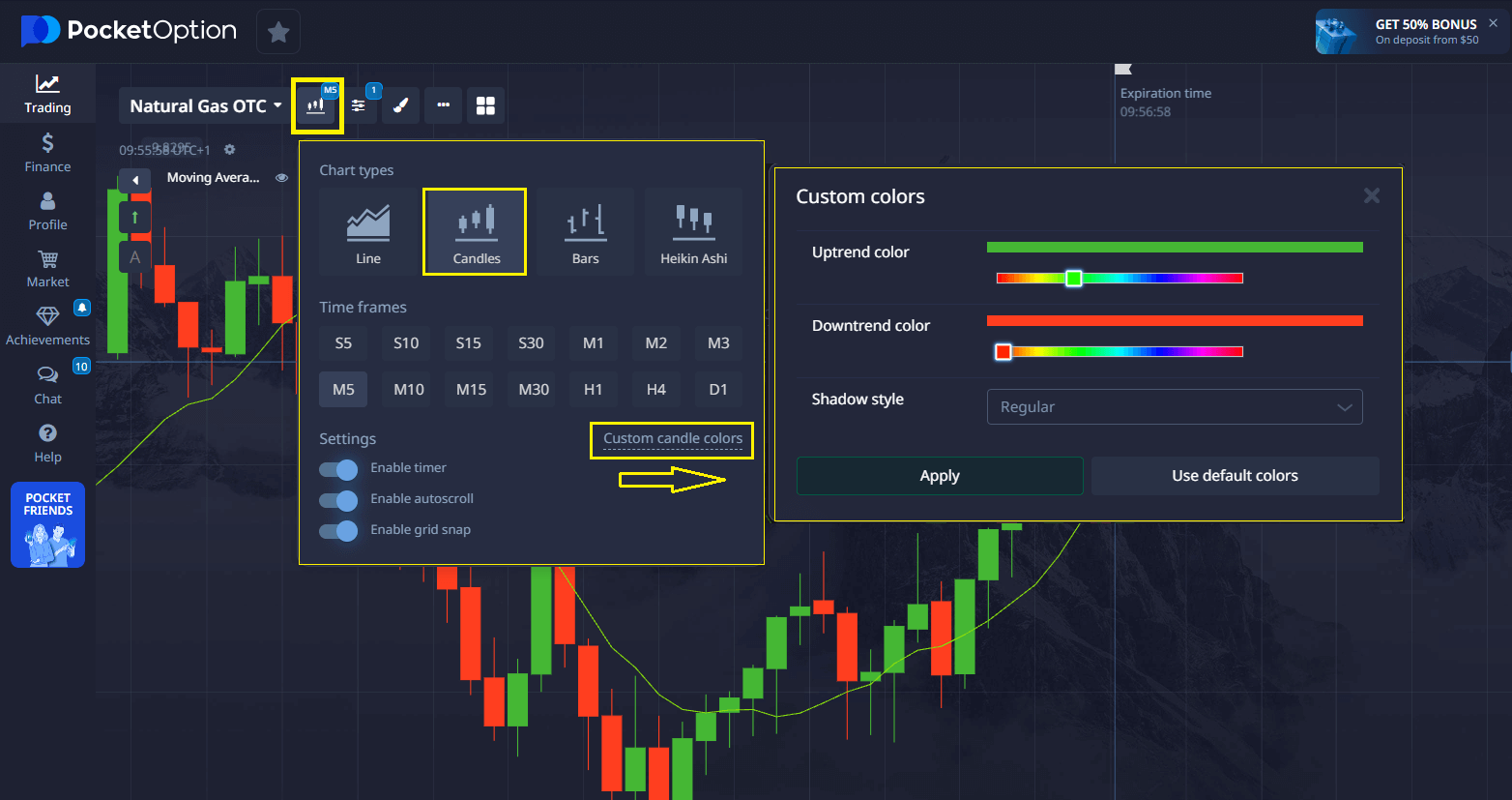

Using Candlestick Technical Analysis on Pocket Option

Pocket Option offers easy access to candlestick charts and related tutorials. In the trading interface, traders can switch to “Candlestick” view and start analyzing price behavior. Educational content is available in the Guides and Tutorials section, covering:

Key Candle Patterns Explained with Examples

Below are practical patterns suitable for immediate application on the Pocket Option demo account.

