- Look for higher highs and higher lows in uptrends

- Confirm with MACD crossovers and EMA alignment

- Set stop-losses to manage risk

Best Trading Strategy for Pocket Option for Consistent Trading Success

In 2025, traders are seeking smarter, more adaptive strategies to thrive on Quick Trading platforms. With Pocket Option’s intuitive tools and a growing community, mastering the right approach is more crucial than ever.

Best Strategy: Professional Guide to Trading Successfully

In the fast-paced world of online trading, finding the best Pocket Option strategy is every trader’s dream. The right method can turn uncertainty into consistent results, while the wrong approach can empty your account. This comprehensive guide combines proven trading strategies, professional insights, and step-by-step examples so you can master Pocket Option like a pro.

“A trading strategy is not just a plan—it’s your edge in the market. On platforms like Pocket Option, it separates disciplined traders from impulsive ones.”— Alexei Morozov, Trading Analyst, 2025

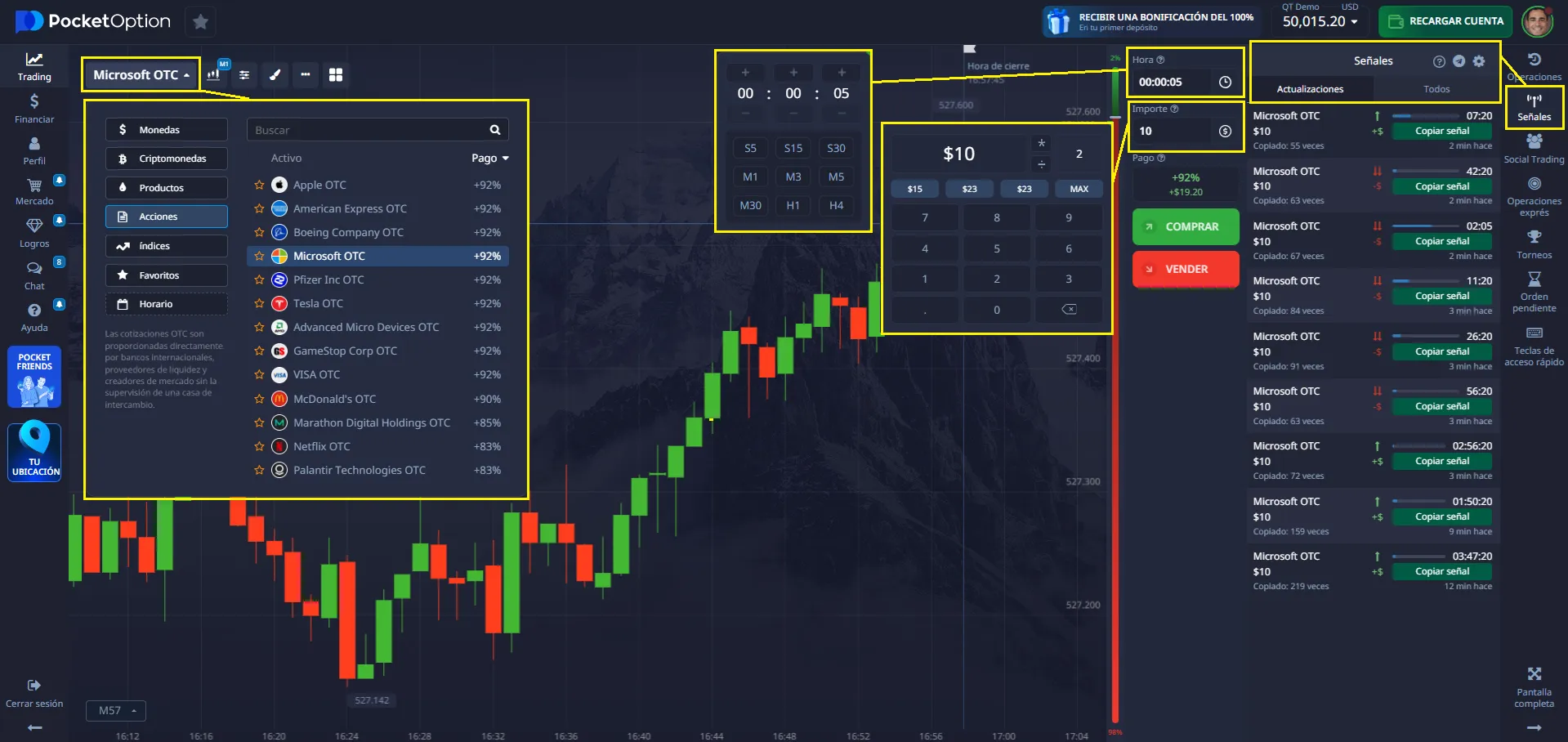

Pocket Option is more than a platform: it’s a complete ecosystem for traders. With over 100 tradable assets, 24/7 OTC trading, and a library of more than 35 detailed strategies, you can hone your skills whether you’re into binary trading, scalping, or advanced technical setups.

Ready to learn the best way to trade on Pocket Option and start practicing today? 🚀

What is the “Best Pocket Option Strategy”?

Let’s break down the most popular and effective strategies used by traders on Pocket Option. Each approach has its strengths, and the best choice depends on your goals, risk tolerance, and trading style.

| Strategy | Timeframe | Key Indicators | Risk Level | Best For |

|---|---|---|---|---|

| Scalping | 1–5 min | RSI, Stochastic, Moving Average | High | Active, experienced traders |

| Trend Trading | 15 min–1 hr | MACD, EMA, Trendlines | Medium | All levels |

| Breakout Trading | 5–30 min | Bollinger Bands, Volume | Medium–High | Intermediate traders |

| Support/Resistance | Any | Horizontal Levels, Candlestick Patterns | Low–Medium | Beginners & up |

Scalping: Fast-Paced Profits

Scalping is a rapid-fire strategy where traders aim to capture small price movements within minutes. On Pocket Option, scalping is popular due to the platform’s quick execution and real-time charting. Key indicators like RSI and Stochastic help identify overbought or oversold conditions.

“Scalping on Pocket Option is all about speed and precision. Use the demo account to practice before risking real funds.”

