- Crude oil (Brent and WTI)

- Natural gas

- Gold and silver

- Corn and wheat

Methods for Implementing an Effective Crude Oil Trading Strategy

Trading crude oil requires concentration, precision, and structured analysis. On Pocket Option, users can implement a crude oil trading strategy using a range of technical tools and educational resources. The platform allows testing strategies in demo mode and applying them on a real account starting from just $5. Crude oil, listed among commodities, is available for short and long-term transactions, with flexible timing and payment visibility.

Overview of Commodity Trading

Commodities are raw physical assets traded on financial markets. These include:

Crude oil is widely used as a benchmark asset due to its price volatility and liquidity. These factors make it suitable for both trend-following and high-frequency strategies.

Role of Crude Oil in Global Markets

Oil prices reflect changes in:

- OPEC production quotas

- Geopolitical risks

- US dollar valuation

- Supply and demand reports

Oil prices tend to react quickly to market news, making it a prime candidate for tactical operations and execution-focused strategies.

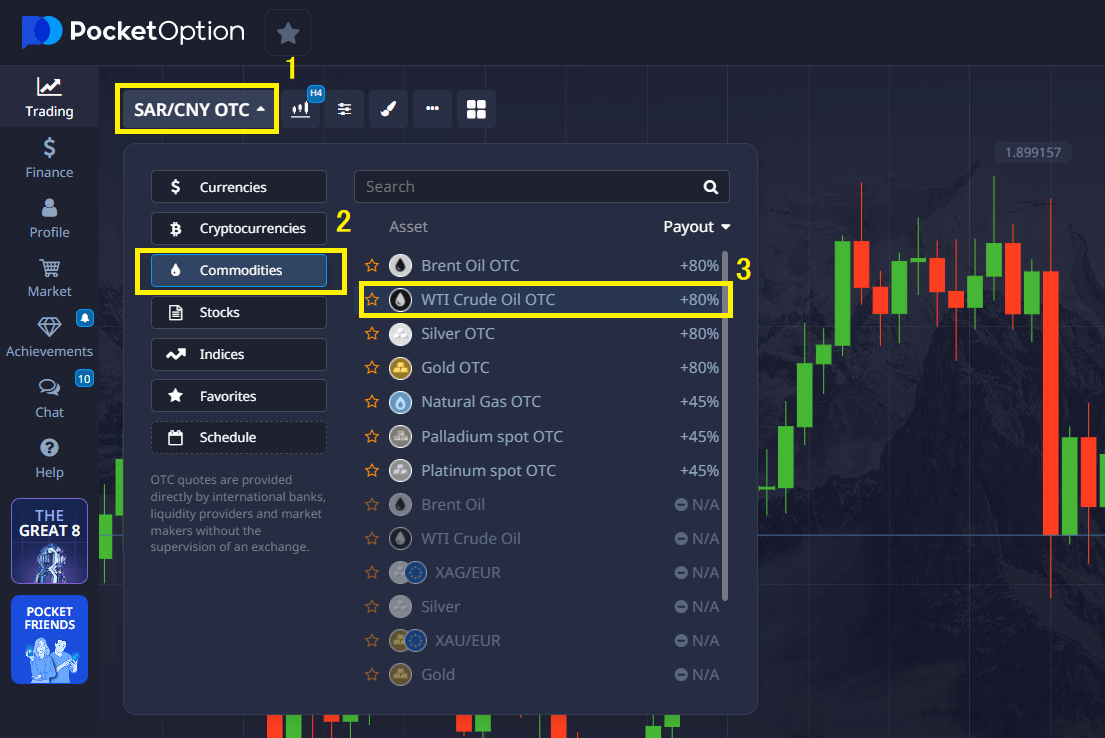

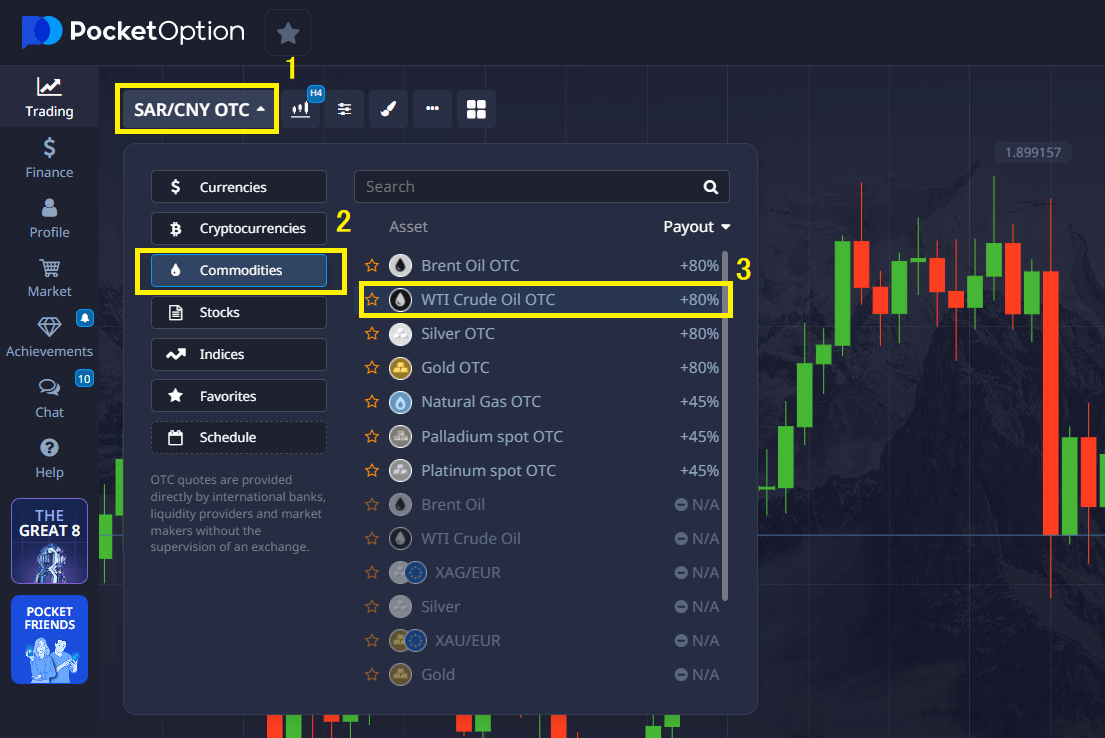

Access to Crude Oil on Pocket Option

The platform classifies oil under commodities. Traders can:

- Initiate trades from $1

- Choose an expiration from 5 seconds (for OTC assets)

- Use indicators to interpret trends

- Monitor return percentages up to 92% in advance

Educational support, including oil trading tips and structured tutorials, is available in the Help section. These resources support both beginners and advanced users.