Hammer

Description: The Hammer is a single-candle pattern found after a downtrend. It has a small body at the top and a long lower shadow, indicating that buyers pushed prices up after initial selling pressure.

Market Meaning: Signals a potential bullish reversal.

Trading Tip: Confirm with a subsequent bullish candle before entering a trade.

Pocket Option Tip: Switch to the demo account, locate a Hammer after a decline, and observe if a reversal forms before risking real funds.

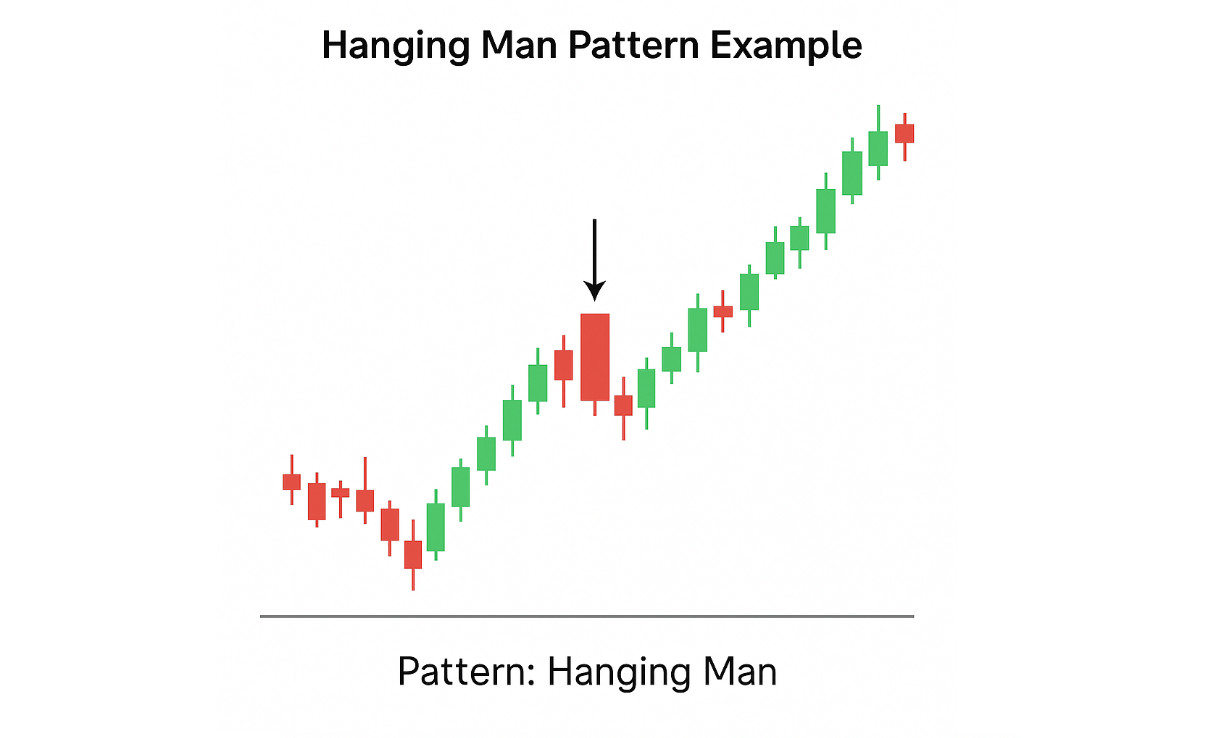

Hanging Man

Description: The Hanging Man is similar in shape to the Hammer but occurs after an uptrend. It suggests that sellers are beginning to gain strength.

Market Meaning: Signals a potential bearish reversal.

Trading Tip: Wait for confirmation with a bearish closing candle before initiating a position.

Pocket Option Tip: Use the demo account to identify Hanging Man patterns after rallies and monitor price responses.

Bullish Engulfing

Description: A two-candle pattern where a small bearish candle is followed by a larger bullish candle that completely engulfs the first.

Market Meaning: Indicates strong buyer momentum and potential start of an uptrend.

Trading Tip: Focus on Bullish Engulfing after a significant downtrend for higher reliability.

Pocket Option Tip: On the demo account, spot the Bullish Engulfing pattern and test entry strategies without risking capital.