Trend Trading: Riding the Momentum

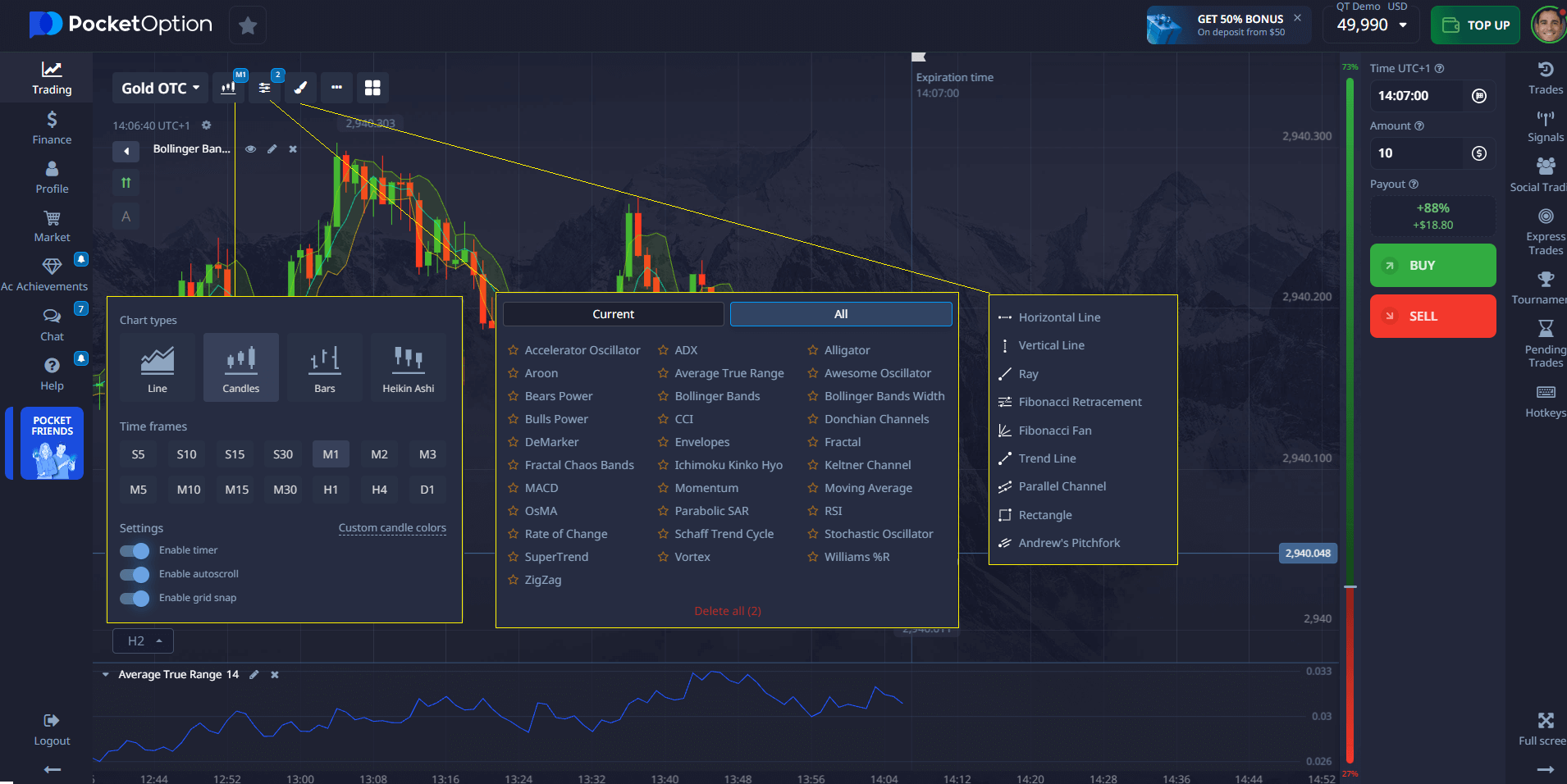

Trend trading involves identifying and following the prevailing market direction. Tools like MACD and EMA are essential for spotting trends. Pocket Option’s charting suite makes it easy to draw trendlines and monitor momentum.

Breakout Trading: Capturing Volatility

Breakout strategies focus on entering trades when price breaks through established support or resistance levels. On Pocket Option, traders use Bollinger Bands and volume spikes to spot potential breakouts.

- Identify key levels on the chart

- Wait for a strong move beyond these levels

- Confirm with increased volume or volatility

“Breakouts can be explosive, but always confirm with volume and avoid false signals.”– Dmitry Sokolov, Technical Analyst, 2025

Support and Resistance: Foundation of Technical Analysis

Support and resistance levels are the backbone of many trading strategies. On Pocket Option, drawing these levels helps traders anticipate reversals or continuations. Candlestick patterns at these zones can provide additional confirmation.