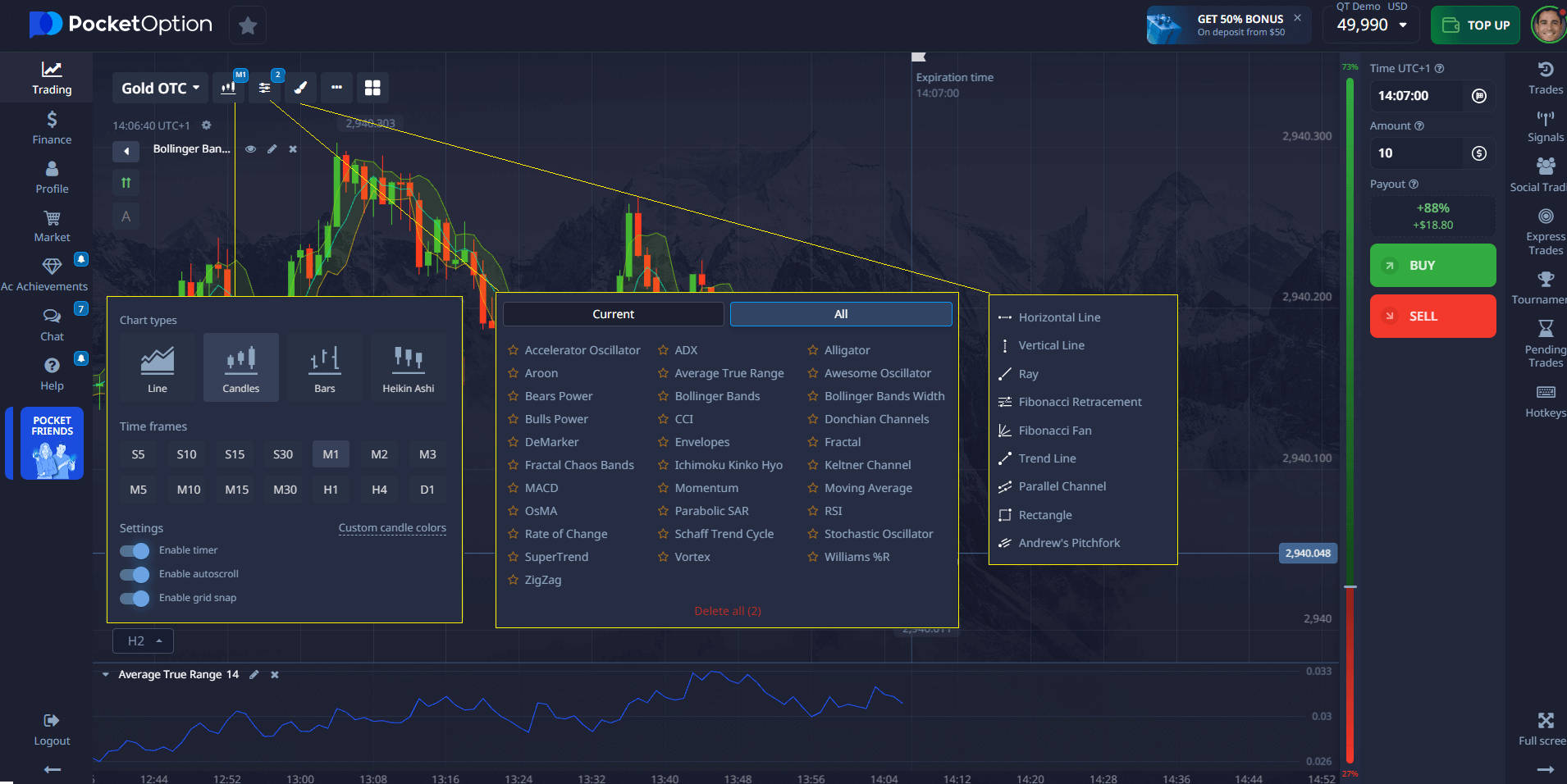

Integrated Tools for Analysis

| Tool | Function | Usage Scenario |

|---|---|---|

| Trend Indicators | Highlight directional bias | Suitable for trending markets |

| Oscillators | Spot exhaustion zones | Refining entries and exits |

| Sentiment Indicator | Visualize public positioning | Confirmation or contradiction |

| Chart Drawing Tools | Support/resistance lines, channels | Technical structure |

| Copy Trading | Replicate successful trades | Complementary trading method |

These components help formulate an effective day trading strategy on crude oil, especially when speed and timing are essential.

Execution Example on Pocket Option (Crude Oil)

- Choose the asset: select Crude Oil from the list.

- Analyze trends: apply the sentiment indicator or an oscillator from the chart panel.

- Set the amount: start from $1.

- Choose the duration: minimum 5 seconds available in OTC.

- Predict the direction: press BUY if you anticipate a rise, SELL for a fall.

- Confirm the return rate: pre-calculated, visible before execution.

- Process the result: correct forecast = profit; features like cashback apply to real accounts.

This process helps learn how to make money with day trading on crude oil through repeated testing and adjustments.

Strategic Approaches

1. Momentum-Based Pursuit

- Identify trends with moving averages

- Use RSI to validate entry strength

- Monitor news calendar for macroeconomic alignment

2. Volatility-Based Entry

- Observe breakouts related to OPEC or EIA data

- Bollinger Bands help capture volatility spikes

- Works best on high-impact news days

3. Sentiment-Guided Reversals

- Use Pocket Option sentiment data

- Wait for price confirmation with a candlestick rejection

- Useful in range-bound markets

Each method corresponds to a different crude oil day trading strategy depending on the user’s objectives and market environment.

Risk Management in Oil Trading

The main risks when trading oil include:

- Sudden spikes due to news

- Overtrading during unstable sessions

- Misinterpreting early technical signals

Risk can be reduced by setting exposure limits and analyzing charts with non-lagging indicators.