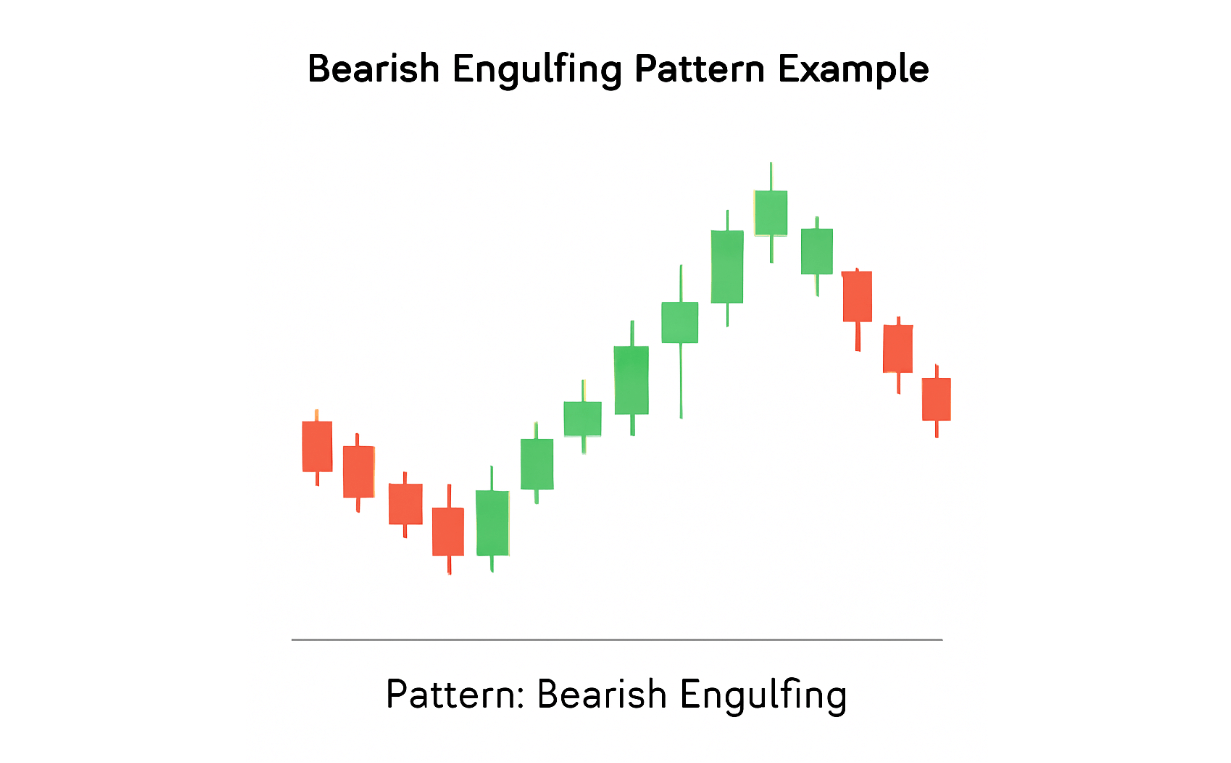

Bearish Engulfing

Description: Opposite to Bullish Engulfing, this pattern features a small bullish candle followed by a larger bearish candle that engulfs it.

Market Meaning: Signals a potential start of a downtrend.

Trading Tip: Bearish Engulfing is stronger when appearing at key resistance levels.

Pocket Option Tip: Try identifying Bearish Engulfing setups on the demo to test how market reacts before making real trades.

