- Moving Averages (MA): Help identify the trend direction

- Relative Strength Index (RSI): Measures momentum and overbought/oversold zones

- MACD: Combines moving averages to highlight trend shifts

- Bollinger Bands: Show volatility and potential breakout zones

- Stochastic Oscillator: Compares recent closing prices to historical ranges

How to Apply and Combine Forex Trading Indicators Effectively

Forex trading indicators are essential tools for traders seeking to analyze market trends. However, many traders fall into common traps when using these indicators, leading to suboptimal results. This article will explore the typical mistakes made with forex trading indicators and provide actionable steps to correct them.

Article navigation

What Are Forex Trading Indicators?

Forex trading indicators are technical tools applied to price charts to help traders interpret market movements. They simplify raw data into visual signals that support better timing for entries and exits. At Pocket Option, indicators are available on both the integrated MetaTrader platform and the platform’s own web-based trading interface — giving traders flexibility to analyze the market wherever they choose to trade.

Some of the most widely used indicators include:

When used correctly, each forex trading indicator can reveal a unique aspect of market behavior.

How to Choose the Right Forex Indicators for Your Strategy

To get the most value out of forex trading indicators, consider these factors:

Your Trading Style:

- Scalping → RSI, Stochastic

- Day Trading → MACD, MA

- Swing Trading → Trend lines, Fibonacci

Timeframe Compatibility:

Match your indicators to the timeframe you analyze. A tool that works well on the 5-minute chart might give misleading signals on the daily chart.

Market Conditions:

Trending vs. ranging markets require different tools. For example, use Moving Averages in trending markets and RSI in ranging ones.

Signal Type:

Know whether your indicator is leading (predictive) or lagging (confirmation), and combine them for stronger setups.

How to Apply Forex Trading Indicators Effectively

Here are key principles for working with indicators like a pro:

- Combine Multiple Indicators: Use 2–3 complementary tools to confirm signals and reduce false positives.

- Adjust Settings to Market Volatility: For example, in high-volatility markets, widen Bollinger Bands or reduce RSI sensitivity.

- Avoid Redundancy: Don’t use several indicators that show the same type of data (e.g. using both RSI and Stochastic).

- Test and Refine Regularly: Track performance and tweak your setup based on market conditions and outcomes.

Using Technical Indicators with Pocket Option

Pocket Option offers flexible tools for traders using technical indicators:

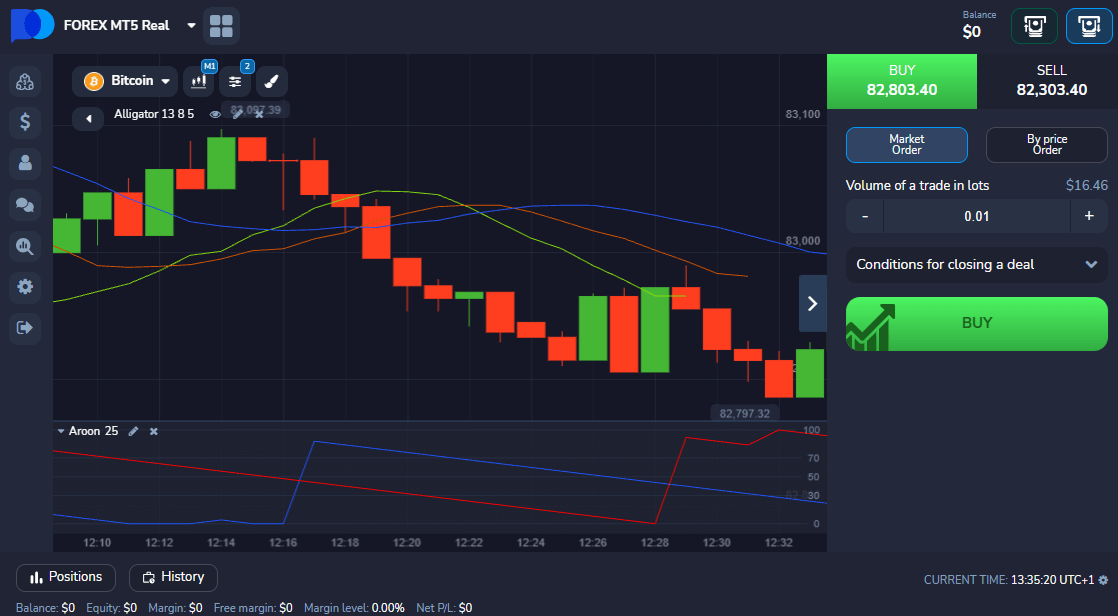

- Forex trading is available via the MT5 terminal, which provides advanced charts, professional layouts, and full indicator control.