| Indicator | Purpose | How to Use on Pocket Option |

|---|---|---|

| MACD | Trend & momentum | Spot trend reversals and confirm entries |

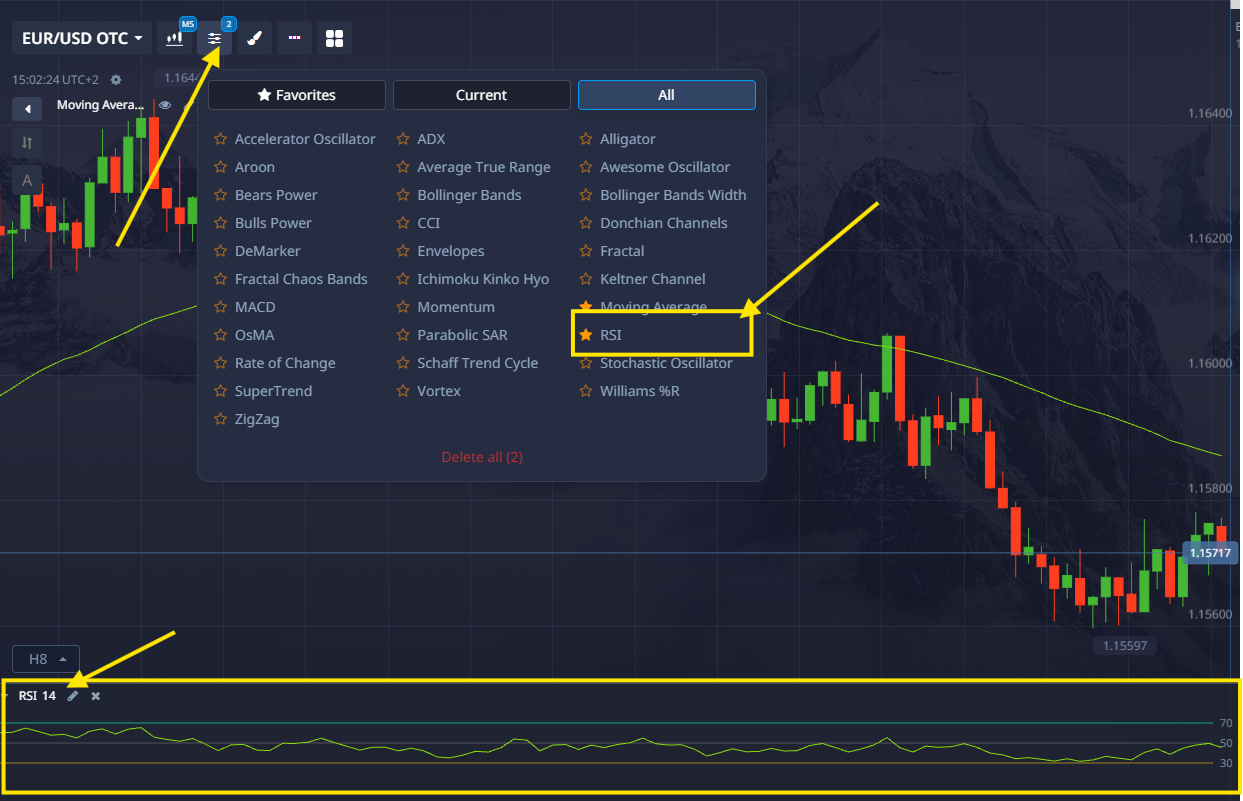

| RSI | Overbought/oversold | Identify entry/exit points in ranging markets |

| Bollinger Bands | Volatility | Detect breakouts and price extremes |

| Stochastic Oscillator | Momentum | Fine-tune entries in fast markets |

Many traders believe there is a single universal “winning” strategy. The truth? The best Pocket Option strategy is the one that adapts to your trading style, asset preferences, and risk tolerance. There is no one-size-fits-all solution, but there are proven methods that work consistently when applied with discipline.

“The most effective Pocket Option strategy is one that aligns with your risk profile, adapts to volatility, and uses both technical and quantitative signals,” says Javier Martín, senior market analyst at Inversor Global (2024).

Defining the best Pocket Option strategy requires considering several key factors:

- Technical indicators to identify patterns and momentum.

- Quantitative analysis to forecast trends with data-driven information.

- Adaptability to market volatility and changing conditions.

A reliable strategy allows you to adjust quickly to market changes, improving your win rate and protecting your capital. Flexibility is essential: a rigid approach can fail in rapidly changing environments.

| Characteristic | Short-Term (5 sec — 1 min) | Long-Term (15 min — 4h) |

|---|---|---|

| Speed | Very fast | Slower, more relaxed |

| Risk per Trade | Higher volatility | Lower volatility |

| Ideal For | Experienced traders | Beginners and swing traders |

| Typical Tools | EMA, RSI, Bollinger Bands | MACD, Support/Resistance |

| Example | 5 sec EMA Bounce | Low-Risk Daily Strategy |

Both short-term and long-term approaches can be part of your arsenal. The real edge comes from combining trading techniques with proper risk management.

Core Elements of Winning Pocket Option Strategies

Before exploring specific setups, here are three pillars you must master for success:

Technical analysis 🖥️

Learn to read charts, spot patterns, and interpret indicators. From simple moving averages to complex oscillator setups, this is the foundation of every profitable trade.

Risk management 💡

No matter how good your strategy is, poor risk control will wipe you out. Use a fixed position size, set daily loss limits, and avoid “revenge trading.”

Money management 📊

Distribute your capital wisely. Use a balance between high-probability trades and exploratory setups. This helps maintain growth while managing losses.