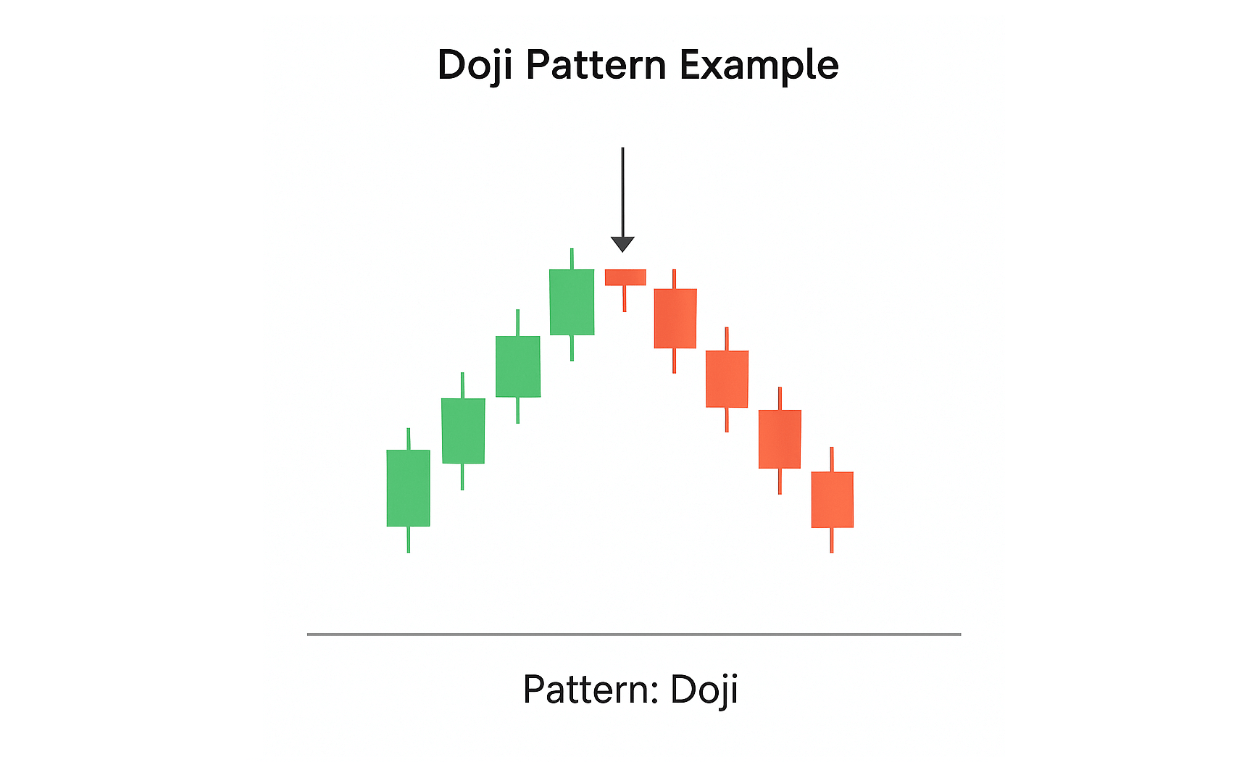

Doji

Description: The Doji forms when the open and close prices are very close or identical. It reflects market indecision.

Market Meaning: Can signal reversal or continuation depending on the preceding trend.

Trading Tip: Always combine Doji analysis with trend context and confirmation signals.

Pocket Option Tip: On the demo account, observe how different types of Doji behave in trending versus ranging markets.