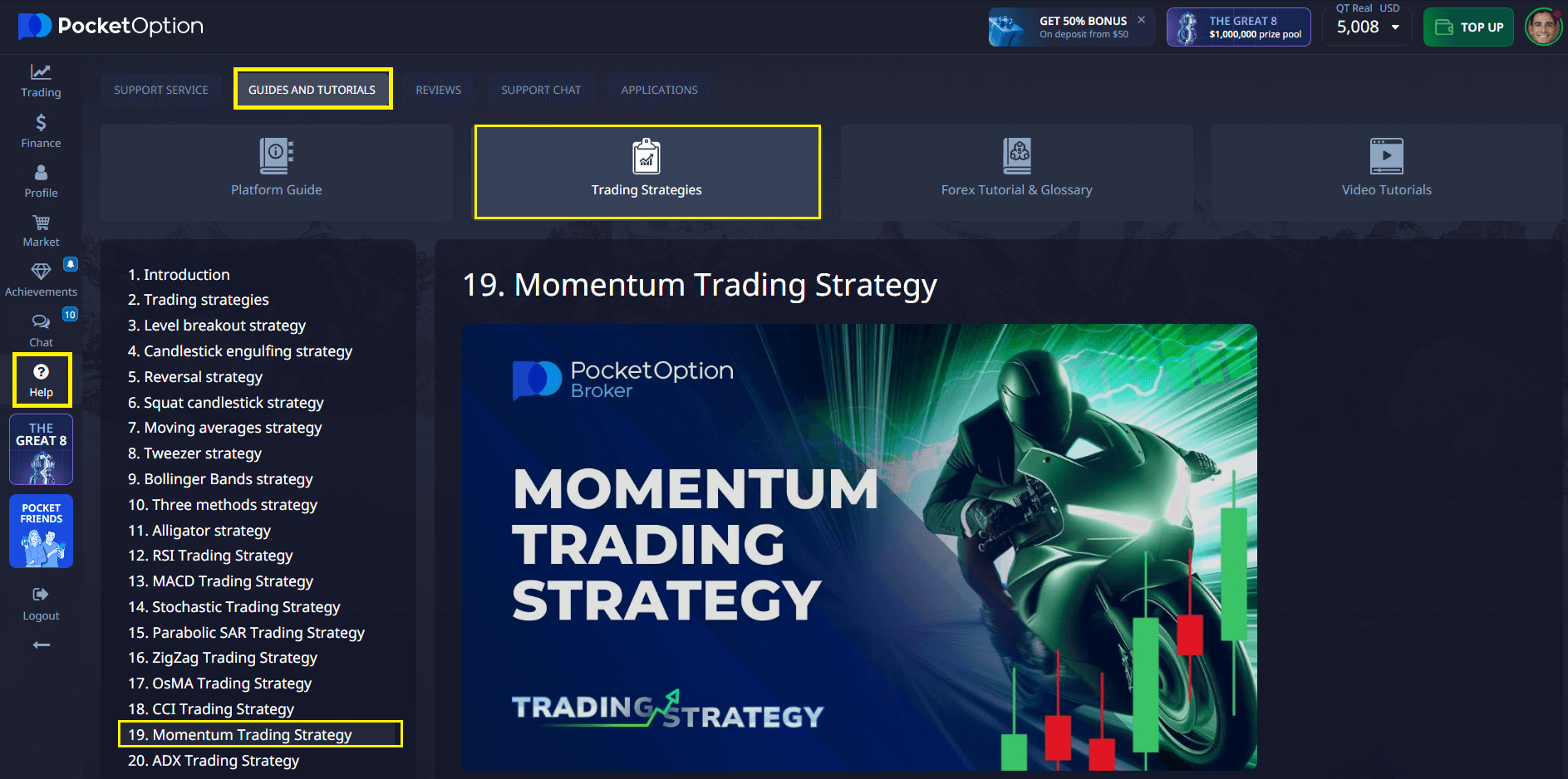

Learning Environment on Pocket Option

Pocket Option offers a structured educational environment:

- Instant access to a demo account

- Test different variants of crude oil day trading strategies

- Use platform-integrated tutorials with step-by-step guides

- Open a real account from $5 with various payment methods

Strategies and tools are clearly explained in the Help section. This provides a foundation to explore techniques beyond basic execution, including tips for choosing the right timing and asset for oil trading.

Conclusion

Crude oil trading on Pocket Option combines chart analysis, execution control, and educational support. With the help of tutorials, technical tools, and demo features, users can refine methods like oil trading strategy and apply them concretely. Structured learning and informed decisions are essential to successfully navigate oil markets.

FAQ

What is the best time to apply a trading strategy on crude oil?

During major economic releases or when market volatility increases.

Are there any specific tips for beginners trading in oil?

Start with trend confirmation and avoid periods of high news activity.

How to make money day trading crude oil on Pocket Option?

How to make money day trading crude oil on Pocket Option?

Is there a preferred day trading strategy for crude oil?

Sentiment-based and volatility-based approaches are commonly used.

Can I test a day trading strategy on crude oil without risk?

Yes, Pocket Option offers a demo account for risk-free training.