List — Indispensable Principles for Success

- Only trade setups that have clear confirmation signals.

- Keep the risk per trade between 1-3% of your balance.

- Use the demo mode to test before risking real funds.

Example Strategy #1 — 5-Second Trend EMA Bounce

This is one of the fastest and most exciting methods on Pocket Option. Perfect for traders who enjoy action-packed sessions.

How It Works:

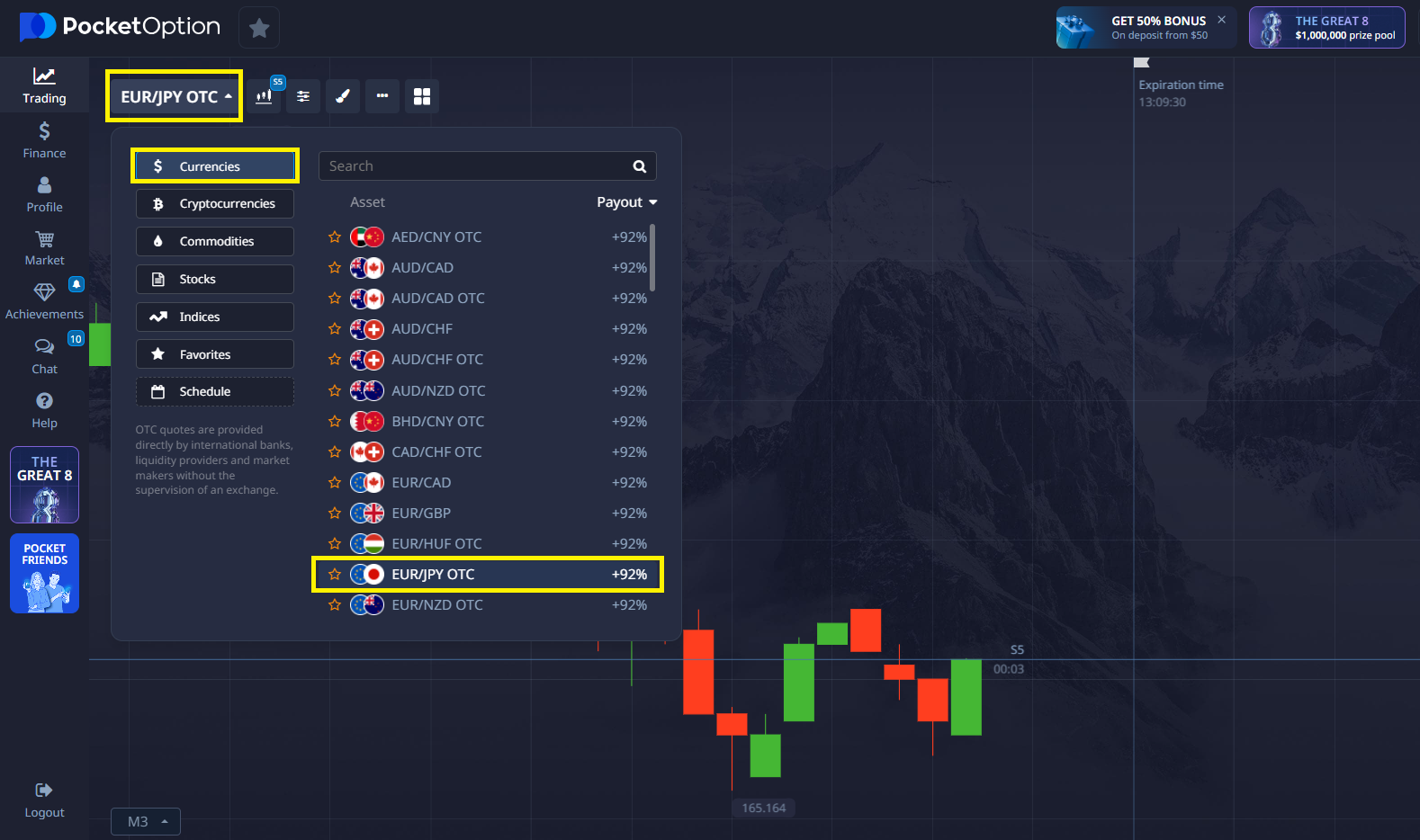

- Select a high-liquidity asset (EUR/JPY or EUR/USD during the London/New York overlap).