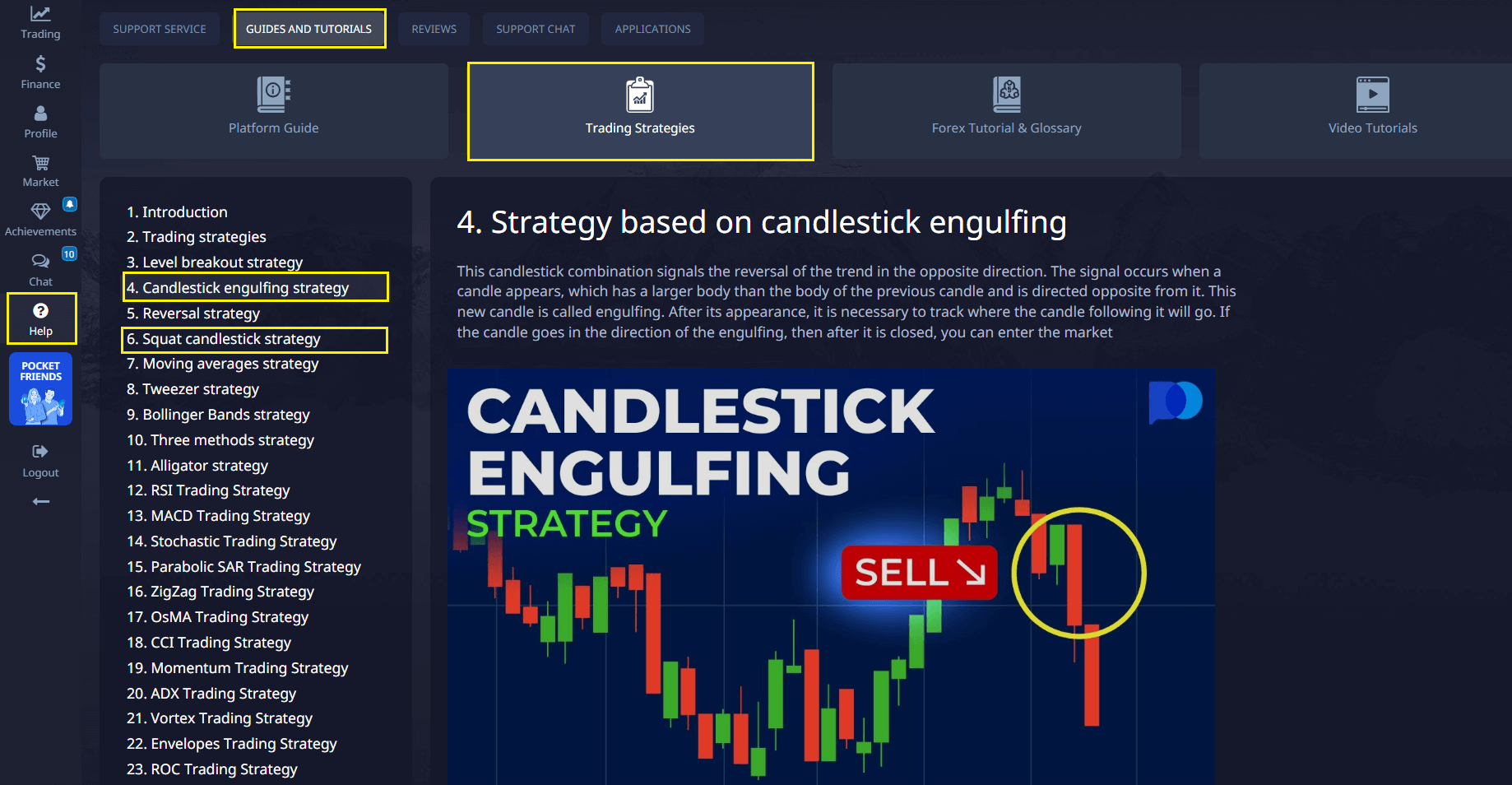

Where to Learn Candlestick Patterns on Pocket Option

To help traders learn how to use candlestick analysis step by step, Pocket Option offers a special Guides and Tutorials section on trading strategies. This section contains popular strategies with detailed instructions, allowing traders to:

- Learn how to read candlestick charts correctly.

- The main key candlestick patterns

- Apply step-by-step approaches to effectively predict price movements.

This section is a great resource for both beginners and experienced traders looking to improve their skills.

Table: Quick Summary of Pocket Option Candle Patterns

| Pattern | Market Indication | Recommended Action |

|---|---|---|

| Hammer | Possible bullish reversal | Confirm before entry |

| Hanging Man | Possible bearish reversal | Wait for bearish confirmation |

| Bullish Engulfing | Strong buyer pressure | Trade after downtrend |

| Bearish Engulfing | Strong seller pressure | Trade after uptrend |

| Doji | Indecision | Confirm with next candle |

How to Trade Pocket Option Trading Candlestick Technical Analysis

Applying candlestick analysis at Pocket Option involves a structured process:

- Select “Candlestick” mode on the trading platform.

- Identify key patterns among current price movements.

- Confirm findings with additional technical indicators.

- Practice setups in demo mode to understand reliability.

- Transition to live trading after establishing consistent accuracy.

Critical Observations on Candlestick Usage

While useful, candlestick patterns alone are not sufficient for making consistent profits. They reflect probabilities, not certainties. Market anomalies, low trading volumes, or external news can invalidate traditional setups. Traders should combine candlestick analysis with risk management and broader market understanding.

FAQ

What is a Pocket Option candle pattern?

It refers to candlestick setups on Pocket Option charts used to anticipate market movements.

How to learn candlestick patterns at Pocket Option?

Use the free Guides and Tutorials section for step-by-step education.

Can I test candlestick patterns without risking money?

Yes, Pocket Option provides a free demo account for practice.

What patterns should beginners focus on first?

Start with Hammer, Engulfing, and Doji formations for clarity.

Are candlestick patterns reliable for real trading?

They improve decision-making but should be combined with additional analysis.

CONCLUSION

Candlestick patterns on Pocket Option offer practical tools for structured analysis but require careful application. Mastering Pocket Option Trading Candlestick Technical Analysis is essential for building structured strategies and improving trading accuracy on the platform. Beginners are encouraged to explore these strategies first in a risk-free environment using the demo account. Mastery comes from observation, practice, and critical thinking rather than blind reliance on patterns.

Start trading