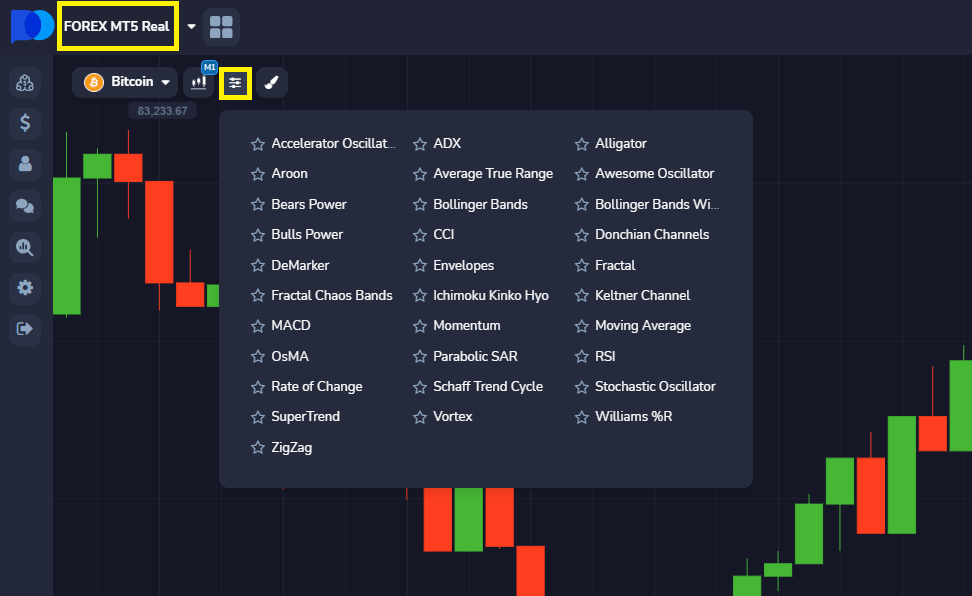

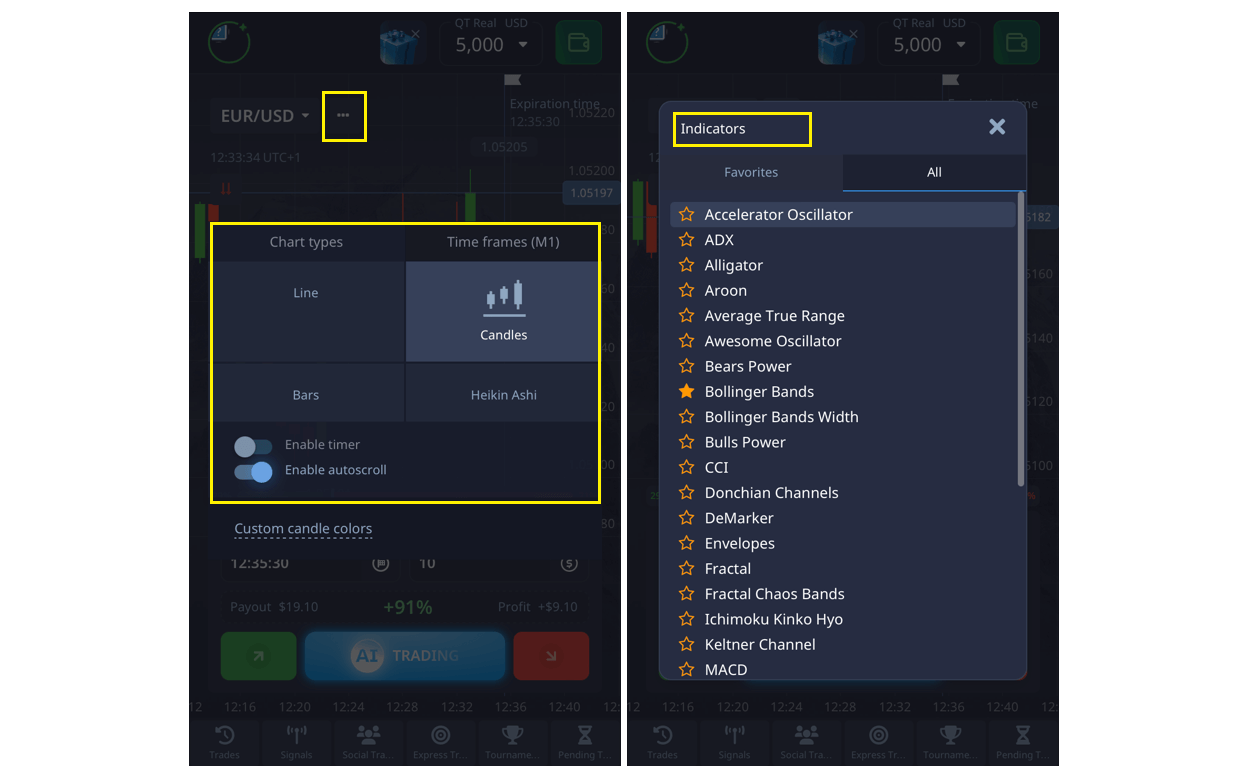

- In the standard platform interface, you can:

- Open the “Indicators” tab in the top-left corner

- Add up to 30 indicators per chart

- Save favorites for quick access

- Analyze multiple timeframes in one view

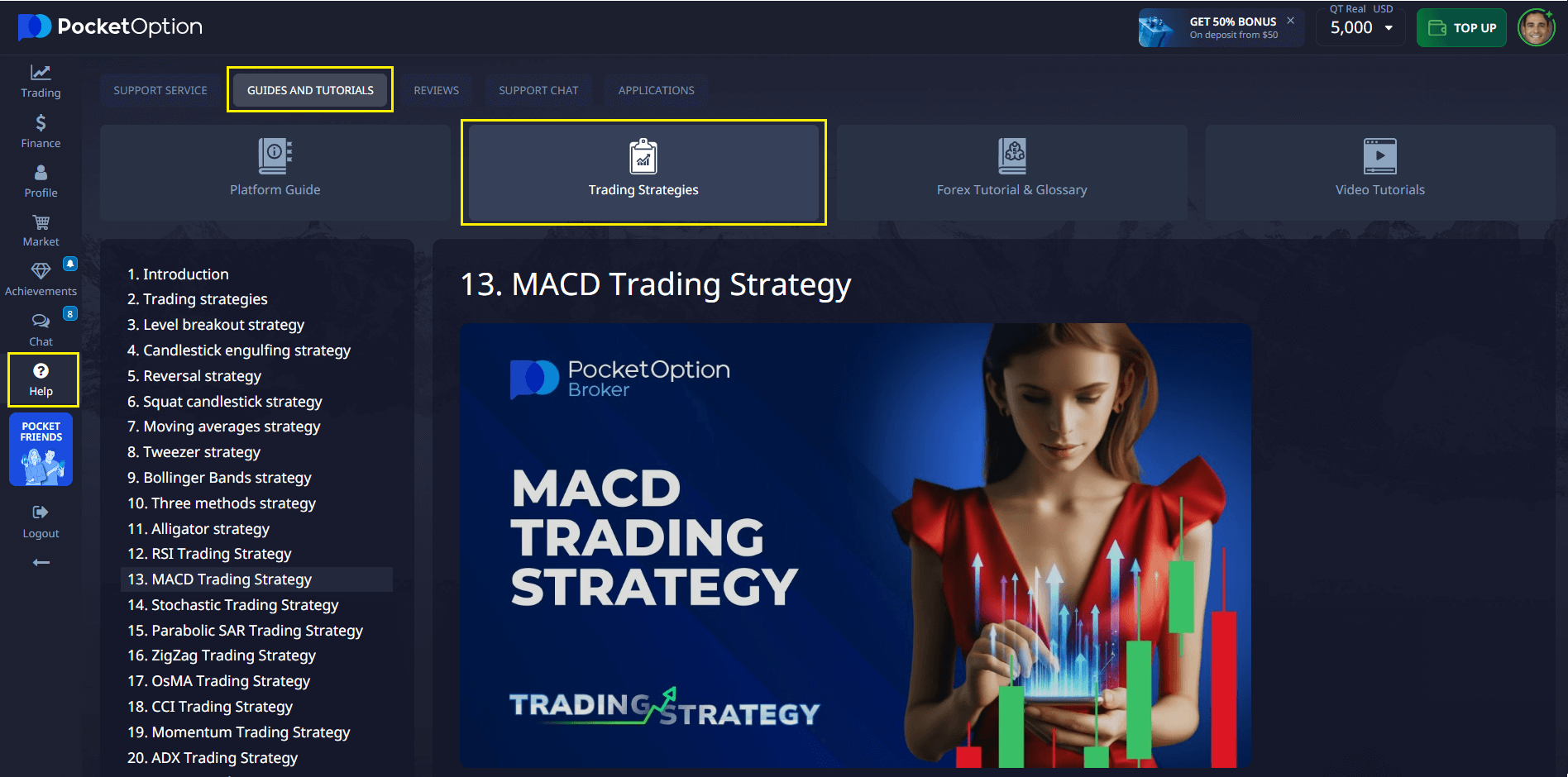

Pocket Option also features a learning center and glossary, making it easier to understand how each forex trading indicator works — even if you’re just getting started.

Advanced Techniques for Indicator-Based Trading

Once you’re comfortable with the basics, explore more advanced strategies:

- Indicator Confluence: Combine tools like MA + RSI for confirmation before trade execution.

- Custom Indicators: Develop your own formulas if you need a tailored approach.

- AI & Signal Analysis: Use machine learning models to interpret signal patterns (ideal for experienced traders).

Note: These approaches require solid technical understanding and constant monitoring.

Risk Management with Technical Indicators

Even the best indicator won’t guarantee profits. Always pair your technical setups with solid risk management:

- Define how much you risk per trade

- Use stop-loss and take-profit consistently

- Avoid overtrading weak or conflicting signals

- Review results and improve your plan continuously

Why Choose Pocket Option for Forex Trading

Pocket Option is built to support technical traders with modern features and real-time access:

- $50,000 demo account for unlimited testing

- Quick trading with precision forecasting

- Integrated risk controls like SL and TP

- Mobile trading via app for full flexibility

- Social trading, OTC access, and full MT5 compatibility

Pocket Option gives you everything you need to practice and apply your knowledge of forex trading indicators in live market conditions.

Conclusion

Mastering forex trading indicators means more than just adding tools to a chart. It requires understanding their signals, adjusting to the market, and integrating them into a disciplined trading system. Platforms like Pocket Option give you the features and flexibility to put your strategy into action — whether you’re learning, testing, or trading live.

FAQ

What are the most popular forex trading indicators?

Moving Averages, RSI, MACD, Bollinger Bands, and Stochastic Oscillator are widely used.

How many indicators should I use at once?

Typically 2–3 complementary indicators are enough. Using too many can cause confusion.

Can indicators predict market direction accurately?

Not with certainty. They estimate probabilities. Always combine them with risk control.

When should I adjust indicator settings?

Whenever market volatility changes or your strategy stops working as expected.

Does Pocket Option offer unique indicators?

Pocket Option includes a wide range of standard indicators and advanced tools through the MT5 terminal.