- Apply a 20-period Exponential Moving Average (EMA) to the chart.

- Watch for the price to bounce off the EMA in the direction of the prevailing trend.

- Enter a 5-second trade in the direction of the trend.

| Indicator | Setting | Purpose |

|---|---|---|

| EMA | 20 Period | Identifies the short-term trend |

| RSI | Period 2, Level 80/20 | Confirms overbought/oversold |

| Bollinger | Period 5, Dev. 2.5 | Measures volatility |

Example Trade:

- Asset: EUR/JPY

- The EMA shows an uptrend; the candle bounces upward from the EMA.

- RSI at 30, the lower Bollinger band was touched.

- A CALL option for 5 seconds was entered — the trade closed with a +92% profit. 🎯

Risk Tip: Keep 5-second trades with small position sizes. Volatility can be brutal here.

According to Bloomberg Markets (Nov 2024), ultra-short-term trades, under 10 seconds, can have win rates as low as 38% without strict rules, but disciplined traders can raise that figure above 55%.

Example Strategy #2 — 1-Minute Scalping with RSI and Volume

If you prefer a slightly slower pace, this scalping method combines binary options strategies with high-volume confirmation.

How It Works:

- Use a 1-minute chart.

- Add the RSI (14) with levels of 40 and 60.

- Add the Volume indicator — look for spikes above 150% of the average.

- Buy when RSI < 40 and the volume spike is green; Sell when RSI > 60 and the spike is red.

- Asset: GBP/USD

- The RSI drops to 35, a large green volume bar appears.

- A CALL option for 1 minute was entered. It closed with an +85% profit.

Pro Tip: Avoid trading 1 minute before/after major news.

⚠️ Risk Warning: Ultra-short-term trades can result in rapid losses. Always limit exposure to 1-2% per trade.

Key Factors for Every Trade

Before entering any trade on Pocket Option:

- Position size: Adjust it based on account size and volatility.

- Risk management: Fixed percentage risk (1-3%).

- Signal quality: Confirm with at least 2 indicators or price action patterns.

- Discipline: Stick to your plan, no impulsive trades.

Advanced Tactics for Professional Traders

If you are an experienced trader, consider these enhancements for your strategies:

- Multi-Timeframe Confirmation: Check the 1m chart for entry, the 5m chart for trend confirmation.

- AI and Algorithmic Support: Use Pocket Option’s built-in signals alongside your setups.

- Confluence Trading: Combine at least 3 independent confirmations before entering a trade.

These tactics turn basic trading strategies into high-probability setups that can handle different market conditions.

Risk and Money Management on Pocket Option

Even the best setups will fail without proper risk and money management. Here is a recommended approach. Professional traders calculate position size using volatility measures like the ATR.

A 2023 report from Finance Magnates found that traders who adjusted their position size based on volatility experienced a 17% reduction in their drawdowns compared to those using fixed lot sizes.

Example: If your maximum risk per trade is $20 and the ATR shows a $0.002 move, you adjust the size to stay within the limits.

Volatility Adjustment:

In high volatility periods (e.g., during news releases), reduce the trade size by 30-50%. This protects capital while keeping you in the game.

| Account Size | Risk per Trade | Maximum Daily Loss |

|---|---|---|

| $100 | $2–$3 | $10 |

| $500 | $10–$15 | $50 |

| $1,000 | $20–$30 | $100 |

Strategy Performance Evaluation

“The win rate is only half the story; your profit factor must be above 1.5 to survive in the long run,” notes María Velasco, options strategist at Rankia Pro Traders.

A high win rate means nothing if the risk-to-reward ratio is poor.

Monitor:

- Win rate (%)

- Average R:R ratio

- Impact of volatility on performance

- Adjustments needed for market conditions

Timeframe Analysis: Tailoring the Strategy to the Trader’s Profile

Short timeframes (5 sec, 1 min) = high intensity, require speed and focus.

Longer timeframes (15 min, 1h, 4h) = stability, better for beginners and with lower stress. Choose based on your risk tolerance and trading goals.

Data collected by TradingView Insights (2024) shows that traders using 1-minute charts placed an average of 42 trades per day, while those on 15-minute charts averaged 9, with an average profit per trade 1.3 times higher.

Continuous Strategy Improvement

Markets evolve, and your strategy should too.

- Review results weekly.

- Integrate new indicators if they add value.

- React to emerging trends and volatility patterns.

“Your trading journal should be treated like your P&L statement; without reviewing it weekly, you are trading blind,” says Diego Ortega, professional binary options coach.

Profitable Trading with Pocket Option: Characteristics and Examples

A profitable trader on Pocket Option:

- Balances profit targets with strict risk control.

- Uses accurate indicators and solid market analysis.

- Maintains emotional discipline.

Example Case:

A trader with a $500 account focuses on the EMA Bounce and RSI-Volume setups. Risk per trade: 2%. After 3 months of disciplined execution, the account grows to $720, a 44% increase without over-leveraging.

Pocket Option’s internal data from 2024 shows that the top 5% of traders averaged a monthly ROI of 11.7% over a 6-month period, with strict adherence to risk limits.

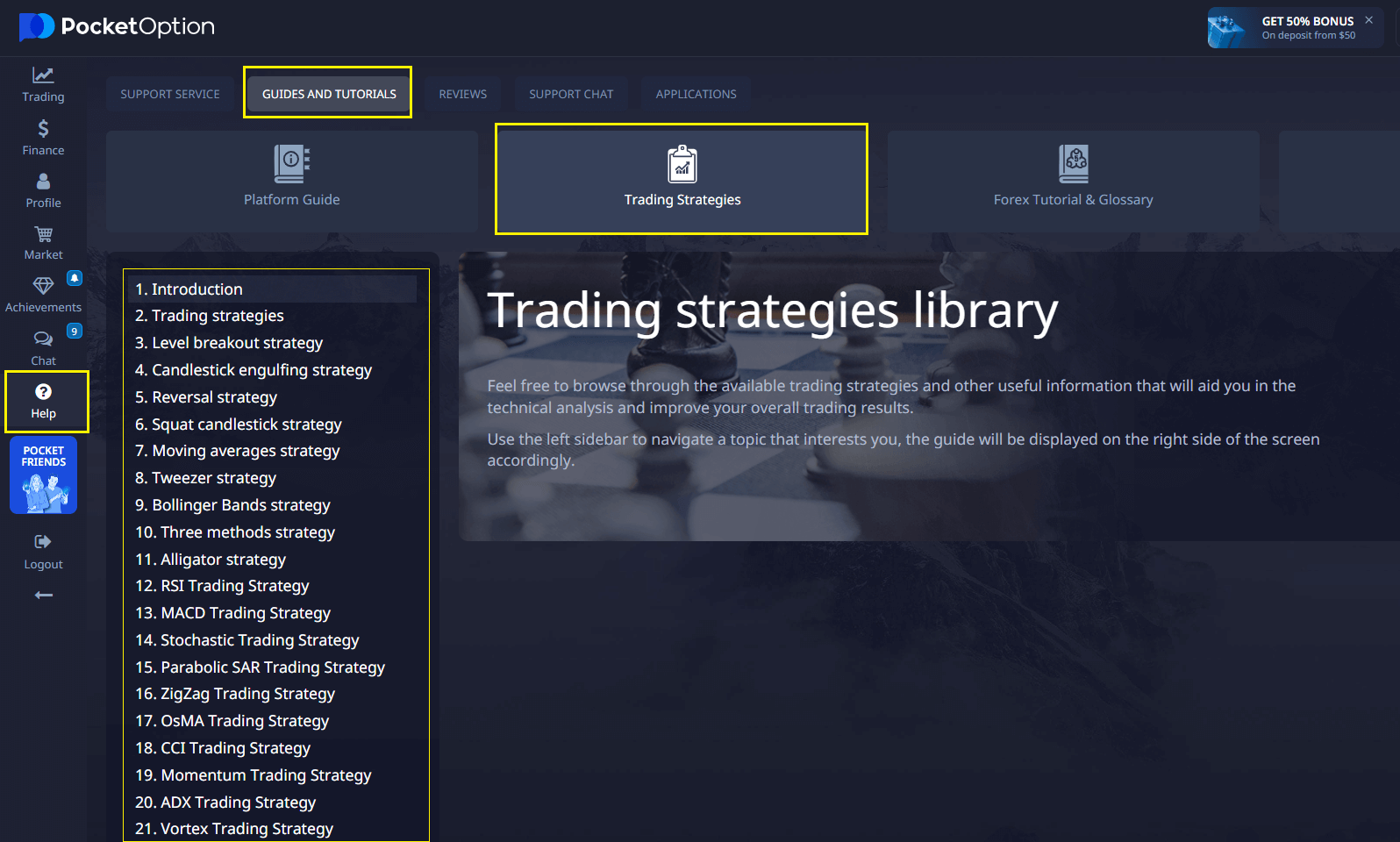

Pocket Option Learning Center — Over 35 Strategies

One of Pocket Option’s biggest advantages is its educational center, filled with resources:

- Video tutorials on indicators, price action, and risk control.

- Guides detailing over 35 proven strategies for different market types.

- Access to a $50,000 demo account to practice without risk.

Whether you’re into binary trading or advanced swing setups, the library covers it all.

FAQ

What timeframes work best with these strategies on Pocket Option?

Timeframes should match your trading style. Scalpers prefer 1-5 minute charts, day traders use 15-minute to 1-hour charts, while swing traders may use 4-hour or daily charts for more reliable signals with less market noise.

How much capital should I start with on Pocket Option?

Start with capital you can afford to lose. While some traders begin with as little as $100, a more substantial account of $500-1000 provides better flexibility for proper position sizing and withstanding normal market fluctuations.

Should I use multiple indicators or keep it simple?

Quality over quantity is key. Using 2-3 complementary indicators that provide different types of information (trend, momentum, volatility) is often more effective than crowding your chart with redundant tools.

How do I know if my strategy is working?

Track your results meticulously. A profitable strategy should show positive results over at least 30-50 trades. Focus on your win rate, risk-reward ratio, and overall account growth rather than individual trade outcomes.

How often should I review and adjust my trading strategy?

Regular review is essential, but avoid constant changes. Evaluate performance monthly, looking for patterns in winning and losing trades. Make incremental adjustments rather than completely abandoning strategies after short-term setbacks.

What are common mistakes to avoid on Pocket Option?

Avoid trading without a plan, risking too much on a single trade, and letting emotions drive your decisions. Consistent review and practice are essential.

Can I learn trading strategies using the Pocket Option demo account?

Absolutely. The demo account is designed for practice and learning, allowing you to test strategies and indicators without risking real money.

What is the role of trading psychology on Pocket Option?

Trading psychology is crucial. Staying disciplined, managing emotions, and sticking to your plan are key to long-term success on any trading platform.

How can I manage risks effectively while trading?

Use stop-losses, limit your position size, and never risk more than a small percentage of your capital per trade. Pocket Option’s risk management tools can help automate these processes.

Is scalping suitable for beginners on Pocket Option?

Scalping requires quick decision-making and experience. Beginners should practice on the demo account and start with slower-paced strategies before attempting scalping.

What are the most effective indicators for trading on Pocket Option?

Popular indicators include MACD, RSI, Bollinger Bands, and Stochastic Oscillator. These tools help identify trends, momentum, and potential entry or exit points.

How do I choose the best trading strategy for Pocket Option?

Start by assessing your risk tolerance, trading goals, and available time. Use Pocket Option’s demo account to test different strategies like scalping or trend trading before committing real funds.

CONCLUSION

Finding the best trading strategy for Pocket Option requires patience, dedication, and continuous learning. Rather than seeking a perfect system, focus on developing an approach that aligns with your trading personality, risk tolerance, and time availability. The strategies outlined in this article provide a solid foundation, but their effectiveness ultimately depends on consistent application and disciplined execution. Remember that even professional traders experience losing streaks – what separates successful traders from unsuccessful ones is their ability to manage risk and maintain emotional discipline through market fluctuations.

Start trading